There are many good economic reasons to have multi-generational (at least 3 generations) households. There are some good social reasons too. There can be interpersonal benefits but also annoyances (which I think is why they decreased – plus we could afford it, the USA was living extremely richly).

The Return of the Multi-Generational Family Household

…

This represents a significant trend reversal. Starting right after World War II, the extended family household fell out of favor with the American public. In 1940, about a quarter of the population lived in one; by 1980, just 12% did. A range of demographic factors likely contributed to this decline, among them the rapid growth of the nuclear-family-centered suburbs; the decline in the share of immigrants in the population; and the sharp rise in the health and economic well-being of adults ages 65 and older.

…

Another factor has been the big wave of immigration, dominated by Latin Americans and Asians, that began around 1970. Like their European counterparts from earlier centuries, these modern immigrants are far more inclined than native-born Americans to live in multi-generational family households.

However, the trend reversal has also played out among native-born Americans. And for all groups, the move into multi-generational family households has accelerated during the Great Recession that began at the end of 2007.

The percentage of the population in such households now is 16%, still significantly below the high of 24.7% in 1940.

Related: Mortgage Rates Falling on Fed Housing Focus – Personal Finance Basics: Long-term Care Insurance – Bankruptcies Among Seniors Soaring (2008)

The global economy continue to be fragile and chaotic. At the same time companies continue to make large, and often increasing, profit. Here are some good blog posts on investing, personal finance and the economy.

- The Economy is Weak and Prospects May be Grim, But Many Companies Have Rosy Prospects by John Hunter – “the prospects in emerging markets look incredibly good to me. Yes they will slow their growth a bit if the large economies stall, but I think it is foolish to avoid investments in China, Singapore, Brazil, Korea, India, Ghana, Malaysia, Indonesia. In fact that is where companies like Google, Tesco, Apple, Toyota and Amazon are going to be making lots of money. Emerging markets are volatile and the companies in them are too. This will continue.”

- Extreme Early Retirement in Practice: How Two People Did It by Robert Brokamp – “We recently spent three months in Guatemala nestled between three volcanoes, on the shores of beautiful Lake Atitlan, and our average spending was $40 per day for the two of us, which equates to $14,600 per year. Our hotel price included daily cleaning, wi-fi, room service, cable TV, and a view.”

- Are stocks cheap yet? Not if the economy is slowing, these numbers say by James Jubak – “A 20% drop in forecast earnings—the rough equivalent of an economic slowdown instead of a recession—would put the price-to-earnings ratio of the S&P 500 at 13. That’s below the average of 15 but not really very cheap given the degree of economic risk that an investor is taking on right now.”

- Private Pensions: Another Gradual Catastrophe by Evan Tarte – “Despite the arguably noble intent of defined benefit plans and the PBGC, these plans demand crippling contributions from employers and inevitably the taxpayer, and make little sense in today’s market environment. PBGC’s current deficit stands at $22 billion”

- Emergency Savings: is 6 Months Still Enough? by GE Miller – “with the average unemployment duration at 40.4 weeks, 6 months (or 26 weeks) is no longer enough, particularly when you take into account the possibility of medical emergency, pet operations, or other unforeseen circumstances. What is a good length these days? 1 year, at a minimum.”

I believe in weak stock market efficiency. And recently the market is making me think it is weaker than I believed :-/ I believe that the market does a decent job of factoring in news and conditions but that the “wisdom of crowds” is far from perfect. There are plenty of valuing weaknesses that can lead to inefficient pricing and opportunities for gain. The simplest of those are spotted and then adopted by enough money that they become efficient and don’t allow significant gains.

And a big problem for investors is that while I think there are plenty of inefficiencies to take advantage of finding them and investing successfully is quite hard. And so most that try do not succeed (do not get a return that justifies their time and risk – overall trying to take advantage of inefficiencies is likely to be more risky). Some Inefficiencies however seem to persist and allow low risk gains – such as investing in boring undervalued stocks. Read Ben Graham’s books for great investing ideas.

There is also what seems like an increase in manipulation in the market. While it is bad that large organizations can manipulate the market they provide opportunities to those that step in after prices reflect manipulation (rather than efficient markets). It is seriously annoying when regulators allow manipulators to retroactively get out of bad trades (like when there was that huge flash crash and those engaging in high frequency “trading” front-running an manipulation in reality but not called that because it is illegal). Those that were smart enough to buy stocks those high frequency traders sold should have been able to profit from their smart decision. I definitely support a very small transaction tax for investment trades – it would raise revenue and serve reduce non-value added high frequency trading (which just seems to allow a few speculators to siphon of market gains through front running). I am fine with speculation within bounds – I don’t like markets where more than half of the trades are speculators instead of investors.

Related: Market Inefficiencies and Efficient Market Theory – Lazy Portfolios Seven-year Winning Streak – investing in stocks – Naked Short Selling

The national credit card delinquency rate (the rate of borrowers 90 or more days past due) decreased for the sixth consecutive quarter, dropping to 0.6% at the end of the second quarter in 2011. This is the lowest mark observed in 17 years. Credit card debt per borrower increased $20 in the quarter to $4,699, though it remains near record-low levels (and yet still at a level that is far too high).

Although credit card delinquencies were expected to drop, the data released today shows credit card delinquency rates improving by more than at any other time since the recovery began in 2009, both on a quarter-over-quarter basis (-18.9%) and on a year-over-year basis (-34.8%).

“National credit card delinquency rates have fallen to levels not seen since 1994 as consumers continue to tighten their spending,” said Ezra Becker, vice president of research and consulting in TransUnion’s financial services business unit. “TransUnion believes that the recovering economy is only indirectly impacting delinquency rates. More important and impactful to the decline in bank card delinquency are that consumers are using credit cards more responsibly; a large number of delinquent accounts have moved to charge-off status; and lenders remain conservative in their underwriting.”

The record low-level of credit card debt that has continued post recession is supported by a separate TransUnion credit card deleveraging analysis released in July. The analysis found that consumers made an estimated $72 billion more in payments on their credit cards than purchases between the first quarters of 2009 and 2010.

This is good news. We still need to reduce pay off much more of the excessive debt we took on living beyond our means the last few decades, but at least this is a small positive step. Overall consumer debt increased in the 2nd quarter, according to the Federal Reserve, and stands at over $2.45 Trillion. Revolving debt (credit cards) decreased slightly but non-revolving debt increased more. Consumer debt peaked near $2.55 Trillion in 2009 and recently bottomed just below around $2.4 in 2010. Consumer debt totals still need a great deal of improvement.

Related: Consumer and Real Estate Loan Delinquency Rates 2000-2010 – Consumer Debt Down, but Still Over $2.4 Tillion in the USA –

The current frustration with economic conditions in the USA and Europe has at its core two main elements. First the anti-capitalist concentration of power in a few monopolistic and oligopolistic corporations (along with the support and encouragement of governments and the governments failure to regulate markets to encourage capitalist practices). And second the consequences of living beyond our means finally becoming much more challenging.

What we have had has been very questionably capitalist. The largest reason for this “questionable” nature is not related to labor but instead to the inordinate power given to a limited number of large corporations. The corporations are suppose to not have “market power” in real capitalism. They have huge and growing market power. To me the main problem is that power disruption to the functioning of capitalist free markets.

There is also the problem that we have been living far beyond our means. This has nothing to do with capitalism or not capitalism. It is as simple as you produce 100 units of goods and use 110 that can’t continue forever. The USA started building a surplus in the 1940’s, I imagine Europe did in the 1950’s. Since about the 1980’s both areas have been living far beyond their means. While they were consuming what they saved over the previous decades it wasn’t so bad. While they mortgaged their future to live lavishly today that was worse. We continue to live beyond our means and are beginning to see some consequences but we haven’t come close to accepting the lavish lifestyles we enjoyed (while Europe and the USA lived off past gains and off very advantageous trade with the rest of the world) is not possible any longer. We can’t just have everyone in Europe and the USA live exceeding well and the rest of the world support us. Eventually we have to realize this (or in any event we will experience it, even if we don’t realize it).

Those 2 factors need to be addressed for our economic future to be as bright as it should be.

Related: Too big too fail, too big to exist – Using Capitalism in Mali to Create Better Lives – Creating a World Without Poverty

The fundamental truth right now is that the overall economy in Europe, the USA and Japan is weak and has some serious long term problems. But the connection between that and company weakness is not incredibly strong. Many companies have huge cash hoards, built up through the large profits they continue to make. Yes, the economy entering a serious downturn will hurt many companies. A railroad is going to lose some sales if retail sales decline (and so they don’t have to be shipped). Airlines (historically problematic companies to begin will) will struggle. Banks that pay exorbitant amounts to senior staff have trouble making money without handouts of taking huge risks that then result in more handouts once the risks fail (as usually a bad economy will expose the risks they have taken). Companies that can only do well based on large top line growth will suffer. But that isn’t all companies.

When you look at companies like Google, Apple, Tesco, Danaher, Amazon even Toyota I really don’t see many problems looking forward. They seem perfectly capable of staying profitable, even growing profits, even in the face of economic decline in Europe, the USA and Japan (if that happens: it is possible, but not certain – very low growth is possible). Companies that have very good prospects at staying profitable, even getting more profitable going forward are hardly the type of investment I want to sell. Especially not to put it in the bank and get 0%, or a money market fund and pay someone for the privilege of having my money.

The options for investing today don’t look so great. But I really don’t see any reason to be concerned about owning stocks that have good prospects to do well even if the quite a few large economies do poorly in the next decade. In fact I am happy to own them. Frankly the biggest worry I have is that the senior executives will loot the owners profits with exorbitant pay (this is not a worry at Toyota and less of one at Amazon). I would worry more about owning index funds in such an environment. But even as bad as things look now, I am not sure they will really turn out as bad as we fear – especially for many companies, for some yes, but many are well prepared for change).

And the prospects in emerging markets look incredibly good to me. Yes they will slow their growth a bit if the large economies stall, but I think it is foolish to avoid investments in China, Singapore, Brazil, Korea, India, Ghana, Malaysia, Indonesia. In fact that is where companies like Google, Tesco, Apple, Toyota and Amazon are going to be making lots of money. Emerging markets are volatile and the companies in them are too. This will continue.

Read more

His point on dollar cost averaging is sensible. Markets go up, more than down, overall [the statistically best approach] if you have a lump sum to invest the best strategy would be to invest it all now. There is added risk with this however, which he would accept. Also it doesn’t change the main reason people end up dollar cost averaging (by default, with retirement savings from each paycheck).

He discusses these ideas, and many more in his book: Debunkery: Learn It, Do It, and Profit from It-Seeing Through Wall Street’s Money-Killing Myths.

Related: Curious Cat investment books – Investment Risk Should be Evaluated as Part of a Portfolio, Rather than Risk of Each Individual Investment – Save Some of Each Raise

The report on employment released today was not good news but it was less bad than feared. Total nonfarm payroll employment rose by 117,000 in July, and the unemployment rate was little changed at 9.1%, the United States Bureau of Labor Statistics reported today. Employment growth in July, follows little growth over the prior 2 months. Total private employment rose by 154,000 over the month. Sectors experiencing growth include: health care, retail trade, manufacturing, and mining. Government employment continued to trend down.

Some good news is found in the adjustments to the last two months job numbers. The change in total nonfarm payroll employment for May was revised from +25,000 to +53,000, and the change for June was revised from +18,000 to +46,000. That adds 56,000 jobs to the 117,000 jobs added in July and brings to the total for this report to 173,000 additional jobs. Still not great but much better than the last 2 months. The economy needs to add 125,000 a month to keep up with population growth.

And currently the economy needs to add much more to make up for all the jobs lost due to the too big to fail institution created credit crisis. The damage done to the economy by those institutions and continuing to be done in order to support those companies remains enormous. I believe we need to see 230,000 jobs added a month consistently (in order to be making ground up for the damage done), before we can believe we are doing well.

Remember it was just over 2 years ago we were losing hundreds of thousands of jobs a month. We are doing much better now, but fixing how broken things were is not easy. Between January of 2008 and February of 2010, the economy lost 8.75 million jobs. Since February 2010, 1.94 million jobs have been added. That means we have still lost 6,810,000 jobs and when you consider we have to add 125,000 a month to keep up we have 43 * 125,000 = 5,375,000 we haven’t added bringing a the total of jobs needed to over 12,000,000 (the number we need to add to get back to where we were). But truthfully we probably were at a bubble induced level at the peak so 12,000,000 is probably an overestimate of how many jobs we need to gain back.

Read more

Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts and articles. If you want to have an post considered for the next carnival please submit it to quixperito: money.

- A Retailer’s Perspective on Amazon’s Amazingly Awesome Quarter by Scot Wingo – “This quarter provided more mounting evidence that Amazon is essentially running away with market share in e-commerce. Consequently, we believe retailers urgently need to think of an Amazon Strategy – partner, compete, co-opetition? Amazon is becoming so big and growing so fast, you almost can’t afford not get on this train.”

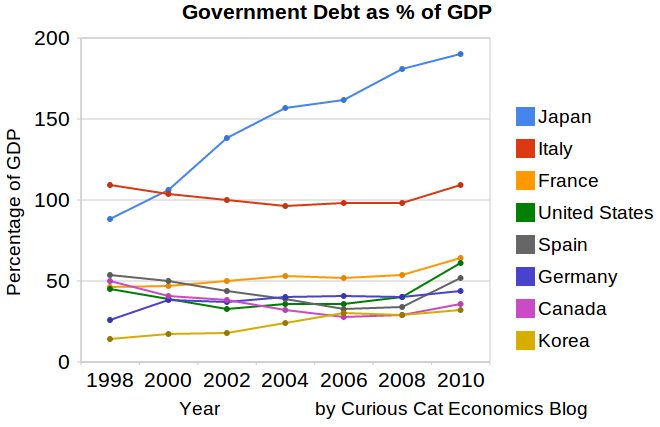

- Government Debt as Percent of GDP 1998-2010 for OECD countries by John Hunter – There has been a dramatic increase from 2008-2010. The USA is up from 41% of GDP to 61%. Spain is up from 34% to 52% (but given all the concern with Spain this doesn’t seem to indicate the real debt problems they have. Economic data contains quite of bit of noise, unfortunately.

- Cause of Decline in U.S. Financial Position by Barry Ritholtz – “The Pew Center reported in April 2011 the cause of a $12.7 trillion shift in the debt situation, from a 2001 CBO forecast of $2.3 trillion cumulative surplus by 2011 versus the estimated $10.4 trillion public debt in 2011. The major drivers were:

Revenue declines due to two recessions, separate from the Bush tax cuts of 2001 and 2003: 28%

Defense spending increases: 15%

Bush tax cuts of 2001 and 2003: 13%

Increases in net interest: 11%

Other non-defense spending: 10% - How This Blog Earns Full-Time Income from Part-Time Work by David Weliver – “for the most part, I’ve tried to focus on simply writing on topics that are unique, helpful, that answer specific questions. (It’s easy enough to be helpful, I think, but with billions of web pages out there, being unique is a never-ending challenge).”

- How to live off investment income – 1. Set up a cash buffer account between your regular monthly spending, and your income-spewing engines. 2. Work out how much of your annual investment income you will/can spend. The rest of the money you will reinvest…

- A Risky Investment Isn’t a Bad Investment by Kevin McKee – “If you want all the potential for Apple-esque gains, you need to be prepared to accept Enron-esque results. That’s the magic of risk; it goes both ways. Would I hold 100% of my portfolio in company stock? No.”

Buying investments when prices are low is often a good investment strategy. Sometimes the prices just get lower, so it doesn’t always work. But, most likely the USA housing market will turn around, at some point. Buying real estate before prices start to rise may well be a very profitable investment. And rental property can be a very good investment, even without price appreciation, if the rental income provides a nice cash flow. This is especially true with interest rates so low (so a decent cash flow is very attractive compared to other investments). Of course, real estate investing also has challenges.

The HomeVestors-Local Market Monitor Best Markets to Invest in Rental Property ranking forecasts the expected performance of rental real estate properties, specifically single-family homes maintained as rental properties. The rankings show the extra return, or risk-return premium, that an investor must demand from rental property in a local market. The risk-return premium can be added to the regular capitalization rate to produce a risk-adjusted cap rate at full occupancy for a local market. The ranking is calculated based on three-year forecasts of home prices (reflecting underlying home-price appreciation potential) and gross rents (as a proxy for potential investor cash flow). Of course, this is based on the creators expectation (and therefore hardly to be relied upon – they have no track record to measure against yet) but it is interesting.

The Top 10 markets in the new ranking are:

- Las Vegas, Nevada

- Detroit, Michigan

- Warren, Michigan

- Orlando, Florida

- Bakersfield, California

- Tampa-St. Petersburg, Florida

- Phoenix, Arizona

- Ft. Lauderdale, Florida

- Rochester, New York

- Stockton, California

Obviously their expectations favor cities that have seen drastic price declines. And that makes sense, as long as those cities rental markets are steady and housing prices stabilize.

An interesting piece of data: HomeVestors and Local Market Monitor estimate that approximately 14% of single-family homes in the USA are maintained as rental properties.

I do believe rental property investments in many markets in the USA may well be quite wise. Investing in rental properties is much more difficult than say stocks and has some high costs (if you chose to higher a property manager, for example). Real estate also requires a long term (5+ year commitments) to have reasonable expectations of successful investing results.

Related: Apartment Vacancies Fall to Lowest in 3 Years in the USA (April 2011) – Home Values and Rental Rates – Landlords See Increase in Apartment Rentals (June 2010)