Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts and articles. If you want to have an post considered for the next carnival please submit it to quixperito: money.

- A Retailer’s Perspective on Amazon’s Amazingly Awesome Quarter by Scot Wingo – “This quarter provided more mounting evidence that Amazon is essentially running away with market share in e-commerce. Consequently, we believe retailers urgently need to think of an Amazon Strategy – partner, compete, co-opetition? Amazon is becoming so big and growing so fast, you almost can’t afford not get on this train.”

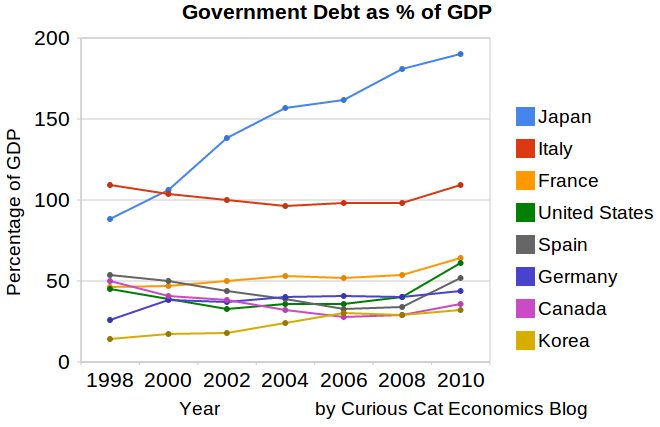

- Government Debt as Percent of GDP 1998-2010 for OECD countries by John Hunter – There has been a dramatic increase from 2008-2010. The USA is up from 41% of GDP to 61%. Spain is up from 34% to 52% (but given all the concern with Spain this doesn’t seem to indicate the real debt problems they have. Economic data contains quite of bit of noise, unfortunately.

- Cause of Decline in U.S. Financial Position by Barry Ritholtz – “The Pew Center reported in April 2011 the cause of a $12.7 trillion shift in the debt situation, from a 2001 CBO forecast of $2.3 trillion cumulative surplus by 2011 versus the estimated $10.4 trillion public debt in 2011. The major drivers were:

Revenue declines due to two recessions, separate from the Bush tax cuts of 2001 and 2003: 28%

Defense spending increases: 15%

Bush tax cuts of 2001 and 2003: 13%

Increases in net interest: 11%

Other non-defense spending: 10% - How This Blog Earns Full-Time Income from Part-Time Work by David Weliver – “for the most part, I’ve tried to focus on simply writing on topics that are unique, helpful, that answer specific questions. (It’s easy enough to be helpful, I think, but with billions of web pages out there, being unique is a never-ending challenge).”

- How to live off investment income – 1. Set up a cash buffer account between your regular monthly spending, and your income-spewing engines. 2. Work out how much of your annual investment income you will/can spend. The rest of the money you will reinvest…

- A Risky Investment Isn’t a Bad Investment by Kevin McKee – “If you want all the potential for Apple-esque gains, you need to be prepared to accept Enron-esque results. That’s the magic of risk; it goes both ways. Would I hold 100% of my portfolio in company stock? No.”

- Let the M&A boom show you where to put your money in this crazy market by Jim Jubak – “I’d target sectors such as coal and iron mining where companies are used to working with very long lead times and where supply—hence growth—is very hard to find. (It helps that even if the company you pick doesn’t wind up being acquired, you’ve still bought a stake in very attractive sector.)… I’d also target sectors such as chemicals and software games where the market is very, very fragmented—lots of players with small market shares.”

- HousingTracker: Homes For Sale inventory down 11.1% Year-over-year in July – “Of course there is a large percentage of distressed inventory, and various categories of “shadow inventory” too. But the decline in listed inventory will put less downward pressure on house prices and is something to watch carefully all year.”

- Can We Expect the Health Care System in the USA to Become Less Damaging to the Economy? by John Hunter – “We have had over 20 years of health care costs going up more than inflation – every year. That is an amazing (and horrifyingly bad) record. We need very strong evidence to conclude we can even just reduce the increase in damage done year after year by the broken health care system.”