I heard of Angie’s List several years ago. I looked at it a couple times but thought the price was a bit much so I never joined (it is around $10/month). But I joined a few weeks ago and I am impressed. What they offer is information. And there is lots of information for free on the internet. But they do a good job of organizing what the information and provide a valuable service in my experience.

From their site: “Angie’s List is where you’ll find thousands of unbiased reports and reviews about service companies in your area. Our members share their experiences with each other so that you can choose the service company that’s right for your job the first time around.”

The usefulness boils down to their ability to get accurate and useful information and present it well. And they do. The reviews, provided by other users, are detailed and helpful. I found two companies to do some work for me based on the site and both were very good. So far so good. I hope the track record continues.

The day the dream of global free- market capitalism died

The lobbies of Wall Street will, it is true, resist onerous regulation of capital requirements or liquidity, after this crisis is over. They may succeed. But, intellectually, their position is now untenable.

The intellectually depravity of such claims were obvious well before. Two problems make that truth less important. First, few actually believe in intellectual rigor any longer. Second, huge payments to politicians from those wishing to receive special favors from the government work (not very surprisingly). So given the lack of intellect and the alternative of just rewarding those that pay you huge sums of money it is no surprise politicians turned against capitalism and instead gave favors to a few that paid them well.

Maybe the latest huge bailout will change how things are done. I doubt it. New rules will be put in place. Plenty of people will pay politicians plenty of money to assure their methods of subverting the intent of those rules are allowed to continue. To change things you would need to vastly improve the intellectual rigor of decision making. That is unlikely, but if it happens it will be plenty obvious from how debate is carried out.

Read more

It has long been the case that home owners refuse to accept falling prices and choose to demand higher prices than the market demands in a falling market. Therefore when prices should fall (to find buyers) instead the sales decrease as buyers don’t decrease prices to a level buyers are willing to pay. Be It Ever So Illogical: Homeowners Who Won’t Cut the Price

Three years ago, when the real estate bubble was still inflating, this sort of standoff was the exception. It’s the norm today. Overall home sales have fallen a remarkable 33 percent since the summer of 2005. Home prices, on the other hand, continued to rise until 2006 and are now only 5 to 10 percent below where they were in mid-2005, according to various measures.

From the official US Federal Trade Commission site:

Viewing your credit report is an important step to financial security. You should review your credit reports annually (at least) to correct and any errors. Also doing so can be a tool to help you spot identity theft. The credit report site also has a large frequently asked question section with answers to questions like: What is a credit score? How do I request a “fraud alert” be placed on my file? Should I order all my credit reports at one time or space them out over 12 months? (I would suggest spreading the requests out during the year myself).

Reposting, original is from last January.

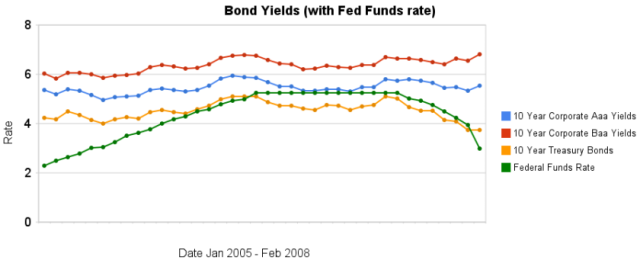

From January 2005 to July 2007 the Federal Funds Rate was steadily increased. The rate was held for a year. Since then the rate has been decreasing (dramatically, recently). As you can see from the chart, 10 year bond yields have been much less variable. The chart also shows 10 year corporate bond yields increasing in February when the federal funds rate fell 100 basis points.

Is the worst over, or just beginning?

…

If rates continue to fall, they could hit not only a new low for the year – the 10-year briefly touched 3.28% in January – but could come close to falling below the 3.07% level they hit in June 2003, which was a 45-year low at the time.

Treasury bond yields are down but a huge part of the reason is a “flight to quality,” where investors are reluctant to hold other bonds (so they buy treasuries when they sell those bonds). Therefore other bond yields (and mortgage rates) are not decreasing (the data in the chart is a bit old – the yields may well decrease some for both 10 year bonds once the March data is posted, though I would expect the spread between treasuries be larger than it was in January).

Data from the federal reserve – corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: 30 Year Fixed Mortgage Rates versus the Fed Funds Rate – After Tax Return on Municipal Bonds

So lets say you have a 401(k) and are adding to it regularly, you own your house, you have no credit card debts, you are paying off your car loan and overall your financial house is in fairly good order. Still you keep hearing the news about credit crisis, mortgage meltdown, dollar depreciation… It is enough to make you nervous but what should you do?

Frankly very little in the macro economy has much impact on what is a smart long term strategy. Should you move your retirement money into a money market fund, because of the risks of stocks now? No. If you are good enough to time the market you are already amazingly rich (or will be soon). But either no one is able to do this or next to no one is. Occasionally you might get lucky and time things right but being able to consistently do so over 40 years is just not something that happens.

So what you should do now is what you should always do. Have cash savings. Pay off your mortgage (don’t over-leverage yourself – don’t take out equity just because you have some). Save for retirement. Have health insurance. Don’t take on credit card debt (or most other debt). Keep up your employment skills (learn new skills…). Diversify your investments (stocks, international stocks, real estate, cash…).

People often get careless when the overall economy is good. And so maybe you failed to do what you should have been doing then. But the right thing to do today is essentially the right thing to do always. For example, Americans are drowning in debt. They were also drowning in debt 3 years ago. That problem is the same. If you have too much debt you should fix that. Not because of all the fear today, but because to much debt is always bad. You should not take out too much debt in the first place and if you have to much you should fix it whether the economy is strong or weak.

Read more

How bad is the mortgage crisis going to get?

This interview of Paul Krugman is worth reading. And it does seem to me the magnitude of the mortgage crisis is very large and likely will result in national declines in home prices of over 15% from the peak. Which is a very large decline. And in local markets declines of 35% seem likely.

Related: Home Price Declines Exceeding 10% Seen for 20% of Housing Markets (Sep 2007) – Home Values and Rental Rates – Real Estate Median Prices Down 1.5% in the Last Year (Aug 2007) – Real Estate articles

Ok the title is a bit of an misstatement but I am getting so tired of massive government transfers to the rich. Basically here is what has happened. People with tens and hundreds of millions of dollars didn’t want to be subject to pesky regulations just because capitalism requires it. So they paid their politicians to not regulate their investment activities. They paid their lawyers to evade the legal requirements that they couldn’t get their political friends to remove.

Largely what they did was take huge amounts for taking positions that risk the economy for personal gain. The investments have huge leverage and massive negative externalities to the economy. Any capitalist would know this is exactly what the government is suppose to protect the economy from. Unfortunately our politicians think capitalism is that whoever has the gold, therefore should make the rules. A sad state but not a surprise.

So then, the negative externalities begin taking effect and the government now seems to think that massive government intervention is a great thing. What a sad state of affairs.

What should happen now. That is hard to say.

But certainly with the amount of huge financial bailout the government has engaged in recently certainly they need to plan for this far in advance (it is obvious their preferred method of letting their friends take huge risks with the economy and pay themselves well while the risks work out requires huge bailouts very frequently).

You could, I suppose, decide everyone should pay to support a few thousand people being allowed take positions that have huge negative externalities (in risks to the economy) and pay themselves millions before those externalities become obvious and then bail them out when it doesn’t but that doesn’t seem like the best strategy to me. Though it is obviously the one we have chosen. This is one very non-partisan issue. They pretty much all support letting those that pay the politicians well, do whatever they want. And then support bailing them out if there are problems.

What should the government do in economic matters. Not at all hard to say. Politicians shouldn’t auction off the health of the economy to those that pay them the most money. Politicians should not allow companies to subvert the legal and tax system and be rewarded (just because those companies pay the politicians well and fly them to nice vacations…). The government should regulate negative externalities as capitalism requires to function properly.

But most of all the voters need to vote for those actions. As long as voters elect those that believe in corporate welfare this is the natural result.

Related: Why Pay Taxes or be Honest – Politicians Give Lobbyists Tax Breaks for Billion Dollar Private Equities Deals (not the politicians are given the deal makers cash loans) – Estate Tax Repeal (payoff to the rich) – Politicians Again Raising Taxes On Your Children

Read more

The next shoe to drop in housing

…

Fannie and Freddie are demanding higher credit scores and charging higher rates for those who don’t have them. Until recently, a borrower with a 620 score might pay the same as one with a 680 score, said Victoria Bingham, chief executive with Pacific Rim Mortgage in Tigard, Ore.

But now that person might have to pay a half percentage point more. With today’s rates, that translates into 6.75% for a 30-year fixed-rate mortgage instead of 6.25%, or $74 more a month on a $225,000 loan, typical for her client base.

Borrowers must also put more money down, especially if they don’t have stellar credit. For instance, those with down payments of less than 5% need a credit score of at least 680, said Steven Plaisance, executive vice president of Arvest Mortgage Co. in Tulsa, Ok. Previously, he could make loans to people without big down payments if they had other strong points, such as stable employment.

Related: Federal Funds Rate and 30 Year Fixed Mortgage Rate – Mortgage Payments by Credit Score (Aug 2007) – learn about mortgage terms – Beginning of the End of Housing Bubble? – How Not to Convert Equity

Central bank intervention … unprecedented in scale and scope by Brad Setser

…

As around $900b, the fed’s balance sheet is something like 6-7% of US GDP. With $1600b in foreign assets, the PBoC’s external balance sheet alone is more like 50% of China’s GDP.

…

But with Martin Wolf now arguing that scenarios with more than a trillion in credit market losses cannot be ruled out – even more unprecedented central bank — and government — action cannot be entirely ruled out. The scale of the “great unwind” has been stunning. The pace of change in the policy debate only slightly less so.

Related: Fed takes leap towards the unthinkable – Goldman Sachs Rakes In Profit in Credit Crisis – Misuse of Statistics: Mania in Financial Markets – Why do we Have a Federal Reserve Board?