The largest oil consuming countries (and EU), in millions of barrels per day:

| Country | consumption | % of oil used | % of population | % of World GDP |

|---|---|---|---|---|

| USA | 20.8 | 25.9 | 4.5 | 21.0 |

| European Union | 14.6 | 18.1 | 7.4 | 21.9 |

| China | 6.9 | 8.6 | 19.9 | 10.7 |

| Japan | 5.4 | 6.7 | 1.9 | 6.5 |

| Russia | 2.9 | 3.6 | 2.1 | 3.2 |

| Germany | 2.6 | 3.3 | 1.2 | 4.3 |

| India | 2.4 | 3.0 | 17.0 | 4.6 |

| Canada | 2.3 | 2.9 | 0.5 | 1.9 |

| Korea | 2.1 | 2.7 | 0.7 | 1.8 |

| Brazil | 2.1 | 2.6 | 2.9 | 2.8 |

| Mexico | 2.1 | 2.6 | 1.6 | 2.1 |

All data is from CIA World Factbook 2008 (downloaded Jun 2008). GDP calculated using purchasing power parity.

Related: Top 10 Manufacturing Countries 2006 – Country H-index Rank for Science Publications – Best Research University Rankings (2007)

…

Even worse is the influence of the pork-barrel. Only around 20 states use cost-benefit analyses to evaluate transport projects; of these, just six do so regularly. Alaska’s “bridge to nowhere” is an infamous result of this sort of planning. But it is not exceptional. Two months after the bridge collapsed in Minneapolis, the Senate approved a transport and housing bill that included money for a stadium in Montana and a museum in Las Vegas.

…

Such plans stand in stark contrast to the federal government’s strategy today. America invests a mere 2.4% of GDP in infrastructure, compared with 5% in Europe and 9% in China, and the distribution of that money is misguided.

I think they underestimate our ability to ignore. For example we have over $500,000 in federal government debt per household and continue to raise taxes on future generations without any guilt. I think our capacity to ignore is pretty large and certainly large enough to ignore the decision to spend money on things other than infrastructure repair.

I think those that don’t somehow manage to remain ignorant all know that China has taken the lead in investing in infrastructure and that the USA has chosen to elect politicians that are gutting infrastructure investments (and still spending far beyond the resources they have available). I can’t imagine many who understand economics have any trouble seeing which country is investing in the future and which country is selling out its future. It is not the choice I wish was being made in the USA but it is obviously the choice we are making.

Related: USA Infrastructure Needs Improvement – Politicians Again Raising Taxes On Your Children – Manufacturing Takes off in India – True Level of USA Federal Debt

Poorer Than You posed the question: Where to Stash Your Rainy Day Fund?

Pros: Interest rate usually meets or beats inflation, transfers to checking account, separation from checking decreases temptation to spend, no minimum balance requirement

Cons: Slow transfers may hinder urgent emergencies, limited by federal law to 6 transfers out of the account per month

…

Personally, I’m using a credit card/online savings account combination right now. After I graduate from college and grow my emergency fund, I’ll move most of the fund to a money market savings account, and perhaps keep a couple hundred dollars in cash as well.

Here are my thoughts:

A money market fund is where I used to hold emergency funds, but things have changed. Money market funds are paying less than inflation (especially true inflation – which exceeds reported inflation). Right now high yield savings is where I have my emergency funds. You need to not only pick a good choice but pay attention to see if the marketplace shifts and certain options are not as appealing as before.

I would use a credit card for immediate spending needs and then paying the balance in full with funds from high yield savings. But right now high yield savings accounts pay more than money market funds, so just stay with high yield savings. If money market funds pay more in the future then I would put the emergency funds there.

Related: Personal Finance Basics: Health Insurance – personal finance tips

New research confirms feeling powerless leads to expensive purchases. So in addition to learning about personal finance logically it can be important to build your self esteem in order to improve your financial position. For many people understanding human psychology helps them take more control of their own life. And can help when helping others.

In a study that may explain why so many Americans who are deeply in debt still spend beyond their means, authors Derek D. Rucker and Adam D. Galinsky (both Kellogg School of Management at Northwestern University) found that research subjects who were asked to recall times when someone else had power over them were willing to pay higher prices for status-symbol items.

“This increased willingness to pay for status-related objects stems from the belief that obtaining such objects will indeed restore a lost sense of power,” write the authors.

Instead of allowing yourself to submit to this impulse you will put yourself in a better position if you refrain from trying to buy a sense of power. Take a real look at your position and make changes that move your personal finances in the right direction.

Related: Buy Less Stuff – Too Much Personal Debt – Financial Illiteracy Credit Trap – Curious Cat Investing Library: Personal Loans

I have made some additional loans through Kiva, $250 for 5 loans in: Nicaragua, Ghana, Viet Nam, Togo and Tanzania. I have now made 37 loans for a total of $1,775. 5 loans of $250 have been paid back (and I relent the proceeds). Kiva says 5.64% are delinquent. While they show my delinquency rate they don’t show me which loans are delinquent. Frankly I think that figure may be in error (maybe it is counting one that was delinquent but is not now – see next paragraph). In any event all loans appear to have been paid off in full on time or are being paid in full now on time.

In any event no loans are in default. One loan in Kenya for bike repair shop (that for whatever reason I especially liked) and did connect me more to the troubles in Kenya recently. Kiva mentioned many banks were having trouble keeping in touch with clients as many people fled violence. For two months there was no activity then there was a payment for 3 full months. I was happy when a new payment came in, not for the money being repaid (which shows again that my aim with this money is not a return for me but to provide opportunities to entrepreneurs), but for confirmation he was doing well.

Photo of Cesar Augusto SantamarÃa Escoto in his welding workshop, Chinandega, Nicaragua.

If you have a Kiva page, let me know and I will add a link to it on the Curious Cat Kivans page.

Related: Provide a Helping Hand – Microfinancing Entrepreneurs – Entrepreneurship posts on the Curious Cat Science and Engineering blog

Japan to Cut the Cost of Solar 50% Creating Greater Self-sufficiency (site broke the link so I removed it, sigh, sites can’t even manage to avoid breaking 10 year old web usability guidelines, when will they learn?)

…

The incentive will decrease the cost of a solar photovoltaic system by an estimated 50% within 3 to 5 years. This initiative will make solar energy especially appealing because the cost of electricity in Japan is already over $.20 a kWh. This is roughly double the rate of electricity found in many areas of the US.

Germany is the largest solar market (due to government policy encouraging solar development).

Related: Large-Scale, Cheap Solar Electricity – Solar Energy: Economics, Government and Technology – Wind Power Potential to Produce 20% of Electricity Supply by 2030 – solar energy posts on the Curious Cat Science and Engineering blog

The USA stock market has not been doing so well recently (the S&P 500 index is down over 9% so far this year). And I own S&P 500 indexes in my retirement account (in addition to other index funds). So I am losing money on those investments but I am not worried. It is possible the market will do very poorly over the next few months, year… if the economy struggles (and with the huge credit card like spending Washington much of the last 30 years and huge increases in gas prices that is certainly possible). But I am not worried.

I don’t plan on using that money for decades. Therefore the short term declines really have no impact on my life. Sure if I was able to move all that money into a money market fund for the decline and then move it back into stock funds for the increase that would be wonderful. But I can’t and no-one has proven to be able to time the market effectively over the long term. It is unlikely you or I will be the ones that do it right. I wouldn’t be surprised if the market was lower at the end of the year, but I wouldn’t be surprised if it was higher either.

Dollar cost averaging is the best long term strategy (not trying to time the market). And using that strategy, if you assume stocks reach whatever level they do say 20 years from now, I am actually better off will prices falling now – so I can buy more shares now that will reach that final price. You actually are better off with wild swings in stock prices, when you dollar cost average, than if they just went up .8% every single month (if both ended with stocks at the same price 20 years later). Really the wilder the better (the limit is essentially the limit at which the economy was harmed by the wild swings (people deciding they didn’t want to take risk, make investments…) to the point that the final value 20 years later is deflated.

Read more

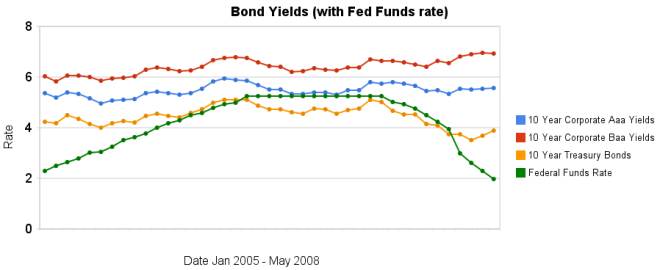

Over the last 2 months the yields on bonds have increased the discount rate has continued to decline.

The spread between corporate bond yields and government bonds has decreased a bit as treasury yields have increased 37 basis points compared to just 4 and 6 basis point increased in corporate bond yields.

Data from the federal reserve – corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Bond Yields 2005-2008 – 30 Year Fixed Mortgage Rates versus the Fed Funds Rate – Initial Retirement Account Allocations

With the drastic increases in food prices recently a home garden an attractive way to save some money. I have planted a garden for several years. Frankly the main reasons I did so had nothing to do with money. I find it cool to plant a seed or small plant and then just water it occasionally and then be able to eat. Plus it is great to just go grab some fresh food and eat it. It tastes great and is healthy.

The increasing price of food it makes it more attractive. I plant a few tomato plants and some pepper and cucumber plants. And then some pea and beans from seed (and I did celery this year – though I didn’t realize I was suppose to start them inside 10 weeks early so we will see what happens). I think my total cost was under $30. I would guess all the water I use will be under $5. From that I will get 10+ weeks many tomatoes and green peppers, sweet peppers, hot peppers. The cucumbers and and peas don’t seem to produce as long (if I remember right from last year). I am trying to plant some peas from seeds every couple of weeks and see if that works to give me peas for a longer period this year.

I also have a bunch of berries. I have wineberries that just grew themselves (which started as 1 plant 3 years ago and now covers maybe 20 square feet) which are the best thing of all from my garden, frankly (I have never been able to buy any berries nearly as good). And I bought a small blackberry plant 2 years ago which has grown to be quite productive. Last year I had birds eating so many berries I hardly got any. The previous 2 years I could get more than I could eat for several weeks and enough to eat for maybe 4 more weeks total. Any advice on how to keep birds away?

Even while there are some financial benefits I really think the good healthy food and fun is more important.

Related: Backyard Wildlife: Raptor – Food Price Inflation is Quite High – Backyard Wildlife: Fox – Backyard Wildlife: Turtle

This post is included in the Carnival of Personal Finance #157: Third Anniversary Edition

Foreclosure Filings Continue to Rise

…

last week the Mortgage Bankers Association reported that about 2.47 percent of home mortgages were in foreclosure during the first quarter of the year, almost double the 1.28 percent rate of a year earlier, and the highest point since the group began compiling such figures in 1979. A Credit Suisse report this spring predicted that 6.5 million loans will fall into foreclosure over the next five years, reaching more than 8 percent of all U.S. homes.

There numbers really are astounding. How lame were the decisions of banks and mortgagees that nearly 1 in 40 mortgages are in default (and that number likely increasing in the next year to much more?

Related: Homes Entering Foreclosure at Record (Sep 2007) – Homes Entering Foreclosure at Record – Ignorance of Many Mortgage Holders