U.S. health care spending increased yet again in 2009, increasing 4%. Total health expenditures reached $2.5 trillion, which translates to $8,086 per person or 17.6% of the nation’s Gross Domestic Product (GDP). This represents yet another record high percentage of GDP taken by health care – for decades, year after year, health care takes more and more of the economic resources of the country. The broken USA health care system costs twice as much as other rich countries for worse results. And those are just the direct accounting costs – not the costs of millions without preventative health care, sleepness nights worrying about caring for sick children without health coverage, millions of hours spent on completing forms to try and comply with the requirements of the health care system’s endless demand for paperwork, lives crippled by health care bankruptcies…

Medicare spending grew 7.9% in 2009 to $502.3 billion. The senior citizen and health care lobbies have continued to increase spending on medicare. Too bad they can’t work on improvement instead of increased spending. Spending for fee-for-service (FFS) Medicare accelerated in 2009, increasing 5.5%. Medicare Advantage (MA) spending increased 15.8% in 2009 following 21.4% growth in 2008 and was primarily attributable to a continuation of significant increases in MA enrollment. Total Part D spending (which includes spending for benefits, government administration, and the net cost of health insurance) increased 9.3% to $54.5 billion in 2009.

Medicaid (which is a line item for the cost of medical treatment for the un-insured, though far from the only cost): Total Medicaid spending grew 9.0% in 2009 to $373.9 billion was driven by a 7.4% increase in Medicaid enrollment. Federal Medicaid expenditures increased 22%, while state Medicaid expenditures declined 9.8%. This difference in growth is due to a significant increase in the Federal Medical Assistance Percentages (FMAP) used to determine federal Medicaid payments to states—a provision of the American Recovery and Reinvestment Act of 2009 (ARRA). Essentially the federal government funded the spending since the states were almost all out of money.

Private Health Insurance: Private health insurance premiums grew 1.3% in 2009 (actually a pretty great figure by itself – unfortunately one lone good piece of data is not enough). Benefit payment growth increased 2.8% in 2009. These trends were heavily influenced by the recession, which resulted in private health insurance enrollment declines (which reminds you why looking at 1 piece of data isn’t a good idea). In 2009, spending for benefits increased faster than premiums, and as a result, the net cost of private health insurance (or the difference between premiums and benefits) fell to an 11.1% share of total private health insurance spending.

The burden of the large costs of the health care system in the USA are financed by businesses (21%), households (28%), governments (44%), and other private sponsors [foundations, charities and the like] (7%).

Read the complete National Health Expenditure Data report.

Related: USA Spends Record $2.3 trillion ($7,681 Per Person) on Health Care in 2008 – USA Heath Care System Needs Reform – Resources to Help Improve the Health Care System – CEOs Want Health-Care Reform

Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts.

- 5 Unconventional Ideas That Really Shouldn’t Be – “Before going to college or graduate school, know if this large investment of time and money is the best investment for you. For some people, college or grad school is the best investment. For some, self-education is.”

- 12 Stocks for 10 Years: Oct 2010 Update by John Hunter – Google is the top holding and top performer up 184% since the inception of the fund, PetroChina is up 102% and Templeton Dragon Fund is up 100%.

- 7 Ways To Retire Rich and On Time by Laura Adams – “1) Start an investing routine as early as possible. It might surprise you to know that the most important factor for investing success isn’t the investments you choose—it’s time… Compounding interest is a powerful force that can make even the most inexperienced investor rich… 4) Increase your savings rate each year. “

- 10 stocks for the next 10 years by James Jubak – “Johnson Controls (JCI). The stock did amazingly well in 2010—up 42.3%–considering that two of the company’s three businesses were in sectors of the economy that had been crushed. 2011 will be a better year for the company’s auto interior and auto battery business and for its building-wide energy efficiency unit… Yingli Green Energy Holding (YGE) is my choice for a horse to ride in China’s solar industry.”

- Six investing books that never left my bookshelf – “The Intelligent Investor: This has been referred to as the “value investor’s Bible” and the title is deserved. In it, Benjamin Graham, a former Columbia professor and the mentor of Warren Buffett, outlines his value-investing philosophy.”

China’s GDP grew 10.3% in 2010, 9.8% in the 4th quarter. China’s economy grew 9.2% in 2009. China likely became the 2nd largest economy in 2010, surpassing Japan. Inflation continues to be a worry with consumer inflation standing at 4.6% and producer inflation standing at 5.9%. Excessive real estate investing (pushing up prices and leading to what many see as overbuilding) also continues to be a worry that is growing.

China quarterly growth surges, inflation eases

“We expect GDP growth in year-on-year terms to moderate a bit from here,” Lu said. Tighter monetary conditions should see some easing in growth this year, forecasting full year growth expected at 9% and consumer inflation of 4%, according to Merrill’s estimates.

…

RBC revised its outlook for China’s growth this year to 9.5% from 8.8%, after trade data earlier this month showed imports and exports at record levels.

Related: China GDP up 8.7% in 2009 – Rodgers on the US and Chinese Economies (2008)

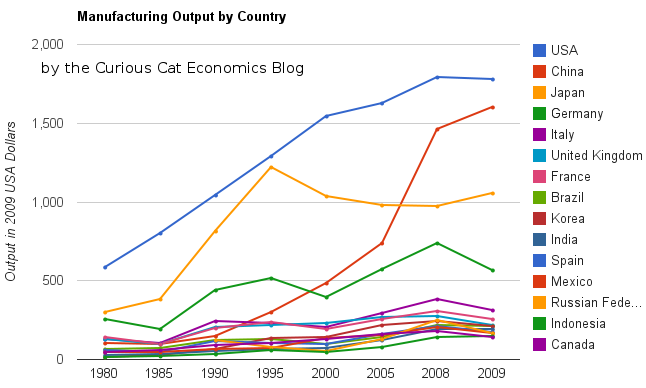

China continues to grow manufacturing is output. In 2009, the USA, and most countries saw declines in manufacturing production. China, however, continued to grow. China is now finally approaching the level of manufacturing done in USA. The latest data again shows the USA is the largest manufacturer but China looks poised to take over the number one spot soon.

The chart showing manufacturing output by country was created by the Curious Cat Economics Blog based on UN data (in 2009 USA dollars). You may use the chart with attribution.

The large decline in Germany was 23%. This was a 18% decline in Euro terms, and when you added the decline of the Euro the total USA dollar decline was 23%. Quite extraordinary. Most European countries were down over 15%. In fact, so extraordinary it makes me question the data. World economic data is useful and interesting but it isn’t perfect. USA manufacturing declined just .5%. China increased manufacturing production by 9%.

The last 2 years, China has stopped separating out mining and utilities from manufacturing. The percentage of manufacturing (to manufacturing, mining and utilities) was 78% for 2005-2007 (I used 78% of the manufacturing, mining and utilities figure provided in the 2008 and 2009 data – but that could be wrong). The unadjusted 2009 China total was $2.05 trillion and for the USA the total manufacturing, mining and utilities was $2.33 trillion. In 2009, the manufacturing total was 76% of USA manufacturing, mining and utilities. The percentage varies significantly between countries (the Russian federation is about 55% and Japan about 91%) and various over time as a countries economy changes.

The big, long term story remains the same. China has continued to grow manufacturing output tremendously. I see very little data to support the stories about manufacturing having to leave China to go elsewhere (especially when you look at the “lower wages” counties mentioned in news stories – they are not growing at any significant rate). The USA is still manufacturing a huge amount and that production has steadily grown over time.

When you look back over the period from 1980 to today you can see

- The biggest story is the growth in Chinese manufacturing

- The USA started out the largest and has grown significantly

- Japan did very well from 1980 to 1995, and since they have struggled

- The USA, China, Japan are really far ahead of other countries in total manufacturing output, and Germany is solidly in 4th place.

- After that the countries are fairly closely grouped together. Though there are significant trends hidden by the scale of this graph, which I will explore in future posts. South Korea has growth significantly over this period, for example.

- The biggest macro trend that the data shows, but is not so visible in this chart (other than China’s growth), is the very strong performance of emerging markets (and in fact some counties have fully become manufacturing powerhouses during this period, most notably China but also, South Korea and Brazil). And I see that continuing going forward (though that is speculation).

Two more interesting pieces of data. Italy is the 5th largest manufacturing country, I don’t think many people would guess that. Since 1980 Italy surpassed the UK and France but China rocketed passed them. And Indonesia has moved into 14th place, edging out Canada in 2009.

I plan to take more time in 2011 to look at global manufacturing and other global economic data more closely and to write about it here.

Related: Data on the Largest Manufacturing Countries in 2008 – Top 12 Manufacturing Countries in 2007 – Top 10 Manufacturing Countries 2006 – Leading global manufacturers in 2004