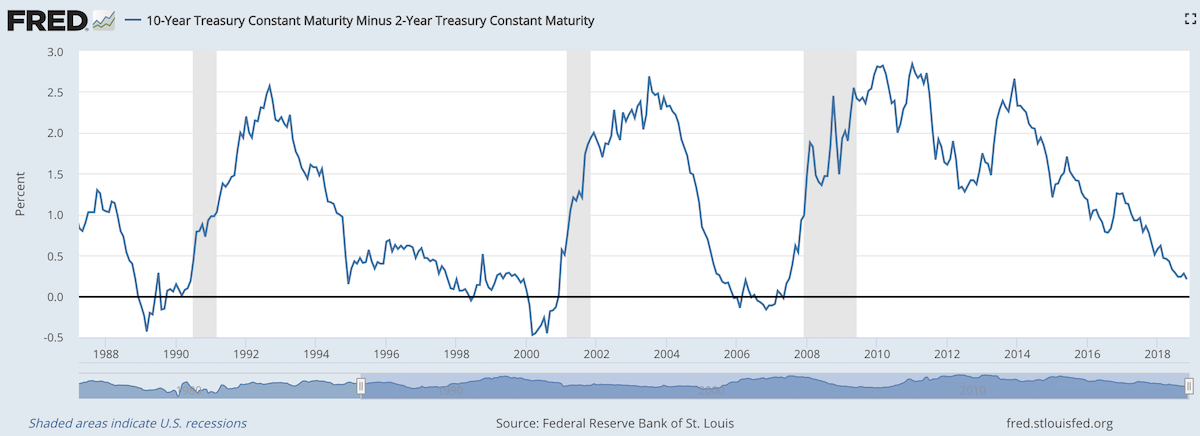

When 2 year US government bonds yield more than the 10 year US government bonds a recession is likely to appear soon. This chart shows why this is seen as such a reliable predictor.

The chart shows the 10 year yield minus the 2 year yield. So when the value falls below 0 that means the 2 year yield is higher. Each time that happened, since 1988, a recession has followed (the grey shaded areas in the chart).

Do note that there were very small inversions in 1998 and 2006 that did not result in a recession in the near term. Also note that in every case the yield curve was no longer inverted by the time a recession actually started.

The reason why this phenomenon is getting so much attention recently is another thing that is apparent when looking at this chart, the 2 and 10 year yields are getting close to equal. But you can also see we are no closer than 1994 and the USA economy held off a recession for 7 more years.

Since 1970 the average length of time from the inversion of the 10 to 2 year yield curve has been 12 months (with a low of 6 months in 1973 and a high of 17 months, before the great recession of 2008).

In addition to a possibly impending yield curve inversion it has been a long time since the last recession which makes many investors and economists nervous that one may be due.

Related: 30 Year Fixed Mortgage Rates are not correlated with the Fed Funds Rate – Bond Yields Stay Very Low, Treasury Yields Drop Even More (2010) – Looking for Dividend Stocks in the Current Extremely Low Interest Rate Environment (2011) – Stock Market Capitalization by Country from 2000 to 2016

Another thing to note about yield curves at this time is that the US Federal Reserve continues to hold an enormous amount of long term government debt (trillions of dollars) which it has never done before the credit crisis of 2008. This reduces the long term yield since if they sold those assets that would add a huge amount of supply. How this impacts the predictive value of this measure will have to be seen. Also, one way for the Fed to delay the inversion would be to sell some of those bonds and drive up long term rates.

The USA economy is far from strong. The global economy seems even weaker. Inflation is not an imminent risk. Under such conditions the USA Federal Reserve adding gasoline to the economy via low interest rates makes sense.

The issue I see is that a .25% Fed Funds rate is adding gasoline to the economy via low interest rates. Many people are saying an increase is like taking away the gasoline and taking out a fire extinguisher. But it really isn’t. Raising the rate to .25% is slightly decrease the amount of gas you are adding to the fire. A .25% Federal Funds rate is pouring nearly as much gas on as you are able to but not quite the absolute most you are able to.

It is also true that the Fed bailing out the too-big-to-fail bankers and banks resulted in them not only opening up the gasoline as much as possible (taking rates to 0) they even went far beyond that with new methods of pouring on gasoline that hadn’t even been considered until the bankers’ risk-taking doomed the economy (and bankrupted their institutions – without government bailouts propping them up).

The Federal Reserve has finally turned off the massive extraordinary dumping of gasoline onto the economic fire (via quantitative easing). But they have kept not only dumping lots of gasoline on the economy but doing so to the absolute maximum possible via a 0% Fed Funds rate.

Arguing for slowing the amount of fuel you are dumping into the economy is not the same as saying you are constricting the economy. We have been put into a crazy global economic condition by the too-big-to-fail bankers and the massive amounts of government and personal debt taken out. So simple analogies are not effective in making policy.

The analogies can help explain what the intent and expectation of the policy is. It is true we have created a very tenuous economic foundation (and we haven’t in any way substantial way addressed the risk too-big-to-fail bankers can throw the global economy into and we still have massive debt problems). The main beneficiaries of the central banker’s policies the last nearly 10 years are too-big-to-fail bankers and those borrowing huge amounts of money.

Those suffering from the policy are savers and I fear those that have to cope with the aftermath of this massive intervention with likely bubbles (government debt, personal debt [including education debt in the USA, etc.]). The main reason I believe rates should be raised are to begin the path to stop transferring wealth from savers to too-big-to-fail bankers and those with massive debt problems.

This is a startling piece of data, from The nagging fear that QE itself may be causing deflation:

The situations have many differences, for example, China is a poor country growing rapidly, Japan was a rich country growing little (though in 1990 it showed more growth promise than today). Still this one of the more interesting pieces of data on how much a bubble China real estate has today. Japan suffered more than 2 decades of stagnation and one factor was the problems created by the real estate price bubble.

The global economic consequences of the extremely risky actions taken to bail out the failed too-big-too-fail banks including the massive quantitative easing are beyond anyones ability to really understand. We hope they won’t end badly that is all it amounts to. Noone can know how risky the actions to bail out the bankers is. The fact we not only bailed them out, but showered many billions of profit onto them (even after taking billions in fines for the numerous and continuing violations of law by those bailed out bankers), leaves me very worried.

It seems to me we have put enormous risk on and the main beneficiaries of the policies are the bankers that caused the mess and continue to violate laws without any consequences (other than taking a bit of the profit them make on illegal moves back sometimes).

The West ignored pleas for restraint at the time, then left these countries to fend for themselves. The lesson they have drawn is to tighten policy, hoard demand, hold down their currencies and keep building up foreign reserves as a safety buffer. The net effect is to perpetuate the “global savings glut” that has starved the world of demand, and that some say is the underlying of the cause of the long slump.

I hope things work out. But I fear the extremely risky behavior by the central banks and politicians could end more badly than we can even imagine.

Related: Continuing to Nurture the Too-Big-To-Fail Eco-system – The Risks of Too Big to Fail Financial Institutions Have Only Gotten Worse – USA Congress Further Aids The Bankers Giving Those Politicians Piles of Cash and Risks Economic Calamity Again – Investment Options Are Much Less Comforting Than Normal These Days

Congress gives Wall Street public backing for derivatives trading again: http://t.co/PtBePRGuhy Oh joy.

— John Robb (@johnrobb) November 11, 2013

It is no surprise those we elect that have shown there primary concern is providing favors to those giving them lots of cash have given the wall street crowd that showers them in cash what they want yet again. As long as we keep electing these people they will keep providing benefits to those giving lots of cash that the rest of society is stuck paying for.

Read more about this huge fiasco: Congress Sells Out To Wall Street, Again!

Even ill-informed politicians now can’t pretend they don’t know the risks they run by providing these favors. But they figure they won’t have to be accountable – they haven’t been held accountable so far. So they are probably right that they won’t be held accountable when the taxpayers suffer huge losses and the taxpayers have to again bail out the too big to fail institutions and savers have to again bail out the too big to fail banks and…

As bad as the economy has been since the to-big-too-fail crowd created economic calamity it is amazing it hasn’t been much worse. The extraordinary efforts of the Fed have been amazingly successful. I worry they have put us in an extraordinarily risky place but so far the results have been remarkable. Hoping such slights of hand (plus huge transfers of wealth from middle class savers to to-big-too-fail speculators – in the tune of hundreds of billions of dollars – so it isn’t like there are not huge suffering by millions of people – even those that were not thrown out of work) will allow continued reckless giveaways to those paying politicians is a very bad idea.

But it is no surprise those we elect have chosen that course of action. It seems we are very unlikely to learn without a real depression being forced by decades of extremely foolish behavior by our elected officials in Washington DC.

Related: Continuing to Nurture the Too-Big-To-Fail Eco-system – The Risks of Too Big to Fail Financial Institutions Have Only Gotten Worse – Adding More Banker and Politician Bailouts is not the Answer – Failure to Regulate Financial Markets Leads to Predictable Consequences (as does letting big contributors create “regulations” that are nothing more than government granted favors to huge organizations) – Congress Eases Bank Laws, 1999, while risks were stated by those not willing to lie down for Wall Street Lobbyists (few though they were)

Fed Continues Adding to Massive Quantitative Easing

In fact, while the Fed has pumped about $2.8 trillion into the financial system through nearly five years of asset buying.

Bank excess reserves deposited with the New York Fed have mushroomed from less than $2 billion before the financial crisis to $2.17 trillion today. In essence, roughly two-thirds of the money the Fed pumped into the banking system never left the building.

The Fed now pays banks for their deposits. These payment reduce the Fed’s profits (the Fed send profits to the treasury) by paying those profits to banks so they can lavish funds on extremely overpaid executives that when things go wrong explain that they really have no clue what their organization does. It seems very lame to transfer money from taxpayers to too-big-to-fail executives but that is what we are doing.

Quantitative easing is an extraordinary measure, made necessary to bailout the too-big-to-fail institutions and the economies they threatened to destroy if they were not bailed out. It is a huge transfer payment from society to banks. It also end up benefiting anyone taking out huge amounts of new loads at massively reduced rates. And it massively penalizes those with savings that are making loans (so retirees etc. planing on living on the income from their savings). It encourages massively speculation (with super cheap money) and is creating big speculative bubbles globally.

This massive intervention is a very bad policy. The bought and paid for executive and legislative branches that created, supported and continue to nurture the too-big-to-fail eco-system may have made the choice – ruin the economy for a decade (or who knows how long) or bail out those that caused the too-big-to-fail situation (though only massively bought and paid for executive branch could decline to prosecute those that committed such criminally economically catastrophic acts).

The government is saving tens of billions a year (maybe even hundred of billions) due to artificially low interest rates. To the extent the government is paying artificially low rates to foreign holders of debt the USA makes out very well. To the extent they are robbing retirees of market returns it is just a transfer from savers to debtors, the too-big-to-fail banks and the federal government. It is a very bad policy that should have been eliminated as soon as the too-big-to-fail caused threat to the economy was over. Or if it was obvious the bought and paid for leadership was just going to continue to nurture the too-big-to-fail structure in order to get more cash from the too-big-to-fail donors it should have been stopped as enabling critically damaging behavior.

It has created a wild west investing climate where those that create economic calamity type risks are likely to continue to be rewarded. And average investors have very challenging investing options to consider. I really think the best option for someone that has knowledge, risk tolerance and capital is to jump into the bubble created markets and try to build up cash reserves for the likely very bad future economic conditions. This is tricky, risky and not an option for most everyone. But those that can do it can get huge Fed created bubble returns that if there are smart and lucky enough to pull off the table at the right time can be used to survive the popping of the bubble.

Maybe I will be proved wrong but it seems they are leaning so far into bubble inflation policies that the only way to get competitive returns is to accept the bubble nature of the economic structure and attempt to ride that wave. It is risky but the supposedly “safe” options have been turned dangerous by too-big-to-fail accommodations.

Berkshire’s Munger Says ‘Venal’ Banks May Evade Needed Reform (2009)

Related: The Risks of Too Big to Fail Financial Institutions Have Only Gotten Worse – Is Adding More Banker and Politician Bailouts the Answer? – Anti-Market Policies from Our Talking Head and Political Class

A report by the Dallas Federal Reserve Bank, Assessing the Costs and Consequences of the 2007–09 Financial Crisis and Its Aftermath, puts the costs to the average household of the great recession at $50,000 to $120,000.

The worst downturn in the United States since the 1930s was distinctive. Easy credit standards and abundant financing fueled a boom-period expansion that was followed by an epic bust with enormous negative economic spillover.

…

Our bottom-line estimate of the cost of the crisis, assuming output eventually returns to its pre-crisis trend path, is an output loss of $6 trillion to $14 trillion. This amounts to $50,000 to $120,000 for every U.S. household, or the equivalent of 40 to 90 percent of one year’s economic output.

They say “misguided government incentives” much of which are due to payments to politicians by too-big-to-fail institution to get exactly the government incentives they wanted. There is a small bit of the entire problem that is likely due to the desire to have homeownership levels above that which was realistic (beyond that driven by too-big-to-fail lobbyists).

“Were safer” says a recent economist. Which I guess is true in that it isn’t quite as risky as when the too-big-to-fail-banks nearly brought down the entire globally economy and required mass government bailouts that were of a different quality than all other bailouts of failed organizations in the past (not just a different quantity). The changes have been minor. The CEOs and executives that took tens and hundreds of millions out of bank treasures into their own pockets then testified they didn’t understand the organization they paid themselves tens and hundreds of a millions to “run.”

We left those organizations intact. We bailed out their executives. We allowed them to pay our politicians in order to get the politicians to allow the continued too-big-to-fail ponzie scheme to continue. The too-big-to-fail executives take the handouts from those they pay to give them the handouts and we vote in those that continue to let the too-big-to-fail executives to take millions from their companies treasuries and continue spin financial schemes that will either work out in which case they will take tens and hundreds of millions into their person bank accounts. Or they won’t in which case they will take tens of millions into their personal bank accounts while the citizens again bail out those that pay our representatives to allow this ludicrous system to continue.

Printing money (and the newer fancier ways to introduce liquidity/capital) work until people realize the money is worthless. Then you have massive stagflation that is nearly impossible to get out from under. The decision by the European and USA government to bail out the too big to fail institutions and do nothing substantial to address the problem leaves an enormous risk to the global economy unaddressed and hanging directly over our heads ready to fall at any time.

The massively too big to fail financial institutions that exist on massive leverage and massive government assistance are a new (last 15? years) danger make it more likely the currency losses value rapidly as the government uses its treasury to bail out their financial friends (this isn’t like normal payback of a few million or billion dollars these could easily cost countries like the USA trillions). How to evaluate this risk and create a portfolio to cope with the risks existing today is extremely challenging – I am not sure what the answer is.

Of the big currencies, when I evaluate the USA $ on its own I think it is a piece of junk and wouldn’t wan’t my financial future resting on it. When I look at the other large currencies (Yen, Yuan, Euro) I am not sure but I think the USD (and USA economy) may be the least bad.

In many ways I think some smaller countries are sounder but smaller countries can very quickly change – go from sitting pretty to very ugly financial situations. How they will wether a financial crisis where one of the big currencies losses trust (much much more than we have seen yet) I don’t know. Still I would ideally place a bit of my financial future scattered among various of these countries (Singapore, Australia, Malaysia, Thailand, Brazil [maybe]…).

Basically I don’t know where to find safety. I think large multinational companies that have extremely strong balance sheets and businesses that seem like they could survive financial chaos (a difficult judgement to make) may well make sense (Apple, Google, Amazon, Toyota, Intel{a bit of a stretch}, Berkshire Hathaway… companies with lots of cash, little debt, low fixed costs, good profit margins that should continue [even if sales go down and they make less they should make money – which many others won’t]). Some utilities would also probably work – even though they have large fixed costs normally. Basically companies that can survive very bad economic times – they might not get rich during them but shouldn’t really have any trouble surviving (they have much better balance sheets and prospects than many governments balance sheets it seems to me).

In many ways real estate in prime areas is good for this “type” of risk (currency devaluation and financial chaos) but the end game might be so chaotic it messes that up. Still I think prime real estate assets are a decent bet to whether the crisis better than other things. And if there isn’t any crisis should do well (so that is a nice bonus).

Basically I think the risks are real and potential damage is serious. Where to hide from the storm is a much tricker question to answer. When in that situation diversification is often wise. So diversification with a focus on investments that can survive very bad economic times for years is what I believe is wise.

Related: Investing in Stocks That Have Raised Dividends Consistently – Adding More Banker and Politician Bailouts in Not the Answer –

Failures in Regulating Financial Markets Leads to Predictable Consequences – Charlie Munger’s Thoughts on the Credit Crisis and Risk – The Misuse of Statistics and Mania in Financial Markets

Eurozone unemployment hits new high with quarter of under-25s jobless

The problem was most extreme in Greece where almost two-thirds of those under-25 are unemployed. The rate was 62.5% in February, the most recently available data.

…

Youth unemployment in Spain is 56.4%, in Portugal 42.5%. Italy recorded its highest overall unemployment rate since records began in 1977, at 12%, with youth joblessness at 40.5%. Economists said that the rise in unemployment was fairly broad-based with rises in so-called core countries as well, including Belgium and the Netherlands. The rate in France was 11%.

…

Ireland recorded one of the biggest falls in unemployment, down to 13.5% from 14.9% a year ago. That compares with a rate of 7.7% for the UK, where youth unemployment is 20.2%. The lowest rates for youth unemployment were in Germany at 7.5% and Austria at 8%.

Unemployment continues to be a huge problem. The slow recovery from the great recession caused by the too big to fail financial institutions continues to do great damage. That damage is very visible in unemployment figures and the huge transfer of wealth from savers to bail out otherwise failed financial institutions (that not only haven’t been made to be small enough to fail but continue to pay themseves enormous bonuses while taking the billions in transfer of wealth from retirees that have had their income sliced by the interest rate policies necessatated to bail out the bankers).

The USA employment situation is still bad but has actually could easily be much worse. Unemployment in the USA stands at 7.5% now (the rate for teenagers is 24.1%).

Related: 157,000 Jobs Added in January and Adjustments for the Prior Two Months add 127,000 More (Feb 2013) – USA Unemployment Rate Drops to 7.8%, 200,000 Jobs Added (Oct 2012) – USA Adds 216,00 Jobs in March and the Unemployment Rate Stands at 8.8% (March 2011)

Total nonfarm payroll employment increased by 171,000 in October, and the unemployment rate increased at 7.9%, the U.S. Bureau of Labor Statistics reported today. Employment rose in professional and business services, health care, and retail trade. The change in total nonfarm payroll employment for August was revised from +142,000 to +192,000, and the change for September was revised from +114,000 to +148,000.

So with this report another 255,000 (171 + 50 + 34) were added, quite a good number. If we could see 250,000 jobs added for 12 more months that would be quite nice – though still will not have recovered all the jobs cost by the too-big-too-fail credit crisis.

Employment growth has averaged 157,000 per month thus far in 2012, about the same as the average monthly gain of 153,000 in 2011.

Hurricane Sandy had no discernable effect on the employment and unemployment data for October. Household survey data collection was completed before the storm, and establishment survey data collection rates were within normal ranges nationally and for the affected areas.

Long-term unemployment remains a problem, in October, the number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 5.0 million. These individuals accounted for 40.6% of the unemployed (a higher percentage than normal – as it has been for the duration of the too-big-too-fail job recession.

The civilian labor force rose by 578,000 to 155.6 million in October, and the labor force participation rate edged up to 63.8%. Total employment rose by 410,000 over the month (I am guessing this is not seasonally adjusted – the highlighted figures normally quotes are seasonally adjusted figures). The employment-population ratio was essentially unchanged at 58.8%, following an increase of 40 basis points in September.

Related: Unemployment Rate Reached 10.2% (Oct 2009) – USA Economy Adds 151,000 Jobs in October and Revisions Add 110,000 More (Oct 2010, unemployment rate at 9.6%) – USA Unemployment Rate Drops to 8.6% (Nov 2011) – USA Lost Over 500,000 Jobs in November, 2008

Big Income Losses for Those Near Retirement takes a look at some interesting data, including data on median income drops due to the too-big-too-fail credit crisis recession.

The post also includes data showing the only groups with income increases as those 65-74 years old and, 75 and over which is surprising. 25-34 took the 2nd largest drop decreasing 8.9%.

Another interesting tidbit is the percent of people over 65 with jobs. In 1960 20% of those over 65 had jobs. Which pretty much decreased steadily to 10% in 1986 and then has increased steadily to 17% in 2011.

Related: USA Individual Earnings Levels: Top 1% $343,000, 5% $154,000, 10% $112,000, 25% $66,000 –

Looking at Data on the Value of Different College Degrees – 60% of Workers in the USA Have Less Than $25,000 in Retirement Savings – Credit Card Regulation Has Reduced Abuse By Banks