I like charity that provides leveraged impact. I like charity that is aimed at building long term improvement. I like entrepreneurship. I like people having work they enjoy and can be proud of. And I like people having enough money for necessities and some treats and luxuries.

I think sites like oDesk provide a potentially great way for people to lead productive and rewarding lives. They allow people far from rich countries to tap into the market demand in rich counties. They also allow people to have flexible work arrangements (if someone wants a part time job or to work from home that is fine).

These benefits are also true in the USA and other rich countries (even geography – there are many parts of the USA without great job markets, especially many rural areas). The biggest problem with rich country residents succeeding on something like oDesk is they need quite a bit more money than people from other countries to get by (especially in the USA with health care being so messed up). There are a great deal of very successful technology people on oDesk (and even just freelancing in other ways), but it is still a small group that is capable and lucky enough to pull in large paychecks (it isn’t only technology but that is the majority of high paying jobs I think on oDesk).

But in poor countries with still easily 2 billion and probably much more there is a huge supply of good workers. There is a demand for work to be done. oDesk does a decent job of matching these two but that process could use a great deal of improvement.

I think if I became mega rich one of the projects I would have would be to create an organization to help facilitate those interested in internet based jobs in poor countries to make a living. It takes hard work. Very good communication is one big key to success (I have repeatedly had problems with capable people just not really able to do what was expected in communications). I think a support structure to help with that and with project management would be very good. Also to help with building skills.

If I were in a different place financially (and I were good at marketing which I am not) I would think about creating a company to do this profitably. The hard part for someone in a rich country to do this is that either they have to take very little (basically do it as charity) or they have to take so much cash off the top that I think it makes it hard to build the business.

But building successful organizations that can grow and provide good jobs to those without many opportunities but who are willing to work is something I value. I did since I was a kid living in Nigeria (for a year). I didn’t see this solution then but the idea of economic well being and good jobs and a strong economy being the key driver to better lives has always been my vision.

This contrast to many that see giving cash and good to those in need as good charity. I realize sometimes that is what is needed – especially in emergencies. But the real powerful change comes from strong economy providing people the opportunity to have a great job.

I share Dr. Deming’s personal aim was to advance commerce, prosperity and peace.

Related: Commerce Takes More People Out of Poverty Than Aid – Investing in the Poorest of the Poor – I am a big fan of helping improve the economic lives of those in the world by harnessing appropriate technology and capitalism – A nonprofit in Queens taught people to write iPhone apps — and their incomes jumped from $15k to $72k

Based on my thoughts on killing the Goose laying golden eggs in Iskandar Malaysia posted on a discussion forum. The government has instituted several several policies to counteract a bubble in luxury real estate prices in the region (new taxes on short term capital gains in real estate [declining amounts through year 6]), increasing limits on purchases by foreigners, new transaction fees (2% of purchase price?) for real estate transactions, requirements for larger down-payments from purchasers…

Iskandar is 5 times the size of Singapore and is in the state of Johor in Malaysia. Johor Bahru is the city which makes up much of Iskandar but as borders are currently drawn Iskandar extends beyond the borders of Johor Bahru.

The prospects for economic growth in Iskandar Malaysia in the next 5, 10 and 15 years remain very strong. They are stronger than they were 5 years ago: investments that produce economic activity (theme parks, factories, hospitals, hotels, retail, film studio…) have come online and more on being built right now.

Cooperation with Singapore is the main advantage Iskandar has (Iskandar is next to the island of Singapore similar to those areas surrounding Manhattan). It provides Iskandar world class advantages that few other locations have (it is the same advantages offered by lower cost areas extremely close to world class cities – NYC, Hong Kong, London, San Francisco etc.). Transportation connections to Singapore are critical and have not been managed as well as they should have been (only 2 bridges exist now and massive delays are common). A 3rd link should be in place today (they haven’t even approved the location yet).

A MRT connection to Singapore (Singapore’s subway system) should be a top priority of anyone with power interested in the future economic well being of Iskandar and Johor. Johor Bahru doesn’t have a light rail system yet this would be the start of it. It has been “announced” as planned for 2018 but not officially designated or funded yet.

At the close of business this Friday Goldman Sachs, Visa and Nike will be added to Dow Jones Industrial Average (DJIA) and HP, Alcoa and Bank of America will be dropped. The DJIA is a not something that deserves attention in my opinion, but it gets it. The index of 30 large stocks is less useful than say the S & P 500 Index with I prefer.

The “industrial” heritage (represented by the name) is still visible but as the economy has changed the makeup of stocks has moved to reflect the growing importance of services.

The 30 stocks in the DJIA will be:

- American Express Company – AXP

- AT&T – T

- Boeing – BA

- Caterpillar – CAT

- Chevron – CVX

- Citigroup – C

- Coca-Cola – KO

- Du Pont – DD

- Exxon Mobil – XOM

- General Electric Company – GE

- General Motors – GM

- Goldman Sachs – GS

- Home Depot – HD

- Intel – INTC

- International Business Machines – IBM

- Johnson & Johnson – JNJ

- J. P. Morgan Chase – JPM

- Kraft Foods – KFT

- McDonald’s – MCD

- Merck – MRK

- Microsoft – MSFT

- Minnesota Mining & Manufacturing – MMM

- Nike – NIKE

- Pfizer – PFE

- Procter & Gamble – PG

- United Technologies – UTX

- Verizon Communications – VZ

- Visa – V

- Wal-Mart Stores – WMT

- Walt Disney – DIS

Related: GM and Citigroup Replaced by Cisco and Travelers in the Dow (2009) – Bank of America and Chevron replace Altria and Honeywell in the DJIA – Stock Markets Down $30 Trillion for 2008

High frequency trading is rightly criticized. It isn’t bad because rich people are getting richer. It is bad because of the manipulation of markets. Those being

- Front running – having orders executed milliseconds in advance to gain an edge (there is no market benefit to millisecond variation). In the grossest for it is clearly criminal: putting in orders prior to known orders from a customer to make money at the expense of your customer and others in the market. My understanding is the criminal type is not what they are normally accused of, of course, who knows but… Instead they front run largely by getting information very quickly and putting in orders to front run based on silly price difference (under 1/10 of a cent).

- Putting in false orders to fake out the market – you are not allowed to put in false orders. It is clear from the amount of orders placed and immediately withdrawn they are constantly doing this. Very simply any firm doing this should be banned from trading. It wouldn’t take long to stop. Of course the SEC should prosecute people doing this, but don’t hold your breath.

Several things should be done.

- Institute a small new financial transaction tax – adding a bit of friction to the system will reduce the ludicrous stuff going on now. Use this tax to fund investigation and prosecution of bad behavior.

- Redo the way matching of orders is done to promote real market activity not minute market arbitrage and manipulation – I don’t know exactly what to do but something like putting in a timing factor along with price. An order that is within 1/10 of cent for less than 1,000 shares are executed in order of length of time they have been active (or something like that).

- Institute rules that if you cancel more than 20% of your order (over 10 in a day) in less than 15 minutes you can’t enter an order for 24 hours. Repeated failures to leave orders in place create longer bans.

- Don’t let those using these strategies get their money back when they do idiotic things like sell bull chip companies down to 20% of their price at the beginning of the day. You don’t get to say, oh I didn’t really mean to buy this stock that lost me 50% the day I bought it, give me money back. There is no reason high frequency traders should be allowed to take their profits and then renege on trades they don’t like later.

Speculation is fine, within set rules for a fair market. Traders making money by manipulating the system instead of through beneficial activities such as making a market shouldn’t be supported.

To the extent high frequency trading creates fundamental buying opportunities take advantage of the market opportunity. Just realize the high frequency traders may be able to reverse you gains (and if you lose you are not going to be granted the same favors).

Related: Naked Short Selling – Misuse of Statistics, Mania in Financial Markets – Failure to Regulate Financial Markets Leads to Predictable Consequences – Fed Continues Wall Street Welfare

The truth is the billions of dollars high frequency traders steal from others market returns matters much less to true investors. For long terms holdings the less than a cent they steal from other market participants is small. It is still bad. Just people really get more excited about it than they need to. I would love to just get 1/1000 of cent on every trade made in the markets, I could retire. But they are mainly stealing very small amounts from tons of different people. Now the fake orders and trades that go against them that they then get reversed are a different story.

I believe in weak stock market efficiency. And recently the market is making me think it is weaker than I believed :-/ I believe that the market does a decent job of factoring in news and conditions but that the “wisdom of crowds” is far from perfect. There are plenty of valuing weaknesses that can lead to inefficient pricing and opportunities for gain. The simplest of those are spotted and then adopted by enough money that they become efficient and don’t allow significant gains.

And a big problem for investors is that while I think there are plenty of inefficiencies to take advantage of finding them and investing successfully is quite hard. And so most that try do not succeed (do not get a return that justifies their time and risk – overall trying to take advantage of inefficiencies is likely to be more risky). Some Inefficiencies however seem to persist and allow low risk gains – such as investing in boring undervalued stocks. Read Ben Graham’s books for great investing ideas.

There is also what seems like an increase in manipulation in the market. While it is bad that large organizations can manipulate the market they provide opportunities to those that step in after prices reflect manipulation (rather than efficient markets). It is seriously annoying when regulators allow manipulators to retroactively get out of bad trades (like when there was that huge flash crash and those engaging in high frequency “trading” front-running an manipulation in reality but not called that because it is illegal). Those that were smart enough to buy stocks those high frequency traders sold should have been able to profit from their smart decision. I definitely support a very small transaction tax for investment trades – it would raise revenue and serve reduce non-value added high frequency trading (which just seems to allow a few speculators to siphon of market gains through front running). I am fine with speculation within bounds – I don’t like markets where more than half of the trades are speculators instead of investors.

Related: Market Inefficiencies and Efficient Market Theory – Lazy Portfolios Seven-year Winning Streak – investing in stocks – Naked Short Selling

Dividends Beating Bond Yields by Most in 15 Years

Kraft Foods Inc. and DuPont Co. are among 68 companies in the Standard & Poor’s 500 Index with payouts that top the 3.78 percent average rate in credit markets, based on data since 1995 compiled by Bloomberg and Bank of America Corp. While Johnson & Johnson sold 10-year debt at a record low interest rate of 2.95 percent last month, shares of the world’s largest health products maker pay 3.66 percent.

The combination of record-low interest rates, potential profit growth of 36 percent this year and a slowing economy has forced investors into the relative value reversal. For John Carey of Pioneer Investment Management and Federated Investors Inc.’s Linda Duessel, whose firms oversee $566 billion, it means stocks are cheap after companies raised payouts by 6.8 percent in the second quarter

…

S&P 500 companies’ cash probably has grown to a record for a seventh straight quarter, according to S&P. For companies that reported so far, balances increased to $824.8 billion in the period ended June 30 from the first three months of the year, based on data from the New York-based firm.

Cash represents 10.2 percent of total assets at S&P 500 companies, excluding banks and financial firms, according to data compiled by Bloomberg. That’s higher than the 9.5 percent at the end of the second quarter last year, 8.4 percent in 2008 and 7.95 percent in 2007.

“The economy is slowing down, but productivity has been so great in this country and companies have been able to make good profits,”

10-year Treasury note yields were as low as 2.42% last month. The combination of continued extraordinarily low interest rates and good earnings increase this odd situation where dividends increase and interest yields fall. Extremely low yields aimed at by the Fed continue to aid banks and those that caused the credit crisis a huge deal and harm investors.

Money markets and bonds are not attractive places to invest now. Putting money in those places is still necessary for diversification (and as a safety net – especially in cases like 401-k plans where options are often very limited). Seeking out solid companies with strong long term prospects that pay reasonable dividends is a very sensible strategy today.

Related: Where to Invest for Yield Today – S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 – 10 Stocks for Income Investors – Bond Yields Show Dramatic Increase in Investor Confidence (Aug 2009)

…

Fears are growing that the global recovery will falter as Europe’s debt crisis spreads, China’s property bubble bursts and America’s stimulus-fuelled rebound peters out.

…

Fears about the fragility of the global recovery are exaggerated. Led by big emerging economies, the world’s output is probably growing at an annual rate of more than 5%, far swifter than most seers expected.

…

America’s structural budget deficit will soon be bigger than that of any other OECD member, and the country badly needs a plan to deal with it. But for now, lower bond yields and a stronger dollar are the route through which American spending will rise to counter European austerity. Thanks to its population growth and the dollar’s role as a global currency, America has more fiscal room than any other big-deficit country. It has been right to use it.

The world is nervous for good reason. Although the fundamentals are reasonably good, the judgment of politicians is often unreasonably bad. Right now that is what poses the biggest risk to the world economy.

Some very good thoughts from the Economist. As always there are plenty of risks to focus on today. There are also plenty of reasons to be optimistic. It looks like globally we are in for a good economy in 2010-2011 but those prospects could worsen fairly easily.

Related: India Grew GDP 8.6% in First Quarter – Consumer Debt Needs to Decline Much More – Government Debt as Percentage of GDP 1990-2008 – USA, Japan, Germany…

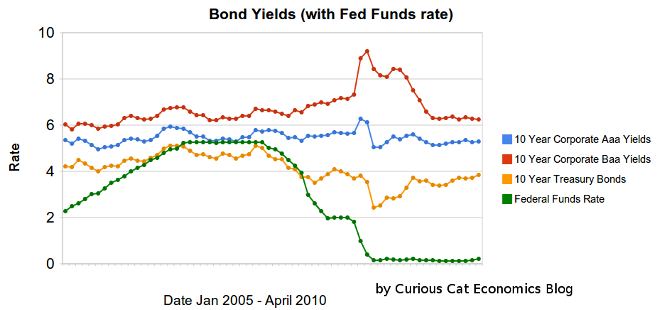

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have remained low, with little change over the last 6 months. 10 year Aaa corporate bonds yields have increase 10 basis points to 5.29%. 10 year Baa yields have decreased 7 basis points to 6.25%. 10 year USA treasury bonds have increased 45 basis points (largely the effective of money scared into the safety of US treasuries leaving as the credit crisis eased. The federal funds rate remains under .25%.

The United States economy appears to be gaining strength and if job growth can continue the Fed will likely reduce the amount giveaways to the banks by increasing the fed funds rate (though when this will happen is still very hard to judge). The Fed will also likely sell mortgages back to the market which will increase long term rates. The Fed will likely start by changing the wording that the economic conditions “are likely to warrant exceptionally low levels of the federal funds rate for an extended period.” When this language changes rates may well go up 25 to 50 basis points quickly.

Related: Bond Yields Change Little Over Previous Months (December 2009) – Chart Shows Wild Swings in Bond Yields in Late 2008 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Government Debt as Percentage of GDP 1990-2008 in OECD: USA, Japan, Germany…

Bogle on Bankers, Buffett, Obama; an interview of John Bogle, from February 2010.

But what made the decade quite so bad is that we then had a major recession or light depression at the end of 2008 to 2009 which is still with us. That coming with the market so highly valued meant that earnings growth was much less than what we might have expected. So looking out from here, I think we can look for better earnings growth. And dividend yields are back in decent territory but not great. We started this decade with a 1% dividend yield, and that’s an important part of investment returns, and now the dividend yield is around 2.25%, so a higher dividend yield contributing to future growth. So I think it’s highly likely that stocks will outpace bonds in the decade that just began.

…

Are we on the right path now? Has America learned its lesson?

Bogle: No. Unequivocally not. The long overdue reforms being discussed in Washington do not go nearly far enough, in my opinion. We need protection for consumers. Canada has a financial structure similar to ours except it has a consumer-protection board, which would prevent banks from giving people mortgages if they have no ability to pay them back. To get that done has been very difficult. Also, Senators (John) McCain and (Maria) Cantwell have proposed a return of the Glass-Steagall Act, and that’s gotten nowhere but it is long overdue. We should have banks behave as banks and not as investment banks or hedge-fund managers.

…

But let’s suppose the stock market creates a 10% return. And the value of the stock market today is around $13 trillion so 10% is $1.3 trillion. By my numbers, Wall Street and the mutual fund industry take $600 billion a year out of that return. That’s half of the return. So the only way investors are going to get their fair share of the $1.3 trillion is to reduce the costs and get the casinos out.

As usually John Bogle provides excellent analysis and vision.

Related: Bogle on the Retirement Crisis – Is Trying to Beat the Market Foolish? – Lazy Portfolios Seven-year Winning Streak – Sneaky Fees

Excellent post by James Jubak, Get your portfolio ready for the profitless global economic recovery

…

To avoid the trap of excess capacity killing even modest profits I think you have to look for sectors that have barriers that prevent excess capacity from driving down all prices as companies slit each other’s throats to acquire profitless market share.

…

Cisco is the IBM of the Internet—companies can buy the company’s gear and know that it will talk to the rest of the gear in their network (because Cisco probably sold them a good part of that gear and because everybody makes sure their gear works with Cisco equipment.) Plus Cisco has used recent acquisitions to continue its transformation from a simple—but globally dominant–seller of routers into a company that builds unified digital communications systems.

A second is Google (GOOG). Yes, Google stands a good chance of getting kicked out of China with its 1.3 billion potential Internet users (How old does a baby need to be to use the Gmail?). But no company is better positioned for the long-term trend toward distributed computing over the Internet than Google.

Both Google and Cisco have been long term investments in my 12 stocks for 10 years portfolio. Jubak’s blog is excellent: the best investing blog I know of. He does trade quite a bit more than I do but his performance has been exceptional.

Related: Jubak Looks at 5 Technology Stocks – Why Investing is Safer Overseas – 10 Stocks for Income Investors – Tesco: Consistent Earnings Growth at Attractive Price