I am glad we have a “fiscal cliff” to finally get some reduction in the future taxes both parties have been piling on with abandon the last few decades. When you have enormous spending beyond your income, as the USA has had the last few decades, cutting current taxes is just raising taxes on your grandchildren to pay for your spending. Shifting taxes to your grand children is not cutting taxes it is shifting them to future generations.

If you want to really cut taxes you must cut taxes and not pass on paying for your cuts to your kids. It seems pretty obvious those that advocating cutting current taxes the last few decades were only interested in living beyond their means today and foisting the responsibility to pay to their grandchildren. That is despicable behavior.

The fiscal cliff is an opportunity to return to a budget that has the generation doing the spending paying the taxes (last seen in the Clinton administration). The fiscal cliff outcome is going to be far from perfect. But the result will be a much more honorable outcome than foisting ever increasing taxes on future generations to pay for our current spending.

Obviously, if you reducing how much you are adding to your credit card balance each month and start paying your bills that means you don’t get to live off your future earnings today. So you will suffer today compared to continuing to tax the future to pay for your spending.

I hope the compromise results in spending cuts and an elimination of the Bush generation shifting taxes (cutting taxes on the the current wealthy without spending cuts – so just taxing the future to pay for tax cuts today). It is unlikely the fiscal cliff results in us actually paying for our spending (the best possible result is not an elimination of adding to the taxes future generations must pay but just a reduction in the level of tax increases we are imposing on the future every year).

Lots of little things should be done to save a few billion (maybe it could add up to $50 billion a year if we are very lucky). But the serious spending cuts have to come from reductions in military spending, reducing waste in the health care system and making social security more actuarially sensible (social security is not part of the fiscal cliff discussions though). Reducing tax breaks also has to happen, unless absolutely huge spending cuts can be found which is not at all likely.

Building your saving is largely about not very sexy actions. The point where most people fail is just not saving. It isn’t really about learning some tricky secret.

You can find yourself with pile of money without saving; if you win the lottery or inherit a few million from your rich relative via some tax dodge scheme like generation skipping trusts or charitable remainder trusts.

But the rest of us just have to do a pretty simple thing: save money. Then, keep saving money and invest that money sensibly. The key is saving money. The next key is not taking foolish risks. Getting fantastic returns is exciting but is not likely and the focus should be on lowering risk until you have enough savings to take risks with a portion of the portfolio.

My favorite tips along these lines are:

- spend less than you make

- save some of every raise you get

- save 10-15% of income for retirement

- add to any retirement account with employer matching (where say they add $500 for every $1,000 you put into your 401(k)

Spending less than you make and building up your long term savings puts you in the strongest personal finance position. These things matter much more than making a huge salary or getting fantastic investing returns some year. Avoiding risky investments is wise, and sure making great returns helps a great deal, but really just saving and investing in a boring manner puts you in great shape in the long run. Many of those making huge salaries are in atrocious personal financial shape.

Another way you can boost savings is to do so when you pay off a monthly bill. So when I paid off my car loan I just kept saving the old payment. Then I was able to buy my new car with the cash I saved in advance when I was ready for a new car.

The largest manufacturing countries are China, USA, Japan and then Germany. These 4 are far in the lead, and very firmly in their positions. Only the USA and China are close, and the momentum of China is likely moving it quickly ahead – even with their current struggles.

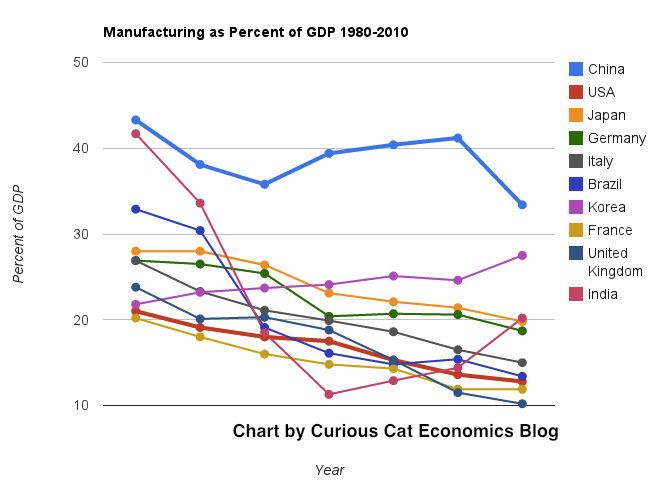

The chart below shows manufacturing production by country as a percent of GDP of the 10 countries that manufacture the most. China has over 30% of the GDP from manufacturing, though the GDP share fell dramatically from 2005 and is solidly in the lead.

Nearly every country is decreasing the percentage of their economic output from manufacturing. Korea is the only exception, in this group. I would expect Korea to start following the general trend. Also China has reduced less than others, I expect China will also move toward the trend shown by the others (from 2005 to 2010 they certainly did).

For the 10 largest manufacturing countries in 2010, the overall manufacturing GDP percentage was 24.9% of GDP in 1980 and dropped to 17.7% in 2010. The point often missed by those looking at their country is most of these countries are growing manufacturing, they are just growing the rest of their economy more rapidly. It isn’t accurate to see this as a decline of manufacturing. It is manufacturing growing more slowly than (information technology, health care, etc.).

This chart shows manufacturing output, as percent of GDP, by country and was created by the Curious Cat Economics Blog based on UN data. You may use the chart with attribution.

The manufacturing share of the USA economy dropped from 21% in 1980 to 18% in 1990, 15% in 2000 and 13% in 2010. Still, as previous posts show, the USA manufacturing output has grown substantially: over 300% since 1980, and 175% since 1990. The proportion of manufacturing output by the USA (for the top 10 manufacturers) has declined from 33% in 1980, 32% in 1990, 35% in 2000 to 26% in 2010. If you exclude China, the USA was 36% of the manufacturing output of these 10 countries in 1980 and 36% in 2010. China’s share grew from 7.5% to 27% during that period.

The United Kingdom has seen manufacturing fall all the way to 10% of GDP, manufacturing little more than they did 15 years ago. Japan is the only other country growing manufacturing so slowly (but Japan has one of the highest proportion of GDP from manufacturing – at 20%). Japan manufactures very well actually, the costs are very high and so they have challenges but they have continued to manufacture quite a bit, even if they are not growing output much.

Global Trends in Renewable Energy Investment 2012

…

renewable power (excluding large hydro) accounted for 44% of new generation

capacity added worldwide in 2011, up from 34% in 2010 [and 10% in 2004]. The $237 billion invested in building these green power plants compares with $223 billion of net new expenditure annually on building additional fossil-fuelled power plants globally last year.

…

Current predictions are that total installed capacity in non-hydro renewable power will rise ninefold to 2.5Tw by 2030, with investment in assets rising from $225 billion in 2011 to $395 billion-a-year by 2020 and $460 billion-a-year by 2030

Total investment in solar in 2011 increased 52% to $147 billion, driven by a drop of 50% in photovoltaic module prices. Investment in wind dropped 12% to $84 billion, while onshore wind turbine prices fell between 5 and 10%. Biomass and waste to energy was the 3rd largest renewable sector at $11 billion in investments (down 12% from 2010).

USA investment surged 51% to $51 billion just behind China at $52 billion (China increased investment in renewable energy by 17% from 2010). German investment dropped 12% to $31 billion.

In 2011 renewable energy power capacity (excluding large hydropower), as a percentage of total system capacity, reached 9%, up from 4% in 2004. Total renewable energy generation (excluding large hydro) reached 6%, up from 4% in 2004.

Related: Top Countries For Renewable Energy Capacity – Wind Energy Capacity Exceeds 2.5% of Global Electricity Needs – Leasing or Purchasing a Solar Energy System For Your Home

The expenses for long term care is exactly the type of financial risk insurance is best for. The problem is the whole area is so uncertain that what you buy may not provide the coverage you planned on (the health care system is so broken that it is not certain insurance will cover the costs, companies can go bankrupt, change coverage rules drastically…).

The questions about long term care insurance are not about the sensibility of the coverage abstractly, it is very wise. But the complexities, today, in the real world make the question of buying more a guess about what coverage you will actually receive if you need it.

Many of my posts here are focused on the USA but applicable elsewhere, or just applicable wherever you are. This post is mainly focused on the USA, long term care insurance options in other locations will be very different and have different considerations (in many countries it may not even apply, mainly due to a less broken health care system than the USA has).

Long-Term-Care Insurance: Who Needs It? by Marilyn Geewax

Such care can be crushingly expensive: Just one hour of home-health-aide care costs roughly $20, while the average private nursing home room costs $87,000 a year. Neither routine employer-based medical insurance nor Medicare will pay for extended periods of custodial care.”

…

Also, some people pay their premiums for years, and then get hit with rate hikes they can’t afford.

Insurance has a transaction cost. Paying that transaction cost for expenses you can afford is just waste. You should pay the cost directly. This is why higher deductibles are most often wise. It doesn’t make sense to cover pay insurance costs every year to pay for a $500 risk you can afford to absorb yourself.

But huge expenses are exactly what you want coverage for. Long term care expenses are huge. However, long term care insurance is still in flux, which isn’t good for something you want to provide long term protection. A huge risk is paying premiums for years, and then getting hit with rate hikes that may well be designed primarily just to get people to drop coverage (or be so expensive that those that stay pay enough that the insurance company makes money).

Ideally such insurance would be set so maybe the cost rose at some preset limit when you signed up. The problem is the USA health care system is so broken this won’t work. No one can predict how much more excessively expensive long term coverage will be in 30 years so the insurance companies can’t predict. It leaves consumers in a risky place.

Insurance is regulated by the states. There are huge differences in which states do a good job regulating long term care insurance and those that don’t. The majority don’t.

This is one of the more important areas of personal finance. Unfortunately there is no easy answer. If the system were stable, reliable and predictable, long term care insurance would be a definite requirement for a sound financial plan. Today it is wise to insure yourself from those risks, the problem is determining whether any of the options available are worth it. The risk of needing this insurance is high: it is both likely and costly. So getting coverage is definitely wise if you can find some you think is reliable over the long term. Because of the uncertain nature of the options, this will require much more effort on your part than many personal finance actions (I included several links below to help your research).

Also look at how long the coverage is for. This is another limitation insurance companies have put in place that makes it much less worthwhile.

Related: Personal Finance Basics: Long-term Care Insurance – National Clearinghouse for Long-Term Care Information – AARP advice – Disability Insurance is Very Important – How to Protect Your Financial Health

The basics of retirement planning are not tricky. Save 10-15% of your income for about 40 years working career (likely over 15%, if you don’t have some pension or social security – with some pension around 10+% may be enough depending on lots of factors). That should get you in the ballpark of what you need to retire.

Of course the details are much much more complicated. But without understanding any of the details you can do what is the minimum you need to do – save 10% for retirement of all your income. See my retirement investing related posts for more details. Only if you actually understand all the details and have a good explanation for exactly why your financial situation allows less than 10% of income to be saved for retirement every year after age 25 should feel comfortable doing so.

There is value in the simple rules, when you know they are vast oversimplifications. I am amazed how many professionals don’t understand how oversimplified the rules of thumb are.

Here is one thing I see ignored nearly universally. I am sure some professions don’t but most do. If you have retirement assest such as a pension or social security (something that functions as an annuity, or an actually annuity) that is often a hugely important part of your retirement portfolio. Yet many don’t consider this when setting asset allocations in retirement. That is a mistake, in my opinion.

A reliable annuity is most like a bond (for asset allocation purposes). Lets look at an example for if you have $1,500 a month from a pension or social security and $500,000 in other financial assets. $1,500 * 12 gives $18,000 in annual income.

To get $18,000 in income from an bond/CD… yielding 3% you need $600,000. That means, at 3%, $600,000 yields $18,000 a year.

Ignoring this financial asset worth the equivalent of $600,000 when considering how to invest you $500,000 is a big mistake. Granted, I believe the advice is often too biased toward bonds in the first place (so reducing that allocation sounds good to me). To me it doesn’t make sense to invest that $500,000 the same way as someone else that didn’t have that $18,000 annuity is a mistake.

I also don’t think it makes sense to just say well I have $1,100,000 and I want to be %50 in bonds and 50% in stocks so I have “$600,000 in bonds now” (not really after all…) so the $500,000 should all be in stocks. Ignoring the annuity value is a mistake but I don’t think it is as simple as just treating it as though it were the equivalent amount actually invested.

Related: Immediate Annuities – Managing Retirement Investment Risks – How to Protect Your Financial Health – Many Retirees Face Prospect of Outliving Savings

3 Economic Misconceptions That Need to Die

…

Just 6.4% of nondurable goods — things like food, clothing and toys — purchased in the U.S. are made in China; 76.2% are made in America. For durable goods — things like cars and furniture — 12% are made in China; 66.6% are made in America.

Those numbers are significantly less than I expected but the concept matches my understanding – that we greatly underestimate the purchasing of USA goods and services.

We have an inflated notion of how large the China macro economic numbers are for the USA (both debt and manufacturing exports to us). The China growth in both is still amazingly large: we just overestimate the totals today. We also forget that 25 years ago both numbers (imports from China and USA government debt owned by China) were close to 0.

We also greatly underestimate how much manufacturing the USA does, as I have been writing about for years. In fact, until 2010, the USA manufactured more than China.

Who owns the rest? The largest holder of U.S. debt is the federal government itself. Various government trust funds like the Social Security trust fund own about $4.4 trillion worth of Treasury securities. The Federal Reserve owns another $1.6 trillion.

Ok, this figure is a bit misleading. But even if you thrown out the accounting games 1.13/8.9 = 12.7%. That is a great deal. But it isn’t a majority of the debt or anything remotely close. Other foreign investors own $3.5 trillion trillion in federal debt (Japan $1 trillion, UK $500 billion). The $4.6 trillion of federal debt owned by foreigners is a huge problem. With investors getting paid so little for that debt though it isn’t one now. But it is a huge potential problem. If interest reates increase it will be a huge transfer of wealth from the USA to others.

The oil figure is a bit less meaningful, I think. Oil import are hugely fungible. The USA cutting back Middle East imports and pushing up imports from Canada, Mexico, Nigeria… doesn’t change the importance of Middle East oil to the USA in reality (the data might seem to suggest that but it is misleading due to the fungible nature of oil trading). Whether we get it directly from the Middle East or not our demand (and imports) creates more demand for Middle East oil. It is true the USA has greatly increased domestic production recently (and actually decreased the use of oil in 2009). So while I believe the data on Middle East oil I think that it is a bit misleading. If we had 0 direct imports from there we would still be greatly dependent on Middle East oil (because if France and China and India… were not getting their oil there they would buy it where we buy ours… Still the USA uses far more oil than any other country and is extremely dependent on imports. Several other countries are also extremely dependent on oil imports, including the next two top oil consuming countries: China, Japan.

Related: Oil Production by Country 1999-2009 – Government Debt as Percentage of GDP 1990-2009: USA, Japan, Germany, China… – Manufacturing Output as a Percent of GDP by Country – The Relative Economic Position of the USA is Likely to Decline

Very interesting USA federal tax data via the tax foundation. Top 1% has adjusted gross income of $343,000; over $154,000 puts you in the top 5%; $112,000 puts you in the top 10% and $66,000 puts you in the top 25%.

The chart only shows federal income tax data. So the costly social security tax (which is directly based on earned income* so in reality is federal income tax but is handled in a separate account so is consistently not classified as income tax data) for outside the top 5% (income above $106,800 [for 2011] does not have to pay the social security tax) is not reflected in the rates paid here.

Looking at the data excluding social security is fine, but it is very important to remember the social security (plus medicare) tax is the largest tax for, I would guess, most people in the USA. Social security tax is 6.2% paid by the employee plus 6.2% paid by the company – a total of 12.4%. That part of the tax was capped at $106,800 in income for 2011. The medicare tax is 1.45% of income paid by the employee and 1.45% paid by the employer (and it has no cap). So that totals 2.9% (for the employee and employer tax) and brings the total to 15.3%** for most earned income.

|

|

Number of Returns with Positive AGI |

AGI ($ millions) |

Income Taxes Paid ($ millions) |

Group’s Share of Total AGI |

Group’s Share of Income Taxes |

Income Split Point |

Average Tax Rate |

|

All Taxpayers |

137,982,203 |

$7,825,389 |

$865,863 |

100.0% |

100.0% |

– |

11.06% |

|

Top 1% |

1,379,822 |

$1,324,572 |

$318,043 |

16.9% |

36.7% |

$343,927.00 |

24.01% |

|

1-5% |

5,519,288 |

$1,157,918 |

$189,864 |

14.8% |

22.0% |

|

16.40% |

|

Top 5% |

6,899,110 |

$2,482,490 |

$507,907 |

31.7% |

58.7% |

$154,643.00 |

20.46% |

|

5-10% |

6,899,110 |

$897,241 |

$102,249 |

11.5% |

11.8% |

|

11.40% |

|

Top 10% |

13,798,220 |

$3,379,731 |

$610,156 |

43.2% |

70.5% |

$112,124.00 |

18.05% |

|

10-25% |

20,697,331 |

$1,770,140 |

$145,747 |

22.6% |

17.0% |

|

8.23% |

|

Top 25% |

34,495,551 |

$5,149,871 |

$755,903 |

65.8% |

87.3% |

$ 66,193.00 |

14.68% |

|

25-50% |

34,495,551 |

$1,620,303 |

$90,449 |

20.7% |

11.0% |

|

5.58% |

|

Top 50% |

68,991,102 |

$6,770,174 |

$846,352 |

86.5% |

97.7% |

> $32,396 |

12.50% |

|

Bottom 50% |

68,991,102 |

$1,055,215 |

$19,511 |

13.5% |

2.3% |

< $32,396 |

1.85% |

Source: Internal Revenue Service. Table via the tax foundation.

Other interesting data shows that the top 1% earn 16.9% of the total income and pay 36.7% of the total federal income taxes. Those in the top 1-5% earn 14.8% of the total income and pay 22% of the income taxes. Those in the top 5-10% earn of the income 11.5% of the income and pay 11.8% of the federal income taxes. So once you exclude the main tax on income (social security) and use adjusted gross income the tax rates are slightly progressive (higher rates for those that are making the most – and presumably have benefited economically the most from the economic system we have).

Given that this is skewed by excluding the regressive (higher taxes paid by those earning less – social security is the same rate for everyone except those earning the very most who don’t have to pay it on their income above $106,800 [in 2011]) social security tax I believe we should have a more progressive tax system. But that is mainly a political debate. There are good economic arguments for the bad consequences of too unequal a distribution of wealth (which the USA has been moving toward the last few decades – unfortunately).

In addition to the other things I mention there are all sorts of games played by those that desire a royalty type system (where wealth is just passed down to the children of those who are rich, instead of believing in a capitalist system where rewards are given not to the children of royalty but to those that are successful in the markets). A good example of the royalty model is Mitch Romney giving his trust fund children over $100 million each. These schemes use strategies to avoid paying taxes at all. Obviously these schemes also make the system less progressive (based on my understanding of the tax avoidance practiced by these trust fund babies and those that believe it is ethical to give such royalty sized gifts to their royal heirs).

I don’t like the royalty based model of behavior. I much prefer the actions of honorable capitalist such as Warren Buffett and Bill Gates that give their children huge benefits that any of us would be thrilled with, but do not treat them as princes and princesses who should live in a style of luxury that few kings have every enjoyed based solely off their birthright. Both Bill Gates and Warren Buffett have honorably refused to engage in royal seeking behavior that many of their less successful business peers have chosen to engage in. Those that favor trust fund babies are welcome to their opinion and have managed to get most of congress to support their beliefs instead of a capitalist model that I would prefer so they are free to engage in their desire to parrot royalty and honor the royalty model of behavior.

* earned income – you also don’t have to pay social security or medical tax on unearned income (dividends, capital gains, rental income…). Again this by and large favors wealthy taxpayers. Everyone is eligible for the same favorable tax treatment but only those that have the wealth to make significant amounts of unearned income get this advantage.

** the social security tax has been reduced by 200 basis points (this relief was recently extended) as part of dealing with the results of the too big to fail banking caused credit crisis. So under the temporary reduction the personal tax rate is 4.2% and the total cost is 13.2%.

Related: Taxes – Slightly or Steeply Progressive? – Taxes per Person by Country – USA State Governments Have $1,000,000,000,000 in Unfunded Retirement Obligations – Retirement: Roth IRA Earnings and Contribution Limits

The latest data from the commonwealth fund report confirms the status quo. The USA spends twice as much on their health care system for no better results. It is easier to argue the USA is below average in performance that leading. And for double the cost that is inexcusable.

Globally the rich countries citizens are not tremendously happy with health care systems overall. It seems likely not only does the USA cost twice and much as it should and perform poorly compared to countries doing an excellent job but the USA performs that poorly compared to countries that themselves have quite a bit of improvement to make. Which makes the state of the USA system even worse.

Data from the Commonwealth fund report published in 2011 with data for 2009, International Profiles of Health Care Systems, 2011:

Table showing, percent of GDP spent and total spending per capita in USD on health care by country.

| Country | 2007 | Spending |

|

2009 | Spending |

| Australia | 9.5% | $3,128 | 8.7% | $3,445 | |

| Canada | 9.8% | $3,326 | 11.4% | $4,363 | |

| Germany | 10.7% | $3,287 | 11.6% | $4,218 | |

| Japan | 8.5% | $2,878 | |||

| New Zealand | 9.0% | $2,343 | 10.3% | $2,983 | |

| UK | 8.3% | $2,724 | 9.8% | $3,487 | |

| USA | 16.0% | $6,697 | 17.4% | $7,960 |

| Survey of population, showing % that chose each statement (no data available for Japan) | |||||||

| Australia | Canada | Germany | New Zealand | UK | USA | ||

| 2007 – 2010 | 2007 – 2010 | 2007 – 2010 | 2007 – 2010 | 2007 – 2010 | 2007 – 2010 | ||

| Overall health system views | |||||||

| Only minor changes needed, system works well | 24 – 24 | 26 – 38 | 20 – 38 | 26 – 37 | 26 – 62 | 16 – 29 | |

| Fundamental changes needed | 55 – 55 | 60 – 51 | 51 – 48 | 56 – 51 | 57 – 34 | 48 – 41 | |

| Rebuild completely | 18 – 20 | 12 – 10 | 28 – 14 | 17 – 11 | 15 – 3 | 34 – 27 | |

| Percent uninsured | 0 – 0 | 0 – 0 | <1 – 0 | 0 – 0 | 0 – 0 | 16 – 16 | |

Under currently law in the USA by 2020 the uninsured rate should decline to under 5% by 2020 (still far more than any rich country – nearly all of which are at 0%).

On many performance measures in the report the USA is the worst performing system (in addition to costing twice as much). Such as Avoidable Deaths, 2006–07, the USA had 96 per 100,000, the next highest was the UK at 83, Australia was the lowest at 57. And Diabetes Lower Extremity Amputation Rates per 100,000 population, the USA had 36 the next highest was New Zealand at 12, the lowest was the UK at 9. For experiencing a medical, medication or lab test rrror in past 2 years, the USA was at 18%, next worst was Canada at 17%, best was UK at 8%. The USA was top performer in breast cancer five-year survival rate, 2002–2007. And sometimes the USA was in the middle, able to get same/next day appointment when sick: the USA was at 57%, New Zealand achieved 78% while Canada only reached 45%.

It is possible to argue the USA provides mediocre results, which is consistent with most global health care performance measures. Unless you directly benefit from the current USA system it is hard to see how you can argue it is not the worst system of any rich country. Costing twice as much and achieving middling performance. All that doesn’t even factor in the cost in anguish and bankruptcies and restricting individual freedom (when you have to stay tied to a job you would rather leave, just because of health insurance) caused by the difficulty getting coverage and fighting with the insurance companies for payment and coverage for treatment expenses.

Related: Measuring the Health of Nations – USA Paying More for Health Care – Traveling for Health Care – resources for improvement health system performance

Apple has been performing amazingly well for years. They keep producing blockbuster hits over and over. Not only are these hits enormously popular they are enormously profitable.

The only real objections to Apple’s stock I can see are: the overall market value is so huge it just has to collapse (over $400 billion – the largest in the world) or it has to be time for a huge reversal of fortunes.

The problem with the view that it will fall is that the stock is very cheap by any rational measure. You are not paying much for all the earnings. Even if Apple does not continue the trend of the last 5 years, if it just stopped growing altogether, it is still cheap (if it does continue that trend it will break $1 trillion by 2014 – but I don’t think it will). The biggest risk is the profit margin shrinks drastically. That is possible. It is even somewhat likely to shrink a fair amount. But there isn’t much reason to think revenues will not grow. And to me, the current price makes sense only if revenues fall and profit margins fall. It takes the worst case scenario to make this stock seem overpriced.

The data on the last quarter (and for 2011 overall) are impossible (except they actually happened).

- record quarterly revenue of $46.33 billion ($26.74 billion in 2010)

- record quarterly net profit of $13.06 billion ($6 billion in 2010)

- Gross margin was 44.7 percent compared to 38.5 percent in the year-ago quarter

- $17.5 billion in cash flow from operations during the quarter (and $38 billion in the last year)

- $100 billion in cash now ($97.6 billion to be exact but since the data was gathered they probably passed $100 billion anyway). That is more than the market cap of all but 52 companies in the world.

You can’t grow quarterly sales from $26.7 billion to $46.3 billion. $26 million to $46 million, fine that is possible, billions however – not possible. Except Apple did. You can’t grow a $6 billion quarterly profit to $13 billion in 1 year. Except Apple did. You can’t generate a cash flow of $17.5 billion in a quarter. Except Apple did. You can’t have a stockpile of $100 billion in cash. Except Apple does. These figures would not have been seen as unlikely just 3 years ago. They were impossible. But Apple achieved them.

These figures are not short term blips. They are the latest in a long stream of amazingly results.

Related: How Apple Can Grow from $200 Billion to $300 Billion In Market Cap – Apple Tops Google (August 2008)

Apple has numerous, incredibly strong businesses. Each could be the linchpin of an extremely valuable company.

- iPhone initial sales and reoccurring income (over 50% of Apple’s revenue)

- app sales (for iPhones, iPads and Macs)

- iPads

- iTunes

- Macs

- Their retail store business – selling all their products