My comments on a post by Kiva about their decision to end the Kiva Zip (direct to people loans – no intermediary financial institution) program in Kenya.

I do think it is very important to retain an infrastructure for those people you got to try the new effort with, as I believe Kiva will. This has to be part of any innovation efforts – a budget to include unwinding the effort in a way that is in keeping with Kiva’s mission to help people. I strongly believe in efforts to avoid abandoning those who worked with you in general, but for those taking loans from Kiva it is much more important than normal.

Keep up the good work. And keep challenging Kiva to get better and not get complacent when things are not going as well as they should. I am happy to continue to lend to Kiva but I also am concerned that the focus on making a difference and making people’s lives better can be lost in the desire to grow.

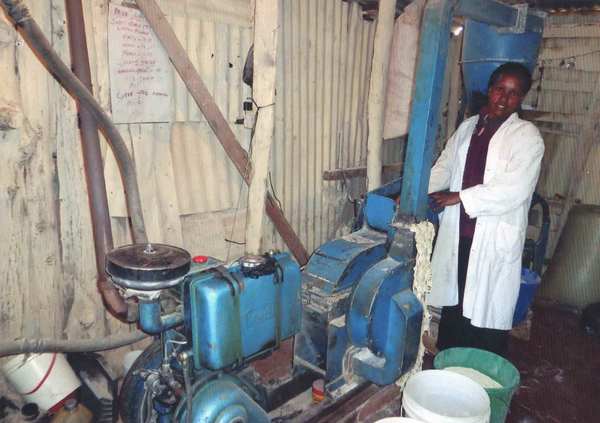

I made a loan via Kiva zip for Hilda to buy a posho mill machine. The loan was repaid in full.

The Curious Cats group on Kiva has made over $27,000 in loans to entrepreneurs around the world (the way Kiva works the groups, they don’t include Kiva Zip loans). You can join us. I believe in the model of micro-finance (Investing in the Poorest of the Poor [this one is grants instead of loans]), though I also believe we need more data on real experience of borrowers. Kiva Zip gives loans directly to people with a 0% interest rate. Normal Kiva loans have financial institutions (some of which are charities but they still have expenses) make the loans and Kiva lenders provide capital (at 0%) but the borrowers have to pay interest (the idea is they pay lower interest since the financial institution has a 0% cost of capital).

Related: Kiva Loans to Entrepreneurs in Columbia, India and Kenya – Kiva Loans Give Entrepreneurs a Chance to Succeed (2011) – Using Capitalism to Create Better Lives in Mali (2009)

I have been giving loans through Kiva for many years now. I enjoy the opportunity to help out entrepreneurs around the world. And the web site is well done to give you a psychological boost – photos of the entrepreneurs, stories on what they will do, etc..

I often have difficulty finding real entrepreneurs (many of the loans are for things like education, fixing up their house, buying motorcycle/car, etc. that may well be very important but are not really related to entrepreneurship in most cases). That is fine, in this session I had 3 loans to entrepreneurs and 2 loans for solar energy solutions for people’s homes. Improved energy, cooking or water access are some things I am happy to lend to that are not entrepreneur related. Though usually the water loans are – to an entrepreneur that will sell clean water to a neighborhood and sometimes the solar energy ones are, though not in this case.

Kelly in Medellin, Columbia is starting a shoe business.

Kelly in Medellin, Columbia is starting a shoe business.

The write-ups on Kiva are often fairly well done; targeting those interested in making loans. Kelly’s:

She works as a saleswoman in different shoe stores in the municipality of Medellin.

She wants to start her own business making and selling shoes of all styles. She wants to start this activity because she has the desire to generate the resources she needs to support herself and her education, in addition to helping with expenses at home.

She is a young, very disciplined entrepreneur. She is requesting a loan to buy a wide range of materials such as leather, soles, adhesives, and fabrics. With these elements, she can start this business and improve her quality of life.

I often screen the data on delinquencies and defaults for the partner bank in making loan decisions. It isn’t because I am worried about losing my loan (I just re-lend what I get paid back). But if I lend to organizations that are having more failures I increase their supply of money to make loans which don’t seem to be working out for borrowers as well as another lender). I want my money going to help people, not get people into a mess.

My response to a comment by John Green on Reddit

I really really like your work and webcasts (example included below).

This seems to me to make it really difficult on people trying to use judgement. Calling people’s actions “extremely paternalistic” if they are not definitely so, I think impedes debate. And I think debate should be encouraged.

When making Kiva loans I do steer away from loans with rates above 40% (I also prefer loans that are geared toward a capital investment that will increase earning power going forward though this is hard – lots of loans are essentially for inventory that will be sold at a profit so a fine use of loans but not as powerful [in my opinion] and new capital investments – say a new tool, solar power that will be resold to users…).

Just like people anywhere, people taking Kiva loans are capable of getting themselves into trouble. Choosing to allocate my lender toward certain loans does not mean I am being paternalistic.

I am not being paternalistic if I chose not to invest in the stock of some company that vastly overpays executives and uses high leverage to do very well (in good times).

I do like the idea of direct cash to people in need. I give cash that way (and in fact did it a long time ago, 20 years, for several years – before any of this new hipster cachet :-). And I still do like it.

I find it disheartening that it is necessary to take out a loan to pay for vocational school after graduating from middle school (this is in Indonesia but the same thing happens all over in those countries that are not the most wealthy). Indonesia has been doing extremely well economically (which many people do not realize).

Kafita already graduated from junior high school and wants to go to vocational school.

So essentially she is paying for high school. I sure hope it is financially beneficial. This is the kind of investment in the economic development of a country that I wish governments could make. If not, I sure wish the super rich would give money to fund this kind of education instead of giving trust fund babies millions for conspicuous consumption.

It is disgusting how spoiled brats are such vapid people that they do what they do, while so many hundred of millions of kids lives could be changed with the most wasteful spending these trust fund babies that our politicians keep giving massive tax breaks to. Our politicians should be ashamed of themselves. And so should the spoiled brats.

Manuel De Jesus, miller and farmer in El Salvador, will use his loan to buy parts for this milling euipment.

There is a great deal focus recently on the “99%” (via occupy wall street and the like). The truth is these are mainly about the 5% or 10% (those rich, but not quite as rich as the richest 1% – and much further from the richest than they were a few decades ago). As I have written before, most of those in the USA (also Europe, Japan…) are rich (though this is changing, a greater percentage of the USA is not rich, looking globally, than maybe any point since the 1930s).

We get confused because many near us are even richer and think that means the rest of us are very poor. But those in the USA are often in the 5% or 10% – not the 30% or 60% or 90% they seem to think they are. $50,000 in annual income puts you in the top 1% globally. $25,000 puts you in the top 10%.

I agree with the desire to reduce the political and market corruption, as I have written for years.

For the 99% (or the 90% anyway), I really think the best things are government policies that reduce corruption and increase market forces. Letting actually capitalism work instead of political and corporate cronyism failing to let markets work as they should. Also giving education and the chance to build a better life for yourself are important. Thankfully many countries have been doing very well on this front: Singapore, Korea, Brazil, Ghana, China… That doesn’t mean there are not huge issues to still address for most of the 90%, there are.

Microfinance in general, and Kiva in particular, are one great way to help. Again it isn’t perfect. And those getting the loans are not given an easy life. They are given a chance to try and build there business to improve there economic condition. This isn’t a certain success. And I do worry that taking on too high an interest rate, or loan amount, can leave people worse off than before. But when looking at the system of microfinance I really like the opportunity it gives people, who haven’t been given many.

Those getting loans have to make smart personal finance and business decisions. If they do well they can greatly improve their financial situation. I made several more loans today, using money repaid by previous borrowers. I try to find loans where I am able to help fund a investment that will improve capacity (but that isn’t always possible) – a new machine that makes them more efficient for example. I also try to avoid loans where the interest rate is over 30% (which might seem very high, but rates below 20% are very rare given the economics of these loans – they are very costly to service). What Kiva does is provide the funds people like me lend as interest free loans to the partner banks. The idea is that this allows partner banks to provide more capital for loans (obviously) and at a lower rate because the bank isn’t having to pay interest on the funds.

My loans today went to: Mali, Honduras, Senegal, Ecuador, Togo, Philippines and in the photo above El Salvador. The Curious Cat Kivans group has now lent $12,925 in 320 loans. We now have 11 members, join up and help give people an opportunity to improve their economic condition.

Related: More Kiva Entrepreneur Loans: Kenya, Honduras, Armenia… – Using Capitalism in Mali to Create Better Lives – Funding Entrepreneurs in Nicaragua, Ghana, Viet Nam, Togo and Tanzania

I made several more Kiva loans to entrepreneur in Kenya, Lebanon, Nicaragua, Kenya, Honduras and Armenia (brining my total loans to 251). It really is great to see real people using capitalism to improve their lives. And being able to help by lending some money is wonderful. When looking for loans I give preference to loans that improve productivity and increasing capacity of the entrepreneur. If they use the proceeds of the loan to increase their capacity to produce they can pay off the loan and find themselves much better off.

Douglas Osusu, Kisii, Kenya, in front of his posho mill (used for grinding maize into flour).

Douglas Osusu, Kisii, Kenya, in front of his posho mill (used for grinding maize into flour).A nice example of this is the loan to Douglas Osusu (pictured). He has requested this loan of 80,000 KES to purchase a dairy cow and a posho mill. This loan also has a portfolio yield (Kiva’s equivalent of an annual percentage rate) of 19%. 19% is very loan for loans on Kiva (remember there are significant costs to servicing micro-loans) – I like the rate to be under 30% but sometimes accept rates up to 40% (or even higher occasionally). I also give great preference to low rates, as the lower the rate the better for the entrepreneur. The 3rd factor I consider is the history of the field partner bank (default rate, delinquency rate and currency exchange loss rate). In this case the field partner is new and carries risk because of that. Still in this case I really like the loan and I like that this lender is charging low rates so I want to take the risk and see how they can do. The amount I lend is based on the combination of these factors – I lend more when I have several reasons to really like the loan.

Join other readers by making loans and joining the Curious Cats Lending Team: 8 members, 213 loans totaling $8,775. Comment with the link to your Kiva page and I will add a link on Curious Cat Kivans.

My current default rate is 1.39% and the delinquency rate is 8.49% (see chart of USA general delinquency rates). The delinquency rate is exaggerated due to technical details (some difficulties in reporting in various countries and such things). Agricultural loans often become delinquent on Kiva but still are paid in full (in my experience). While the defaulted loan rate is 1.39% if you look at the percent of dollars lost I have a rate of 1.2% (this is nearly all due to a bank that failed over a year ago to which I had 2 loans where I lost $87.50 of $100 – there are also 2 other losses for under $5). I add to my total loan amount a couple times a year but also I get to keep relending as money is paid back.

Some of my favorite ways to help reduce extreme poverty are Trickle Up, Kiva and using Global Giving to find small organizations.

Related: 100th Entrepreneur Loan – More Kiva Entrepreneur Loans: Kenya, El Salvador (June 2010) – Kiva Opens to USA Entrepreneur Loans – MicroFinance Currency Risk – Kiva Fellows Blog: Nepalese Entrepreneur Success

Some fast facts on the Kiva micro-lending site:

- 58 months old

- $153,090,650 raised

- 99% repayment rate

- 395,427 entrepreneurs funded

- 742,717 Kiva lenders

- 201 countries

- Curious Cats Lending Team: – 8 members, 193 loans totaling $7,950

Add to those numbers by joining Kiva today or lending more money today. Let me know and we will add you to the Curious Cat Kivan page.

Related: Provide a Helping Hand Using Kiva – Funding Entrepreneurs in Nicaragua, Ghana, Viet Nam, Togo and Tanzania – Creating a World Without Poverty

I made 6 more loans to entrepreneurs through Kiva today, including the 2 mentioned below. I have now made 227 loans through Kiva.

Christopher Kibubi Wahinya (in photo), Nairobi, Kenya, buys old computers, which he repairs and sells to the local people. He has been in this kind of business for the last four years and he says that the business is profitable. He is using his loan of Kes 50,000 to purchase old computers, repair them and sell to the local people. He plans to grow his business by moving to the ground floor of a busy building where he will stock all computer accessories and later own a computer showroom.

Carlos Alberto Pereira Granados is 43 years old and resides in the town of Cojutepeque, El Salvador. He has a workshop where he repairs sewing machines and sells all types of related parts. His business is located at the municipal market. Carlos Alberto works Monday through Sunday repairing the machines of his customers. He is requesting a loan so that he can buy sewing machines wholesale as well as parts such as bobbins, belts, hooks, and other items so that he has everything required to perform his work and attract more customers.

Kiva is a great way to support entrepreneurs. I try to focus on loans I think will benefit the borrower and grow the economy (not always easy). One of the things I try to watch is the “portfolio yield” (which is similar to Annual Percentage Rate) – the lower the better. Some banking Kiva partners are charities or partially funded by charities and therefore can 1) fund some of the administrative expenses of the bank and 2) are focused on helping the customers not making a profit. I would rather have my money used where it most helps entrapranuers so the lower the rate the better.

I encourage you to join me: let me know if you contribute to Kiva and I will add your Kiva page to our list of Curious Cat Kivans. Also join the Curious Cats Kiva Lending Team (the team has now lent over $7,500).

Related: Micro-credit Research – 100th Entrepreneur Loan – MicroFinance Currency Risk

I made several more loans using Kiva today to entrepreneurs in: Mongolia, Costa Rica, Kenya, Togo and Peru. One nice improvement they have made to the layout of the site is to show the “portfolio yield” (which is their form of APR – to provide an idea of the fees an entrepreneurs must pay).

Since I am making loans on Kiva to help others out one of the big factors for me is the cost to the entrepreneur. I just would much rather provide funding for loans where the entrepreneurs gets a reasonably low rate. I understand there are costs the lenders have to cover. I have no problem with that, but if my choice is helping an entrepreneurs get a loan at 20% or 40% I am going to take 40%. I figure the odds that the entrepreneurs benefits will be much greater with lower costs. I also prefer loans where I see how the loan will let them be more productive, for example by purchasing a machine to help improve productivity.

I wish Kiva would let me selected lenders I like and then have the results shown only for those lenders (as one option).

I encourage you to join me: let me know if you contribute to Kiva and I will add your Kiva page to our list of Curious Cat Kivans. Also join the Curious Cats Kiva Lending Team.

Related: 100th Entrepreneur Loan – Creating a World Without Poverty – Financial Thanksgiving – MicroFinance Currency Risk

Wells Fargo is offering to donate $1 to Kiva for every person that completes a 7 question survey (no contact information is required) to get what they call a retirement security index. I did and there are 2 benefits to doing so yourself. First, most of us would benefit from more attention to our retirement planning. Second help out Kiva – which I have mentioned many time.

Now I think their questionnaire is far too simplistic but it is hard to get people to spend even 15 minutes looking at a saving plan for retirement. So I know they are trying to keep it very simple so people will complete it. That said, read our posts on retirement planning to lean more about planning for retirement. It is critical that you spend the time in your 20’s, 30’s and 40’s doing this or you are really going to have trouble making decent retirement plans.

Related: Add to Your 401(k) and IRA – Spending Guidelines in Retirement – Retirement Savings Survey Results – Personal Finance: Saving for Retirement