Photos from my hike in Forest Glen Preserve, Illinois 2 years ago.

Other photos: Bull Run Mountain Conservancy Trail, Virginia – Yellowstone National Park – Devils Tower National Monument

Read more

Pretty much everyone (certainly the vast majority of regulators and politicians) have no clue about capitalism. The concept that a “free market” should be allowed to operate is theoretical, based on “perfect competition” (which essentially means zero barriers to entry). Obviously the politicians support, not capitalism (which would require regulation of imperfect markets (and certainly not support consolidation past the point of many competing companies), but the idea that those with the gold make the rules. Natural monopolies (like gas distribution, electricity, likely internet infrastructure…) should be fully regulated companies which then have the infrastructure accessed by multiple competitors (none of which own the natural monopoly – of course).

With some market that is even remotely in the area where a capitalist free market was in place, it is very simple to not have to deal with companies that treat customers horribly (like Verizon, Comcast, Time Warner Cable…) you just chose another company to deal with.

But these companies want to have the government allow them to create a monopoly (or something extremely close) and then claim to be in favor of capitalism (and further make ludicrous claims about what capitalism would suggest about regulation in oligopolistic markets). These ideas is so laughable that if politicians had even a sense of economic understanding they would adopt the appropriate capitalist response (for government).

Obviously, regulation is required as the market moves away from the area of “perfect competition.” When some huge company wants to buy some other huge company (say creating greater than 10% of the market combined) this would be rejected. If the market is a natural monopoly where the free market is not the proper capitalist market (such as one where the government would allow the proper capitalist response to players in the market attempting to break the free market by gaining to much control), then, of course a regulated natural monopoly would take on that economic task. This is not really complicated stuff.

Read more

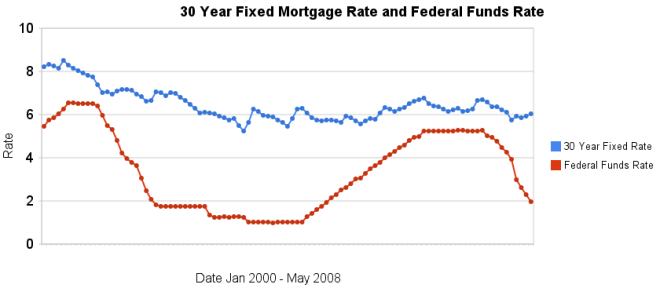

This year, the average discount rate has fallen every month while the average 30 year mortgage rate has climbed all but 1 month (a 5 basis point drop). In January, 2008 the discount rate averaged 3.94% and 30 year conventional fixed rate mortgages averaged 5.76%. In May, 2008 the discount rate had fallen to 1.98% (for a 196 basis point drop) and 30 year conventional fixed rates had risen to 6.04% (for a 28 basis point increase).

The chart shows the federal funds rate and the 30 year conventional fixed rate mortgage rate from January 2000 through May 2008 (for more details see: historical comparison of 30 year fixed mortgage rates and the federal funds rate).

Related: Affect of Fed Funds Rates Changes on Mortgage Rates – real estate articles – Bond Yields 2005-2008 – Jumbo and Regular Mortgage Rates By Credit Score

Read more

Graduates should put off living large after college

The key, experts say, is a simple one: Live like a poor college student for a couple more years. While you’re doing that, you can pay off your debt, start a savings plan and embrace healthy habits that will serve you well for life.

This is exactly what I did. Outside of paying for college, extra living expenses in college were small. Just retaining the spending habit of college gets your personal finances off on a good start.

Patty Procrastinator lives a little better when she first gets out of college and doesn’t start saving in the 401(k) until she’s 32. From that point, she also saves $500 a month, her employer adds $250 a month, and she earns a 9% return — just like Sallie. But at age 65, Patty will have only $1.7 million. That decade of delay will cost Patty $2.4 million.

Incidentally, Sallie contributes from her own money just $60,000 more than Patty does. The rest of the difference comes from employer contributions and investment returns.

By immediately starting to save for retirement and other needs you create a great foundation for your finances. Start saving for a house, a new car, create an emergency fund… Then you can create a situation where the only loans you need to take are for a house and maybe a new car – avoiding credit card debt or other personal loans.

Related: Personal Finance Basics: Health Insurance – Initial Retirement Account Allocations – Why Americans Are Going Broke

What’s the real federal deficit? by Dennis Cauchon, 2006

…

The audited financial statement – prepared by the Treasury Department – reveals a federal government in far worse financial shape than official budget reports indicate, a USA Today analysis found. The government has run a deficit of $2.9 trillion since 1997, according to the audited number. The official deficit since then is just $729 billion.

…

The new Medicare prescription-drug benefit alone would have added $8 trillion to the government’s audited deficit. That’s the amount the government would need today, set aside and earning interest, to pay for the tens of trillions of dollars the benefit will cost in future years.

Standard accounting concepts say that $8 trillion should be reported as an expense. Combined with other new liabilities and operating losses, the government would have reported an $11 trillion deficit in 2004 – about the size of the nation’s entire economy.

The federal government also would have had a $12.7 trillion deficit in 2000 because that was the first year that Social Security and Medicare reported broader measures of the programs’ unfunded liabilities. That created a one-time expense.

The continued attempts by politicians to distract from the huge taxes they are voting to place on our children and grandchildren is disheartening. And the continued actions that are the equivilent of getting another credit card when they spend so much that even the “official” books that they have exceeded the allowable total federal debt that is damaging the economy. They need to learn how to live within the current taxes they collect just as people need to learn to live within their earning. Either that fails to do so mortgages their future.

Related: Politicians Again Raising Taxes On Your Children – USA Federal Debt Now $516,348 Per Household – Washington’s Funny Accounting – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – Failed Leadership: Estate Tax Repeal

I originally setup the 10 stocks for 10 years portfolio in April of 2005.

At this time the stocks in the sleep well portfolio in order of returns:

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| Google – GOOG | 163% | 17% | 14% | |

| Amazon – AMZN | 124% | 7% | 7% | |

| PetroChina – PTR | 114% | 7% | 7% | |

| Templeton Dragon Fund – TDF | 90% | 10% | 10% | |

| Templeton Emerging Market Fund – EMF | 47% | 4% | 4% | |

| Cisco – CSCO | 42% | 7% | 8% | |

| Toyota – TM | 38% | 10% | 11% | |

| Tesco – TSCDY | 9% | 0% | 10% | |

| Intel – INTC | 3% | 5% | 6% | |

| Danaher – DHR | 1% | 5% | 8% | |

| Pfizer – PFE | -29% | 4% | 6% | |

| Dell | -30% | 7% | 6% |

At this point I am most positive on Google, Toyota, Templeton Dragon Fund and Tesco. I am wary of Dell – they seem to be moving in the wrong direction, but I am willing to give them longer to improve. I am even more wary of Prizer but again willing to stick with them for the long term. I will be looking for a suitable replacement.

In order to track performance I setup a marketocracy portfolio but had to make some minor adjustments. The current marketocracy calculated annualized rate or return (which excludes Tesco) is 9.8% (the S&P 500 annualized return for the period is 7.9%) – marketocracy subtracts the equivalent of 2% of assets annually to simulate management fees – as though the portfolio were a mutual fund – so without that the return is about 10.8%). View the current marketocracy Sleep Well portfolio page.

Related: 12 Stocks for 10 Years Update (Feb 2008) – Retirement Account Allocations for Someone Under 40 – Lazy Portfolio Results

I would guess a majority of people that read this blog are in the top 2% of earnings in the world. Many might not think they expect to live with more economic wealth than 98% of the world but their expectations seem to indicate that they do.

Generalizations about age groups I find to be mainly useless (providing no actual valuable information, either because it is plain wrong or the truth is so limited as to provide little value). There are often differences among age groups, but rather than the binary way it is presented it is more like those in their 20’s have x trait to say 45% and those in their 30’s have it 35% – hardly the distinct separation many claim. I do, however, think many in the USA today seem to think that it is their right to be rich. This can lead to behavior that is detrimental in the long term – since they are entitled no need to work hard, since they are entitled no need to worry about spending more than they have, since they are entitled there is no need to invest so the future will be prosperous, since they are entitle no need to worry about their own future (savings, career planning…)…

I don’t think this is very defined by age: though to some extent I feel this has grown over the decades. Those that lived through the depression, World War II, without air conditioning, without central heating, had parents that worked in factories when the parents were 14, only the richest in the USA lived in mansions (Mc or otherwise)… are not as likely to think that they just have a natural right to be rich.

Other countries are making the sacrifices today to invest in a prosperous future. It seems to me the USA is mainly counting on the huge economic wealth that has been built up to continue to provide it a prosperous future. That wealth does provide a huge advantage. But if too much is consumed today the future will not be as bright. And for the last few decades it seems to me we have been spending down the huge advantage more than building it up.

It is nice to be rich. But a society believing it is owed a life of luxury has not worked out well over the course of human history.

Related: The Ever Expanding House – Creating a World Without Poverty – Charge It to My Kids – Engineering the Future Economy – USA Federal Debt Now $516,348 Per Household – China’s Economic Science Experiment – Trying to Keep up with the Jones – It’s Not Money