From Greg Mankiw’s Blog

Taxes/GDP x GDP/Person = Taxes/Person

France .461 x 33,744 = $15,556

Germany .406 x 34,219 = $13,893

UK .390 x 35,165 = $13,714

US .282 x 46,443 = $13,097

Canada .334 x 38,290 = $12,789

Italy .426 x 29,290 = $12,478

Spain .373 x 29,527 = $11,014

Japan .274 x 32,817 = $8,992

The USA is the 2nd lowest for percent of GDP taxes 28.2% v 27.4% for Japan. But in taxes per person toward the middle of the pack. France which has 46% taxes/GDP totals $15,556 in tax per person compared to $13,097 for the USA.

Related: Government Debt as Percentage of GDP 1990-2008 – USA, Japan, Germany… – Oil Consumption by Country in 2007 – USA, China and Japan Lead Manufacturing Output in 2008 – Bigger Impact: 15 to 18 mpg or 50 to 100 mpg?

Half of Commercial Mortgages to Be Underwater

…

We now have 2,988 banks – mostly midsized, that have these dangerous concentrations in commercial real estate lending.” As a result, the economy will face another “very serious problem” that will have to be resolved over the next three years, she said, adding that things are unlikely to return to normalcy in 2010.

…

Warren said it’s time for the government to “pull the plug” on mortgage lenders Fannie Mae and Freddie Mac. “I’m one of those people who never liked public-private partnership to begin with. I think what they did was use public when public was useful and private when private was useful,” she said. “And I think we’ve got to rethink that whole thing.”

“There is no implicit guarantee anymore,” she added. “I don’t care how big you are, if you make serious enough mistakes, then your business can be entirely wiped out.”

Financially literate people should know that the current commercial real estate market is in serious trouble. I still figure it will rebound well. I just want to wait and see how far prices fall and then try to buy when people are so frustrated they will sell at very low prices.

Related: Commercial Real Estate Market Prospects Remain Dim – Mortgage Delinquencies and Foreclosures Data Indicates 2010 Could Show Improvement – Jumbo Loan Defaults Rise at Fast Pace (Feb 2009)

Bill Gross Warning May Catch Bond Investors Off-Guard

The prospect of a strengthening U.S. economy and rising interest rates makes an “argument to not own as many” bonds, Gross said in the interview.

…

Treasuries have rallied for almost three decades, pushing the yield on the 10-year Treasury note from a high of 15.8 percent in September 1981 to 3.89 percent as of yesterday. The yield reached a record low of 2.03 percent in December 2008 during the height of the credit crunch.

Excess borrowing in nations including the U.S., U.K. and Japan will eventually lead to inflation as governments sell record amounts of debt to finance surging deficits, Gross said.

“People have been making money on fixed income for so long, people assume it’s going to continue when mathematically, it cannot,” said Eigen, whose fund is the third-best selling bond fund this year, according to Morningstar. “When people finally start to lose money in fixed-income, they won’t hesitate to pull money out very soon,” he said.

John Hancock Funds President and Chief Executive Officer Keith Hartstein said retail investors are already late in reversing their rush into bond funds, repeating the perennial mistake of looking to past performance to make current allocation decisions.

I agree bonds don’t look to be an appealing investment. They still may be a smart way to diversify your portfolio. I am investing some of my retirement plan in inflation adjusted bonds and continue to purchase them. My portfolio is already significantly under-weighted in bonds. I would not be buying them if it were not just to provide a small increasing of my bond holdings.

Related: Municipal Bonds, After Tax Return – 10 Stocks for Income Investors – Bond Yields Show Dramatic Increase in Investor Confidence – Investors Sell TIPS as They Foresee Tame Inflation

10 Ways the New Healthcare Bill May Affect You by Katie Adams

…

Starting this fall, your health insurance company will no longer be allowed to “drop” you (cancel your policy) if you get sick.

…

Starting this year your child (or children) cannot be denied coverage simply because they have a pre-existing health condition. Health insurance companies will also be barred from denying adults applying for coverage if they have a pre-existing condition, but not until 2014.

…

If you currently have pre-existing conditions that have prevented you from being able to qualify for health insurance for at least six months you will have coverage options before 2014. Starting this fall, you will be able to purchase insurance through a state-run “high-risk pool”, which will cap your personal out-of-pocket expenses for healthcare. You will not be required to pay more than $5,950 of your own money for medical expenses; families will not have to pay any more than $11,900.

…

Under the new law starting in 2014, you will have to purchase health insurance or risk being fined.

…

Starting in 2018, if your combined family income exceeds $250,000 you are going to be taking less money home each pay period. That’s because you will have more money deducted from your paycheck to go toward increased Medicare payroll taxes. In addition to higher payroll taxes you will also have to pay 3.8% tax on any unearned income, which is currently tax-exempt.

Related: How the health care bill could affect you – Answers About Health Care Bill – Why the Health Care Bill May Eventually Curb Medical Costs – post on health care – USA Consumers Paying Down Debt – Personal Finance Basics: Long-term Care Insurance

I created the 10 stocks for 10 years portfolio in April of 2005. In order to track performance created a marketocracy portfolio but had to make some minor adjustments (and marketocracy doesn’t allow Tesco to be purchased, though it is easily available as an ADR to anyone in the USA to buy in real life – it is based in England). The current marketocracy calculated annualized rate or return (which excludes Tesco) is 6.2% (the S&P 500 annualized return for the period is 2.5%) – marketocracy subtracts the equivalent of 2% of assets annually to simulate management fees – as though the portfolio were a mutual fund – so without that the return is about 5.7% above the S&P 500 annually).

The current stocks, in order of return:

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| Amazon – AMZN | 248% | 11% | 8% | |

| Google – GOOG | 152% | 16% | 15% | |

| PetroChina – PTR | 87% | 9% | 9% | |

| Templeton Dragon Fund – TDF | 80% | 10% | 10% | |

| Templeton Emerging Market Fund – EMF | 40% | 5% | 6% | |

| Cisco – CSCO | 38% | 6% | 8% | |

| Danaher – DHR | 10% | 9% | 10% | |

| Toyota – TM | 10% | 8% | 10% | |

| Intel – INTC | 0% | 4% | 7% | |

| Tesco – TSCDY | -10%* | 0%* | 10% | |

| Pfizer – PFE | -34% | 4% | 8% | |

| Dell | -56% | 3% | 0% |

The current marketocracy results can be seen on the Sleep Well portfolio page.

Related: 12 Stocks for 10 Years – July 2009 Update – Investing, My Thoughts at the End of 2009 – posts on stocks – investing books

Read more

Apple currently has the 4th largest market capitalization for USA stocks, behind ExxonMobil (over $300 billion), Microsoft ($250 billion) and Wal-Mart and ahead of Berkshire Hathaway, General Electric, Procter & Gamble and Google ($180 billion). Eric Bleeker has a nice article on fool.com looking at how Apple can grow to a $300 Billion market capitalization.

In many ways, the mobile race is similar to the PC battle of the ‘80s. In one corner we have Apple, packaging its hardware and software in a limited number of systems. In the other corner, there’s Google (replacing Microsoft), licensing out software to any number of hardware vendors.

Apple could actually learn from Microsoft. It needs to be more than just the best smartphone on the market right now. Microsoft never controlled the operating-system market because it was the best — it won because it locked users in, and most people essentially had to use its products. Microsoft has released some real clunkers over the years, but it took few hits from them. Likewise, even though Apple’s unparalleled in its commitment to quality-unlike a certain competitor we just discussed — with a price tag that implies sustainable long-run dominance, Apple needs a margin of safety to ensure that even with a hiccup or two, it will continue to rule the mobile world.

The $300 billion question

So it all boils down to one question: How well can Apple lock users into its ecosystem? As developers continue building apps at rates far in excess of competing platforms and more users synch their digital lives around iTunes, you can see Apple creating a platform that’s sustainable well beyond just the next upgrade. From there, no company possesses a virtuous circle like Apple. Higher iPhone market share begets high-margin sales of apps and media, as well as increased Mac sales. Given the size of the smartphone market, the margins Apple collects from each iPhone, and the boost to other Apple products, you can see a path to $300 billion forming.

I missed out on investing in Apple. I came close to buying in, but didn’t quite do it – that was a big mistake. And I am still not buying now, which could be another mistake. We shall see. I am very comfortable owning Google. But I think Apple could well be good also. My 12 stocks for 10 years portfolio has Cisco, Intel and Amazon which I am happy with and Dell which has been a mistake.

Related: Apple exceeded Google for the first time since Google went public (Aug 2008) – Amazon Soars on Good Earnings and Projected Sales – It is Never to Late to Invest – Great Google Earnings (April 2007)

Many people are ignoring huge costs (to the economy) and benefits (to those financial companies that ruined so many people’s lives and severely damaged the economy. Paying back money the government paid you is not that same as being innocent. While several of the too big to fail banks have paid back the direct cash they were given that is not an indication they are now off the hook for their disastrous behavior.

First we know that much of the money “sent to AIG” just went directly to Goldman Sachs and others. Those big banks had taken risks and the only way those risks paid off was with billions from taxpayers. Without that they would have been bankrupt. And then when they paid the money they received directly they still haven’t paid back the billions they got from taxpayers (via AIG). And this money was paid back at 100 cents on the dollar though those instruments were trading for much less in the market (the government certainly would have found a less costly solution but for ignorance or a desire to reward their former company and friends at Goldman Sachs.

Second, rates have been kept artificially low, to among other things, allow the big banks to make tens of billions (and costing savers tens of billions). Those savers have not been reimbursed for the losses caused by the big banks.

And third if I gamble with money from my company and win my bet on the Super Bowl and then put the money back, I am still not innocent. Just because many of the big banks have paid back the money they were given directly by taxpayers does not mean they didn’t get huge benefits from the government. Pretending they are not bad guys because after ruining the economy, costing millions of people their jobs and savings, getting many benefits from the government, they then pay back the direct cash payments is not accurate.

Response to: The New Bank Tax

Related: Elizabeth Warren Webcast On Failure to Fix the System – The Best Way to Rob a Bank is as An Executive at One – Failure to Regulate Financial Markets Leads to Predictable Consequences – Jim Rogers on the Financial Market Mess – Congress Eases Bank Laws (1999)

Welcome to the Curious Cat Investing and Economics Carnival: we highlight interesting recent personal finance, investing and economics blog posts.

- The 4% rule and other fallacies of retirement planning – “I might try a 5% withdrawal rate, which according to the Trinity study, would give me an 80% chance of not outliving my money. As time goes on, I’ll adjust up or down depending on what life and the market throws at me.”

- The lesson of the Greek crisis: Every government cheats and no one wants to know by James Jubak – “The IMF projects that U.S. net debt as a percentage of GDP will be 66.8% in 2010, more than twice that for Canada, and gross debt will be 93.6% of GDP, still almost 14 percentage points above Canada’s.”

- Renting 101: What You Should Know Before You Sign by Austin Morgan – “Renter’s insurance helps protect the items in your apartment in case of theft or damage. The renter’s insurance will also cover you in case a visitor in your apartment gets injured or their items get damaged.”

- In the USA 43% Have Less Than $10,000 in Retirement Savings by John Hunter – “if you plan ahead you have a long time for compounding to work in your favor. Unfortunately most people continue to fail to make even the most minimal efforts to save for retirement”

- The US Has A Spending Problem, China Has A Savings Problem – “Back in 2005 the savings rate in the US dropped to below 1%. That’s sad considering up until the mid 80s we were always above 5% and crested 10% a few times… Our savings rate is currently just under 5%… The savings rate in China is something like 30%; and this number has grown in recent years, “

- When will the Fed raise interest rates? by Olivier Coibion and Yuriy Gorodnichenko – “given current information and barring political or populist pressures, one can reasonably expect the Federal Reserve to start raising interest rates toward the end of this year in its attempt to balance the risks of higher inflation against prolonging the current economic downturn.”

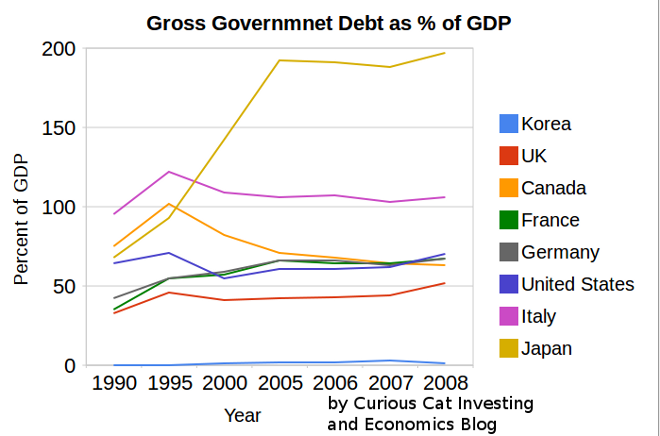

Recently Greece and the huge USA federal deficits have highlighted the problem of excessive government debt. The above chart shows gross government debt by country from the IMF.

Korea has essentially no gross government debt (under 2% of GDP for the entire period). At the other end of the spectrum Japan has seen gross government debt rise to 197% (Japan’s 2008 figure is an IMF estimate). The IMF did not have data for Greece (which would likely look very bad) or China (which I would think would be very low – maybe even negative – the government having more assets than debt).

The USA debt stood at 64% in 1990, 71% in 1995, 55% in 2000, 61% in 2005 and 70% in 2008. Most countries are expected to see significant increases in 2009. The IMF sees the USA going to 85% in 2009 and 100% in 2012. They see Germany at 79% in 2009 and 90% in 2012. They See the UK at 69% in 2009 and 94% in 2012. They see Japan at 237% in 2012.

The chart shows gross government debt as percentage GDP 1990-2008. By Curious Cat Investing and Economics Blog, Creative Commons Attribution.

The chart shows gross government debt as percentage GDP 1990-2008. By Curious Cat Investing and Economics Blog, Creative Commons Attribution.___________________________

The data here is very similar to the OECD data I provided earlier, Government Debt Compared to GDP 1990 to 2007, though with some notable differences. In the OECD data was still in the best shape, but is seen as having 29% debt to GDP in 2007. The IMF data attempts to avoid issues where some countries have debt of non-federal governments that are hidden when looking just at federal government debt.

Data source: IMF data (for some countries the data is also from that site but at different urls).

Related: The Long-Term USA Federal Budget Outlook – USA, China and Japan Lead Manufacturing Output in 2008 – Oil Consumption by Country in 2007 – Saving Spurts as Spending Slashed

There are several personal finance basics that everyone must account for. Retirement requires the most planning and accumulating the largest amount of money. Luckily if you plan ahead you have a long time for compounding to work in your favor. Unfortunately most people continue to fail to make even the most minimal efforts to save for retirement: 43% have less than $10k for retirement

The percentage of workers who said they have less than $10,000 in savings grew to 43% in 2010, from 39% in 2009, according to the Employee Benefit Research Institute’s annual Retirement Confidence Survey. That excludes the value of primary homes and defined-benefit pension plans.

Fewer workers report that they and/or their spouse have saved for retirement (69%, down from 75% in 2009 and 72% in 2008. Moreover, fewer workers say that they and/or their spouse are currently saving for retirement (60%, down from 65 percent in 2009).

27% say they have less than $1,000 in savings (up from 20% in 2009).

46% report they and/or their spouse have tried to calculate how much money they will need to have saved for a comfortable retirement by the time they retire.

What is a very rough estimate of what you need? Well obviously factors like a pension, social security payments, age at retirement, home ownership, health insurance, marital status… make a huge difference in the total amount needed. But something in the neighborhood of 15-25 times your desired retirement income is in the ballpark of what most experts recommend. So if you want $50,000 in income you need $750,000 – $1,250,000. Obviously that is difficult to save over a short period of time. The key to saving for retirement is a consistent, long term saving program.

Related: Retirement Savings Survey Results (2007) – How Much Will I Need to Save for Retirement? – Personal Finance Basics: Long-term Care Insurance