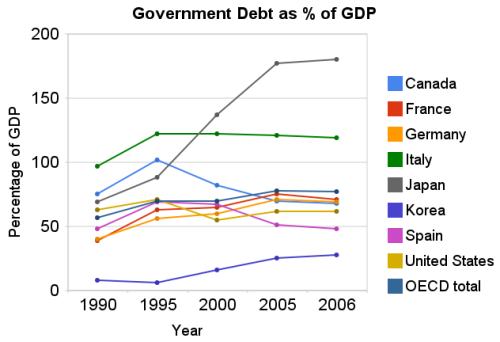

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, March 2009.

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, March 2009.The USA federal government debt is far too large, in my opinion. We have been raising taxes on future taxpayers for several decades, to finance our current spending. Within reason deficit spending is fine. What that reasonable level is however, is not easy to know. One big problem with the past few decades is that during very prosperous economic times we spent money that we didn’t have, choosing to raise taxes on the future (instead of either not spending as much or paying for what we were spending by raising taxes to pay for current spending).

By not even paying for what we are spending when times were prosperous we put ourselves in a bad situation when we have poor economic conditions – like today. If we were responsible during good economic times (and at least paid for what we spent) we could have reduced our debt as a percentage of GDP. Even if we did not pay down debt, just by not increasing the outstanding debt while the economy grew the ratio of debt to GDP would decline. Then when times were bad, we could afford to run deficits and perhaps bring the debt level up to some reasonable level (maybe 40% of GDP – though it is hard to know what the target should be, 40% seems within the realm of reason to me, for now).

There is at least one more point to remember, the figures in the chart are based on reported debt. The USA has huge liabilities that are not accounted for. So you must remember that the actually debt is much higher than reported in the official debt calculation.

Now on to the good news. As bad as the USA has been at spending tomorrows increases in taxes today, compared to the OECD countries we are actually better than average. The OECD is made up of countries in Europe, the USA, Japan, Korea, Australia, New Zealand and Canada. The chart shows the percentage of GDP that government debt represents for various countries. The USA ended 2006 at 62% while the overall OECD total is 77%. In 1990 the USA was at 63% and the OECD was at 57%. Japan is the line way at the top with a 2006 total of 180% (that is a big problem for them). Korea is in the best shape at just a 28% total in 2006 but that is an increase from just 8% in 1990.

Related: Federal Deficit To Double This Year – Politicians Again Raising Taxes On Your Children – True Level of USA Federal Deficit – Who Will Buy All the USA’s Debt? – Top 12 Manufacturing Countries in 2007 – Oil Consumption by Country

Read more

The health care system in the USA is broken, and has been for decades. The economic consequences of failing to implement effectively solutions has been immense. Finally, the momentum demanding change is growing. I still think the entrenched interests are going to delay needed reform, but hopefully I am wrong. An interesting proposal for ending medical status pricing is in the news – Health Insurers Propose End to Medical-Status Pricing

…

Health insurers oppose a Democratic push to create a government-run health plan to compete with private insurers for customers. Supporters of a public plan, including President Barack Obama, say it would guarantee affordable coverage, especially among those denied insurance or charged higher rates because of pre-existing medical conditions.

…

Insurers still would adjust variations in the price of premiums to an applicant’s age, family size and place of residence, according to Zirkelbach’s group. The organization speaks for 1,300 companies that provide public or privately funded benefits, led by UnitedHealth Group Inc. of Minnetonka, Minnesota, and Indianapolis-based WellPoint Inc.

This federal employees health benefit plan provides any federal employee the option to buy the insurance with no cost difference depending on health status. Some option, building off that is one that seems to have some possibility of success. I think some such system would be an improvement. However, it is far from the solution. Many problems are not solved by that at all. The huge amount of waste generated by insures and all the forms, needless bureaucracy… they generate is hard to justify. What value to they provide for the enormous costs?

Related: Broken Health Care System: Self-Employed Insurance – Traveling for Health Care – Employees Face Soaring Health Insurance Costs – Personal Finance Basics: Health Insurance – USA Spent $2.2 Trillion, 16.2% of GDP, on Health Care in 2007

Here is a very interesting paper showing real analysis of the data to illustrate that the deteriorating condition of loans should have been caught by those financing such loans years before the mortgage crisis erupted. Understanding the Subprime Mortgage Crisis by Yuliya Demyanyk, Federal Reserve Bank of Cleveland and Otto Van Hemert, New York University.

…

In many respects, the subprime market experienced a classic lending boom-bust scenario with rapid market growth, loosening underwriting standards, deteriorating loan performance, and decreasing risk premiums.30 Argentina in 1980, Chile in 1982, Sweden, Norway, and Finland in 1992, Mexico in 1994, Thailand, Indonesia, and Korea in 1997 all experienced the culmination of a boom-bust scenario, albeit in different economic settings.

Were problems in the subprime mortgage market apparent before the actual crisis erupted in 2007? Our answer is yes, at least by the end of 2005. Using the data available only at the end of 2005, we show that the monotonic degradation of the subprime market was already apparent. Loan quality had been worsening for five years in a row at that point. Rapid appreciation in housing prices masked the deterioration in the subprime mortgage market and thus the true riskiness of subprime mortgage loans. When housing prices stopped climbing, the risk in the market became apparent.

Related: Nearly 10% of Mortgages Delinquent or in Foreclosure – How Much Worse Can the Mortgage Crisis Get? – Homes Entering Foreclosure at Record – Articles on Real Estate

As I mentioned a few months ago, the New York Times archive is a great tool to see the history that led to the economic crisis we now face. Here is an article from 1999: Congress Passes Wide Ranging Bill Easing Bank Laws

”Today Congress voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the 21st century,” Treasury Secretary Lawrence H. Summers said. ”This historic legislation will better enable American companies to compete in the new economy.”

The decision to repeal the Glass-Steagall Act of 1933 provoked dire warnings from a handful of dissenters that the deregulation of Wall Street would someday wreak havoc on the nation’s financial system. The original idea behind Glass-Steagall was that separation between bankers and brokers would reduce the potential conflicts of interest that were thought to have contributed to the speculative stock frenzy before the Depression.

…

‘The world changes, and we have to change with it,” said Senator Phil Gramm of Texas, who wrote the law that will bear his name along with the two other main Republican sponsors, Representative Jim Leach of Iowa and Representative Thomas J. Bliley Jr. of Virginia. ”We have a new century coming, and we have an opportunity to dominate that century the same way we dominated this century. Glass-Steagall, in the midst of the Great Depression, came at a time when the thinking was that the government was the answer. In this era of economic prosperity, we have decided that freedom is the answer.” In the House debate, Mr. Leach said, ”This is a historic day. The landscape for delivery of financial services will now surely shift.”

But consumer groups and civil rights advocates criticized the legislation for being a sop to the nation’s biggest financial institutions. They say that it fails to protect the privacy interests of consumers and community lending standards for the disadvantaged and that it will create more problems than it solves.

The opponents of the measure gloomily predicted that by unshackling banks and enabling them to move more freely into new kinds of financial activities, the new law could lead to an economic crisis down the road when the marketplace is no longer growing briskly.

”I think we will look back in 10 years’ time and say we should not have done this but we did because we forgot the lessons of the past, and that that which is true in the 1930’s is true in 2010,” said Senator Byron L. Dorgan, Democrat of North Dakota. ”I wasn’t around during the 1930’s or the debate over Glass-Steagall. But I was here in the early 1980’s when it was decided to allow the expansion of savings and loans. We have now decided in the name of modernization to forget the lessons of the past, of safety and of soundness.”

Senator Paul Wellstone, Democrat of Minnesota, said that Congress had ”seemed determined to unlearn the lessons from our past mistakes.”

This is a great view into how both parties foolishly risked the economy to provide favors to their big donors and golfing buddies. It is sad that we chose to elect such people that play such an important role in our economy. But it is not as though we make these choice without easy access to the information on how they govern. And today listening to the people that took the money and voted for these, and similar changes to favor financial friends, they try and make it sound like they are not responsible. And sadly my guess is most people will accept their excuses. Until we do a better job of electing people we are going to continue to suffer the results of bad policy and to pay for the favors politicians give to those giving them money.

Related: Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – Copywrong – Pork Sugar – Monopolies and Oligopolies do not a Free Market Make – Ignorance of Capitalism – Ethanol: Science Based Solution or Special Interest Welfare – Legislation to Address the Worst Credit Card Fee Abuse – Maybe

Fed to start buying T-bonds today, hoping to move rates

The yield on the 10-year T-note plunged to 2.53% on March 18 from 3% the previous day, the biggest one-day drop in decades. But since then, Treasury bond yields have been creeping higher. The 10-year T-note ended Tuesday at 2.65%. Conventional mortgage rates have flattened or inched up, although they remain historically low, in the range of 4.75% to 5%.

…

On Tuesday the Treasury sold $40 billion of new two-year T-notes at a yield of 0.95%, which was lower than expected, indicating healthy investor demand. The government will auction $34 billion in five-year notes today and $24 billion in seven-year notes on Thursday. Against numbers like those in just one week, the Fed’s commitment to buy $300 billion of Treasuries over six months doesn’t look like much.

…

there’s nothing to stop the Fed from suddenly announcing that its $300-billion commitment will get substantially bigger: The central bank can, in effect, print as much money as it wants to buy bonds — at least, until the day that global investors stop wanting dollars.

The original announcement caused a dramatic move but since then yields have been drifting up, every day, including today. Rates are already very low. And the huge amount of increased federal borrowing is a potential serious problem for lowering rates. And potentially an even more serious problem is foreign investors deciding the yield does not provide a good investment given the risks of inflation (I know that is how I feel). It will be interesting to see what happens with rates.

Related: Who Will Buy All the USA’s Debt? – Lowest 30 Year Fixed Mortgage Rates in 37 Years – mortgage terms

Health spending in the United States grew 6.1 percent in 2007, to $2.2 trillion or $7,421 per person.

For comparison the total GDP per person in China is $6,100. This continues the trend of health care spending taking an every increasing portion of the economic output (the economy grew by 4.8 percent in 2007). This brings health care spending to 16.2% of GDP (which is yet another, in a string of record high percentages of GDP spent on health care). In 2003 the total health care spending was 15.3 of GDP.

With the exception of prescription drugs (which grew at 1.4% in 2007, compared to the 3.5% in 2006), spending for most other health care services grew at about the same rate or faster than in 2006. Hospital spending, which accounts for about 30 percent of total health care spending, grew 7.3 percent in 2007, compared to 6.9 percent in 2006.

Spending growth for both nursing home and home health services accelerated in 2007 (4.8% v. 4.0%). Spending growth for freestanding home health care services increased to 11.3 percent. Total health care spending by public programs, such as Medicare and Medicaid, grew 6.4% in 2007 v. 8.2% in 2006. In comparison, health care spending by private sources grew 5.8% compared to 5.4%.

Private health insurance premiums grew 6.0 percent in 2007, the same rate as in 2006. Out-of-pocket spending grew 5.3 percent in 2007, an acceleration from 3.3 percent growth in 2006. Out-of-pocket spending accounted for 12.0 percent of national health spending in 2007. This share has been steadily declining both recently and over the long-run; in 1998, it accounted for 14.7 percent of health spending and, in 1968, out-of-pocket spending accounted for 34.8 percent of all health spending.

The costs for health services and supplies for 2007 were distributed among businesses (25%), households (31%), other private sponsors (4%), and governments (40%).

Decades ago Dr. Deming included excessive health care costs as one of the seven deadly diseases of western management. We have only seen the problem get worse. Finally it seems that a significant number of people are in agreement that the system is broken. Still, admitting the system is broken is not the same as agreeing on how to fix it. The way forward to workable solutions still seems very difficult.

Full press release from the United States Department of Health and Human Services.

Related: International Health Care System Performance – Personal Finance Basics: Health Insurance – Many Experts Say Health-Care System Inefficient, Wasteful – How to Improve the Health Care System

Fluke? Credit crisis was a heist by James Jubak

Of course, just because the plan blew up on the looters, taking off a financial finger here and a portfolio hand there, you shouldn’t have any illusion that they’ve retired. In fact, in the “solutions” now being proposed — by Congress — to fix the global and U.S. financial systems, you can see the looters at work as hard as ever.

He is exactly right.

Answer: Because the federal government had forced them to back off. An aggressive interpretation of the definition of insurance could have let state insurance agencies regulate the derivatives contracts that AIG’s financial-products group was writing out of London. These were, in fact, insurance policies that guaranteed the companies taking them out (banks, other insurance companies, investment banks and the like) against losses on securities in their portfolios.

But Congress had made it very clear in the Commodity Futures Modernization Act — supported by then-Federal Reserve Chairman Alan Greenspan, steered through Congress by then-Sen. Phil Gramm, R-Texas, and signed into law by President Bill Clinton in December 2000 — that most over-the-counter derivatives contracts were outside the regulatory purview of all federal agencies, even the Commodity Futures Trading Commission.

With the new law on the books, the market for credit default swaps exploded from $632 billion outstanding in the first half of 2001, according to the International Swaps and Derivatives Association, to $62 trillion in the second half of 2007.

Question: Wasn’t anybody worried about the risk to the financial system posed by a market that dwarfed the assets of the sellers of this insurance?

Answer: Worry about leverage? You’ve got to be kidding.

In 2004, the Securities and Exchange Commission, after hard lobbying by Wall Street, reversed its 1975 rule limiting investment banks to leverage of 15-to-1. The new limit could be as high as 40-to-1 if the investment banks’ own computer models said it was safe.

Understanding the people paid lots of money to politicians and then (after they got lots of money) those politicians enacted laws that endangered the economy to favor those giving them lots of money. Now maybe these politicians just like letting exceptionally wealthy people endanger the economy for personal gain. Maybe they think that is a good idea. I tend to think instead they do what those they give them lots of money want. But maybe I am wrong on that.

Read more

The recent performance of investments can be discouraging. However, the most damaging reaction to your financial future is to reduce your contributions to retirement savings. IRAs and 401(k)s are great ways to save for retirement. In fact the recent performance has convinced me to increase my contributions. This is for two reasons.

First, I had been somewhat optimistic in my guesses about investment returns. The current decline means that investments in the S&P 500 have returned about 0% over the last 10 years. That is a horrible performance and it will take many years to even bring that up to a bad performance. So if you reduce your long term investment performance expectations you need to add more while you are working (or reduce your retirement expectations – or work longer).

Second, I think now is a very good time (long term) to be investing. I think the declines in the markets (both the stock market and real estate market) now provide good investment opportunities. Of course I could be wrong but I am willing to make investments based on this believe. And I believe there are plenty of place real estate prices may still be too high, but I believe there are also good buys.

A third reason worth considering is the damage done to the economy over the last 10 years and the costs of dealing with that today. Those costs are going to have long term impacts. Likely the economy will be stressed paying for the over-indulgences of the past for quite a long time. That means the risks to those in that economy will increase. And therefore having larger reserves is a wise course of action to survive the rough times ahead. Those rough times include a substantial risk of inflation. Investing to protect against that risk is important.

I would recommend starting with at least a 200 basis point increase in retirement contributions. For example, if you were saving 10% for retirement, increase that to 12%. If you have not added to your IRA for 2008, do so now (you have until April 15th to do so). In fact, if you haven’t added to your IRA for 2009, do so now.

Related: How Much Will I Need to Save for Retirement? – Nearly half of all workers have less than $25,000 in retirement savings – Investing – What I am Doing Now

California jobless rate climbs to 10.5 percent

…

Back then, unemployment remained above 10 percent for a year and briefly hit 11 percent. This time Levy said unemployment probably will break 11 percent and stay there for months, until the housing market hits bottom and starts to recover, healing the state’s biggest economic wound.

…

Metropolitan San Francisco, consisting of San Francisco, San Mateo and Marin counties, had a jobless rate of 7.8 percent in February, better than the state or the nation.

Official unemployment rates above 10% are a huge problem. And the impacts of such high unemployment rates grow over time, so staying above that rate for long is a huge problem. And the odds favor that happening in California and such a result for the USA overall is high. It likely true that the falling housing prices will stop before the economy really starts regaining the ground it has lost recently. But the real key, in my opinion, will be when job losses stop and the economy grows jobs. If we can do that by early 2010 I think we will be lucky.

Look for an improving unemployment rate, but even more important is for the total jobs to be growing faster than 100,000 per month. Long term it needs to grow faster than that but beating that target for several months should be a strong indication we may be reaching a bottom. There are plenty of other factors to look at also: average hours worked per week, increasing average pay, GDP growth, improving consumer confidence, reduction in consumer debt…

Related: USA Unemployment Rate Rises to 8.1%, Highest Level Since 1983 – Bad News on Jobs – What Do Unemployment Stats Mean? – Over 500,000 Jobs Disappeared in November

There is no invisible hand by Joseph Stiglitz, 2001 Nobel Prize in Economics

In particular, last year’s laureates implied that markets were not, in general, efficient; that there was an important role for government to play. Adam Smith’s invisible hand – the idea that free markets lead to efficiency as if guided by unseen forces – is invisible, at least in part, because it is not there.

…

That such models prevailed, especially in America’s graduate schools, despite evidence to the contrary, bears testimony to a triumph of ideology over science. Unfortunately, students of these graduate programmes now act as policymakers in many countries, and are trying to implement programmes based on the ideas that have come to be called market fundamentalism.

Let me be clear: the rational expectations models made an important contribution to economics; the rigour which its supporters imposed on economic thinking helped expose the weaknesses underlying many hypotheses. Good science recognises its limitations, but the prophets of rational expectations have usually shown no such modesty.

Related: Greenspan Says He Was Wrong On Regulation – Ignorance of How Markets Work – Leverage, Complex Deals and Mania – Estate Tax Repeal – Misuse of Statistics – Mania in Financial Markets