Apple analysts are of no value to investors

If the stock moved more than 2% on any uptick in volume, I had to write a story explaining why. After dealing with that every day for about three years, I realized the overwhelming majority of analysts had no better clue than I did about what was moving Cisco’s stock.

Most investors know this, but if you don’t remember this lesson. The “explanations” you hear from media often are just as useless as horoscopes. A bunch of meaningless words presented in the hopes you don’t realize they are empty words.

The talking heads (and writers) need to say something. It would be much more useful if they took the time to do some research and put in some thought but they seem to be driven by the need to fill space instead of the need to inform.

It is also a huge waste of time, explaining random variation.

Related: Fooled by Randomness – Seeing Patterns Where None Exists – Illusions, Optical and Other – Understanding Data

The most popular posts on the Curious Cat Investing and Economics blog in 2017 (based on page views).

- Default Rates on Loans by Credit Score (2015)

- Top 10 Countries for Manufacturing Production in 2010: China, USA, Japan, Germany… (posted in 2011)

- USA Health Care Spending 2013: $2.9 trillion $9,255 per person and 17.4% of GDP (2015) (

- Manufacturing Output as a Percent of GDP by Country (1980 to 2008) (2010)

- The 20 Most Valuable Companies in the World – November 2017*

- Warren Buffett’s 2016 Letter to Shareholders (2017)*

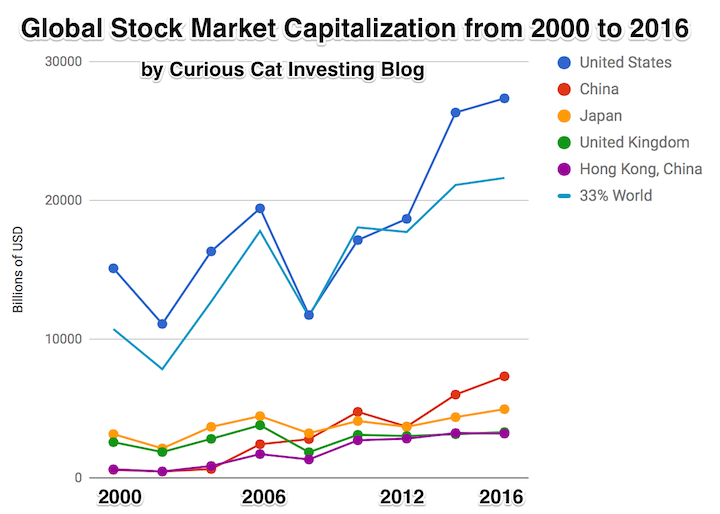

- Stock Market Capitalization by Country from 2000 to 2016 (2017)*

- Stock Market Capitalization by Country from 1990 to 2010 (2012)

- Monopolies and Oligopolies do not a Free Market Make (2008)

- Manufacturing Output by Country 1999-2011: China, USA, Japan, Germany (2013)

- Government Debt as Percentage of GDP 1990-2009: USA, Japan, Germany, China… (2010)

The chart shows the top countries based on stock market capitalization, with data from 2000 to 2016. The chart was created by Curious Cat Investing and Economics Blog may be used with attribution. Data from the World Bank.