There is an increasing trend to move from the USA to another country to work and live. This is not surprising to me. Recently this has picked up quite a bit; I am surprised by the velocity at which this interest in moving (I figured it would be a long term mega trend but not so drastic, so quickly). Economic changes are often quite surprising in how rapidly they move forward.

An interesting survey shows USA investors have become much more interested in relocating in the last two years (the data they show though has tremendous volatility over time, so I am not really sure this means much). I wonder how much of it can be explained by investors wanting to get a deep understanding of very promising markets. I wouldn’t image the actual number that do this is huge, but maybe the number considering it is significant. Billionaire investor, Jim Rodgers moved to Asia because he sees Asia as key to the future. One of the reasons I moved to Malaysia this year was to get a in depth understanding of what South East Asia is like (it is not a deciding reason, at all but maybe the 4th or 5th reason).

I believe the globalization of the employment market is a long term trend that will continue – especially for “knowledge workers.” The USA rested on the post WW II economic domination for nearly 50 years. The policies also helped this continue: investing in science and engineering, favoring entrepreneurship… But other countries have realized the value of these things (and the USA is slipping – not investing nearly as much in science and engineering and favoring large corporations that give politicians large amounts of cash over innovation – see things like the incredibly outdated “intellectual property” system, SOPA, favoring huge financial institutions…

The combination of long term policy weakness, the inevitable decline in the USA to world ratio of economic wealth, and the financial crisis caused by the policy weaknesses have seemingly greatly accelerated the trend. The next 2 or 3 years will determine if that is a permanent acceleration or if we go back to a slower pace – but on the same path. My guess is that we will stay on this path but the pace will not follow the level surveys might indicate (showing interest in such a big change is far different from actually moving).

There don’t seem to be any decent estimates of Americans living abroad. The US State Department claims releasing their estimates would be a national security risk? And the Census bureau says it would cost too much to try. Wild guesses seem to be between 4 and 6 million.

Related: I want out (subreddit) – Why Investing is Safer Overseas – USA Heath Care System Needs Reform – Copywrong

The unemployment rate fell from 9.0% to 8.6% in November, however that is not an accurate representation of employment in the USA. The news is good, but very mildly good, while a decrease in the unemployment rate by 40 basis points would lead you to believe the improvement was dramatic. Nonfarm payroll employment rose by 120,000 which is about the number needed to keep up with population growth each month. Employment continued to trend up in retail trade, leisure and hospitality, professional and business services, and health care. Government employment continued to trend down.

The change in total nonfarm payroll employment for September was revised from +158,000 to +210,000, and the change for October was revised from +80,000 to +100,000. This means this report shows an increase of 192,000 jobs which is pretty good news (especially for those that think the economy has been in a recession – it has not).

One year ago the unemployment rate stood at 9.6%.

The number of unemployed persons, at 13.3 million, was down by 594,000 in November. The labor force, which is the sum of the unemployed and employed, was down by a little more than half that amount. What this means is the reduction in the unemployment rate was largely due to the decrease in those actively looking for jobs.

Among the major worker groups, the unemployment rate for adult men fell to 8.3% in November. The jobless rate rates for adult women (7.8%), teenagers (23.7%), African-Americans (15.5%), and Hispanics (11.4%) showed little or no change. The jobless rate for Asians was 6.5%.

The number of long-term unemployed (those jobless for 27 weeks and over) was little changed at 5.7 million and accounted for 43.0% of the unemployed. This is one of the numbers that has to come down drastically for the job situation to really show good improvement.

Related: Jobs News in the USA is not Good, Unemployment Remains at 9.1% (Aug 2011) – USA Economy Adds 151,000 Jobs in October, Unemployment Rate Steady at 9.6% (Oct 2010) – Unemployment Rate Reached 10.2% (Oct 2009) – Over 500,000 Jobs Disappeared in November (2008)

I try to find global economic data on manufacturing and manufacturing jobs, but it isn’t easy. This is one of the areas I will be working on with the time I have freed up by moving to Malaysia (and taking a “sabbatical” [it isn’t really a sabbatical, I guess, just me studying and working on what I want to instead of what someone pays me to]).

I found some interesting data from the USA census bureau on manufacturing employment in several countries (it would be interesting to see the data for more countries but for now I am limited to this data). Sadly they just use indexed data (I would rather see raw data). This data for example lets you see the changes in countries but I don’t see any way to compare the absolute values between countries – all you can compare is the changes between countries.

The data is all indexed at 2002 = 100. Interestingly the USA has increased output per hour much more than any other country since 2002. The USA index stands at 146, the next highest is Sweden at 127 then the UK at 120. Italy is the only country tracked that fell since 2002, to 94. Japan (the 3rd largest manufacturer and 2nd largest of the countries include, China isn’t included) only increased to 113. Germany (4th and 3rd) increased to 111.

The data also lets you look back from 1990 to 2002 and again the USA has increased productivity very well (2nd most) – the value in 1990 was 58. Sweden actually had the largest gain from 1990-2002, rising from 49. In 1990 Japan stood at 71 and Germany 70.

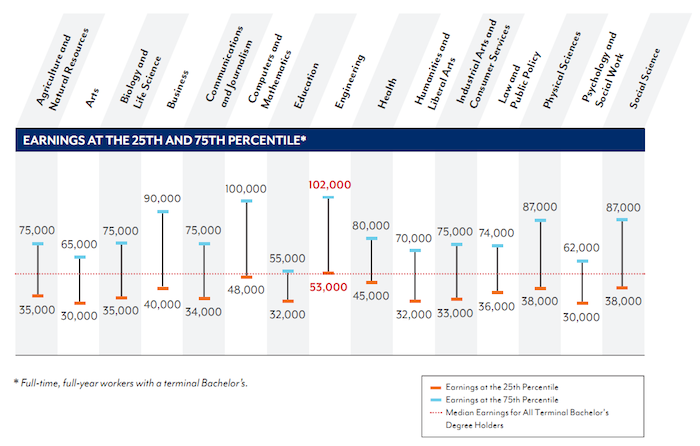

Georgetown University Center on Education and the Workforce has produced a new report looking at the value of different college degrees in the USA. I have seen a great increase in discussions of the “bubble” in education. Those articles often say a college degree doesn’t assure the success it used to. The data I review seems to show extremely large benefits for those with a college degree (higher salaries but, much more importantly, in my opinion, they also have much lower unemployment rates).

Those benefits are greatest for several majors including science, math and engineering. The problem I see is not so much that significant benefits are lacking for college degrees but the huge increases in costs of getting a degree are so large that for some majors the cost is just so large that even with the benefits it is arguable whether it is worth the cost (while a few decades ago the benefits were universal and so large the economic benefit was not debatable).

The authors of the report found that all undergraduate majors are worthwhile, even taking into account the cost of college and lost earnings. However, the lifetime advantage ranges from $1,090,000 for Engineering majors to $241,000 for Education majors. As I have written frequently on the Curious Cat Science and Engineering blog, engineering degrees are very financially rewarding.

The top 10 majors with the highest median earnings for new graduates are:

- Petroleum Engineer ($120,000)

- Pharmacy/pharmaceutical Sciences and Administration ($105,000)

- Mathematics and Computer Sciences ($98,000)

- Aerospace Engineering ($87,000)

- Chemical Engineering ($86,000)

- Electrical Engineering ($85,000)

- Naval Architecture and Marine Engineering ($82,000)

- Mechanical Engineering, Metallurgical Engineering and Mining and Mineral Engineering (each with median earnings of $80,000)

Related: 10 Jobs That Provide a Great Return on Investment – Mathematicians Top List of Best Occupations – New Graduates Should Live Frugally

This was a bad month for jobs in the USA. Not only did the U.S. Bureau of Labor Statistics report that the number of jobs remained at the same level as last month (125,000 additional jobs are needed for population growth, on average and we have huge losses from the credit crisis recession that have to be gained back) the last 2 months were revised down. The change in total nonfarm payroll employment for June was revised from

a gain of 46,000 to a gain of 20,000, and the July was revised down from gaining 117,000 job to gaining

85,000. That results in a total loss for this report of 58,000.

Still much better than the huge losses of several years ago but, along with the last few months, not a good sign for short term job growth. And the failure to address decades of favors given by politicians to too big to fail banks may actually create serious problems much sooner than most people feared. Pretty much everyone knew that the failure to address the main cause of the credit crisis was setting us up for again having the economy suffer huge blows due to the behavior of too big to fail institutions but I, and I think most people, thought it would be at least 5 years away and maybe even 10 before we had to seriously pay for the failures of our politicians to address this problem they (and their predecessors created).

It really seems like politicians don’t understand that their predecessors (decades ago) could afford to payoff large political donors and avoid dealing with problems and the enormous amount of wealth the economy was generating would let us prosper (even with lousy leadership), but that is no longer the case. The USA has used up huge economic advantages and that easy time is not coming back. Sadly the main hope for the USA is that other countries leaders create enough waste that the USA can remain competitive with all the waste our create (extremely lousy health care system, for example). It seems the American public doesn’t understand either, if anything we are electing even less intelligent and capable leaders today (over the last 10 years).

The USA has 14 million unemployed. Among the major worker groups, the unemployment rates for adult men was 8.9%, adult women 8.0% and teenagers 25.4%, whites. Of those 14 million the number of long-term unemployed (those jobless for 27 weeks and over) was about unchanged at 6 million in August.

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) rose from 8.4 million to 8.8 million in August. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

The average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour over the month to 34.2 hours. The manufacturing workweek was 40.3 hours for the third consecutive month; factory overtime increased by 0.1 hour over the month to 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls edged down to 33.5 hours in August, after holding at 33.6 hours for the prior 6 months.

As bad as this news is, it could be much worse. The economy is actually growing (very slowly), probably. Many companies are actually still very profitable (I am not counting companies that have fake profits with congress approved ability to report fake values for their assets – Congress granted their too big too fail donors, this, and many other favors while most others are left out in the cold). The wealth in the USA, even after we have been consuming our capital to live beyond what we earn each year (for decades) is still extremely high. This allows us to live well and invest even with many bad practices in place. We continue to have many excellent companies doing great work and providing great jobs. Even with all the problems in the USA there are few countries that are in as enviable an economic position. The biggest problem I see is we have been squandering those advantages far too easily and quickly for far too long. That leaves us much more economically venerable than we need to be.

Related: Paying Back Direct Cash Bailouts from Taxpayers Does not Excuse Bank Misdeeds – USA Unemployment Rate at 9.6% (after losing 54,000 job in Aug 2010)

The report on employment released today was not good news but it was less bad than feared. Total nonfarm payroll employment rose by 117,000 in July, and the unemployment rate was little changed at 9.1%, the United States Bureau of Labor Statistics reported today. Employment growth in July, follows little growth over the prior 2 months. Total private employment rose by 154,000 over the month. Sectors experiencing growth include: health care, retail trade, manufacturing, and mining. Government employment continued to trend down.

Some good news is found in the adjustments to the last two months job numbers. The change in total nonfarm payroll employment for May was revised from +25,000 to +53,000, and the change for June was revised from +18,000 to +46,000. That adds 56,000 jobs to the 117,000 jobs added in July and brings to the total for this report to 173,000 additional jobs. Still not great but much better than the last 2 months. The economy needs to add 125,000 a month to keep up with population growth.

And currently the economy needs to add much more to make up for all the jobs lost due to the too big to fail institution created credit crisis. The damage done to the economy by those institutions and continuing to be done in order to support those companies remains enormous. I believe we need to see 230,000 jobs added a month consistently (in order to be making ground up for the damage done), before we can believe we are doing well.

Remember it was just over 2 years ago we were losing hundreds of thousands of jobs a month. We are doing much better now, but fixing how broken things were is not easy. Between January of 2008 and February of 2010, the economy lost 8.75 million jobs. Since February 2010, 1.94 million jobs have been added. That means we have still lost 6,810,000 jobs and when you consider we have to add 125,000 a month to keep up we have 43 * 125,000 = 5,375,000 we haven’t added bringing a the total of jobs needed to over 12,000,000 (the number we need to add to get back to where we were). But truthfully we probably were at a bubble induced level at the peak so 12,000,000 is probably an overestimate of how many jobs we need to gain back.

Read more

Nonfarm payroll employment rose by 244,000 in April, and the unemployment rate edged up to 9.0% (from 8.8%) as the labor force grew slightly, the U.S. Bureau of Labor Statistics reported today. Also the number of jobs added is taken from the household survey while the unemployment rate is taken from the business payroll survey (they often have slightly different readings month to month). I, and many others, suspected the 8.8% figure might have been a bit low (and frankly the 9% figure may as well). In April of 2010 the unemployment rate was at 9.9%.

The change in total nonfarm payroll employment for February was revised from +194,000 to +235,000, and the change for March was revised from +216,000 to +221,000. Bringing the total jobs added with this report to 290,000 (244,000 + 41,000 + 5,000) – which is a very good result. Now if we can keep this up for a year that would be great. Overall this provides very encouraging news on the job front.

The number of unemployed persons stands at 13.7 million, up a little in April. Unemployment rates for several groups stood at: adult men 8.8%, adult women 7.9%, teenagers 24.9%, whites 8.0%, blacks 16.1%, Hispanics 11.8% and for Asians was 6.4%.

In another positive sign, the number of long-term unemployed (those jobless for 27 weeks and over) declined by 283,000 to 5.8 million; their share of unemployment declined to 43.4%. This is still a serious problem, but at least it is improving a bit.

The civilian labor force participation rate was 64.2% for the fourth consecutive month. The employment-population ratio, at 58.4%, changed little in April.

The private sector added 268,000 jobs. Employment rose in a number of service-providing industries, manufacturing, and mining. Since a recent low in February 2010, total payroll employment has grown by 1.8 million. Private sector employment has increased by 2.1 million over the same period.

Manufacturing employment rose by 29,000 in April. Since reaching an employment low in December 2009, manufacturing has added 250,000 jobs, including 141,000 in 2011. This is more great news. There has been real strength in manufacturing. Manufacturing is a real source of strength and if it can continue to be strong that will be very good news.

Related: USA Adds 216,00 Jobs in March and the Unemployment Rate Stands at 8.8% – USA Added 290,000 Jobs In April 2010 – Unemployment Rate Increased to 8.9% in April 2009 – USA Unemployment Rate Rises to 8.1%, Highest Level Since 1983

Read more

Nonfarm payroll employment increased by 216,000 in March, and the unemployment rate stands at 8.8%, the U.S. Bureau of Labor Statistics reported today. Revisions for January and February were very small (adding 5,000 jobs to the January totals and 2,000 to February). Since a recent low in February 2010, total payroll employment has grown by 1.5 million.

This is more good news though the economy needs to add jobs more quickly to make a significant dent in the jobs lost since the misdeeds of large financial institutions precipitated the credit crisis and threw so many people out of work.

Job gains occurred in professional and business services, health care, leisure and hospitality, and mining. Employment in manufacturing continued to trend up.

Household Survey Data

The number of unemployed persons (13.5 million) and the unemployment rate (8.8%) changed little in March. Since November 2010, the jobless rate has declined 100 basis points. Among the major worker groups, the unemployment rates are, for adult men, 8.6%; adult women, 7.7%; and for teenagers 24.5%.

The number of long-term unemployed (those jobless for 27 weeks or more) was 6.1 million in March; their share of the unemployed increased from 43.9 to 45.5% over the month. In November of 2010 they accounted for 41.9% of the unemployed. In March of 2010 there were 6.5 million, which was 44.1% of all unemployed.

In March, the civilian labor force participation rate held at 64.2%, which was down from 64.9% in March of 2010, and 65.8% in April of 2009.

Related: Another 663,000 Jobs Lost in March, 2009 – Global manufacturing employment data 1979-2007 – Unemployment Rate Increased to 8.9% (May 2009) – USA Added 162,000 Jobs in March, 2010

Establishment Survey Data

Read more

The unemployment rate grew to 9.8% in November, and nonfarm payroll employment increased by 39,000 (less than the expected 150,000), the U.S. Bureau of Labor Statistics reported today. Temporary help services and health care continued to add jobs over the month, while employment fell in retail trade. The change in total nonfarm payroll employment for September was revised from -41,000 to -24,000, and the change for October was revised from +151,000 to +172,000.

The unemployment rate has now remained above 9% for more consecutive months since data has been gathered since 1940.

There are now 15.1 million unemployed in the USA. Among the major worker groups, the unemployment rates for adult men (10.0 %), adult women (8.4%), and teenagers (24.6%).

The number of long-term unemployed (those jobless for 27 weeks and over) was little changed at 6.3 million and accounted for 41.9%. The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed over the month at 9.0 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

Among the marginally attached, there were 1.3 million discouraged workers in November, an increase of 421,000 from a year earlier. (The data are not seasonally adjusted.) Discouraged workers are persons not currently looking for work because they believe no jobs are available for them. The remaining 1.2 million persons marginally attached to the labor force had not searched for work in the 4 weeks preceding the survey for reasons such as school attendance or family responsibilities.

Total nonfarm payroll employment changed little in November (+39,000). Job gains continued in temporary help services and in health care, while employment fell in retail trade. Since December 2009, total payroll employment has increased by an average of 86,000 per month.

Within professional and business services, employment in temporary help services continued to increase in November (+40,000) and has risen by 494,000 since September 2009.

Related: USA Economy Adds 151,000 Jobs in October and Revisions Add 110,000 More – Over 500,000 Jobs Disappeared in November, 2008 – Manufacturing Employment Data – 1979 to 2007

Read more

Nonfarm payroll employment increased by 151,000 in October, and the unemployment rate was unchanged at 9.6%, the U.S. Bureau of Labor Statistics reported today. Since December 2009, nonfarm payroll employment has risen by 874,000.

The BLS also increased previous estimates by 110,000 jobs in adjustments to August and September. The change in total nonfarm payroll employment for August was revised from -57,000 to -1,000, and the change for September was revised from -95,000 to -41,000.

Adding 151,000 jobs last month (especially with a revision that adds 110,000to our previous estimates) is good news but not great news. We really need to be adding at least 250,000 and hopefully 400,000 for many months in a row. Both to keep up with population growth and restore some of the 8 million job losses from the credit crisis recession. The fears of a depression that some had a few years ago though are decreasing as we provide slow but real growth. However those gains are far from certain to continue, but overall things look much better than than did 2 years ago.

In November of 2008 the economy lost over 500,000 Jobs and in October 2009 the unemployment Rate Reached 10.2%.

The number of unemployed persons, at 14.8 million, was little changed in October. Among the major worker groups, the unemployment rate for adult men (9.7%), adult women (8.1%), teenagers (27.1%). The number of long-term unemployed (those jobless for 27 weeks and over) was about unchanged over the month at 6.2 million.

Both the civilian labor force participation rate, at 64.5 percent, and the employment-population ratio, at 58.3 percent, edged down over the month.

About 2.6 million persons were marginally attached to the labor force in October, up from 2.4 million a year earlier. (The data are not seasonally adjusted.) These individuals were not in the labor force, wanted and were available for work, and had looked for a job sometime in the prior 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey.

Read more