The Federal Weatherization Assistance Program has been around for decades and funding has been increased as part of the stimulus bills. This type of spending is better than much of what government does. It actually invests in something with positive externalities. It targets spending to those that need help (instead of say those that pay politicians to give their companies huge payoffs and then pay themselves tens of millions in bonuses).

The Depart of Energy provides funding, but the states run their own programs and set rules for issues such as eligibility. They also select service providers, which are usually nonprofit agencies that serve families in their communities, and review their performance for quality. In many states the stimulus funds have increased the maximum funds have increased to $6,500 per household, from $3,000.

The weatherization program targets low-income families: those who make $44,000 per year for a family of four (except for $55,140 for Alaska and $50,720 for Hawaii).

The program provides funds for those with low-income for the like of: insulation, air sealing and at times furnace repair and replacement. Taking advantage of this program can help you reduce your energy bills and reduce the amount of energy we use and pollution created. And it employs people to carry out these activities.

The Weatherization Assistance Program invests in making homes more energy efficient, reducing heating bills by an average of 32% and overall energy bills by hundreds of dollars per year.

Weatherization is also often a very good idea without any government support. If you are eligible for some help, definitely take a look at whether it makes sense for you. And even if you are not, it is a good idea to look into saving on your energy costs.

Related: Oil Consumption by Country in 2007 – Japan to Add Personal Solar Subsidies – personal finance tips – Kodak Debuts Printers With Inexpensive Cartridges – Personal Finance Basics: Dollar Cost Averaging

Read more

Is it cynical to think that politicians want to provide payments from the treasury to those that paid the politicians? More cynical to think the politicians that created huge Wall Street Welfare payments won’t actually do anything except talk about how they think it is bad that those they paid billions to are buying new mansions and yachts? More cynical to think they will continue to provide huge amounts of nearly free cash for those that paid them to speculate with? More cynical to think if any of those speculators lose money they will give them more welfare? More cynical to think those bought and paid for politicians won’t actually take any steps to tax or curtail speculation? I think maybe I am cynical about Washington doing anything other than talk about how they don’t want to provide huge amounts of cash to Wall Street all the while giving their Wall Street friends huge amounts of cash that will be paid back by our grandchildren.

Wouldn’t it be nice if the politicians actually took actions to fund a partial payback of the hundreds of billions (or maybe trillions) of bailout dollars by taxing financial speculation? I doubt it will happen. But maybe I am too cynical. Maybe politicians will not just do what they have been paid to do. But it seems the best predictor of what congress will do is based on what they are paid to do, based on their past and current behavior. Now what congress will say is very different. those paying Congressmen might not love it if the congressmen call them names but through a few billion more and they are happy to be called names while given the cash to buy new jets and sports teams and parties for their daughters.

Making Wall Street pay by Dean Baker

The logic of a financial transactions tax is simple. It would impose a modest fee on trades of stocks, futures, credit default swaps and other financial instruments. For example, the UK puts a 0.25% tax on the sale or purchase of shares of stock. This has very little impact on people who buy stock with the intent of holding it for a long period of time.

…

We can raise more than $140bn a year taxing financial transactions, an amount equal to 1% of GDP.

…

Since the financial sector is the source of the country’s current economic and budget problems it also makes sense to have this sector bear the brunt of any new taxes that may be needed. The economic collapse caused by Wall Street’s irrational exuberance has led to a huge increase in the country debt burden. It seems only fair that Wall Street bear the brunt of the clean-up costs. A financial transactions tax is the way to make sure that this happens.

One challenge of understanding the state of the economy is we don’t have clear measures. We attempt to gather accurate data but there is quite a bit of inaccuracy in the data (both from preliminary estimates – before all the data is in, which can take months, or longer – and just plain items we have to estimate no matter how long we have).

Related: Manufacturing Data – Accuracy Questions – Why China’s Economic Data is Questionable – What Do Unemployment Statistics Mean? – Manufacturing Jobs Data: USA and China – The Long-Term USA Federal Budget Outlook – Is China’s Recovery for Real?

Economists Seek to Fix a Defect in Data That Overstates the Nation’s Vigor

The problem is particularly acute in manufacturing. Imported components constitute an ever greater share of the computers, autos, appliances and other finished merchandise that roll off assembly lines in the United States – and an ever greater share of all of the nation’s imports.

…

The stated goal, among those at the conference, is to repair the statistics, but that requires several years, lots of money (from Congress) to gather more information about what companies are doing, and whole new procedures for measuring imports. Much of the conference was devoted to an analysis of the gap between existing data and reality, and ways to close that gap.

The Measurement Issues Arising from the Growth of Globalization conference has thankfully provided open access to papers from the conference including:

Offshoring Bias: The Effect of Import Price Mismeasurement on Manufacturing Productivity Read more

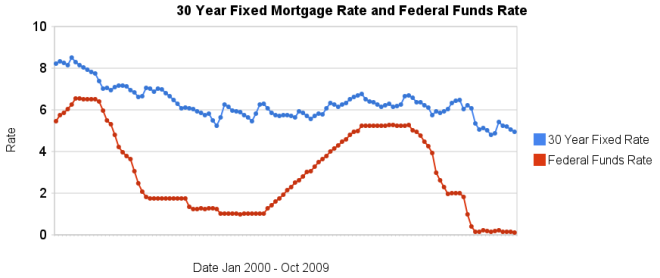

30 year fixed mortgage rates have declined a bit over the last few months and remain at very low levels.

The poor economy, Unemployment Rate Reached 10.2%, has the Fed continuing massive intervention into the economy. The Fed is keeping the fed funds rate at close to 0% (.12% in October). They also continue to hold massive amounts of long term government and mortgage debt (in order to suppress interest rates on long term bonds – by reducing the supply of such bonds in the market).

I can’t see how lending US dollars, over the long term, at 5%, makes any sense. I would much rather borrow at those rates than lend. If you have not refinanced yet, doing so now may well make sense. And if you are looking at a new real estate purchase, financing a 30 year mortgage sure is attractive at rates close to 5%.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – Lowest 30 Year Fixed Mortgage Rates in 37 Years – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score – What are mortgage definitions – Ignorance of Many Mortgage Holders

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

One of the few good recent results of the economy has been a continuous decline in consumer debt. Consumer debt fell for the 8th consecutive month, for the first time, in September, declining by $15 billion.

Consumer debt grew by about $100 each year from 2004 through 2007. In 2008 it increased $40 billion. In 2009 it has fallen over $100 billion so far: from $2,559 billion to $2,456 billion. This still leaves over $8,000 in consumer debt for every person in the USA and $20,000 per family.

The huge amount of outstanding consumer and government debt remains a burden for the economy. At least some progress is being made to decrease consumer debt.

Those living in USA have consumed far more than they have produced for decades. That is not sustainable. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing.

The solution to this problem is to stop spending beyond your means by even increasing levels of personal and government debt. Thankfully over the last year at least consumer debt has been declining. Government debt has been exploding so unfortunately that problem has continued to get worse.

As we know, interest rates have fallen a great deal over the last few years. the federal funds rate sits at essentially 0% and money market funds now yield under 1%. However, credit card accounts that are charging interest increase to an interest rate of 14.9% from 13.6% in the 3rd quarter of 2008. In 2004 the credit card interest rate was 13.2%, 2005 – 14.6%, 2006 – 14.7%, 2007 – 14.7%, 2008 – 13.6%. All credit card balances should be paid off every month to avoid these excessive interest rates.

Data from the federal reserve and census bureau.

Related: Consumer Debt Declined a Record $21.5 Billion in July – The USA Economy Needs to Reduce Personal and Government Debt – Let the Good Times Roll (using Credit)

The unemployment rate rose from 9.8 to 10.2% in October, and nonfarm

payroll employment continued to decline (down another 190,000 jobs), the U.S. Bureau of Labor Statistics reported today. The largest job losses over the month were in construction, manufacturing, and retail trade.

In October, the number of unemployed persons increased by 558,000 to 15.7

million. The unemployment rate rose to 10.2%, the highest rate since April 1983. Since the start of the recession in December 2007, the number of unemployed persons has risen by 8.2 million, and the unemployment rate has grown by 530 basis points.

Among the major worker groups, the unemployment rates for adult men (10.7%) rose in October. The jobless rates for adult women (8.1 percent), teenagers (27.6%), African-Americans (15.7%), and Hispanics (13.1%) were little changed over the month.

The number of long-term unemployed (those jobless for 27 weeks and over) was little changed over the month at 5.6 million. In October, 35.6% of

unemployed persons were long-term unemployed.

The civilian labor force participation rate was little changed over the month

at 65.1%. The employment-population ratio continued to decline in

October, falling to 58.5%.

The number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in October at 9.3 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

Related: Unemployment Rate Rises to 8.1%, Highest Level Since 1983 (March 2009) – posts on employment – USA Unemployment Rate Jumps to 9.4% – Unemployment Rate Increases to 9.7%

Read more

Landlords Offer Incentives to Stay Put

…

One problem for landlords is that existing tenants can easily check the Web to see what deals new tenants are being offered. And new tenants are getting incentives like a waived pet deposit or two months’ free rent.

…

Apartment landlords say that one benefit of the bad market is that it has practically halted new construction. New completions are expected to be 98,000 next year and 109,000 in 2011, compared with 188,000 last year and 204,000 this year, according to Green Street Advisors Inc.

But when loss rates are taken into account—the removal of units because of obsolescence—the actual addition will be immaterial. That means that when the economy rebounds, the supply will be tight, increasing landlord profits.

Related: Apartment Vacancy at 22-Year High in USA (July 2009) – Articles on Real Estate Investing – It’s Now a Renter’s Market – Housing Rents Falling in the USA

Many people notice the ludicrous phone fees the phone companies charge. Some are indeed passed on taxes and fees imposed by government (though phone companies seem to love adding on fees and saying or implying they are government taxes when that is not completely clear). I got rid of my land line phone for Vonage, years ago. Vonage started to add on all sorts of fees so I dropped it and went with Ooma (free after the initial purchase $203 for me).

Ooma has now decided they need to change $12/year in fees (very reasonable I think). But they are not going to charge those, like me, that bought before this change (it has been 100% free for me for the last year). Great service (and a huge contrast to the attitude of typical phone companies looking to gouge everyone they can).

I also use and recommend Google Voice. They have to deal with another form of government approved fees for local phone companies. Some are using traffic pumping and high charges to gouge Google. I am glad Google is taking on these pumpers.

Related: Sex, conference calls, and outdated FCC rules – Telephone Savings – Paying for Over-spending – $8,000 Per Gallon Ink