Find below some interesting thoughts on financial markets and the efficient market theory. That theory essentially says the market prices are right given the available information. I think markets are somewhat efficient but there are plenty of opportunities to profit from inefficiencies in the market. Still it is not easy to consistently exploit these inefficiencies profitably.

Capital Market Theory after the Efficient Market Hypothesis

Capital market theory after the efficient market hypothesis by Dimitri Vayanos and Paul Woolley

…

Theory has ignored the real world complication that investors delegate virtually all their involvement in financial matters to professional intermediaries – banks, fund managers, brokers – who dominate the pricing process.

Delegation creates an agency problem. Agents have more and better information than the investors who appoint them, and the interests of the two are rarely aligned.

…

he new approach offers a more convincing interpretation of the way stock prices react to earnings announcements or other news. It also shows how short-term incentives, such as annual performance fees, cause fund managers to concentrate on high-turnover, trend-following strategies that add to the distortions in markets, which are then profitably exploited by long-horizon investors. At the level of national markets and entire asset classes, it will no longer be acceptable to say that competition delivers the right price or that the market exerts self-discipline.

Related: Nicolas Darvas (investor and speculator) – Beating the Market, Suckers Game? – Lazy Portfolios Seven-year Winning Streak – Stop Picking Stocks? – Don’t miss future gains just because you missed past gains

Why This Real Estate Bust Is Different by Mara Der Hovanesian and Dean Foust

…

While the housing crisis seems to be easing, the commercial storm is still gathering strength. Between now and 2012, more than $1.4 trillion worth of commercial real estate loans will come due…

The USA commercial real estate market, by many account, is going to continue to have trouble. I would like to add to my commercial real estate holdings in my retirement account, because I have so little (and other options are not that great), but with the current prospects I am not ready to move. I would not be surprised if the market comes back sooner than people expect: it seems like it is far too fashionable to have bearish feelings about the market. However, it doesn’t seem like the risk reward trade-off is worth it yet.

Related: Commercial Real Estate Market Still Slumping – Victim of Real Estate Bust: Your Pension – Nearly 10% of Mortgages Delinquent or in Foreclosure (Dec 2008) – Urban Planning

Chart showing corporate and government bond yields from 2005-2009 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

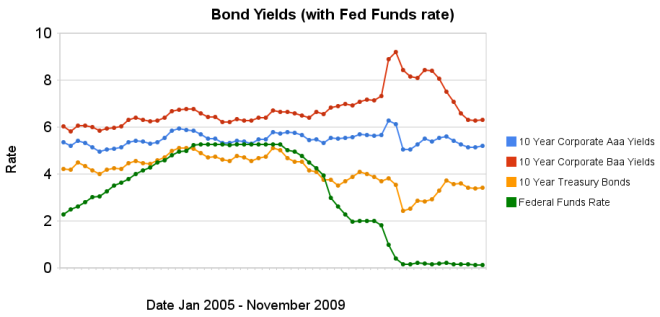

Chart showing corporate and government bond yields from 2005-2009 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have remained low, with little change over the last 4 months. Earlier in the year, yield spreads decreased dramatically, and those reductions have remained over the last 4 months. The federal funds rate remains under .25%.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Continued Large Spreads Between Corporate and Government Bond Yields (April 2009) – Chart Shows Wild Swings in Bond Yields (Jan 2009) – investing and economic charts

This hardly constitutes an outright collapse, nor is it necessarily cause for concern. American exporters, whose goods have become more competitive abroad, are happy with their weaker currency. Similarly domestic producers may be cheered that rival, imported goods are more expensive. And European tourists, who can buy more for their euros during weekend shopping excursions to America, may cheer too. However, the continued decline of the dollar does come against a backdrop of ominous murmurs from the likes of China and Russia, who hold much of their reserves in dollars, about the need to shift their reserves out of the greenback. Brazil’s imposition of a 2% levy on portfolio inflows is also a sign that other countries are getting nervous about seeing their currencies rise against the dollar.

…

But it is hard, also, to think of a parallel in history. A country heavily in debt to foreigners, with a government deficit it is making little headway at controlling, is creating vast amounts of additional currency. Yet it is allowed to get away with very low interest rates. Eventually such an arrangement must surely break down, bringing a new currency system into being, just as Bretton Woods emerged in the 1940s.

The absence of a credible alternative to the dollar means that, despite its declining value, its status as the world’s reserve currency is not seriously under threat. But the system could change in other ways. A world where currencies traded within bands, or where foreign creditors insist on America issuing some debt in other currencies, are all real possibilities as the world adjusts to a declining dollar.

The issuance of USA government debt of any significant size in other currencies would be an amazing event, to me. However, that does not mean it won’t happen. In my opinion it is hard to justify the non-collapse of the dollar, and has been for quite some time.

The huge future tax liability imposed over the last few decades along with the failure to save by those in the country creates a hollow economy. Granted the USA had a huge surplus of wealth built up since the end of World War II. The USA has to a great extent sold off that wealth to finance living beyond the productive capacity of the country the last 20-30 years. But that can only go on so long.

The only thing saving the dollar is that other countries do not want the dollar to decline because they don’t want the competition of American goods (either being sold to their country or for the goods they hope to export). So they intervene to stop the fall of the dollar (and buy USA government debt). That can serve to artificially inflate the dollar for some time. However, eventually I think that will collapse. And when it does it will likely be very quick. The idea of the USA issuing debt in other currencies seems crazy now. It could then go from possibility to necessity within months.

You cannot print money forever to live beyond your means and have people accept it as valuable. The government can runs deficits if the citizen’s finance that debt with savings: and still maintain a sound currency. But the recent period, given the macro-economic conditions, don’t justify the value of the dollar. It should have fallen much further a long time ago. The other saving grace for the dollar is few large economies have untarnished economies. The Euro has strengths but is hardly perfect. The Chinese Renminbi is possibly the strongest contender but the economy is still very controlled, financial data is untrustworthy, political freedom is not sufficient… The Japanese Yen does have some strengths but really their long term macro-economic conditions is far from sound.

In the current economic environment investing in currencies is one way to look for higher returns and even to diversify and hedge your portfolio using forex trading strategies.

Related: The USA Economy Needs to Reduce Personal and Government Debt – Let the Good Times Roll (using Credit) – Federal Reserve to Buy $1.2T in Bonds, Mortgage-Backed Securities – Who Will Buy All the USA’s Debt?

Nouriel Roubini is still worried about the US economy, though he does believe we are coming to the end of the severe recession we have been in.

I believe, that if you were worried about your portfolio being overweighted in stocks late last year, now is a good time to move some money out of the stock market. In December 2008, when many were selling in panic, I invested more in stocks.

The stock market has been on a tear increasing

1 December 2008 the S&P 500 was at 816

1 January 2009 – 903

6 March 2009 – 684 (the lowest point since 1996)

1 May 2009 – 878

1 August 2009 – 987

5 October 2009 – 1040

In 6 months, since the market hit a low on March 6th, it is up 52%. Certainly the decrease in prices seemed overdone. The 50% increase in prices seems overdone also. But trying to predict short term moves in the stock market (say under 1 year) is very difficult and few people can do so successfully (even if you can find lots of people offering their guesses). Predicting the economy, while not easy, is much much easier that predicting the stock market.

Read more

Fed Focusing on Real-Estate Recession as Bernanke Convenes FOMC

…

Commercial property is “certainly going to be a significant drag” on growth, said Dean Maki, a former Fed researcher who is now chief U.S. economist in New York at Barclays Capital Inc., the investment-banking division of London-based Barclays Plc. “The bigger risk from it would be if it causes unexpected losses to financial firms that lead to another financial crisis.”

…

Any sales of mortgage-backed bonds would be the first new issues in the $700 billion U.S. market for commercial-mortgage- backed securities since it was shut down by the credit freeze in 2008. About $3 billion are in the pipeline, and the success of these sales may foster as much as $25 billion in total deals in the next six months

…

Forty-seven percent of loans at the 7,000-plus smaller U.S. lenders are in commercial real estate, compared with 17 percent for the biggest banks…

Related: Data Shows Subprime Mortgages Were Failing Years Before the Crisis Hit – Home Values and Rental Rates – Record Home Price Declines (Sep 2008)

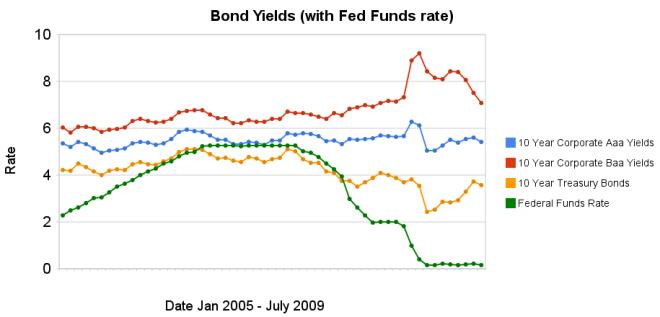

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.The changes in bond yields over the last 3 months months indicate a huge increase in investor confidence. The yield spread between corporate Baa 10 year bonds and 10 year treasury bonds increased 304 basis points from July 2008 to December 2008, indicating a huge swing in investor sentiment away from risk and to security (US government securities). From April 2009 to July 2009 the yield spread decreased by 213 basis points showing investors have moved away from government bonds and into Baa corporate bonds.

From April to July 10 year corporate Aaa yields have stayed essentially unchanged (5.39% to 5.41% in July). Baa yields plunged from 8.39% to 7.09%. And 10 year government bond yields increased from 2.93% to 3.56%. federal funds rate remains under .25%.

Investors are now willing to take risk on corporate defaults for a much lower premium (over government bond yields) than just a few months ago. This is a sign the credit crisis has eased quite dramatically, even though it is not yet over.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Continued Large Spreads Between Corporate and Government Bond Yields (April 2009) – Chart Shows Wild Swings in Bond Yields (Jan 2009) – investing and economic charts

Short selling stock is a tool that can help keep markets more stable. However, short selling can be used to manipulate the market and in the last decade naked short selling has contributed to such manipulation. The SEC has made permanent a temporary rule that was approved in 2008 in response to continuing concerns regarding “fails to deliver” and potentially abusive “naked” short selling. In particular, temporary Rule 204T made it a violation of Regulation SHO and imposes penalties if a clearing firm:

* does not purchase or borrow shares to close-out a “fail to deliver”

* resulting from a short sale in any equity security

* by no later than the beginning of trading on the day after the fail first occurs (Trade + 4 days).

Cutting Down Failures to Deliver: An analysis conducted by the SEC’s Office of Economic Analysis, which followed the adoption of the close-out requirement of Rule 204T and the elimination of the “options market maker” exception, showed the number of “fails” declined significantly.

For example, since the fall of 2008, fails to deliver in all equity securities has decreased by approximately 57 percent and the average daily number of threshold list securities has declined from a high of approximately 582 securities in July 2008 to 63 in March 2009. Which still is not acceptable, in my opinion. In general this is a good move by the SEC, but still not sufficient.

Transparency is increased some by the SEC with the new rules:

* Daily Publication of Short Sale Volume Information. It is expected in the next few weeks that the SROs will begin publishing on their Web sites the aggregate short selling volume in each individual equity security for that day.

* Disclosure of Short Sale Transaction Information. It is expected in the next few weeks that the SROs will begin publishing on their Web sites on a one-month delayed basis information regarding individual short sale transactions in all exchange-listed equity securities.

* Twice Monthly Disclosure of Fails Data. It is expected in the next few weeks that the Commission will enhance the publication on its Web site of fails to deliver data so that fails to deliver information is provided twice per month and for all equity securities, regardless of the fails level.

Full SEC press release: SEC Takes Steps to Curtail Abusive Short Sales and Increase Market Transparency

Related: SEC Temporarily Bans Short-selling Financial Stocks – Shorting Using Inverse Funds – Too Much Leverage Killed Mervyns

Two Professors Argue About the Invisible Hand – And Both Get it Wrong too

…

He used the term not in his discussion and analysis of markets (Book I and II of Wealth Of Nations), but in a discussion of the choice of export/importing versus investing in domestic businesses (Book IV of Wealth Of Nations on his critique of mercantile political economy). It had nothing to do with ‘regulating’.

…

It was a metaphor Smith used only three times and he never said “that when this invisible hand exists, when we all pursue our own interest, we end up promoting the public good, and often more effectively than if we had actually and directly intended to do so.” That is a modern construction placed on the metaphor and has next to nothing to do Adam Smith

…

The invisible hand was never in Adam Smith’s world in the form invented in mid-20th century by some economists who created the Chicago version of Adam Smith, while ignoring the Adam Smith born in Kirkcaldy, Scotland in 1723.

Related: There is No Invisible Hand – Myths About Adam Smith Ideas v. His Ideas – Not Understanding Capitalism

The Formula That Killed Wall Street

His method was adopted by everybody from bond investors and Wall Street banks to ratings agencies and regulators. And it became so deeply entrenched—and was making people so much money—that warnings about its limitations were largely ignored.

Then the model fell apart. Cracks started appearing early on, when financial markets began behaving in ways that users of Li’s formula hadn’t expected. The cracks became full-fledged canyons in 2008—when ruptures in the financial system’s foundation swallowed up trillions of dollars and put the survival of the global banking system in serious peril.

Very nice article on the dangers of financial markets to those that believe that math can provide all the answers. Math can help find opportunities. However markets have physical, psychological and regulatory limitations. And markets frequently experience huge panics or manias. People continue to fail to model that properly.

Related: All Models Are Wrong But Some Are Useful – Leverage, Complex Deals and Mania – Financial Markets with Robert Shiller – Financial Market Meltdown – Failure to Regulate Financial Markets Leads to Predictable Consequences