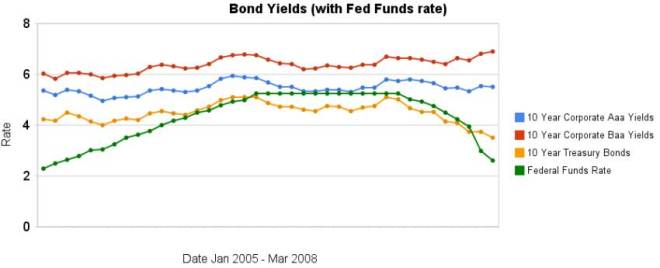

From January 2005 to July 2007 the Federal Funds Rate was steadily increased. The rate was held for a year. Since then the rate has been decreasing (dramatically, recently). As you can see from the chart, 10 year bond yields have been much less variable. The chart also shows 10 year corporate bond yields increasing in February and March when the federal funds rate fell well over 100 basis points.

Treasury bond yields are down but a huge part of the reason is a “flight to quality,” where investors are reluctant to hold other bonds (so they buy treasuries when they sell those bonds). Therefore other bond yields (and mortgage rates) are not decreasing. I guessed last month that the data “may well decrease some for both 10 year bonds once the March data is posted” which wasn’t the case. But I was right in “expect[ing] the spread between treasuries be larger than it was in January.”

Data from the federal reserve – corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: 30 Year Fixed Mortgage Rates versus the Fed Funds Rate – After Tax Return on Municipal Bonds

Housing prices posted large declines over the last year. One important thing to keep in mind when looking at the recent results is how rare significant declines in housing prices have been. In general housing prices decline very little (less than 10% drops and normally less than 5%). Normally the turnover just decreases dramatically as people refuse to sell at lower prices and just stay in their house until prices recover. Housing Prices Post Record Declines:

Of those 20 metro areas, 17 posted their largest year-over-year declines ever. Ten of the 20 cities posted double-digit dips. The 10-city Case/Shiller index is down 13.6% year-over-year, the biggest drop since its launch in 1987

…

Prices in the Las Vegas metro area have plunged more than any other city, down 22.8% over the 12 months through February. Miami prices plummeted 21.7%. In Phoenix, they’ve fallen 20.8%. Of the 20 cities Case/Shiller tracks, only Charlotte, N.C. showed higher prices, up 1.5% over the 12-month period.

Other metro areas recorded only modest price declines, including Portland, Ore., down 2.0%, Seattle, off 2.7% and Dallas, 4.1%. In the nation’s largest city, New York, metro area prices dropped a modest 6.6%.

Related: Home Price Declines Exceeding 10% Seen for 20% of Housing Markets (Sep 2007) – How Not to Convert Equity – Housing Inventory Glut (Aug 2007) – Mortgage Defaults: Latest Woe for Housing (Feb 2007)

Horatio Alger Multiplied by 1.3 Billion

“My mother and father went through the Cultural Revolution,” Mr. Feng said. “They had no chance.” He continued: “When I was in grammar school, the Cultural Revolution ended. When I graduated from university in 1992, that was the year of real reform. Deng Xiaoping encouraged students to go into business and become entrepreneurs. Before then, if you wanted to be an entrepreneur, you would sink like a stone. But after that, anyone could be an entrepreneur.”

…

But look at what else happened: motivated by the prospect of wealth, people started companies. And as those companies succeeded, millions of new jobs were created.

I have written about the importance of capitalism to improve life for people around the globe. I have also discussed how many don’t understand what capitalism is (the general idea that capitalism is largely about those with the gold making the rules, which it is not).

Capitalism fundamentally is about allowing market to determine how to allocate resources (and government protecting that function along with others such as providing security, regulating externalities…). There are serious problems with in the USA in this regard – with enormous political favors granted those giving politicians enormous payments and oligopolies restricting the market from working properly. The government fails to properly regulate oligopolies, as dictated by capitalism – to prevent the markets to be dictated to by organizations pursuing their own interests, again due to large payments to politicians by those favored by preventing capitalism from working (either that or just a co-incidence that those making big payments just happen to give to politicians legislating [and overseeing regulators] against capitalism).

Just to state the obvious, Chinese government policy and practices also conflicts with capitalism frequently.

Related: Estate Tax Repeal – What is Wrong with Copyright Taking Public Good for Private Special Interests – Bill Gates: Capitalism on the 21st Century – The Future is Engineering – Making a Difference – Diplomacy and Science Research

Home Prices Drop Most in Areas with Long Commute by Kathleen Schalch

The Washington, D.C., metropolitan area has been hit hard. Prices tumbled an average of 11 percent in the past year. That’s the big picture. But a look at Ashburn, Va., about 40 miles from the center of town, finds a steeper fall.

…

Jonathan Hill, vice president of Metropolitan Regional Information Systems, which tracks home sales, sat in his office recently, clicking through page after page of price data sorted by ZIP code. There were a lot of negative numbers, but not in places that are close in or near public transit.

…

David Stiff, chief economist for the company that produces the Case-Shiller Home Price Index, saw the trend in other cities, as well – including Los Angeles, San Francisco, New York, San Diego, Miami and Boston. Stiff recently matched home resale values against commute times and found that in most of these major metropolitan areas, the trend is the same. The longer the commute, the steeper the drop in prices.

Related: Urban Planning – How Walkable is Your Prospective Neighborhood – Exurbs Hardest Hit in Recent Housing Slump (Feb 2007)

Much of personal finance is not amazingly complex once you take some time to lay out the basics. We have covered some important topics previously: tips on using credit cards, retirement saving, creating an emergency fund… One of the most critical factors is to insure yourself against possible catastrophic events.

Some personal finance mistakes can set you behind, say falling to save for retirement when you are 28 or cashing in your 401(k) when you switch jobs at 27. Those mistakes however are most often manageable. You just need to save more later. For health insurance the critical need is to protect yourself from huge costs.

Bankruptcies are a huge problem due to health costs. If you have done everything else right and have saved up say $150,000 in mutual funds (in addition to retirement savings and a house) at age 40 but have no health insurance there is little I can think of more likely to result in your losing that saving than a health crisis when you are without coverage (disability insurance is another critical personal finance need that I will discuss in another post and the another such risk – as is an uninsured home). The costs of health care are just too large for any but the richest to survive a major cost without either ruining an entire lifetime of smart financial moves or coming close.

There are certain things that cannot be compromised in your personal financial situation. Health coverage for significant costs is one of those. If you can afford a $5,000 (or higher) deductible that is fine. The critical need for health insurance is not the first $2,000 or $20,000 but the 2nd, 3rd, 4th… $100,000 bill. A bill for $2,000 you can’t afford is a challenge but a bill for $100,000 you can’t afford can ruin decades of smart and diligent financial moves.

Read more

Half of Gen X Doesn’t Expect to Retire

…

“They are earning money and paying into Social Security and yet they fear they may never see the payback,” said Moloney. “They feel they deserve it, but it looks like a financial black hole to them right now.”

The government certainly is failing to pay for future obligations today instead choosing to raise taxes on the future. But Social Security itself is actually in better shape than most think. We really do need to move out the benefit payment date (when it began projected life expectancy was almost the same as the date payments would start – which would mean moving the retirement date more than 15 years later, I believe). Going that far is not needed but it should be moved back. But really social security is in good shape for 30 years or more. First, it isn’t going to go from good shape to failed in a day. And second, they will make adjustments as they have in the past to make it work (the adjustment they made in the last 15 years helped a great deal so now they can just add some additional delays in when it starts paying out… and extend the good condition of Social Security without too much trouble).

Medicare is the huge problem. The country either needs to stop paying an extra 50-80% for health care than other countries do (and thus reduce the cost of Medicare liabilities) or massively cut benefits or massively increase taxes. Likely a combination of all 3.

Read more

Nationalities of the 25 richest people:

| Country | Number |

|---|---|

| Russia | 7 |

| India | 4 |

| USA | 4 |

| Hong Kong | 2 |

| Germany | 2 |

| France | 2 |

| Mexico | 1 |

| Sweden | 1 |

| Spain | 1 |

| Saudi Arabia | 1 |

11 Richest in order: Warren Buffett, USA $62Billion; Carlos Slim Helu & family, Mexico, $60B; William Gates III, USA $58B; Lakshmi Mittal, $45B; Mukesh Ambani, India, $43B; Anil Ambani, India, $42B; Ingvar Kamprad & family, Sweden, $31B; KP Singh, India, $30B; Oleg Deripaska, Russia, $28B; Karl Albrecht, Germany, $27B; Li Ka-shing, Hong Kong $26.5B.

Data from Forbes 2008 Billionaires List, using country of citizenship. Using stock values on 11 February, 2008.

Related: Best Research University Rankings (2007) – Top 10 Manufacturing Countries (2006) – How Rich Are You?

Read a nice review of The Budget Deficit, the Current Account Deficit and the Saving Deficit:

- Tax incentives to encourage saving would likely also stimulate investment and lower both the budget deficit and the trade deficit.

- Reducing the budget deficit would reduce the vulnerability of the U.S. economy to foreign creditors; rising deficits could lead to foreigners dumping dollar assets, causing equities to decline, interest rates to spike and the dollar to plunge.

- Reducing the budget deficit doesn’t necessarily mean higher tax rates; marginal rate cuts reinforced by slower government spending growth would be ideal incentives.

Unfortunately, the recent tax “rebates” designed to stimulate the economy dealt a setback to budget discipline. Most people probably understand that. What they probably don’t understand is that the increased budget deficit will also tend to worsen our international balance of payments and weaken the dollar. The hip bone is connected to the thigh bone; so policymakers need to study these interconnected deficits. They need to borrow my boxes.

US banks Citigroup and Merrill Lynch reveal fresh $15bn loss

Merrill will suffer $5 billion of write-downs, analysts say, which would push the bank $2.7 billion into the red. t is expected to knock a further 20% from the value of its sub-prime holdings, in spite of the fact that it announced $18 billion of write-downs only three months ago. The new rash of Wall Street losses and write-downs come in addition to the billions that have already been recorded.

The world’s biggest banks have suffered losses and write-downs totalling almost $250 billion since the beginning of 2007, according to analysts. Last week the IMF shocked markets by saying that global losses from the credit crisis could rise to $945 billion.

The language becomes even more extreme as the losses balloon.

Related: Fed Continues Wall Street Welfare – Credit Crisis (Aug 2007) – Central Bank Intervention Unprecedented in scale and Scope – Soros Says Credit Crisis Will Worsen Before Improving – Volcker: Spendthrift Americans Bred Credit Crisis

Creating a World Without Poverty by Muhammah Yunus (founder of the Grameen Bank and 2006 Nobel Peace Prize recipient). Giving people the opportunity to advance economically is something I see as very important. It is hard to imagine in the USA when those that are seen as poor have air conditioning, indoor plumbing, cars, TVs, electricity… but billions of people would love to approach such material wealth.

When you really have to struggle to put food on your plate or get clean water economic concerns are critically important. Economic progress may well decide whether your children live or not. Muhammah Yunus’ new book is a good read to hopefully encourage more people to realize there really are much more important things than your fourth pair or shoes (to say nothing of you 20th pair) or expensive wine or a newer car or…

Microfinance is a great system where those that have been lucky to receive material wealth can help provide opportunity to others. Loans of $200-$500 can make a huge difference in an entrepreneurs life. Just giving them the chance to use their intellect and hard work to create a life where they can get raise themselves slightly can change their lives, their children’s lives and together with others perhaps their community.

Trickle Up, Kiva and Grameen Bank are three great ways to help give entrepreneurs a chance to improve their lives. As I have mentioned before if you are a Kiva lender add a comment with your Kiva page and I will add a link to: Curious Cat Kiva Supporters. I will say I am happy with the success of this blog in general, the thing that disappoints me is how few links we have on that page.

Related: Microfinancing Entrepreneurs – Interview with Mohammad Yunus – Trying to Keep up with the Jones – Providing a Helping Hand via Kiva – Curious Cat Science and Engineering blog posts on appropriate technology