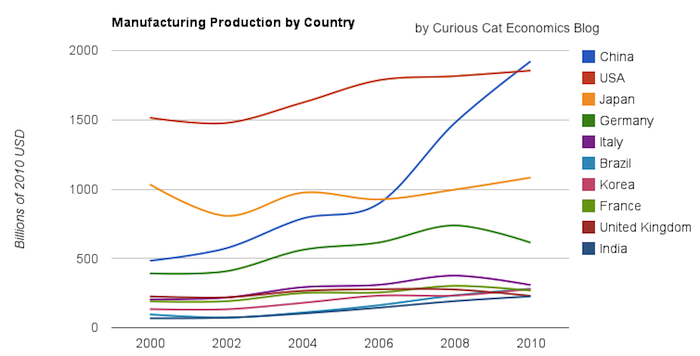

Chart of manufacturing production by the top 10 manufacturing countries (2000 to 2010). The chart was created by the Curious Cat Economics Blog. You may use the chart with attribution. All data is shown in 2010 USD (United States Dollar).

In my last post I looked at the output of the top 10 manufacturing countries with a focus on 1980 to 2010. Here I take a closer look at the last 10 years.

In 2010, China took the lead as the world’s leading manufacturing country from the USA. In 1995 the USA was actually very close to losing the lead to Japan (though you wouldn’t think it looking at the recent data). I believe China will be different, I believe China is going to build on their lead. As I discussed in the last post the data doesn’t support any decline in Chinese manufacturing (or significant moves away from China toward other South-East Asian countries). Indonesia has grown quickly (and have the most manufacturing production, of those discussed), but their total manufacturing output is less than China grew by per year for the last 5 years.

The four largest countries are pretty solidly in their positions now: the order will likely be China, USA, Japan, Germany for 10 years (or longer): though I could always be surprised. In the last decade China relentlessly moved past the other 3, to move from 4th to 1st. Other than that though, those 3 only strengthened their position against their nearest competitors. Brazil, Korea or India would need to increase production quite rapidly to catch Germany sooner. After the first 4 though the situation is very fluid.

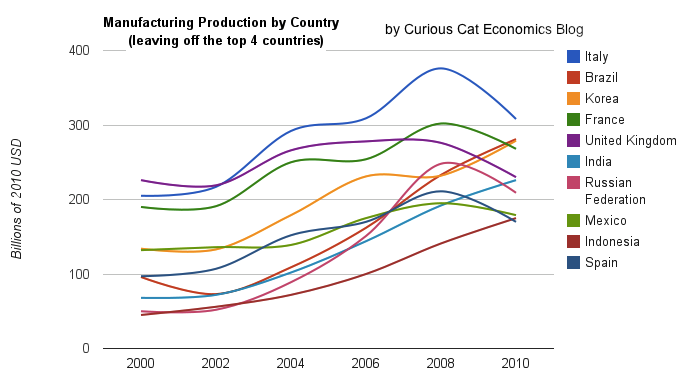

Taking a closure look at the large group of countries after top 4. Chart of manufacturing production from 2000-2010.

Chart of manufacturing production by the leading manufacturing countries (2000 to 2010). The top 4 countries are left off to look more closely at history of the next group. The chart was created by the Curious Cat Economics Blog based on UN data. You may use the chart with attribution.

Removing the top 4 to take a close look at the data on the other largest manufacturing countries we see that there are many countries bunched together. It is still hard to see, but if you look closely, you can make out that some countries are growing well, for example: Brazil, India and Indonesia. Other countries (most in Europe, as well as Mexico) did not fare well in the last decade.

The UK had a particularly bad decade, moving from first place in this group (5th in the world) to 5th in this group and likely to be passed by India in 2011. Europe has 4 countries in this list (if you exclude Russia) and they do not appear likely to do particularly well in the next decade, in my opinion. I would certainly expect Brazil, India, Korea and Indonesia to out produce Italy, France, UK and Spain in 2020. In 2010 the total was $976 billion by the European 4 to $961 billion by the non-European 4. In 2000 it was $718 billion for the European 4 to $343 billion (remember all the data is in 2010 USD).

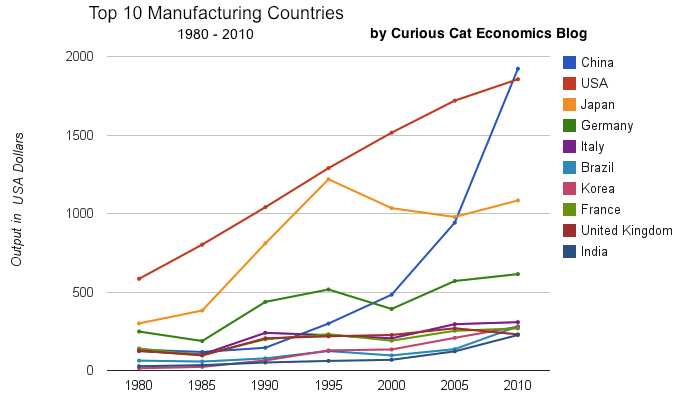

Chart of output by top 10 manufacturing countries from 1980 to 2010. The chart was created by the Curious Cat Economics Blog based on UN data. You may use the chart with attribution.

China has finally actually taken the lead as the largest manufacturer in the world. Reading many news sources and blogs you may have thought the USA lost the lead a couple of decades ago, but you would be wrong. In 1995 it looked like Japan was poised to take the lead in manufacturing production, but they have slumped since then (still they are solidly the 3rd biggest manufacturer). China has been growing manufacturing output enormously for 20 years, and they have now taken the lead from the USA.

As I have been saying for years the biggest economic story about manufacturing is the dramatic and long term increase of productive capacity in China. The next is the continuing global decline in manufacturing employment: increased productivity has seen production rise year after year and employment fall. What is the next most interesting stories is debatable: I would say the continuing failure to appreciate the continuing strong manufacturing production increases by the USA. Another candidate is the the decline in Japan. Another is the increase in several other counties: Korea, Brazil, India, Indonesia…

Looking more closely at some of the long term data shows how much China stands out. From 1980 to 2010 China increased output 1345%. The total top 10 group increased output 302% (all data is in current USD so inflation accounts for most of the gain, 100 1980-USD equal 280 2010-USD). From 1995 to 2010 China increased output 543%. The group increased 64%. For 1980-2010, the results for the other 3 largest manufacturing countries are: USA up 218%, Japan up 261% and Germany up 148% (other countries doing very well are Korea up 1893% and India up 737%). Looking at the last half of that period, from 1995-2010 the: USA up 44%, Japan down 11% and Germany up 19%.

One thing to remember about adjusting manufacturing data for inflation is that often the products created in later years are superior and cost less. So that a computer manufactured in 1990 which added $5,000 to the manufacturing total is far inferior to one in 2010 that added just $1,000. This point is mainly to say that while the increase in manufacturing in real (not inflated dollars) is not as high as it might seem the real value of manufacturing good did likely increase a great deal. But the economic data is based on price so manufacturing increases are reduced by cost decreases. Computers are the most obvious example, but it is also true with many other manufactured goods.

You can that the other largest manufacturing countries fail to keep up with the increases of the entire group of the top 10. China’s gains are just too large for others to match. If you remove China’s results (just to compare how the non-China countries are doing) from 1980-2010 the increase was 216% (so compared to the other 9 top manufacturers over this period the USA was even and Japan better than the average and Germany was worse). And from 1995-2010 the top 9 group (top 10, less China) increased just 28%: so the USA beat while Japan and Germany did worse than the other 9 as a group.

The webcast is by the great Kahn Academy which produces simple educational content (like the above) on all sorts of topics. I find this too slow but I think it might be good for people that are not really sure how the banking system works. There is a group of people that are very apposed to fractional reserved banking, as a principle. I actually am fine with it, but it needs to be regulated much better than we have done.

I suppose it might be true that our political leaders are much too subservient to those giving them lots of cash to regulate in a manner even close to acceptable: and therefore fractional reserve banking is dangerous. I am not sure that they are so hopeless that this is the case, though the more I see of how much they don’t know, and how often they seem to just vote based on what those giving them cash want it gets to be harder to believe they can be trusted to act close to properly (this is extremely sad). And it is mainly an indictment of ourselves: we keep putting people back in power that act mainly to reward those giving them cash and don’t seem interested in actually what is important for the long term interests of the country.

I believe the FDIC actually does quite a good job of providing a solution to manage some issues with a fractional reserve banking system and people being able to rely on getting their money back.

Related: Charlie Munger’s Thoughts on the Credit Crisis and Risk – Leverage, Complex Deals and Mania – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren

See the full list of Dividend Aristocrats below. The stocks in this index are companies within the S&P 500 that have increased dividends every year for at least 25 consecutive years. After 10 were added and 1 removed, this month, there are now 51 companies included (so just over 10% of all S&P 500 stocks) – and remember many S&P 500 stocks haven’t existed for 25 years, or pay no dividend today, or didn’t 10 or 20 years ago (Google, Apple, Intel, …). It is surprising so many companies have successfully done this.

I’ll take a look at a few of them here (I looked at the new additions in my previous post: Investing in stocks that have raised dividends consistently).

| Stock | Yield |

|

div/share 2011 | div/share 2000 | % increase |

|---|---|---|---|---|---|

| 3M (MMM) | 2.8% | $2.20 | $1.16 | 90% | |

| Aflac (AFL) | 3.2% | $1.23 | $0.165 | 645% | |

| Abbott Laboratories (ABT) | 3.5% | $1.92 | $0.74 | 159% | |

| Cincinnati Financial (CINF) | 5.3% | $1.60 | $0.69 | 132% | |

| Coca-Cola Co (KO) | 2.8% | $1.88 | $0.68 | 176% | |

| Exxon Mobil Corp (XOM) | 2.4% | $1.85 | $0.88 | 110% | |

| Johnson & Johnson (JNJ) | 3.6% | $2.25 | $0.62 | 263% | |

| Kimberly-Clark (KMB) | 3.9% | $2.80 | $1.08 | 159% | |

| Medtronic (MDT) | 2.8% | $0.94 | $0.18 | 417% | |

| Procter & Gamble (PG) | 3.2% | $2.06 | $.67 | 207% |

Just looking at this data Aflac sure looks appealing. Having both a high yield and strong growth is an appealing combination. And Warren Buffet agree (he owns quite a bit) which is also reassuring (he also owns a large stake in Coke). Of course strong growth over the last 11 years won’t necessarily repeat (in fact it gets much harder). On the other had some slow growth companies would likely continue slow growth (at best): Exxon Mobil, 3M…

Really almost all of these stocks are pretty attractive. Medtronic, Johnson & Johnson and Abbot Laboratories look particularly appealing to me (along with Aflac and Kimberly-Clark). I would have to do more research on any of these (other than Abbot Laboratories, which I already own) before deciding to buy, but they sure look good as safe long term investments. Health care is a growing need (in the USA and globally). It is true the costs in the USA have to be reduced, and this could make things more difficult for companies in the health care industry.

Related: Sleep well investing portfolio – Looking for Dividend Stocks in the Current Extremely Low Interest Rate Environment – Is the Stock Market Efficient?

Full list of Dividend Aristocrats, an index measures the performance of large cap, blue chip companies within the S&P 500 that have followed a policy of increasing dividends every year for at least 25 consecutive years.

The Dividend Aristocrats index measures the performance of S&P 500 companies “that have followed a policy of increasing dividends every year for at least 25 consecutive years.” S&P makes additions and deletions from the index annually. This year 10 companies were added and 1 was deleted.

| Stock | Yield |

|

div/share 2011 | div/share 2000 | % increase |

|---|---|---|---|---|---|

| AT&T (T) | 6% | $1.72 | $1.006 | 72% | |

| HCP Inc (HCP) | 4.9% | $1.92 | $1.47 | 31% | |

| Sysco (SYY) | 3.7% | $1.04 | $0.24 | 333% | |

| Nucor (NUE) | 3.7% | $1.45 | $0.15 | 867% | |

| Illinois Tool Works (ITW) | 3.1% | $1.40 | $0.38 | 268% | |

| Genuine Parts (GPC) | 3.1% | $1.80 | $1.10 | 64% | |

| Medtronic (MDT) | 2.8% | $0.936 | $0.181 | 417% | |

| Colgate-Palmolive (CL) | 2.6% | $2.27 | $0.632 | 259% | |

| T-Rowe Price (TROW) | 2.9% | $1.24 | $0.27 | 359% | |

| Franklin Resources (BEN) | 1.2% | $1.00 | $.0245 | 308% |

You can’t expect members of the Dividend Aristocrats to match the dividend increases shown here. As companies stay in this screen of companies the rate of growth often decreases as they mature. Also some have already increased the payout rate (so have had an increasing payout rate boost dividend increases) significantly.

The chart also shows that a smaller current yield need not dissuade investing in a company even when your target is dividend yield, giving the large dividend increase in just 10 years. Nucor yielded just 1.5% in 2000 (at a price of $10). Ignoring reinvested dividends your current yield on that investment would be 14.5%. To make the math easy 10 shares in 2000 cost $100, and they paid $1.50 in dividends (%1.5). Dividends have now increase so those 10 shares are paying $14.50 in dividends (14.5%). Of course Nucor worked out very well; that type of return is not common. But the idea to consider is that the long term dividend yield is not only a matter of looking at the current yield.

The period from 2000 to 2011 was hardly a strong one economically. Yet look at how many of these companies dramatically increased their dividend payouts. Even in tough economic times many companies do well.

Related: Looking for Dividend Stocks in the Current Extremely Low Interest Rate Environment – Where to Invest for Yield Today – 10 Stocks for Income Investors

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles.

- Why Financial Literacy Fails (and What to Do About It) by JD Roth – “‘For years, I struggled with money,’ I told my interviewer today. ‘I knew the math, but I still couldn’t seem to defeat debt. It wasn’t until I started applying psychology to the situation that I was able to make changes.'”

- Get ready for the three big financial crises of 2012 by Jim Jubak – “So in 2012 Ireland—and Greece and Portugal—are going to face a huge choice. They can either try to grind out more austerity in the midst of a EuroZone recession or they can try to renegotiate some of that debt. If you remember, the battle over Greek bank debt almost scuttled the euro this year. Well, we’re going to see the same problem again in 2012…”

- How Long Would It Take To Build A $5000/Year Dividend Cash Flow? – John is able to investing $1000 per month in a portfolio now yielding 2.86% and dividends increasing 9% a year (under historical level for the stocks included)… a bit over 7 years…

-

Mark Cuban, invest in yourself. Keep your cash – wait to get a bargin based on the cash your have which allows you to take advantage of market opportunities.

There is an increasing trend to move from the USA to another country to work and live. This is not surprising to me. Recently this has picked up quite a bit; I am surprised by the velocity at which this interest in moving (I figured it would be a long term mega trend but not so drastic, so quickly). Economic changes are often quite surprising in how rapidly they move forward.

An interesting survey shows USA investors have become much more interested in relocating in the last two years (the data they show though has tremendous volatility over time, so I am not really sure this means much). I wonder how much of it can be explained by investors wanting to get a deep understanding of very promising markets. I wouldn’t image the actual number that do this is huge, but maybe the number considering it is significant. Billionaire investor, Jim Rodgers moved to Asia because he sees Asia as key to the future. One of the reasons I moved to Malaysia this year was to get a in depth understanding of what South East Asia is like (it is not a deciding reason, at all but maybe the 4th or 5th reason).

I believe the globalization of the employment market is a long term trend that will continue – especially for “knowledge workers.” The USA rested on the post WW II economic domination for nearly 50 years. The policies also helped this continue: investing in science and engineering, favoring entrepreneurship… But other countries have realized the value of these things (and the USA is slipping – not investing nearly as much in science and engineering and favoring large corporations that give politicians large amounts of cash over innovation – see things like the incredibly outdated “intellectual property” system, SOPA, favoring huge financial institutions…

The combination of long term policy weakness, the inevitable decline in the USA to world ratio of economic wealth, and the financial crisis caused by the policy weaknesses have seemingly greatly accelerated the trend. The next 2 or 3 years will determine if that is a permanent acceleration or if we go back to a slower pace – but on the same path. My guess is that we will stay on this path but the pace will not follow the level surveys might indicate (showing interest in such a big change is far different from actually moving).

There don’t seem to be any decent estimates of Americans living abroad. The US State Department claims releasing their estimates would be a national security risk? And the Census bureau says it would cost too much to try. Wild guesses seem to be between 4 and 6 million.

Related: I want out (subreddit) – Why Investing is Safer Overseas – USA Heath Care System Needs Reform – Copywrong

Chart by Curious Cat Economics Blog using data from the Wind Energy Association. 2011 data is for the capacity on June 30, 2011. Chart may be used with attribution as specified here.

Chart by Curious Cat Economics Blog using data from the Wind Energy Association. 2011 data is for the capacity on June 30, 2011. Chart may be used with attribution as specified here._________________________

In 2007 wind energy capacity reached 1% of global electricity needs. In just 4 years wind energy capacity has grown to reach 2.5% of global electricity demand. And by the end of 2011 it will be close to 3%.

By the end of 2011 globally wind energy capacity will exceed 240,000 MW of capacity. As of June 30, 2011 capacity stood at 215,000. And at the end of 2010 it was 196,000.

As the chart shows Chinese wind energy capacity has been exploding. From the end of 2005 through the end of 2011 they increased capacity by over 3,400%. Global capacity increased by 233% in that period. The 8 countries shown in the chart made up 79% of wind energy capacity in 2005 and 82% at the end of 2010. So obviously many of other countries are managing to add capacity nearly as quickly as the leading countries.

USA capacity grew 339% from 2005 through 2010 (far below China but above the global increase). Germany and Spain were leaders in building capacity early; from 2005 to 2010 Germany only increased 48% and Spain just 106%. Japan is an obvious omission from this list; given the size of their economy. Obviously they have relied heavily on nuclear energy. It will be interesting to see if Japan attempts to add significant wind and solar energy capacity in the near future.

Related: Nuclear Power Production by Country from 1985-2009 – Top Countries For Renewable Energy Capacity – Wind Power Capacity Up 170% Worldwide from 2005-2009 – USA Wind Power Installed Capacity 1981 to 2005 – Oil Consumption by Country 1990-2009

I am frustrated that we have largely allowed those that don’t believe in capitalism to claim their beliefs are capitalist. I believe capitalism is the best system to provide economic gain to human society. When we allow non-capitalist to claim their ideas are capitalist we often lose by allowing bad policies to be adopted and failing to adopt more capitalist ideas.

Robber barons and their ilk are not capitalists. Those attacked today as capitalists are much more like European nobility that fought to let the nobility take most of the economic profit from everyone else.

Capitalism is a wonderful thing.

The foolish economic policies the politicians we have elected over and over again for decades are idiotic and not capitalist (they are somewhat capitalist but the things people are complaining about are not capitalism but the corruption of the system by those subverting capitalism). They are the result of favoring cronyism and bribery over capitalist regulated markets.

What we need to do is not throw out the capitalists. We need to actually throw out those that say their cronyistic policies are capitalist.

Capitalism is an economic system designed to achieve economic gain for a society. Adam Smith (and others) understood that if those with power to destroy the functioning of markets (for personal gain) were allowed to do so then the benefits capitalism can produce are reduced. And they definitely would try to (according to the believes fundamental to the capitalist model) so a capitalist system has to account for that.

“Free” markets are good. But in capitalism “free” markets means markets where no entity has “market” power – that is the ability to move the market. This is the idea of perfect competition. In the real world this doesn’t happen but capitalist understand the weakness of unfree markets and that has to be dealt with. Things start to get messy here. There is no perfect way to do this and I don’t know of anyone (that I don’t think is naive) that thinks this can be done in some way that avoid economic friction (loss to the society from what is possible in some ideal state).

Now those that like cronyism and letting whoever has the clout do whatever they want have tried to say capitalism means doing whatever you want to get as much capital as you want. It doesn’t. Capitalism isn’t about letting whoever has the gold get more. It is an economic system to provide gain to society by setting up rules that result in market forces brining benefit to society.

Those thinking about setting up the rules for a capitalist system understood that many people are going to try and get away with taking what isn’t theirs. So you have to enforce the rule of law. You have to prevent those that seek to destroy markets and take personal gains they should not be able to (due to being allowed to collude with other market players, collude with politicians to gain political concessions that destroy market functions…).

I happen to believe capitalism is the best economic system we have by far.

I happen to believe those that have increasingly turned out system into one where croynism is destroying markets to give gains to a few parties dominates are creating great damage. But the problem is not that these people show capitalism is bad. Instead these people show the dangers of not putting in the effort to retain capitalist ideas: your economy suffers and people suffer.

The unemployment rate fell from 9.0% to 8.6% in November, however that is not an accurate representation of employment in the USA. The news is good, but very mildly good, while a decrease in the unemployment rate by 40 basis points would lead you to believe the improvement was dramatic. Nonfarm payroll employment rose by 120,000 which is about the number needed to keep up with population growth each month. Employment continued to trend up in retail trade, leisure and hospitality, professional and business services, and health care. Government employment continued to trend down.

The change in total nonfarm payroll employment for September was revised from +158,000 to +210,000, and the change for October was revised from +80,000 to +100,000. This means this report shows an increase of 192,000 jobs which is pretty good news (especially for those that think the economy has been in a recession – it has not).

One year ago the unemployment rate stood at 9.6%.

The number of unemployed persons, at 13.3 million, was down by 594,000 in November. The labor force, which is the sum of the unemployed and employed, was down by a little more than half that amount. What this means is the reduction in the unemployment rate was largely due to the decrease in those actively looking for jobs.

Among the major worker groups, the unemployment rate for adult men fell to 8.3% in November. The jobless rate rates for adult women (7.8%), teenagers (23.7%), African-Americans (15.5%), and Hispanics (11.4%) showed little or no change. The jobless rate for Asians was 6.5%.

The number of long-term unemployed (those jobless for 27 weeks and over) was little changed at 5.7 million and accounted for 43.0% of the unemployed. This is one of the numbers that has to come down drastically for the job situation to really show good improvement.

Related: Jobs News in the USA is not Good, Unemployment Remains at 9.1% (Aug 2011) – USA Economy Adds 151,000 Jobs in October, Unemployment Rate Steady at 9.6% (Oct 2010) – Unemployment Rate Reached 10.2% (Oct 2009) – Over 500,000 Jobs Disappeared in November (2008)