Determining exactly what needs to be saved for retirement is tricky. Basically it is something that needs to be adjusted based on how things go (savings accumulated, saving rate, planned retirement date, investing returns, predicted investing returns, government policy, tax rates, etc.). The simple idea is start by saving 15% of salary by the time you are 30. Then adjust over time. If you start earlier maybe you can get by with 12%…

How Much to Save for Retirement is a very good report by the Boston College center for retirement research. They look at the percent of income replacement social security (for those in the USA) provides. This amount varies greatly depending on your income and retirement (date you start drawing social security payments).

Low earners ($20,000) that retire at 65 have 49% of income replaced by social security. Waiting only 2 years, to 67, the replacement amount increases to 55%. For medium earners ($50,000) 36% and 41% of income is replaced. And for high earners ($90,000) 30% an 34%.

Starting savings early make a huge difference. Starting retirement savings at age 25 requires about 1/3 the percentage of income be saved as starting at 45. So you can save for example 7% from age 25 to 70 or 18% from age 45 to 70. Retiring at 62 versus 70 also carries a cost of about 3 times as great savings required each year. So retiring at 62 would require an impossible 65% if you didn’t start saving until 45. But these numbers are affected by many things (the higher your income the less social security helps so the higher percentages you need to save and many other factors play a role).

Starting to save early is a huge key. Delaying retirement makes a big difference but it is not nearly as much in your control. You can plan on doing that but need to understand that you cannot assume you will get to set the date (either because finding a job you can do and pays what you wish is not easy or you are not healthy enough to work full time).

If you don’t have social security (those outside the USA – some countries have their versions but some don’t offer anything) you need to save more. A good strategy is to start saving for retirement in your twenties. As you get raises increase your percentage. So if you started at 6% (maybe 4% from you and a 2% match, but in any event 6% total) each time you get a raise increase your percentage 100 basis points (1 percentage point).

If you started at 27 at 6% and got a raise each year for 9 years you would then be at 15% by age 36. Then you could start looking at how you were going and make some guesstimates about the future. Maybe you could stabilize at 15% or maybe you could keep increasing the amount. If you can save more early (start at 8% or increase by 150 or 200% basis points a year) that is even better. Building up savings early provides a cushion for coping with negative shocks (being unemployed for a year, losing your job and having to take a new job earning 25% less, very bad decade of investing returns, etc.).

Investing wisely makes a big difference also. The key for retirement savings is safety first, especially as you move closer to retirement. But you need to think of investment safety as an overall portfolio. The safest portfolio is well balanced not a portfolio consisting of just an investment people think of as safe by itself.

Related: Retirement Planning, Investing Asset Considerations – Saving for Retirement Must Be a Personal Finance Priority – Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation

Enjoy this edition of the Curious Cat Investing, Economics and Personal Finance Carnival. This carnival is different than many blog carnivals: I select posts on those topics from what I read (instead of posting those that submit to the carnival as many carnivals do). If you would like to host the carnival add a comment below.

Sri Krishnan Temple, Singapore

- The Economics of Netflix’s $100 Million New Show – “ith Netflix spending a reported $100 million to produce two 13-episode seasons of House of Cards, they need 520,834 people to sign up for a $7.99 subscription for two years to break even.”

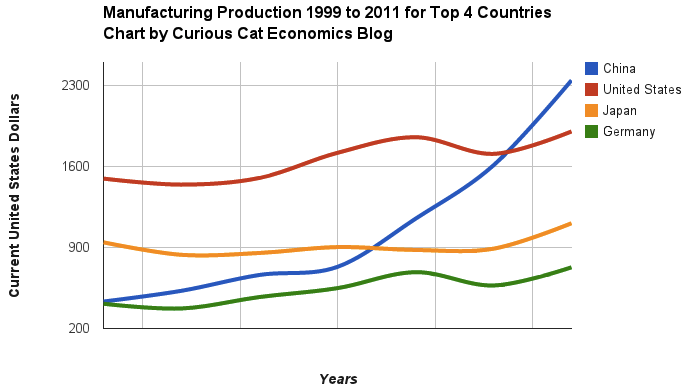

- Chart of Top Countries for Manufacturing Production 1999-2011 by John Hunter – “the four leading nations for manufacturing production remain solidly ahead of all the rest. Korea and Italy had manufacturing output of $313 billion in 2011 and Brazil moved up to $308 are in 4-6 place. Those 3 countries together could be in 4th place (ahead of just Germany). Even adding Korea and Italy together the total is short of Germany by $103 billion.”

- Why a Transaction Fee Matters to You by David Brin – “By raw extrapolation, this zero-point-zero-three-percent (0.03%) fee could raise a whopping deficit-curbing $352 billion dollars in ten years, while helping capital markets to settle down” [I agree we should use a very small fee to raise money and reduce incentive for high frequency trading/frontrunning – John]

- Mexico: The New China – “Today, what Shenzhen is to Hong Kong, Tijuana is becoming to San Diego. You can drive from our San Diego engineering center to our Tijuana factory in 20 minutes, no passport required. (A passport is needed to come back, but there are fast-track lanes for business people.)”

Chart of manufacturing production by China, USA, Japan and Germany from 1999 to 2011. The chart was created by the Curious Cat Economics Blog using UN data. You may use the chart with attribution. All data is shown in current USD (United States Dollar).

The story of global manufacturing production continues to be China’s growth, which is the conventional wisdom. The conventional wisdom however is not correct in the belief that the USA has failed. China shot past the USA, which dropped into 2nd place, but the USA still manufactures a great deal and has continually increased output (though very slowly in the last few years).

The story is pretty much the same as I have been writing for 8 years now. The biggest difference in that story is just that China actually finally moved into 1st place in 2010 and, maybe, the slowing of the USA growth in output (if that continues, I think the USA growth will improve). I said last year, that I expected China to build on the lead it finally took, and they did so. I expect that to continue, but I also wouldn’t be surprised to see China’s momentum slow (especially a few more years out – it may not slow for 3 or 4 more years).

As before, the four leading nations for manufacturing production remain solidly ahead of all the rest. Korea and Italy had manufacturing output of $313 billion in 2011 and Brazil moved up to $308 are in 4-6 place. Those 3 countries together could be in 4th place (ahead of just Germany). Even adding Korea and Italy together the total is short of Germany by $103 in 2011). I would expect Korea and Brazil to grow manufacturing output substantially more than Italy in the next 5 years.

Total nonfarm payroll employment increased by 157,000 in January, and the unemployment rate was essentially unchanged at 7.9%, the USA Bureau of Labor Statistics reported today. The change in total nonfarm payroll employment for November was revised from +161,000 to +247,000, and the change for December was revised from +155,000 to +196,000 which means this report shows an increase of 284,000 (157+86+41). In 2012, employment growth averaged 181,000 per month.

The number of unemployed persons, at 12.3 million, was little changed in January. The

unemployment rate was 7.9% and has been at or near that level since September 2012.

Among the major worker groups, the unemployment rates for adult men (7.3%), adult women (7.3%), teenagers (23.4%), whites (7.0%), african-american (13.8%), Hispanics (9.7%), and Asians (6.5%) showed little or no change in January.

In January, the number of long-term unemployed (those jobless for 27 weeks or more) was about unchanged at 4.7 million and accounted for 38.1% of the unemployed. The continued high level of long term unemployment is a continuing concern.

Health care continued to add jobs in January (+23,000). Within health care, job growth occurred in ambulatory health care services (+28,000), which includes doctors’ offices and outpatient care centers. In the last year, health care employment has increased by 320,000.

Manufacturing employment was essentially unchanged in January and has changed little, on net, since July 2012.

Average hourly earnings for all employees on private nonfarm payrolls rose by 4 cents to $23.78. Over the year, average hourly earnings have risen by 2.1 percent. In January, average hourly earnings of private-sector production and nonsupervisory employees increased by 5 cents to $19.97.

Related: 243,000 Jobs Added in January 2012 to Bring the USA Unemployment Rate Down to 8.3% – USA Unemployment Rate Remains at 9.7% (Feb 2010) – What Do Unemployment Stats Mean?