Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival. The carnival is published twice each month with links to new, related, interesting content online.

- Long Term Care Insurance – Financially Wise but Current Options are Less Than Ideal by John Hunter – “The questions about long term care insurance are not about the sensibility of the coverage abstractly, it is very wise. But the complexities, today, in the real world make the question of buying more a guess about what coverage you will actually receive if you need it.”

- Figuring Out The Real Price Of College by Jacob Goldstein – “For the current school year, the average sticker price for tuition and fees at a private, nonprofit college is $28,500, according to a report from the College Board.

The average price students actually pay is less than half that — $12,970. That’s almost identical to the $12,650 that students paid, on average, in the 2001-2002 school year. (These are inflation-adjusted dollars.) Of course, this is just the average. What students actually pay varies wildly.”

- The Philippines Astounds the Skeptics by Bruce Einhorn – “Much of the credit for the good feeling should go to Aquino and his efforts to tackle corruption and improve the country’s infrastructure… As wages rise in China, the Philippines has a chance to attract investment from companies looking for low-wage alternatives, but the country’s notorious culture of bribery remains a major obstacle to growth”

- Periodic Table Of Dividend Champions by David Van Knapp – the post looks at the 105 stocks raising dividends 25 straight years and looking at current yield and dividend growth rate highlights 34 for further study by an investor “Similarly, some investors may be interested in stocks that have a low current yield coupled with a high rate of dividend growth.”

Marina Bay Sands Casino, Singapore. Singapore added their first two casinos in 2010 and have already the 2nd most gambling revenue of any area: after Macau and ahead of Las Vegas.

The expenses for long term care is exactly the type of financial risk insurance is best for. The problem is the whole area is so uncertain that what you buy may not provide the coverage you planned on (the health care system is so broken that it is not certain insurance will cover the costs, companies can go bankrupt, change coverage rules drastically…).

The questions about long term care insurance are not about the sensibility of the coverage abstractly, it is very wise. But the complexities, today, in the real world make the question of buying more a guess about what coverage you will actually receive if you need it.

Many of my posts here are focused on the USA but applicable elsewhere, or just applicable wherever you are. This post is mainly focused on the USA, long term care insurance options in other locations will be very different and have different considerations (in many countries it may not even apply, mainly due to a less broken health care system than the USA has).

Long-Term-Care Insurance: Who Needs It? by Marilyn Geewax

Such care can be crushingly expensive: Just one hour of home-health-aide care costs roughly $20, while the average private nursing home room costs $87,000 a year. Neither routine employer-based medical insurance nor Medicare will pay for extended periods of custodial care.”

…

Also, some people pay their premiums for years, and then get hit with rate hikes they can’t afford.

Insurance has a transaction cost. Paying that transaction cost for expenses you can afford is just waste. You should pay the cost directly. This is why higher deductibles are most often wise. It doesn’t make sense to cover pay insurance costs every year to pay for a $500 risk you can afford to absorb yourself.

But huge expenses are exactly what you want coverage for. Long term care expenses are huge. However, long term care insurance is still in flux, which isn’t good for something you want to provide long term protection. A huge risk is paying premiums for years, and then getting hit with rate hikes that may well be designed primarily just to get people to drop coverage (or be so expensive that those that stay pay enough that the insurance company makes money).

Ideally such insurance would be set so maybe the cost rose at some preset limit when you signed up. The problem is the USA health care system is so broken this won’t work. No one can predict how much more excessively expensive long term coverage will be in 30 years so the insurance companies can’t predict. It leaves consumers in a risky place.

Insurance is regulated by the states. There are huge differences in which states do a good job regulating long term care insurance and those that don’t. The majority don’t.

This is one of the more important areas of personal finance. Unfortunately there is no easy answer. If the system were stable, reliable and predictable, long term care insurance would be a definite requirement for a sound financial plan. Today it is wise to insure yourself from those risks, the problem is determining whether any of the options available are worth it. The risk of needing this insurance is high: it is both likely and costly. So getting coverage is definitely wise if you can find some you think is reliable over the long term. Because of the uncertain nature of the options, this will require much more effort on your part than many personal finance actions (I included several links below to help your research).

Also look at how long the coverage is for. This is another limitation insurance companies have put in place that makes it much less worthwhile.

Related: Personal Finance Basics: Long-term Care Insurance – National Clearinghouse for Long-Term Care Information – AARP advice – Disability Insurance is Very Important – How to Protect Your Financial Health

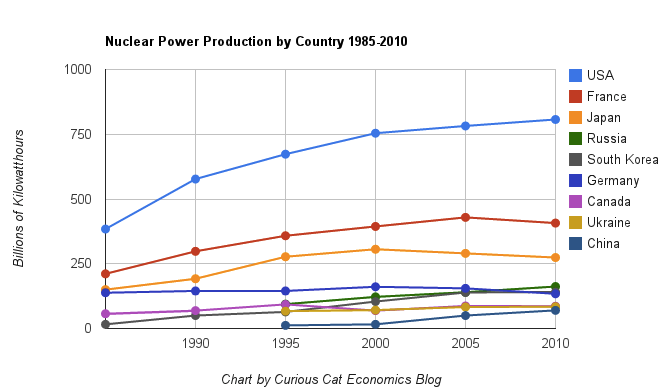

The chart shows the top nuclear power producing countries from 1985 to 2010. The chart created by Curious Cat Investing and Economics Blog may be used with attribution. Data from US Department of Energy.

The chart shows the top nuclear power producing countries from 1985 to 2010. The chart created by Curious Cat Investing and Economics Blog may be used with attribution. Data from US Department of Energy.___________________

Nuclear power provided 14% of the world’s electricity in 2010. Wind power capacity increased 233% Worldwide from 2005 2010, to a total of 2.5% of global electricity needs. Nuclear power generation declined by .72% for the same period.

Burning coal was responsible for 41% of electricity generation in 2010. Burning natural gas accounted for 21% and hydroelectric generation accounted for 15%.

Japan just announced that they have closed their last operating nuclear power plant. They have no nuclear power plant generating electricity for the first time in more than 40 years. It will be interesting to see how low their actual generation totals fall this year. They plan to re-open some of the plants but it is a political issue that is far from settled.

Globally nuclear power production increased 84% from 1985 to 2010. This is a very low percentage. Global output over that period increased much more than that, as did global electricity use. The share of electricity production provided by nuclear power peaked at about 17% for much of the 1990s.

Related: Nuclear Power Production Globally from 1985 to 2009 – Oil Production by Country 1999-2009 – Top 10 Countries for Manufacturing Production from 1980 to 2010: China, USA, Japan, Germany… – Japan to Add Personal Solar Subsidies – Nuclear Energy Institute (statistics)

Another view of data on nuclear power shows which of the leading nuclear producing countries have the largest percentages of their electrical generating capacity provided by nuclear power plants (as of 2009). France has 75% of all electricity generated from nuclear power. Ukraine had the second largest percentage at 49%, then Sweden at 37% and South Korea at 35%. Japan is at 28% compared to 20% for the USA. Russia was at 18% and China was at just 2%.

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. This carnival is different than other carnivals: I select posts from what I read (instead of posting those that submit to the carnival as many carnivals do). If you would like to host the carnival add a comment below.

- Hospital of Cards by Andrew Foy, MD – “For some perspective on the magnitude of the healthcare bubble consider that from 1990 to 2007 the cost of all items, as measured by the Bureau of Labor Statistics (BLS), rose by 159 percent while housing rose 163 percent and medical care rose a staggering 216 percent. A recent study by the Kaiser Family Foundation found that between 1999 and 2011, health-insurance premiums increased 168 percent while workers’ total earnings increased only 50 percent. Over that same time period, government spending on healthcare increased 240 percent while GDP increased 62 percent. The BLS reported that over the last 50 years, the percent of workers employed in private-sector healthcare has gone from 3 percent to over 11 percent and employment has continued to grow throughout the current recession.”

- Apple’s Earning are Again Great, Significantly Exceeding High Expectations by John Hunter – Apple posted quarterly quarterly net profit of $11.6 billion (an increase of 94% in net income)… Apple’s Gross margin was 47.4% (the best ever) compared to 41.4% in the year-ago quarter. International sales accounted for 64% of the quarter’s revenue…

- Demand for Rental Units Could Disrupt Fed by Kathleen Madigan – “The supply among rental housing is the tightest in more than a decade as only 8.8% of units were vacant in the first quarter. And given the steep fall in homeownership rates in the U.S., the demand for rental units is the highest in 15 years.”

- 5 Reasons Why Dividend Investing Rocks – “Dividend investors always look for high and sustainable dividend growth and any stock that decides to slow that down or even stop growing the dividend entirely raises red flags.”