Scott Adams does a great job with Dilbert and he presents a simple, sound financial strategy in Dilbert and the Way of the Weasel, page 172, Everything you need to know about financial planning:

- Make a will.

- Pay off your credit cards.

- Get term life insurance if you have a family to support.

- Fund your 401(k) to the maximum.

- Fund your IRA to the maximum.

- Buy a house if you want to live in a house and you can afford it.

- Put six months’ expenses in a money market fund. [this was wise, given the currently very low money market rates I would use “high yield” bank savings account now, FDIC insured – John]

- Take whatever money is left over and invest 70% in a stock index fund and 30% in a bond fund through any discount broker, and never touch it until retirement.

- If any of this confuses you or you have something special going on (retirement, college planning, tax issues) hire a fee-based financial planner, not one who charges a percentage of your portfolio.

When looking at the long term data, USA manufacturing output continues to increase. For decades people have been repeating the claim that the manufacturing base is eroding. It has not been true. I realize the economy is on weak ground today, I am not talking about that, I am looking at the long term trends.

The USA manufactures more than anyone else – by far. The percentage of total global manufacturing is the same today it was two decades ago (and further back as well). For decades people have been saying the USA has lost the manufacturing base – it just is not true. No matter how many times they say it does not make it true. It is true since 2000 the USA increase in manufacturing output (note not a decrease) has not kept pace with global grown in manufacturing output (global output in that period is up 47% and the USA is up 19% – Japan is down 10% for that period).

I would guess 20 years from today the USA will have a lower percentage of worldwide manufacturing. But I don’t see any reason believe the USA will see a decline in total manufacturing output. I just think the rest of the world is likely to grow manufacturing output more rapidly.

Looking at a year or even 2 or 3 years of manufacturing output data leaves a great deal of room to see trends where really just random variation exists. Even for longer periods trends are hard to project into the future.

Conventional wisdom is correct about China growing manufacturing output tremendously. China has grown from 4% of the output of the largest manufacturing companies in 1990 to manufacturing 16% of the total output in China today. That 12% had to come from other’s shares. And given all you hear from the general press, financial press, politicians, commentators… you would think the USA must have much less than China today, so may 10% and maybe they had 20% in 1990. When actually in 1990 the USA had 28% and in 2007 they had 27%.

Manufacturing jobs are not moving oversees. Manufacturing jobs are decreasing everywhere.

Read more

Warren Buffett quotes from the interview:

|

- “AIG would be doing fine today if they never heard of derivatives… I said they were possibly financial weapons of mass destruction and they have been, I mean they destroyed AIG, they certainly contributed to the destruction of Bear Stearns and Lehman”

- The biggest single cause was that we had an incredible residential real estate bubble.

- [on consuming more than we are producing] I don’t think it is the most pressing problem at all. We are trading away a little bit of our country all the time for the excess consumption that we have, over what we produce. That is not good. I think it is terrible over time.

Related: Warren Buffett related posts – Credit Crisis Continues – Credit Crisis (August 2007)

The updated data from the United Nations on manufacturing output by country clearly shows the USA remains by far the largest manufacturer in the world. UN Data, in billions of current US dollars:

| Country | 1990 | 1995 | 2000 | 2005 | 2006 | 2007 |

|---|---|---|---|---|---|---|

| USA | 1,041 | 1,289 | 1,543 | 1,663 | 1,700 | 1,831 |

| China | 143 | 299 | 484 | 734 | 891 | 1,106 |

| Japan | 804 | 1,209 | 1.034 | 954 | 934 | 926 |

| Germany | 438 | 517 | 392 | 566 | 595 | 670 |

| Russian Federation | 211 | 104 | 73 | 222 | 281 | 362 |

| Italy | 240 | 226 | 206 | 289 | 299 | 345 |

| United Kingdom | 207 | 219 | 228 | 269 | 303 | 342 |

| France | 224 | 259 | 190 | 249 | 248 | 296 |

| Korea | 65 | 129 | 134 | 200 | 220 | 241 |

| Canada | 92 | 100 | 129 | 177 | 195 | 218 |

| Spain | 101 | 103 | 98 | 164 | 176 | 208 |

| Brazil | 120 | 125 | 96 | 137 | 170 | 206 |

| Additional countries of interest – not the next largest | ||||||

| India | 50 | 59 | 67 | 118 | 135 | 167 |

| Mexico | 50 | 55 | 107 | 122 | 136 | 144 |

| Indonesia | 29 | 60 | 46 | 80 | 102 | 121 |

| Turkey | 33 | 38 | 38 | 75 | 85 | 101 |

The USA’s share of the manufacturing output of the countries that manufactured over $200 billion in 2007 (the 12 countries on the top of the chart above) in 1990 was 28%, 1995 28%, 2000 33%, 2005 30%, 2006 28%, 2007 27%. China’s share has grown from 4% in 1990, 1995 7%, 2000 11%, 2005 13%, 2006 15%, 2007 16%.

Total manufacturing output in the USA was up 76% in 2007 from the 1990 level. Japan, the second largest manufacturer in 1990, and third today, has increased output 15% (the lowest of the top 12, France is next lowest at 32%) while China is up an amazing 673% (Korea is next at an increase of 271%).

Read more

Failing to save is a huge problem in the USA. Spending money you don’t have (taking on personal debt) and not even having emergency savings and retirement savings lead to failed financial futures. Even though those in the USA today are among the richest people ever to live many still seem to have trouble saving. Here is a simple tip to improve that result for yourself.

Anytime you get a raise split the raise between savings, paying off debt (if you have any non-mortgage debt), and increasing the amount you have to spend. I think too many people think financial success is much more complicated than it is. Doing simple things like this (and some of the other things, mentioned in this blog) will help most people do much better than they have been doing.

There are lots of ways to spend money. And many people find ways to spend all or more than all (credit card debt, personal loans…) they have which are sure ways to a failed financial future. So anytime you get a raise (a promotion, new job…) take a portion of that extra money and put it toward your financial future. The proportion can very but I would aim for at least 50% if you have any non-mortgage debt, don’t have a 6 month emergency fund, or are behind in saving for retirement, a house…

Exactly how you calculate if you are behind, I will address in a future post (or you can look around for more information). By taking this fairly simple action you will be setting yourself up for a successful financial future instead of finding yourself falling behind, as so many do. And then when things go badly, as they most likely will sometime during your life, you will have built up a financial position to draw on. Instead of, as so many do now, find that you were living beyond your means when things were going well – which it doesn’t take a genius to see will lead to serious problems when things take a turn for the worse.

So lets say you take a new job and get a raise of $4,000 a year. Instead of spending $4,000 more just put $2,000 away (pay off debt, add to your retirement savings, add to savings for a house, add to your emergency fund…). Then you get a promotion of another $3,000, increase your spending by $1,500 and save the rest. It is such a simple idea and just doing this you can find yourself in the top few percent of those making smart financial decisions. And if you get to the point that you are ahead in all your financial areas then you can take more of each raise you get (but most of the time you will have learned how valuable the extra saving are and figured out the extra toys really are not worth it). But if you want to, once you have created a successful financial life, you can choose to buy more toys.

Related: Retirement Savings Survey Results – Earn more, spend more, want more

There are external risks to your financial health. Many people ruin their financial health even before any external risk can, but lets say you are being responsible then what risks should you seek to protect yourself from?

| Risk | Strategy | Also |

|---|---|---|

| medical costs | health insurance | emergency fund, healthy lifestyle to reduce the likelihood of needing medical care |

| property losses (house damaged, car stolen, property damage…) | homeowners insurance, rental insurance | |

| job loss | emergency fund, unemployment insurance (provided by the government and paid for by the company in most cases – in the USA) | updating skills, maintain a career network, education, learning new skills |

| disability (which both damages your earning potential and often has medical care costs) | disability insurance, health insurance | social security disability insurance – in the USA |

| investment losses | sound investment portfolio and strategy (diversification, appropriate investments, adjusting investment strategy over time) | extra savings |

| having to pay damages caused to others | homeowners insurance often includes personal liability coverage (and car insurance often includes some coverage for damage you cause while driving). check and likely choose to pay for extra liability insurance – costs to add coverage is normally cheap. | |

| unexpected expenses | emergency fund | extra savings |

| loss of income of someone you rely on (spouse) | life insurance | extra savings |

Another protection is to be financially literate. You can risk your financial health by being fooled in spending money you should save, borrowing too much for your house, failing to buy the right insurance, using too much leverage, investing too much in high risk investments…

Related: credit card tips – personal finance tips – personal loan information

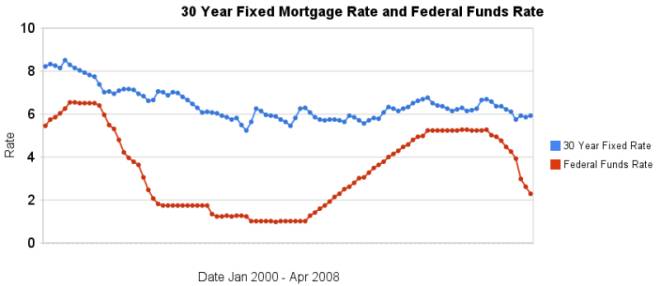

The recent drastic reductions again emphasize (once again) that changes in the federal funds rate are not correlated with changes in the 30 year fixed mortgage rate. In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points.

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Related: real estate articles – Affect of Fed Funds Rates Changes on Mortgage Rates – How Not to Convert Equity – more posts on financial literacy

Read more

Nationalities of the 25 richest people:

| Country | Number |

|---|---|

| Russia | 7 |

| India | 4 |

| USA | 4 |

| Hong Kong | 2 |

| Germany | 2 |

| France | 2 |

| Mexico | 1 |

| Sweden | 1 |

| Spain | 1 |

| Saudi Arabia | 1 |

11 Richest in order: Warren Buffett, USA $62Billion; Carlos Slim Helu & family, Mexico, $60B; William Gates III, USA $58B; Lakshmi Mittal, $45B; Mukesh Ambani, India, $43B; Anil Ambani, India, $42B; Ingvar Kamprad & family, Sweden, $31B; KP Singh, India, $30B; Oleg Deripaska, Russia, $28B; Karl Albrecht, Germany, $27B; Li Ka-shing, Hong Kong $26.5B.

Data from Forbes 2008 Billionaires List, using country of citizenship. Using stock values on 11 February, 2008.

Related: Best Research University Rankings (2007) – Top 10 Manufacturing Countries (2006) – How Rich Are You?

Here is updated data from the UN on manufacturing output by country. China continues to grow amazingly moving into second place for 2006. UN Data, in billions of current US dollars:

| Country | 1990 | 2000 | 2004 | 2005 | 2006 | |

|---|---|---|---|---|---|---|

| USA | 1,040 | 1,543 | 1,545 | 1,629 | 1,725 | |

| China | 143 | 484 | 788 | 939 | 1096 | |

| Japan | 808 | 1,033 | 962 | 954 | 929 | |

| Germany | 437 | 392 | 559 | 584 | 620 | |

| Italy | 240 | 206 | 295 | 291 | 313 | |

| United Kingdom | 207 | 230 | 283 | 283 | 308 | |

| France | 223 | 190 | 256 | 253 | 275 | |

| Brazil | 117 | 120 | 130 | 172 | 231 | |

| Korea | 65 | 134 | 173 | 199 | 216 | |

| Canada | 92 | 129 | 165 | 188 | 213 | |

| Additional countries of interest – not the next largest | ||||||

| Mexico | 50 | 107 | 111 | 122 | 136 | |

| India | 50 | 67 | 100 | 118 | 130 | |

| Indonesia | 29 | 46 | 72 | 79 | 103 | |

| Turkey | 33 | 38 | 75 | 92 | 100 | |

I am not even expecting good customer service but how about just the absence of customer hostility. The latest from Discover Card. I still have not received the money they said they would send (waiting more than a month now) – this is the amount they overcharged my bank (after they had already been told the charges were invalid. I guess it is acceptable to charge me for charges they knew were invalid?). But heck even accepting that, how about paying that money back as they said they would.

Amazingly they did send me a “bill” [with a balance they owe me instead of me owing them so it is not really a bill in the sense of money I owe them] for the account they said didn’t exist which was the reason they claimed that they could not pay the cash back bonus they promised. If people didn’t expect credit card companies to provide outrageously bad customer service wouldn’t this be seen as shockingly bad – so much so that certainly no company would tolerate it if it was brought to their attention. Well, we have evidence that such a thought is not true when dealing with Discover Card.

So according to Discover they don’t owe the money on the cash back bonus they promised because the account is closed. Yet they send me a bill (with a balance owed to me but it is exactly like the bill I would get from them each month including the cashback bonus section where instead of listing the amount they promised to pay me they list $0) that has an new account number on it. Paying what they promised in cash back bonus doesn’t seem like it would be hard (and frankly I can’t imagine not paying it in this circumstance can be acceptable according to the rules but who has the time to try and fight with them). And they don’t send the money that even they agree they owe, but instead just send a bill? What are they thinking?

As I said in a previous post if Discover Card pays the money they owe I will add an equal amount of my own money and lend that amount through Kiva (a charity that arranges loans from individuals to those in need worldwide on the micro-lending model). And I will either continue to roll those loans over for at least 10 years or I will donate the entire amount to a micro-lending charity (if for example Kiva shuts down or I decide that they are not doing a good job or whatever).

Read more