GDP slides 3.8%, worst since 1982

…

“All of this points towards real GDP declining faster in the first quarter than the fourth quarter,” Levy said. Another bad portent was a sharp decline in exports. U.S. sales to other countries had been strong in recent years, boosted by high demand overseas and the relatively low value of the dollar. But that situation reversed sharply in the last three months of 2008, with exports plummeting 19.7%.

According to the International Monetary Fund, the decline in the U.S. is matched by other leading economies, which contracted about 5.5% in the fourth quarter of 2008.

The decline was a bit less than anticipated but obviously shows an economy in serious trouble. U.S. GDP Falls At 3.8 Percent Pace In 4th Quarter

The Commerce report showed consumer spending – which accounts for a whopping two-thirds of U.S. economic activity – fell another 3.5 percent in the fourth quarter after declining 3.8 percent in the third quarter. Spending on durable goods such as cars and furniture plunged 22.4 percent, the steepest decline since the first quarter of 1987.

As I have been saying for awhile the economy is in trouble and 2009 looks to be difficult. We should be happy if a recovery is underway in the 4th quarter of 2009 and we have not too drastically increased the burden on the future to pay for current spending.

Related: Financial Market Meltdown (Oct 2008) – Cracks in US Economy? (Dec 2006) – Fed Continues Wall Street Welfare – Forecasting Oil Prices – Crisis May Push USA Federal Deficit to Above $1 Trillion for 2009

Times are tough. Economic news is grim. But if you are looking to relax somewhere warm, you are in luck. Deals in Paradise

The bargains in Las Vegas are so gigantic that I couldn’t figure them out myself. I called Howard Lefkowitz, the chief executive of Vegas.com, for a little help. After a little patter promising that “everything is 25 to 30 percent” less than last year, Lefkowitz agreed to a real-time test.

“What would a room at the Bellagio cost me tonight?” I asked. After a few keystrokes — I heard his keyboard clacking over his website — he found a $129 rate for a standard room at the five-star property. “That probably would have cost $225 last year,” he said. “What would $129 have gotten me last year?” I wondered. Lefkowitz didn’t hesitate: “A night at Paris, a nice four-star resort.” What was Paris charging tonight?” I asked. A few more keystrokes and Lefkowitz had an answer: $90.

…

“Call me,” the general manager at a new hotel in Miami advised. “I’ll offer you a price you won’t find on the Web.”

Related: Medieval Peasants had More Vacation Time – Dream More, Work Less – 9 Days in Egypt – Costa Rica Photo Essay – South Carolina Photos

President Barack Obama’s Inaugural Address

That sounds nice I believe however, it is fairly irrelevant. Economic demand is what is down, not production capacity. We are “no less productive than when this crisis began.” Ok, that is probably true. So what. That implies that the crisis has something to do with productivity. If we say the color of our eyes is the same as when the crisis began it is obvious that is a non-sequitur. Well so is the quote by the new President, though that is less obvious.

Our demand was definitely over stimulated using massive federal government budget deficits, massive trade deficits, massive amounts of consumer debt, massive amounts of unjustified mortgage debt and massive amounts of leverage. None of those things has anything to do with capacity in the implied sense – capacity to produce. They have to do with the capacity to consume. And while our capacity to consume has not declined. The funding that allows that consumption (foreign lending, high leverage, junk mortgages…) has decreased.

Read more

The costs to employees for health insurance keep increasing, even as employers pay more also. A Premium Sucker Punch:

…

The Corporate Executive Board found in its survey that a quarter of officials from 350 large corporations said they had increased deductibles an average of 9 percent in 2008. But 30 percent of the employers said they expected to raise deductibles an average of 14 percent in 2009. Mercer, a global benefits consulting firm, surveyed nearly 2,000 large corporations in a representative poll and found that 44 percent planned to increase employee-paid portion of premiums in 2009, compared with 40 percent in 2008.

The economic slowdown, according to analysts, is making it more difficult for many employers to subsidize health care costs at previous levels. On average, experts say, benefit packages contain the biggest increases for workers since the recession of 2001. Workers’ health costs are rising much faster than wages.

…

Premiums for employer-sponsored plans over a decade on average have risen to $12,680 a year from $5,791, according to the Henry J. Kaiser Family Foundation. The median deductible for the plans was $1,000 in 2008, compared with $500 from 2001 to 2007, according to a survey of 2,900 employers conducted by Mercer.

The broken health care system in the USA has been a huge drain on the economy and people’s standard of living for decades. The longer we allow the system to decline (increasing costs, declining results) the more damage the economy suffers and the larger the costs to implementing fixes become.

Related: Personal Finance Basics: Long-term Care Insurance – Medical Debt Increases as Economy Declines – International Health Care System Performance – Many Experts Say Health-Care System Inefficient, Wasteful – posts on improving the health care system

Gavin Kennedy is a professor and director of contracts at Edinburgh Business School. He authors the Adam Smith’s Lost Legacy blog discussing the mis-attributions to Adam Smith, which are all too common now. A good example is, Perpetrators of Myths Mislead Generations of Students, Some of Whom Grow Up to (mis)Advise Legislators:

…

Smith’s intellectual arguments, and personal warmth for the growth of commercial society, were driven by the conviction that growth across agriculture, industry and specific, targeted public expenditure, such as defence, justice, and public works and public institutions, would assist the spread of opulence, especially to the labouring poor and their families, albeit slowly and gradually, but steadily too, if legislators and those who influenced them were careful not to approve monopoly schemes to narrow markets and restrict competition, not to indulge in spasms of ‘jealousy of trade’, protectionism, forming loss-making colonies and conducting wars for trivial ends (i.e., not for defensive purposes only).

Introducing, a mystical or miraculous force at work in markets detracts from the real and detailed policy measures that may required from time to time to ensure steady growth, competition, and liberty for all, and not just for the amoral ends of privileged monopolists and their cronies.

Related: Not Understanding Capitalism – Ignorance of Capitalism – Monopolies and Oligopolies do not a Free Market Make – Estate Tax Repeal, Bad Policy

I do not like the actions of many in “private equity.” I am a big fan of capitalism. I also object to those that unjustly take from the other stakeholders involved in an enterprise. It is not the specific facts of this case, that I see as important, but the thinking behind these types of actions. Which specific actions are to blame for this bankruptcy is not my point. I detest that financial gimmicks by “private capital” that ruin companies.

Those gimmicks that leave stakeholders that built such companies in ruin should be criticized. It is a core principle that I share with Dr. Deming, Toyota… that companies exist not to be plundered by those in positions of power but to benefit all the stakeholders (employees, owners, customers, suppliers, communities…). I don’t believe you can practice real lean manufacturing and subscribe to this take out cash and leave a venerable company behind kind of thinking.

How Private Equity Strangled Mervyns

When those firms bought Mervyns from Target for $1.2 billion in 2004, they promised to revive the limping West Coast retailer. Then they stripped it of real estate assets, nearly doubled its rent, and saddled it with $800 million in debt while sucking out more than $400 million in cash for themselves, according to the company. The moves left Mervyns so weak it couldn’t survive.

Mervyns’ collapse reveals dangerous flaws in the private equity playbook. It shows how investors with risky business plans, unrealistic financial assumptions, and competing agendas can deliver a death blow to companies that otherwise could have survived. And it offers a glimpse into the human suffering wrought by owners looking to turn a quick profit above all else.

Too much debt is not just a personal finance problem it is a problem for companies too. Continue reading on my original post on the Curious Cat Management Blog.

Related: Leverage, Complex Deals and Mania – Failed Executives Used Too Much Leverage – posts on debt

I am a big fan of helping improve the economic lives of those in the world by harnessing appropriate technology and capitalism. It is wonderful what can be done to improve the lives of so many people with some intelligence and effort. This talk does a great job of showing how engineers thinking about the economic realities in the much of the world can design solutions to help. Without understanding the economic realities you cannot be effective.

Concludes Smith, “Something like 90% of the world’s resources creates products and technologies that serve only the wealthiest 10% of the worlds’ population. There’s a revolution afoot to promote R&D to get designers to work on technologies for the other 90%.”

Related: Nepalese Entrepreneur Success – Creating a World Without Poverty – Engineering a Better World: Bike Corn-Sheller – High School Inventor Teams @ MIT – Smokeless Stove Uses 80% Less Fuel

US living standards in jeopardy by James Jubak

…

the difference would get larger each year as the two rates were compounded. After 10 years at 2.3% growth, the U.S. economy would grow from $14.4 trillion in the third quarter of 2008 to $18.1 trillion, after accounting for inflation. At 3%, however, the U.S. economy would reach $19.4 trillion in gross domestic product.

…

The official unemployment rate hit 7.2% in December. Factor in part-time workers who would like to work full time and discouraged people who have stopped looking for work, and the real rate is more like 13.5%.

Some of those people won’t go back to work even when this recession is over because the relatively meager safety net supporting the unemployed in the United States will have given way beneath them. They will have suffered so much personal and family damage that they will never regain their full pre-recession productivity.

Related: Bad News on Jobs – The Economy is in Serious Trouble – Why Investing is Safer Overseas

How Should Parents Teach Teens About Credit Cards? by Nancy Trejos

…

there are prepaid cards targeted specifically at teens, such as the Visa Buxx card. With such a card, Bellamkonda would be able to log in and monitor his daughter’s spending online

…

Bill Hardekopf, chief executive of LowCards.com, said parents should pull out their own credit card bills and talk their children through them. Explain the interest rate, minimum payments, grace period and finance charges. If they’ve had late fees or payment problems, they shouldn’t hide them. “Use these as teaching examples,” he said. “Getting a teenager a credit card while she lives in your home is a great teaching opportunity on finances.”

I agree it is wise to explain the use of credit cards to teenagers. I also agree it is wise to have them actually use their own card, assuming they aren’t unreasonably immature and have shown an understanding of personal finance.

Books: Money Sense for Kids – Growing Money: A Complete Investing Guide for Kids – The Motley Fool Investment Guide for Teens – Raising Financially Fit Kids – A Smart Girl’s Guide to Money: How to Make It, Save It, And Spend It

Related: Teaching Children About Money Matters – Student Credit Cards – Majoring in Credit Card Debt

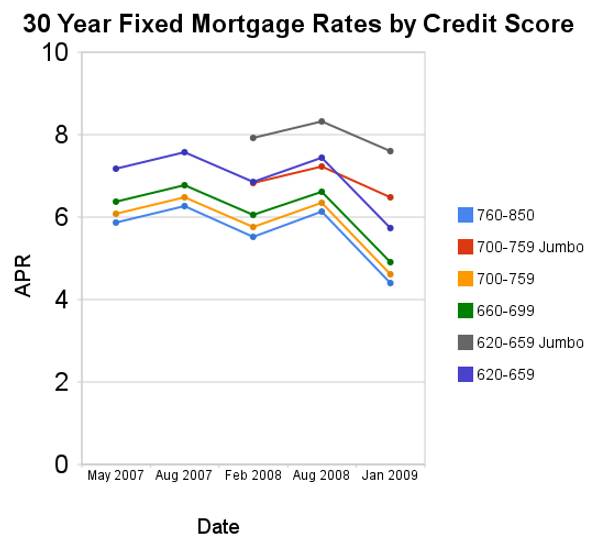

Since August of 2008 conforming mortgage rates are have declined a huge amount. Jumbo rates have fallen a large amount also, but much less (for example for a credit score of 700-759 the jumbo rates declined 73 basis points while the conventional rate declined 172 basis points.

For scores above 620, the APRs above assume a mortgage with 1 point and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio. You can see, with these conditions the rate difference between a credit score of 660 and 800 is not large (remember this is with 20% down-payment) and has not changed much (the difference between the rates if fairly consistent).

Related: Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Rate Mortgage Rate Data – Real Free Credit Report (in USA) – Jumbo Mortgage Shoppers Get Little Relief From Rates – posts on mortgages

Read more