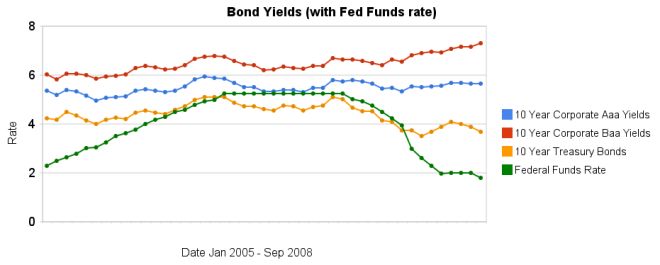

Over the last 3 months the yields on corporate bonds have increased while treasury bonds have decreased. The chart shows the move away from lower quality bonds to higher quality though probably not as dramatically as actually has taken place as it is just an average for each month (and in September the flight to quality became extreme at the end of the month). While the Fed did not announce a formal cut in the discount rate, the average rate for overnight loans from the Fed last month was 1.81%.

The spread between 10 year Aaa corporate bond yields and 10 year government bonds increased to 196 basis points. In January, 2008 the spread was 159 points. The larger the spread the more people demand in interest, to compensate for the increased risk. The spread between government bonds and Baa corporate bonds increased to 362 basis points, the spread was 280 basis point in January. The rate on government bonds has barely change (decreasing from 3.74% in January to 3.69% now) so the change has nearly all been in increased corporate bond rates.

Data from the federal reserve – corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Bond Yields 2005 to June 2008 – 30 Year Fixed Mortgage Rates versus the Fed Funds Rate – Curious Cat Investing and Economics Search – posts on interest rates

Comments

4 Comments so far

The spread between government bonds and Baa corporate bonds increased to 362 basis points, the spread was 280 basis point in January. The rate on government bonds has barely change (decreasing from 3.74% in January to 3.69% now) so the change has nearly all been in increased corporate bond rates.

Great spread graph – very difficut to find such a telling graph on the web! The graph supports the concept that, with the exception of the 1873 panic, stock declines and widening spreads between low and high quality bonds are indicators of a looming financial meltdown. At some point, the spread will narrow after the panic, but if it should begin to widen again, as in the panic of 1907 and the Great Depression, it would signal the beginnings of an intense deflationary cycle – at least in historical studies.

I am not very familiar with the bond market but it does seem like the panic is in full swing but calling the bottom is always hard…

“Dividends paid by Standard & Poor’s 500 Index companies in the past 12 months amounted to 3.51 percent of the benchmark’s closing value yesterday. In early trading today, the 10-year yield fell as low as 3.42 percent…”