2012 Retirement Confidence Survey

The data would be better if some value were placed on defined benefit plans; currently it is a bit confusing how much they may help. But the $25,000 threshold is so low that no matter what being under that value is extremely bad news for anyone over 40. And failing to have saved over just $25,000 toward retirement is bad news for anyone over 30 without a defined benefit plan.

Thirty-four percent of workers report they had to dip into savings to pay for basic expenses in the past 12 months.

…

Thirty-five percent of all workers think they need to accumulate at least $500,000 by the time they retire to live comfortably in retirement. Eighteen percent feel they need between $250,000 and $499,999, while 34 percent think they need to save less than $250,000 for a comfortable retirement.

Workers who have performed a retirement needs calculation are more than twice as likely as those who have not (23 percent vs. 10 percent) to expect they will need to accumulate at least $1 million before retiring.

66% of workers say their family has retirement savings and 58% say they are currently saving for retirement. These results are fairly consistent over the last few decades (the current values are in the lower ranges of results).

Nearly everyone wishes they had more money. One way to act as though you have more than you do is to borrow and spend (which is normally unwise – it can make sense for a house and in limited amounts when you are first going out on your own). Another is to ignore long term needs and just live it up today. That is a very bad personal finance strategy but one many people follow. Saving for retirement is a personal finance requirement. If you can’t save for retirement given your current income and lifestyle you need to reduce your current spending to save or increase your income and then save for retirement.

A year or two of failing to do so is acceptable. Longer stretches add more and more risk to your personal financial situation. It may not be fun to accept the responsibilities of adulthood and plan for the long term. But failing to do so is a big mistake. Determining the perfect amount to save for retirement is complicated. A reasonable retirement saving plan is not.

Saving 10% of your gross income from the time you are 25 until 65 gives you a decent ballpark estimate. Then you can adjust even 5 or 10 years as you can look at your situation. It will likely take over 10% to put you in a lifestyle similar to the one you enjoy while working. But many factors are at play. To be safer saving at 12% could be wise. If you know you want to work less than 40 years saving more could be wise. If you have a defined benefit plan (rare now, but, for example police or fire personnel often still do you can save less but you must work until you gain those benefits or you will be in extremely bad shape.

IRAs, 401(k) and 403(b) plans are a great way to save for retirement (giving you tax deferral and Roth versions of those plans are even better – assuming tax rates rise).

Related: In the USA 43% Have Less Than $10,000 in Retirement Savings – Saving for Retirement

In my opinion is has never been more difficult to plan for retirement. It is extremely difficult to guess what rates of return should be expected in the next 10-30 years. It might have actually been as difficult 10 years ago, but it seemed that it wasn’t. Estimating a 7-8% return for your portfolio seemed a pretty reasonable thing to do, and evening considering 10% wasn’t unthinkable, if you wanted to be optimistic and took more risk.

Today it is very hard to guess, going forward, what is reasonable. It is also hard to find any very safe decent yields. Is 4% a good estimate for your portfolio? 6%? 8%? What about inflation? I know inflation isn’t a huge concern of people right now, but I still think it is a very real risk. I think trying to project is helpful (even with all the uncertainty). But it is more important than ever to look at various scenarios and consider the risks if things don’t go as well as you hope. The best way to deal with that is to save more.

In the USA save at least 10% of your income for retirement in your own savings (in addition to social security) and it would be better to save 12% and you might even need to be saving 15%. And if you waited beyond 30 to start doing this you have to save substantially more, to have a comfortable retirement plan (obviously if you are willing to live at a much lower standard of living in retirement than before, you can save less).

Other factors matter too. If you don’t own your house with no more mortgage payments you will need to save more. Ideally you will have not debts at retirement, if you do, again you need to save more.

That Retirement Calculator May Be Lying to You

…

Vanguard founder Jack Bogle has a slightly more upbeat assessment. He expects stock returns of 7 percent to 7.5 percent over the next decade. He assumes no expansion in the market’s price-earnings ratio, dividend yields of 2.2 percent, and earnings growth of at least 5 percent. Bogle expects bond returns to be about 3 percent. For a balanced portfolio, that produces a net nominal return of slightly more than 6 percent. A higher forecast is T. Rowe Price’s estimate of 7 percent; until this year it had used 8 percent.

I also suggest using high quality high yield dividend stocks for more of the bond portfolio. I wouldn’t hold bonds with maturities over 5 years at these yields (or if I did, they would be an extremely small portion of the portfolio). I would also have a fair amount of the bond portfolio in inflation protected bonds.

I also invest in emerging economies like China, Brazil, India, Malaysia, Indonesia, Thailand, the continent of Africa… To some extent you get that with large companies like Google, Intel, Tesco, Toyota, Apple… that are making lots of money in emerging economies and continuing to invest more in emerging markets. VWO (.22% expense ratio) is a good exchange traded fund (ETF) for emerging markets. I also believe investing in real estate is wise as part of a retirement portfolio.

Related: 401(k) Options, Select Low Expenses – How Much Will I Need to Save for Retirement? – Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation

My preference is for a lower use of bonds than the normal portfolio balancing strategies use. I just find the risks greater than the benefits. This preference increases as yields decline. Given the historically low interest rates we have been experiencing the last few years (and low yields even for close to a decade) I really believe bonds are not a good investment. Now for someone approaching or in retirement I do think some bonds are probably wise to balance the portfolio (or CDs). But I would limit maturities/duration to 2 or 3 years. And really I would pursue high yielding stocks much more than normal.

In general I like high yielding stocks for retirement portfolios. Many are very good long term investments overall and I prefer to put a portion of the portfolio others would place in bonds in high yielding stocks. Unfortunately 401(k) [and 403(b)] retirement accounts often don’t offer an option to do this. Luckily IRAs give you the options to invest as you chose and by placing your IRA in a brokerage account you can use this strategy. In a limited investing option retirement account [such as a 401(k)] look for short term bond funds, inflation protected bonds and real estate funds – but you have to evaluate if those funds are good – high expenses will destroy the reasons to invest in bond funds.

There are actually quite a few attractive high yield stocks now. I would strive for a very large amount of diversity in high yield stocks that are meant to take a portion of the bonds place in a balanced portfolio. In the portion of the portfolio aimed at capital appreciation I think too much emphasis is placed on “risk” (more concentration is fine in my opinion – if you believe you have a good risk reward potential). But truthfully most people are better off being more diversified but those that really spend the time (it takes a lot of time and experience to invest well) can take on more risk.

A huge advantage of dividends stocks is they often increase the dividend over time. And this is one of the keys to evaluate when selected these stock investments. So you can buy a stock that pays a 4% yield today and 5 years down the road you might be getting 5.5% yield (based on increased dividend payouts and your original purchase price). Look for a track record of increasing dividends historically. And the likelihood of continuing to do so (this is obviously the tricky part). One good value to look at is the dividend payout rate (dividend/earnings). A relatively low payout (for the industry – using an industry benchmark is helpful given the different requirement for investing in the business by industry) gives you protection against downturns (as does the past history of increasing payouts). It also provides the potential for outsized increases in the future.

There are a number of stocks that look good in this category to me now. ONEOK Partners LP pays a dividend of 5.5% an extremely high rate. They historically have increased the dividend. They are a limited partnership which are a strange beast not quite a corporation and you really need to read up and understand the risks with such investments. ONEOK is involved in the transportation and storage of natural gas. I would limit the exposure of the portfolio to limited partnerships (master limited partnerships). They announced today that the are forecasting a 20% increase in 2012 earnings so the stock will likely go up (and the yield go down – it is up 3.4% in after hours trading).

Another stock I like in this are is Abbott, a very diversified company in the health care field. This stock yields 3.8% and has good potential to grow. That along with a 3.8% yield (much higher than bond yields, is very attractive).

My 12 stocks for 10 year portfolio holds a couple investments in this category: Intel, Pfizer and PetroChina. Intel yields 3.9% and has good growth prospects though it also has the risk of deteriorating margins. There margins have remains extremely high for a long time. Maybe it can continue but maybe not. Pfizer yeilds 4.6% today which is a very nice yield. At this time, I think I prefer Abbott but given the desire for more diversification in this portion of the portfolio both would be good holdings. Petro China yields 4% today.

When invested in a retirement portfolio prior to retirement I would probably just set up automatic reinvesting of the dividends. Once in retirement as income is needed then you can start talking the dividends as cash, to provide income to pay living expenses. I would certainly suggest more than 10 stocks for this portion of a portfolio and an investor needs to to educate themselves evaluate the risks and value of their investments or hire someone who they trust to do so.

Related: Retirement Savings Allocation for 2010 – S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 – 10 Stocks for Income Investors

The current frustration with economic conditions in the USA and Europe has at its core two main elements. First the anti-capitalist concentration of power in a few monopolistic and oligopolistic corporations (along with the support and encouragement of governments and the governments failure to regulate markets to encourage capitalist practices). And second the consequences of living beyond our means finally becoming much more challenging.

What we have had has been very questionably capitalist. The largest reason for this “questionable” nature is not related to labor but instead to the inordinate power given to a limited number of large corporations. The corporations are suppose to not have “market power” in real capitalism. They have huge and growing market power. To me the main problem is that power disruption to the functioning of capitalist free markets.

There is also the problem that we have been living far beyond our means. This has nothing to do with capitalism or not capitalism. It is as simple as you produce 100 units of goods and use 110 that can’t continue forever. The USA started building a surplus in the 1940’s, I imagine Europe did in the 1950’s. Since about the 1980’s both areas have been living far beyond their means. While they were consuming what they saved over the previous decades it wasn’t so bad. While they mortgaged their future to live lavishly today that was worse. We continue to live beyond our means and are beginning to see some consequences but we haven’t come close to accepting the lavish lifestyles we enjoyed (while Europe and the USA lived off past gains and off very advantageous trade with the rest of the world) is not possible any longer. We can’t just have everyone in Europe and the USA live exceeding well and the rest of the world support us. Eventually we have to realize this (or in any event we will experience it, even if we don’t realize it).

Those 2 factors need to be addressed for our economic future to be as bright as it should be.

Related: Too big too fail, too big to exist – Using Capitalism in Mali to Create Better Lives – Creating a World Without Poverty

The biggest investing failing is not saving any money – so failing to invest. But once people actually save the next biggest issue I see is people confusing the investment risk of one investment in isolation from the investment risk of that investment within their portfolio.

It is not less risky to have your entire retirement in treasury bills than to have a portfolio of stocks, bonds, international stocks, treasury bills, REITs… This is because their are not just risk of an investment declining in value. There are inflation risks, taxation risks… In addition, right now markets are extremely distorted due to the years of bailouts to large banks by the central banks (where they are artificially keeping short term rates extremely low passing benefits to investment bankers and penalizing individual investors in treasury bills and other short term debt instruments). There is also safety (for long term investments – 10, 20, 30… years) in achieving higher returns to gain additional assets – increased savings provide additional safety.

Yes, developing markets are volatile and will go up and down a lot. No, it is not risky to put 5% of your retirement account in such investments if you have 0% now. I think it is much riskier to not have any real developing market exposure (granted even just having an S&P 500 index fund you have some – because lots of those companies are going to make a great deal in developing markets over the next 20 years).

I believe treating very long term investments (20, 30, 40… years) as though the month to month or even year to year volatility were of much interest leads people to invest far too conservatively and exacerbates the problem of not saving enough.

Now as the investment horizon shrinks it is increasing import to look at moving some of the portfolio into assets that are very stable (treasury bills, bank savings account…). Having 5 years of spending in such assets makes great sense to me. And the whole portfolio should be shifted to have a higher emphasis on preservation of capital and income (I like dividends stocks that have historically increased dividends yearly and are likely to continue). And the same time, even when you are retired, if you saved properly, a big part of your portfolio should still include assets that will be volatile and have good prospects for long term appreciation.

Related: books on investing – Where to Invest for Yield Today – Lazy Portfolios Seven-year Winning Streak (2009) – Fed Continues Wall Street Welfare (2008), now bankers pay themselves huge bonuses because the Fed transferred investment returns to too-big-to-fail-banks from retirees, and others, investing in t-bills.

I have posted about the need to save money while you are working numerous times. Here is a good article looking at the large number of people that have failed to do so and are now retiring.

Retiring Boomers Find 401(k) Plans Fall Short

…

Vanguard long advised people to put 9% to 12% of their salaries—including the employer contribution—in their 401(k) plans. The current median amount that people contribute is 9%, counting the employer contribution, Vanguard says.

Recently, Vanguard has begun urging people to contribute 12% to 15%, including the employer contribution, because of the stock market’s weak returns and uncertainty about the future of Social Security and Medicare.

…

Experts estimate Social Security will provide as much as 40% of pre-retirement income, or $35,080 a year for that median family. That leaves $39,465 needed from other sources. Most 401(k) accounts don’t come close to making up that gap.

The median 401(k) plan held $149,400, including plans from previous jobs, according to the Center for Retirement Research. To figure the annual income from that, analysts typically look at what the family would get from a fixed annuity. That $149,400 would generate just $9,073 a year for a couple, according to New York Life Insurance Co., the leading provider of such annuities— less than one-quarter of the $39,465 needed.

Just 8% of households approaching retirement have the $636,673 or more in their 401(k)s that would be needed to generate $39,465 a year.

Knowing exactly what is needed for retirement is difficult. But knowing what is a responsible amount is not. It is certainly no less than 8%, and is likely the 12-15% figure Vanguard recommends. If you start at 10% from the time you join the full time workforce (in your 20’s) then you have some flexibility you can see how thing look when you are 30, maybe 12% is sensible, maybe 15%, maybe 10%. If you fail to save for a decade however, you are likely to need to be at 15%, or higher.

Read more

Consumers debt decreasing very slowly. In the 3rd quarter it decreased at an annual rate of 1.5%, after decreasing at a 3.25% rate in the second quarter. Revolving credit (credit card debt) decreased at an annual rate of 8.5% (compared to 9.5% in the second quarter), and nonrevolving credit (car loans…, not including mortgages) was up 2.5% (versus essentially unchanged).

Revolving consumer debt now stands at $814 billion down $52 billion this year. That is on top of a $92 decline in 2009. Hopefully we can increase the size of the decrease going forward. As individuals we should aim to have no consumer debt and build up cash reserves instead (the way the debt figures are calculated though, even if you don’t really have any debt, say you pay off your credit card bill each month, I believe your balance is still seen as “debt”, it is credit extended to you).

On September 30, 2010 total outstanding consumer debt was $2,411 billion (a decline of just $8 billion in the 3rd quarter, after a decline of $21 billion in the 2nd quarter). This still leaves over $8,000 in consumer debt for every person in the USA and $20,000 per family.

Consumer debt grew by about $100 billion each year from 2004 through 2007. In 2009 consumer debt declined over $100 billion: from $2,561 billion to $2,449 billion. For the first 3 quarters of 2010 it has declined just $38 billion.

The huge amount of outstanding consumer and government debt remains a burden for the economy. At least some progress is being made to decrease consumer debt. Credit card delinquency rates have actually been decreasing the last couple of year (from a high of 6.75% in the 2nd quarter of 2009 to 5% in the 2nd quarter of 2010 (I would guesstimate the average for the decade was 4.5%).

Those living in USA have consumed far more than they have produced for decades. That is not sustainable. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing.

We can’t afford to seek even more short term spending powered by more debt. Government debt has been exploding so unfortunately that problem has continued to get worse.

Data from the federal reserve.

Related: Consumers Continue to Slowly Reduce Their Debt Level – The USA Economy Needs to Reduce Personal and Government Debt – Consumer debt needs to decline much more.

In the USA we fail to save nearly enough for retirement by and large. And fail to save emergency funds or prepare for economically difficult times. We by and large chose to spend today and hope tomorrow will be good rather than first establishing a good financial safety net before expanding spending.

When people are debating withdrawing from their retirement account it is actually not the important decision it seems to be (normally). Normally the important decision was years before when they chose to take on consumer debt and not to build up an emergency fund. And when they failed to just build up saving beyond that which could be used for nice vacations, a new car, or to live on in economically challenging times.

If someone had been saving 15% of their salary in retirement since they started working if they took an amount that left them at 10% that is hardly a horrible result. While someone that was already behind by say adding just 3% to retirement savings and they took out all of it that would be much worse.

And we should remember even having a retirement account to withdraw from might put you ahead of nearly 50% of the population (and our state and federal governments, by the way). If you have to resort to withdrawing from your retirement account don’t think of that as the failure. The failure was most likely the lack of savings for years prior to that. And as soon as possible, re-fund your retirement account and build up a strong emergency fund, even if that means passing spending on things you want.

Related: Retirement Savings Allocation for 2010 – 401(k)s are a Great Way to Save for Retirement – Save Some of Each Raise

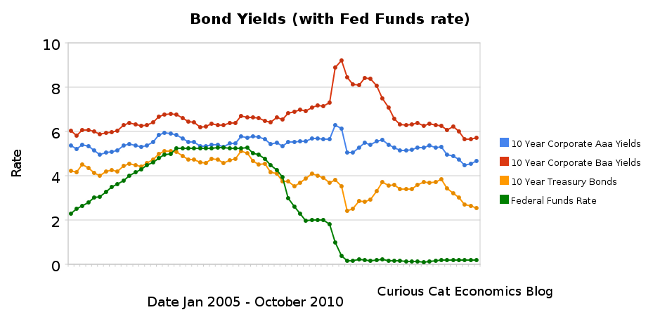

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have dropped even lower over the last 6 months, dramatically so for treasury bonds. 10 year Aaa corporate bonds yields have decreased 61 basis points to 4.68%. 10 year Baa yields have decreased 53 basis points to 5.72%. 10 year USA treasury bonds have decreased an amazing 169 basis points to a incredibly low yield of %2.54. The federal funds rate remains under .25%.

The Fed continues to try and discourage saving and encourage spending by punishing savers with policies to drive interest rates far below what the market alone would set. Partially this is a continuation of their subsidy to the large banks that caused the credit crisis. And partially it is an attempt to find a way to encourage spending to try and build job creation in the economy. The Fed announced they are taking huge steps to purchase $600 billion more bonds in an attempt to lower rates even further (much of the impact has been priced into the market as they have been saying they will take this action – but the size is larger than the consensus expectation). I do not think this is a sensible move.

Savers do not have many good options for safely investing retirement assets for a reasonable income. The best options are probably to hold short term bonds and money markets and hope that the Fed finally stops making things so difficult for them. But that will take awhile. I think investing in medium or long term bonds (over 4 years) is crazy at these rates (especially government bonds – unless you are a large bank that can get essentially free money from the Fed to then loan the government and make a profit). Dividends stocks may be a good alternative for some more yield (but this needs to be done carefully to not take unwise risks). And I think you to look at investing overseas because these fiscal policies are just too damaging to savers to continue to just wait for a decent rate of return in bonds in the USA. But there are not many good options. TIPS, inflation protected bonds, are another option to consider (mainly as a less bad, of bad choices).

It is a great time to take on debt however (as often is the case, there are benefits and costs to economic conditions). If you have a mortgage, and can qualify, or are looking to buy a home, mortgage rates are amazingly low.

Related: Bond Rates Remain Low, Little Change in Last 6 Months (April 2010) – Bond Yields Change Little Over Previous Months (December 2009) – Chart Shows Wild Swings in Bond Yields in Late 2008 – Government Debt as Percentage of GDP 1990-2009 in USA, Japan, Germany, China…

Dividends Beating Bond Yields by Most in 15 Years

Kraft Foods Inc. and DuPont Co. are among 68 companies in the Standard & Poor’s 500 Index with payouts that top the 3.78 percent average rate in credit markets, based on data since 1995 compiled by Bloomberg and Bank of America Corp. While Johnson & Johnson sold 10-year debt at a record low interest rate of 2.95 percent last month, shares of the world’s largest health products maker pay 3.66 percent.

The combination of record-low interest rates, potential profit growth of 36 percent this year and a slowing economy has forced investors into the relative value reversal. For John Carey of Pioneer Investment Management and Federated Investors Inc.’s Linda Duessel, whose firms oversee $566 billion, it means stocks are cheap after companies raised payouts by 6.8 percent in the second quarter

…

S&P 500 companies’ cash probably has grown to a record for a seventh straight quarter, according to S&P. For companies that reported so far, balances increased to $824.8 billion in the period ended June 30 from the first three months of the year, based on data from the New York-based firm.

Cash represents 10.2 percent of total assets at S&P 500 companies, excluding banks and financial firms, according to data compiled by Bloomberg. That’s higher than the 9.5 percent at the end of the second quarter last year, 8.4 percent in 2008 and 7.95 percent in 2007.

“The economy is slowing down, but productivity has been so great in this country and companies have been able to make good profits,”

10-year Treasury note yields were as low as 2.42% last month. The combination of continued extraordinarily low interest rates and good earnings increase this odd situation where dividends increase and interest yields fall. Extremely low yields aimed at by the Fed continue to aid banks and those that caused the credit crisis a huge deal and harm investors.

Money markets and bonds are not attractive places to invest now. Putting money in those places is still necessary for diversification (and as a safety net – especially in cases like 401-k plans where options are often very limited). Seeking out solid companies with strong long term prospects that pay reasonable dividends is a very sensible strategy today.

Related: Where to Invest for Yield Today – S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 – 10 Stocks for Income Investors – Bond Yields Show Dramatic Increase in Investor Confidence (Aug 2009)