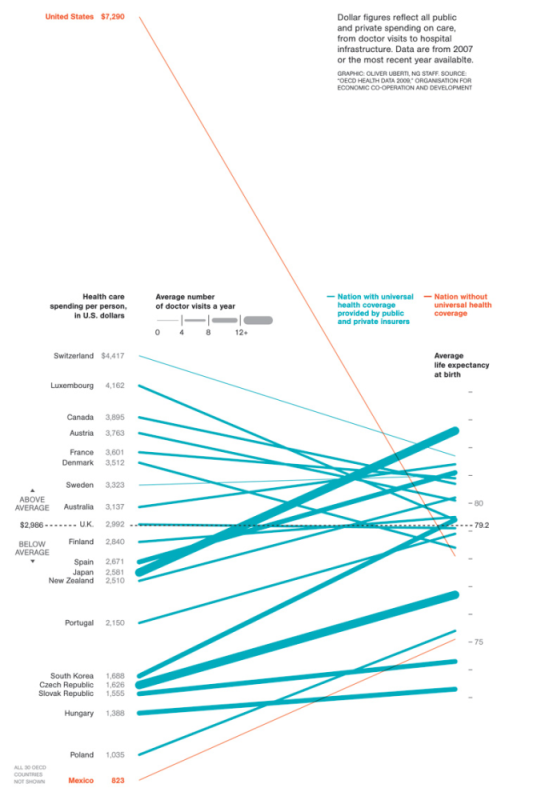

This graphic from the National Geographic shows the amazingly high cost of health care in the USA and the poor performance. Granted just life expectancy is not a good overall measure of success. But this just mirrors the general mediocre at best performance of the USA health care system.

The USA spends $7,290 per person (based on 2007 OECD data) the next highest spending country is Switzerland at $4,417. Canada spends the 4th most: $3,895. Only 5 countries have a lower life expectancy. The most any of those countries spend is $1,626. How people continue to accept arguments by the apologists for the special interests trying to defend the current system is beyond me.

The Cost of Care by Michelle Andrews

Related: USA Spent $2.2 Trillion, 16.2% of GDP, on Health Care in 2007 – Employees Face Soaring Health Insurance Costs – International Health Care System Performance – USA Heath Care System Needs Reform

Home Prices in 20 U.S. Cities Rose for Fifth Month

…

“The tax credit had the intended impact of drawing buyers in and lowering inventory,” Lawrence Yun, the real-estate agents group’s chief economist, said in a news conference. “An estimated 2 million buyers have taken advantage of the credit.”

…

Foreclosure filings in 2009 will reach a record for the second consecutive year with 3.9 million notices sent to homeowners in default, RealtyTrac Inc., the Irvine, California- based company said Dec. 10. This year’s filings will surpass 2008’s total of 3.2 million.

The housing market seems to have been stabilized with the tax credits, previous declines, continued low mortgage rates and a somewhat better credit environment. The market is still far from healthy. And the credit environment is still very tight. But housing may have hit a bottom nationwide, though this is not certain. I do expect mortgage rates to increase in 2010 which will put pressure on housing prices.

Related: House Prices Seem to be Stabilizing (Oct 2009) – USA Housing Foreclosures Slowly Declining – The Value of Home Ownership – Your Home as an Investment

In December 2008 I decided to substantially increase my investments in the stock market. This turned out to be quite successful. As I said at the time, the economy continues to struggle and the prospects for 2009 did not look good. And I even guessed the stock market (in the USA) would be lower 12 months from now. But, I also said I was far from certain, in that guess and that I had been increasing my stock investment and would continue to do so.

At this time my retirement contributions are going 100% to stock investments (if I were close to retirement I would not do this). I am likely going to reduce the contributions going forward (maybe 75% stocks – 25% money market). Unfortunately my retirement fund does not have great alternatives – it has very good real estate options but I am not ready to start putting new funds there (though I likely will during 2010, at some point).

I did sell reduce my equity exposure in a retirement account that I am not adding to this month. It reduced my overall equity exposure of my portfolio by a couple percentage points, at most. It is still significantly higher than a year ago, due to the incredible gains for 2009 in my stock investments.

Last year I fully fund my Roth IRA, in January and bought Amazon (AMZN), Templeton Emerging Market Fund (EMF) and PetroChina (PTR). I will fully fund the Roth IRA in January again. I am leaning toward some combination of Templeton Emerging Market Fund (EMF), Vanguard Emerging Markets Stock (VWO), Toyota (TM) and maybe Danaher (DHR). I purchased all of those in my non-retirement account in 2009.

Investing well is not easy. Saving money is though, sometime people get these confused. You need to save money for retirement – aim for 10% of your income and invest that conservatively if you do not wish to focus on investing. I have no question fully funding your Roth IRA is a wise move for almost everyone. How to invest once you do that is a bit trickier but funding it is not a difficult question to answer. It was not easy to increase investments into stocks last year, when so many others were selling (and the press is full of stories reinforcing the bad news, bad prospects and risks). You can get great opportunities when others are panicking, but things do not always recovery so nicely.

What the next year holds, again for 2010, if very difficult to see. The economy looks to be in much better shape than a year ago. But it is far from strong. And the recovery in the stock market means the higher prices stocks command today leave more downside risk for stocks, if things do not go well. I am more concentrated in stocks now than I was a year ago, but I am not comfortable with that. I don’t see bonds, even short term bonds, as an acceptable alternative. The risks are not at all justified by the returns in my opinion. I am happy with my real estate investments and may even look to increase that area though I think it may be too early for commercial real estate. I think individual companies may well prosper even if the economy falters – such as Google, Amazon, Danaher, Toyota, Tesco (though Amazon’s price increases may already have more than accounted for this) – all of these are in my 12 stocks for 10 years portfolio.

Related: Save Some of Each Raise – It is Never to Late to Invest – Does a Declining Stock Market Worry You? – Uncertain Economic Times

China has been growing incredibly quickly for years. The credit crisis slowed things down. But unlike so many other governments that spent all their resources and more in good times, China has plenty of cash and spent a great deal on large projects. That spending has boosted their economy. And with that encouragement their economy has continued to grow, including consumer spending. As I posted earlier, China May Take Car Sales Lead from USA in 2009.

China Raises GDP Growth Estimates, Narrowing Gap With Japan

…

China’s expansion in 2008 compares with U.S. growth of less than 1 percent. Japan’s gross domestic product shrank 1.2 percent. The Indian economy expanded 6.7 percent in the fiscal year ended March 2009.

Economic data always has some errors within, and from China the data is even less reliable. But the overall strength seem very real and significant.

Related: Government Debt Compared to GDP 1990-2007 – Japanese Economy Grew at 3.7% Annual Rate (Aug 2009)

I made several more loans using Kiva today to entrepreneurs in: Mongolia, Costa Rica, Kenya, Togo and Peru. One nice improvement they have made to the layout of the site is to show the “portfolio yield” (which is their form of APR – to provide an idea of the fees an entrepreneurs must pay).

Since I am making loans on Kiva to help others out one of the big factors for me is the cost to the entrepreneur. I just would much rather provide funding for loans where the entrepreneurs gets a reasonably low rate. I understand there are costs the lenders have to cover. I have no problem with that, but if my choice is helping an entrepreneurs get a loan at 20% or 40% I am going to take 40%. I figure the odds that the entrepreneurs benefits will be much greater with lower costs. I also prefer loans where I see how the loan will let them be more productive, for example by purchasing a machine to help improve productivity.

I wish Kiva would let me selected lenders I like and then have the results shown only for those lenders (as one option).

I encourage you to join me: let me know if you contribute to Kiva and I will add your Kiva page to our list of Curious Cat Kivans. Also join the Curious Cats Kiva Lending Team.

Related: 100th Entrepreneur Loan – Creating a World Without Poverty – Financial Thanksgiving – MicroFinance Currency Risk

Why This Real Estate Bust Is Different by Mara Der Hovanesian and Dean Foust

…

While the housing crisis seems to be easing, the commercial storm is still gathering strength. Between now and 2012, more than $1.4 trillion worth of commercial real estate loans will come due…

The USA commercial real estate market, by many account, is going to continue to have trouble. I would like to add to my commercial real estate holdings in my retirement account, because I have so little (and other options are not that great), but with the current prospects I am not ready to move. I would not be surprised if the market comes back sooner than people expect: it seems like it is far too fashionable to have bearish feelings about the market. However, it doesn’t seem like the risk reward trade-off is worth it yet.

Related: Commercial Real Estate Market Still Slumping – Victim of Real Estate Bust: Your Pension – Nearly 10% of Mortgages Delinquent or in Foreclosure (Dec 2008) – Urban Planning

Elizabeth Warren is the single person I most trust with understanding the problems of our current credit crisis and those who perpetuate the climate that created the crisis. Unfortunately those paying politicians are winning in their attempts to retain the current broken model. We can only hope we start implementing policies Elizabeth Warren supports – all of which seem sensible to me (except I am skeptical on her executive pay idea until I hear the specifics).

She is completely right that the congress giving hundreds of billions of dollars to those that give Congressmen big donations is wrong. Something needs to be done. Unfortunately it looks like the taxpayers are again looking to re-elect politicians writing rules to help those that pay the congressmen well (one of the problems is there is little alternative – often both the Democrat and Republican candidates will both provide favors to those giving them the largest bribes/donations – but you get the government you deserve and we don’t seem to deserve a very good one). We suffer now from the result of them doing so the last 20 years. Wall Street has a winning model and betting against their ability to turn Washington into a way for them to mint money and be favored by Washington rule making is probably a losing bet. If Wall Street wins the cost will again be in the Trillions for the damage caused to the economy.

Related: If you Can’t Explain it, You Can’t Sell It – Jim Rogers on the Financial Market Mess – Misuse of Statistics – Mania in Financial Markets – Skeptics Think Big Banks Should Not be Bailed Out

America Must ‘Reassert Stability and Leadership’

Volcker: I remember there were people, beggars and tramps as we called them, who wanted to be fed. So it’s true, today we also have people who are relying on food stamps and other payments but we are a long way from the Great Depression. We are in a serious, great recession. Today we have 10 percent unemployment, but at that time it was more like 20 or 25 percent. That’s a big difference. You had mass unemployment.

…

SPIEGEL: Are you sure? The Wall Street businesses are doing well. The big bonuses are back.

Volcker: It’s amazing how quickly some people want to forget about the trouble and go back to business as usual. We face a real challenge in dealing with that feeling that the crisis is over. The need for reform is obviously not over. It’s hard to deny that we need some forward looking financial reform.

…

SPIEGEL: But the American government seems to have lost some eagerness in setting a tougher regime of rules and regulations to control Wall Street. Everything is being watered down. Why?

Volcker: I will do the best I can to fight any tendency to water it down. What we need is broad international consensus to make things happen.

I am surprised how many people are trying to compare the economic situation today (often using unemployment rates) and say we are in nearly as bad a situation as the great depression. The economy is certainly struggling, great recession, is a good term for it, I think. But taking the high measures of unemployment and underemployment today and comparing it to unemployment in the 1930’s is not comparing like numbers. The employment situation is bad now. It was much worse in the great depression. As intended, support systems like unemployment pay, FDIC, food stamps… have worked to reduce the depth of the recession.

He is right that we need serious reform to the deregulation that allowed the credit crisis to explode the economy.

Related: Volcker: Economic Decline Faster Now Than Any Time He Remembers – The Economy is in Serious Trouble (Nov 2008) – Unemployment Rate Reached 10.2% – Canada’s Sound Regulation Resulted in a Sound Banking System Even During the Credit Crisis

Mortgage defaults hit an all-time high in July according to RealtyTrac (the data in this post is from their survey). Last month default notices nationwide were down 8% from the previous month but still up 22% from November 2008, scheduled foreclosure auctions were down 12% from the previous month but still up 32% from November 2008, and bank repossessions were flat from the previous month and down 2% from November 2008. The housing market is currently not getting worse but it is hardly improving rapidly.

“November was the fourth straight month that U.S. foreclosure activity has declined after hitting an all-time high for our report in July, and November foreclosure activity was at the lowest level we’ve seen since February,” said James J. Saccacio, chief executive officer of RealtyTrac.

Four states account for 52% of national foreclosures for the second month in a row: California, Florida, Illinois and Michigan.

Related: Mortgage Delinquencies Continue to Climb – Over Half of 2008 Foreclosures From Just 35 Counties – Nearly 10% of Mortgages Delinquent or in Foreclosure

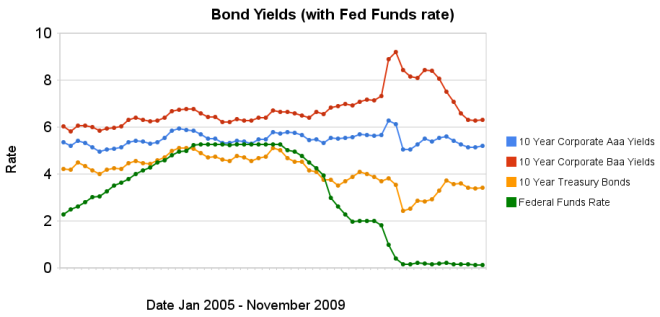

Chart showing corporate and government bond yields from 2005-2009 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields from 2005-2009 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have remained low, with little change over the last 4 months. Earlier in the year, yield spreads decreased dramatically, and those reductions have remained over the last 4 months. The federal funds rate remains under .25%.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Continued Large Spreads Between Corporate and Government Bond Yields (April 2009) – Chart Shows Wild Swings in Bond Yields (Jan 2009) – investing and economic charts