Feds Rethink Rules on Retirement Savings

Among the possible changes: allowing taxpayers to delay taking required withdrawals from their individual retirement accounts, 401(k) plans and other similar accounts this year — or at least reducing the amount that must be withdrawn. Also under consideration are various ways to provide tax relief for people who already have made their required withdrawals for this year.

This is silly. Everyone in the situation of having to make a withdrawal has know about the requirement for years. My guess is this has been the law for over 20 years. Yes, the stock market is down. Yes, being forced to sell now would be bad. And how does providing “tax relief” to those who already made required withdrawals make any sense? Why not just have the treasury send checks to every American, who had a loss on an investment this year, equal to the amount of their loss? (By the way this is sarcasm – they should not really do that). These people have lost any sense of what investing, planning, responsibly… are.

First, knowing you have required withdrawals from your IRA, you should not hold those assets in stock (I suppose you could have significant cash assets outside your IRA and chose to just use the next option). Second, you can buy the stock outside your IRA at the same minute you sell them in the IRA. What is the big deal: the cost should be about $20 in stock commission for each stock – you save that much each time you fill up your gas tank lately (compared to prices this summer). All that not having to withdraw funds does is let those wealthy enough not to need a small amount of their IRA or 401(k) savings by the time they are 70 1/2 to keep deferring taxes on their investment gains.

Therein lies one of the major problems. This year’s distributions are based on Dec. 31, 2007, levels — a time when market prices generally were far above today’s deeply depressed values. As a result, “millions of Americans are forced to withdraw larger-than-anticipated amounts from already-depleted retirement funds,” says David Certner, legislative policy director at AARP, an advocacy group that represents nearly 40 million older Americans.

What kind of 1984 newspeak is this? I mean this is absolutely ridicules. You have to withdraw the exact amount you knew on January 1st 2008. Nothing about that has changed in almost a year. How can the Wall Street Journal report this without pointing out the completely false claim.

Read more

For me, giving back to others is part of my personal financial plan. As I have said most people that are actually able to read this are financially much better off than billions of other people today. At least they have the potential to be if they don’t chose to live beyond their means. Here are some of the ways I give back to others.

Kiva is a wonderful organization and particularly well suited to discuss because they do a great job of using the internet to make the experience rewarding for people looking to help – as I have mentioned before: Using Capitalism to Make a Better World. One of my goals for this blog is to increase the number of readers participating in Kiva – see current Curious Cat Kivans. I have also created a lending team on Kiva. Kiva added a feature that allows people to connect online. When you make a loan you may link you loan to a group.

I actually give more to Trickle Up (even though I write about Kiva much more). I have been giving to them for a long time. They appeal to my same desire to help people help themselves. I believe in the power of capitalism and people to provide long term increases in standards of living. I love the idea of providing support that grows over time. I like investing and reaping the rewards myself later (with investment I make for myself). But I also like to do that with my gifts. I would like to be able to provide opportunities to many people and have many of them take advantage of that to build a better life for themselves, their families and their children.

The photo shows Frew Wube, Haimanot and Melkan (brother and two sisters), an entrepreneur that received a grant from Trickle up. Trickle Up provides grants to entrepreneur, similar to micro loans, except the entrepreneur does not have to pay back the grant. They are able to use the full funds to invest in their business and use all the income they are able to generate to increase their standard of living and re-invest in the business.

“I also save every month,” says Frew, who has over $40 stored in a cooperative savings fund. The capital he has saved with other people in his group is used to provide loans to group members at a low interest rate. Frew, now able to access credit thanks to his Trickle Up clothing business, has taken progressively larger loans from the group, including his latest loan of $300 to start a candle business.

Citigroup Saw No Red Flags Even as It Made Bolder Bets

…

Citigroup’s stock has plummeted to its lowest price in more than a decade, closing Friday at $3.77. At that price the company is worth just $20.5 billion, down from $244 billion two years ago. Waves of layoffs have accompanied that slide, with about 75,000 jobs already gone or set to disappear from a work force that numbered about 375,000 a year ago.

…

“They pushed to get earnings, but in doing so, they took on more risk than they probably should have if they are going to be, in the end, a bank subject to regulatory controls,” said Roy Smith, a professor at the Stern School of Business at New York University. “Safe and soundness has to be no less important than growth and profits but that was subordinated by these guys.”

It is sad to see the same story repeated over and over. Give people the change for obscene bonuses. They make up claims that they are making lots of money to get bonuses but actually set the company to go bankrupt. They take huge bonuses because of course they are so smart and successful. The company fails and they say the market is to blame (it isn’t that they are really not that smart and of course they deserve the obscene bonuses they took before the collapse – or even after the collapse). They feel no shame for the horrible mess they leave in their wake that they would paid more than a king’s ransom to manage. They will be on to similar schemes in a few years.

If you are a bank you make money by borrowing for less than you lend. If you are a speculator then you try to out bet the other speculators. Nothing wrong with either choice to me. When you want to say you are a bank but you want to make most of your money from speculating their is a problem. Investment banks used to also make huge amounts from fees they would charge (they still do but not enough to offset the huge speculative losses).

Read more

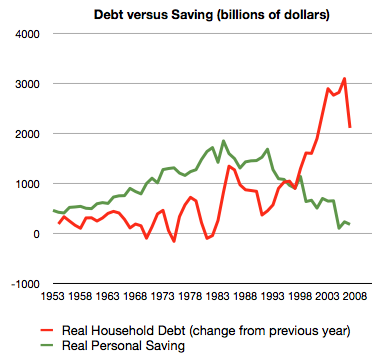

The whole sorry mess in one picture (including chart) by Philip Brewer

…

Starting back in about 2005, the American consumer reached the point that they could no longer service ever-increasing amounts of debt. That led to the housing bubble popping. The result is what you can see in the last datapoint on the graph–less new borrowing in 2007.

Related: $2,540,000,000,000 in USA Consumer Debt – Americans are Drowning in Debt – save an emergency fund – Financial Illiteracy Credit Trap – posts on saving money

How to thrive when this bear dies by Jim Jubak

…

In the case of the 2000-02 bear, the initial rush after the end of the bear delivered a huge share of the 101% gain for the bull market that ran from October 2002 through October 2007. In the 16 months from the Oct. 9, 2002, low through Feb. 9, 2004, the S&P 500 gained 47%. The gains from the remaining years of the “great” bull market of the “Oughts” were rather anemic: just 9% in 2004, 3% in 2005 and 14% in 2006.

…

If I’m right about the arrival of a secular bear, emerging economies and their stock markets will deliver higher returns, despite relatively slow growth, than the even more slowly growing developed economies. If I’m wrong about the secular bear, emerging economies will still deliver stronger growth than the world’s developed economies. Under either scenario, investors want to increase their exposure to the world’s emerging economies, which deliver more performance bang for less risk than most investors think.

Jim Jubak is one of my favorite investing writers. He can of course be wrong but he provides worthwhile insight, backed with research, and specific suggestions. I am also positive on the outlook for stocks (though what the next year or so hold I am less certain) and on emerging markets.

Related: Why Investing is Safer Overseas – Rodgers on the US and Chinese Economies – Beating the Market – The Growing Size of non-USA Economies – Warren Buffett’s 2004Annual Report

S&P 500 Payout Tops Bond Yield, a First Since 1958 (site broke the link, so I removed it):

…

Treasuries routinely had higher yields than stocks before 1958, according to Bernstein. When this relationship came to an end, yields were near their current levels. The S&P 500 dividend yield fell 0.58 percentage point, to 3.24 percent, in the third quarter of 1958. The 10-year yield rose about the same amount, 0.6 point, to 3.80 percent.

Two explanations later emerged for the reversal, he wrote. One held that the economy’s recovery from the 1957-58 recession showed “investors could finally put to rest the widely held expectation of an imminent return to the Great Depression.” The second was the increasing popularity of investing in growth stocks, or shares of companies whose sales and earnings rose at a relatively fast pace. Because of their expansion, the companies often paid below-average dividends.

Reversal of Fortunes Between Stocks and Bonds

Arnott takes it a step further. “In a world of deleveraging, both for the financial services arena and for the economy at large, growth is less certain,” he says. “And with the economy eroding sharply, so is inflation. If stocks don’t deliver nominal growth in dividends and earnings, then their yield ‘must’ exceed the Treasury yield, in order to give us any sort of risk premium.”

Related: Corporate and Government Bond Rates Graph – Highest Possible Returns – posts on interest rates – investing strategy

The challenges are difficult. I am not confident the current leadership (if their is leadership globally) is capable of making the difficult decisions. There are not easy answers though their are some pretty basic principles people should agree on (excessive leverage is dangerous, massive positions that endanger entire economies are dangerous…). But how to deal with those issues is not easy.

Related: Leverage, Complex Deals and Mania – Treasury Now (1987) Favors Creation of Huge Banks – Monopolies and Oligopolies do not a Free Market Make – Negligent Watchmen

Financial Markets with Professor Robert Shiller (spring 2008) is a fantastic resource from Open Yale courses: 26 webcast (also available as mp3) lectures on topics including: The Universal Principle of Risk Management, Stocks, Real Estate Finance and Its Vulnerability to Crisis, Stock Index, Oil and Other Futures Markets and Learning from and Responding to Financial Crisis (Guest Lecture by Lawrence Summers).

Robert Shiller created the repeat-sales home price index with Karl Case that is known as the Case-Shiller home price index.

Related: Berkeley and MIT courses online – Open Access Education Materials – Curious Cat Science and Engineering Blog open access posts – Paul Krugman Speaks at Google

The New Paradigm for Financial Markets is George Soros‘ newest book. Here is an interview with him in May of this year, on PBS, Financial World Shifts Gears Amid Economic Tumult, about the ideas in the book and the current crisis.

GEORGE SOROS: I think this is the most serious crisis of our lifetime. It’s not just a housing crisis, but a crisis of the financial system.

…

GEORGE SOROS: The regulators have failed to regulate, and they really have to — they left it to the market. That was this market fundamentalist philosophy, that markets will take care of themselves.

…

And I contend that there’s been what I call a super bubble that has been growing over the last 25 years at least, which basically consisted of an extension in credit, increasing use of leverage. That was the trend in reality.

And the misconception that credit is that markets can be left to their own devices. Now, in fact, they are given to excesses, and occasionally they create crises, but each time the authorities intervene and bail out the failing institutions, provide fiscal stimulus, monetary stimulus.

So it seems like the market corrects itself, but it’s actually the intervention of the authorities that saves the market.

Related: Soros on the Financial Market Collapse – Jim Rogers on the Financial Market Mess – Leverage, Complex Deals and Mania

With the recent turmoil in the financial market this is a good time to look at Dollar cost averaging. The strategy is one that helps you actually benefit from market volatility simply.

You actually are better off with wild swings in stock prices, when you dollar cost average, than if they just went up .8% every single month (if both ended with stocks at the same price 20 years later). Really the wilder the better (the limit is essentially the limit at which the economy was harmed by the wild swings and people decided they didn’t want to take risk and make investments.

Here are two examples, if you invest $1,000 in a mutual fund and the price goes up every year (for this example the prices I used over 20 years: 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 22, 24, 26, 28, 30, 33, 36,39) you would end up with $40,800 and you would have invested $20,000. The mutual fund went from $10 a share to $39 over that period (which is a 7% return compounded annually for the share price). If you have the same final value but instead of the price going up every year the price was volatile (for example: 10, 11, 7, 12, 16, 18, 20, 13, 10, 16, 20, 15, 24,29, 36, 27, 24, 34, 39) you end up with more most often (in this example: $45,900).

You could actually end up with less if the price shot up well above the final price very early on and then stayed there and then dropped in the last few years. As you get close to retirement (10 years to start paying close attention) you need to adopt a strategy that is very focused on reducing risk of investment declines for your entire portfolio.

The reason you end up with more money is that when the price is lower you buy more shares. Dollar cost averaging does not guaranty a good return. If the investment does poorly over the entire period you will still suffer. But if the investment does well over the long term the added volatility will add to your return. By buying a consistent amount each year (or month…) you will buy more share when prices are low, you will buy fewer shares when prices are high and the effect will be to add to your total return.

Now if you could time the market and sell all your shares when prices peaked and buy again when prices were low you could have fantastic returns. The problem is essentially no-one has been able to do so over the long term. Trying to time the market fails over and over for huge numbers of investors. Dollar cost averaging is simple and boring but effective as long as you chose a good long term investment vehicle.

Investing to your IRA every year is one great way to take advantage of dollar cost averaging. Adding to your 401(k) retirement plan at work is another (and normally this will automatically dollar cost average for you).

Related: Does a Declining Stock Market Worry You? – Save Some of Each Raise – Starting Retirement Account Allocations for Someone Under 40 – Save an Emergency Fund