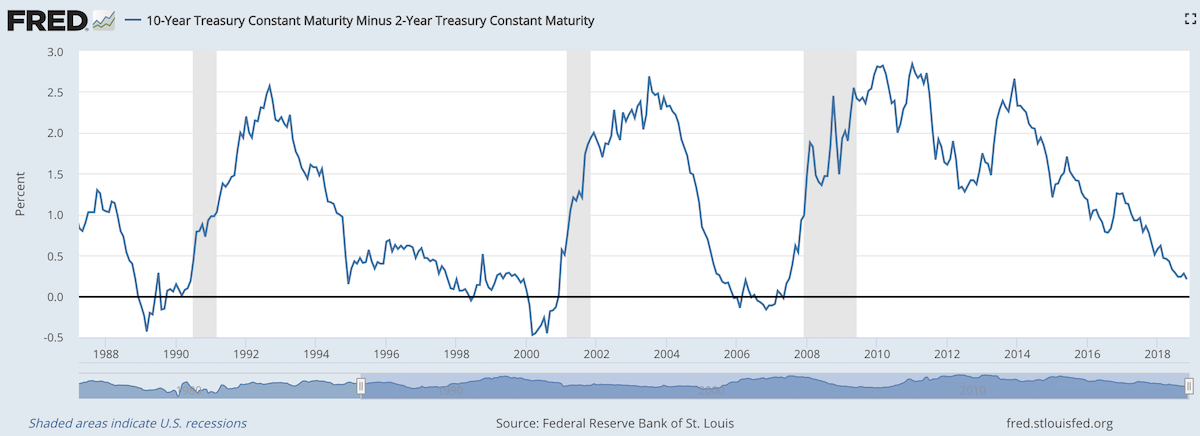

When 2 year US government bonds yield more than the 10 year US government bonds a recession is likely to appear soon. This chart shows why this is seen as such a reliable predictor.

The chart shows the 10 year yield minus the 2 year yield. So when the value falls below 0 that means the 2 year yield is higher. Each time that happened, since 1988, a recession has followed (the grey shaded areas in the chart).

Do note that there were very small inversions in 1998 and 2006 that did not result in a recession in the near term. Also note that in every case the yield curve was no longer inverted by the time a recession actually started.

The reason why this phenomenon is getting so much attention recently is another thing that is apparent when looking at this chart, the 2 and 10 year yields are getting close to equal. But you can also see we are no closer than 1994 and the USA economy held off a recession for 7 more years.

Since 1970 the average length of time from the inversion of the 10 to 2 year yield curve has been 12 months (with a low of 6 months in 1973 and a high of 17 months, before the great recession of 2008).

In addition to a possibly impending yield curve inversion it has been a long time since the last recession which makes many investors and economists nervous that one may be due.

Related: 30 Year Fixed Mortgage Rates are not correlated with the Fed Funds Rate – Bond Yields Stay Very Low, Treasury Yields Drop Even More (2010) – Looking for Dividend Stocks in the Current Extremely Low Interest Rate Environment (2011) – Stock Market Capitalization by Country from 2000 to 2016

Another thing to note about yield curves at this time is that the US Federal Reserve continues to hold an enormous amount of long term government debt (trillions of dollars) which it has never done before the credit crisis of 2008. This reduces the long term yield since if they sold those assets that would add a huge amount of supply. How this impacts the predictive value of this measure will have to be seen. Also, one way for the Fed to delay the inversion would be to sell some of those bonds and drive up long term rates.

The Federal Reserve has taken very slow steps to start reducing the amount of long term debt they hold. That links show a chart of the debt increasing from $870 million to over $4 Trillion (the unprecedented move was first taken to bail out the banks and save the economy from the destruction that would result from allowing all the banks that took risks they couldn’t survive to fail). At the start of 2018 the debt holdings at the Fed stood at $4.4 trillion. As of last week that has decreased to $4.1 trillion.

The Fed has not made clear how far they intend to reduce their holdings though it seems unlikely they are aiming at even reducing to $1 trillion (33% above where it stood before the “too big to fail bailout of 2008”). And the pace of the reduction is not really clear though for the time being they have indicated they will move slowly, as they have done this year. They haven’t indicated they plan on dramatically increase that pace. I do think it would be wise to speed up moving off more of the long term bond holding that they have and allow markets to return to a more normal state of affairs.

As I explained in a post on this blog in 2015 that I believed the Fed should raise the Fed Funds rate. They delayed a bit longer than I would have but the fed funds rates is much closer to where it should be today than when I wrote that article. It is likely increase again this month (which I believe would be wise).

I would likely increase fed funds rates a bit faster than is likely to happen in 2019. But if I could choose to increase the reduction in the Fed balance sheet (sell off more of their long term holding than they plan to) or increase the fed funds rate more than they plan to I would choose to speed up the reduction in the Fed balance sheet. My thoughts in doing so isn’t aimed at delaying a inversion of the yield curve, but it would likely result in such a delay.

I would like to see the Fed balance sheet reduced to $2 trillion as fast as possible (it is a complicated matter to determine how quickly that could be down without dramatic impacts on the economy). I would hope to do so in say 3 years (but that is a wild guess, I haven’t studied what is actually reasonable given the realities of the market). And then I would like to continue the reduction to $1 trillion (or less).

Economic Forecasts with the Yield Curve (Research from Federal Reserve Bank of San Francisco, this study used 10 year versus 1 year rates): “Every U.S. recession in the past 60 years was preceded by a negative term spread, that is, an inverted yield curve. Furthermore, a negative term spread was always followed by an economic slowdown and, except for one time, by a recession.”