The most popular posts on the Curious Cat Investing and Economics blog in 2016 (by page views).

- Top 10 Countries for Manufacturing Production in 2010: China, USA, Japan, Germany… (posted in 2011)

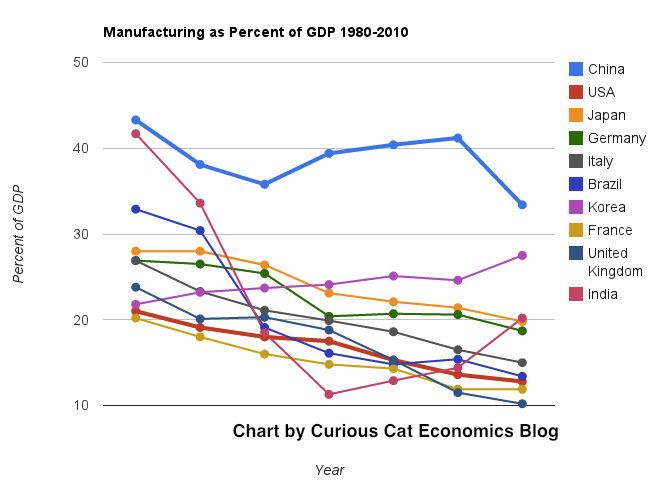

- Manufacturing Output as a Percent of GDP by Country (1980 to 2008) (2010)

- Default Rates on Loans by Credit Score (2015)*

- Stock Market Capitalization by Country from 1990 to 2010 (2012)

- Investing in Peer to Peer Loans (2015)

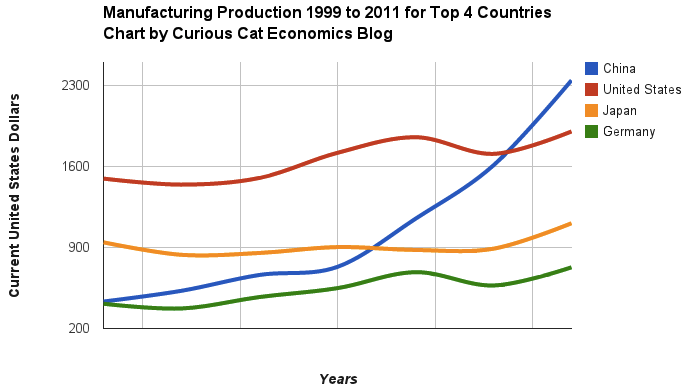

- Manufacturing Output by Country 1999-2011: China, USA, Japan, Germany (2013)

- The 20 Most Valuable Companies in the World – October 2015

- Manufacturing Output as Percent of GDP from 1980 to 2010 by Country (2012)

- Monopolies and Oligopolies do not a Free Market Make (2008)

- Government Debt as Percentage of GDP 1990-2009: USA, Japan, Germany, China… (2010)

- USA Individual Earnings Levels: Top 1% $343,000, 5% $154,000, 10% $112,000, 25% $66,000 (2012)

Chart of manufacturing production by China, USA, Japan and Germany from 1999 to 2011. The chart was created by the Curious Cat Economics Blog using UN data. You may use the chart with attribution. All data is shown in current USD (United States Dollar).

Enjoy this edition of the Curious Cat Investing, Economics and Personal Finance Carnival. This carnival is different than many blog carnivals: I select posts on those topics from what I read (instead of posting those that submit to the carnival as many carnivals do). If you would like to host the carnival add a comment below.

Sri Krishnan Temple, Singapore

- The Economics of Netflix’s $100 Million New Show – “ith Netflix spending a reported $100 million to produce two 13-episode seasons of House of Cards, they need 520,834 people to sign up for a $7.99 subscription for two years to break even.”

- Chart of Top Countries for Manufacturing Production 1999-2011 by John Hunter – “the four leading nations for manufacturing production remain solidly ahead of all the rest. Korea and Italy had manufacturing output of $313 billion in 2011 and Brazil moved up to $308 are in 4-6 place. Those 3 countries together could be in 4th place (ahead of just Germany). Even adding Korea and Italy together the total is short of Germany by $103 billion.”

- Why a Transaction Fee Matters to You by David Brin – “By raw extrapolation, this zero-point-zero-three-percent (0.03%) fee could raise a whopping deficit-curbing $352 billion dollars in ten years, while helping capital markets to settle down” [I agree we should use a very small fee to raise money and reduce incentive for high frequency trading/frontrunning – John]

- Mexico: The New China – “Today, what Shenzhen is to Hong Kong, Tijuana is becoming to San Diego. You can drive from our San Diego engineering center to our Tijuana factory in 20 minutes, no passport required. (A passport is needed to come back, but there are fast-track lanes for business people.)”

The Curious Cat Investing, Economics and Personal Finance Carnival is published monthly with links to new, related, interesting content online. Also see related books and articles.

- QE3 is Ben Bernanke’s masterstroke of market manipulation by Matt Phillips – “it’s way more profitable to make mortgages now than it was during the peak of the housing frenzy. This is because at that time banks were competing like crazy to make new mortgages, driving profit margins way down.”

- Long Term View of Manufacturing Employment in the USA by John Hunter – “In 1980 manufacturing jobs accounted for over 22% of USA jobs; by 1990 that fell to 17%, by 2000 to 14% and by 2010 to 10%.” During this period jobs fell from 18 million to 12 million while manufacturing output increased.

- Let’s Increase America’s Savings Rate in November! by Jim Blankenship – “Recent figures have shown that we Americans are doing a little bit better of late, at a 5% savings rate versus around 1% back in 2005 – but this is a dismal figure when you consider how most folks are coming up short when they want to retire.”

- The Importance Of Elizabeth Warren by Simon Johnson – “We should confront excessive market power, irrespective of the form that it takes. We need a new trust-busting moment. And this requires elected officials willing and able to stand up to concentrated and powerful corporate interests. Empower the consumer – and figure out how this can get you elected.”

Fruit at outdoor market in Phnom Penh, Cambodia by John Hunter.

The Curious Cat Investing, Economics and Personal Finance carnival is published monthly with links to new, related, interesting content online.

- We Need a Warby Parker for Mattresses by Rohin Dhar – “Like eyeglasses, mattress technology is fairly stable. Yet, publicly traded mattress wholesalers have gross margins of 41-64% (TPX, ZZ, SCSS). Across the industry, the retailers then mark up the mattresses another 96% on average (calculated from here). By the time a customer buys a mattress, it costs them ~74% more than the production cost of the product. An 74% gross margin is a lot of room for a startup to figure out how to acquire customers!”

- Manufacturing Output as Percent of GDP from 1980 to 2010 by Country by John Hunter – “For the 10 largest manufacturing countries in 2010, the overall manufacturing GDP percentage was 24.9% of GDP in 1980 and dropped to 17.7% in 2010.”

This chart shows manufacturing output, as percent of GDP, by country and was created by the Curious Cat Economics Blog based on UN data. You may use the chart with attribution.

- Wall Street doesn’t know what business it is in by Mark Cuban – “Regulators have got to start to recognize that traders are not investors and vice versa and treat them differently. Different regulations. Different tax structure. Different oversight. Individual investors and the funds that just invest in stocks and bonds are not going to crash the market. Big traders who are always leveraging up and maximizing the number of trades/hacks they make will always put the system at risk…

There is absolutely NO VALUE to High Frequency Trading. None.”

I am reducing the Curious Cat Investing, Economics and Personal Finance Carnival to being published once each month. If I get some decent contributors that want to host it I would consider going back to twice a month.

Also see related investing and economics books and articles.

- A controlled break-up of the euro would be hugely risky and expensive – “Estimating the price of a “Grexit” is guesswork, but Germany’s share might reach €110 billion of this, about 4% of the country’s GDP.”

- Personal Finance: Minimal Budgeting by John Hunter – “I just leave that in my checking account and what is in checking is what I have to spend… I couldn’t spend any more, I didn’t have it. If I were to go over (I never did), but if I were to have (say my credit card bill exceeded my checking account balance), I would have had to reduce my cash the next month.”

- Are Dividend Stocks Overvalued? Four Reasonable Blue-Chips to Consider by Matt Alden – “Although I do think the market as a whole is modestly expensive (via the Shiller P/E for an overview as well as inspection of individual securities), dividend stocks in general do not appear to be at dangerous valuations.” [Aflac has been on my almost buy list for over a year – John]

- Actually, The U.S. Lost 1.2 Million Jobs Last Month by Jacob Goldstein – “Everyone (including us) is saying this morning that the U.S. economy gained 163,000 jobs last month. Strictly speaking, this is a lie. In fact, the U.S. economy actually lost 1.2 million jobs last month. There were 134.1 million jobs in June, and 132.9 million jobs in July… the government releases “seasonally adjusted” jobs numbers every month. The basic idea is to correct for these predictable fluctuations.”

- Current crisis exposes weakness in China’s economic system by Jim Jubak – “The current obvious fakery is degrees of magnitude different from the usual distortion in Chinese economic data. So, for example, the Public Safety Bureau has simply stopped publishing data on new car registrations because the numbers show such a big drop in new car sales that they can’t simply be fudged. Data on the steel industry has been revised and revised again because the government can’t come up with a methodology that disguises the drop in steel sales and yet isn’t completely unbelievable. And, of course, the government hasn’t published data on the number of vacant apartments in China—a reflection of the country’s real estate boom and bust—since 2008.”

- For the first time since 1998 more money leaves China than enters it – “more than 16% of China’s rich have already emigrated, or handed in immigration papers for another country, while 44% intend to do so soon. Over 85% are planning to send their children abroad for their education, and one-third own assets overseas.”

More and more the ability to continue to delay the huge problems continued from the credit crisis (too big to fail fakery plus the decades of the USA and Europe living beyond their means) seems to be coming to an end. And onto that the problems in China and it is difficult to see how we avoid big problems. It is amazing the bad behavior in the USA and Europe has been only as bad as it has the last 4 years – but there is a very good chance that will not continue. China is not looking like it can be a savior. Certainly India is not doing much right recently. Japan continues to struggle. 2013 looks very tough economically. Eventually the central bank games of given essentially huge cash payments to bankers will cause people to lose faith in those currencies (frankly I can’t understand why they haven’t already). When that happens we will see some real problems.

Enjoy the 36th edition of the Curious Cat Investing, Economics and Personal Finance Carnival. This carnival is different than many blog carnivals: I select posts on those topics from what I read (instead of posting those that submit to the carnival as many carnivals do). If you would like to host the carnival add a comment below.

- The Apple (Used) Premium? by Daniel Mrdjenovich – “In short, if the Apple product you desire is available refurbished, you are in luck. Refurbished Apple products seem to be a rare case of a great deal with very limited downside. If you can’t find a refurbished version of the product you are looking for, you have a more difficult dilemma. A 17% discount on a used Apple device is a nothing to sneeze at but it’s not enormous either.”

- The fiscal cliff and rationality by James Hamilton – “Although the risks are real, the rational thing to expect is that the actual fiscal contraction next year will be significantly more modest than what is implied by existing law. But the cumbersome process of getting to that outcome will once again exact its own unique toll.”

- Idle corporate cash piles up by David Cay Johnston – “newly released IRS figures show that in 2009 these companies held $4.8 trillion in liquid assets”

- Case Shiller Home Price Indexes Surge – “The real estate market news keeps getting a little bit better as Standard & Poor’s reported big increases for the Case-Shiller Home Price Indexes in May, both the 10-city and 20-city indexes rising 2.2 percent for the month on an unadjusted basis after gains of 1.3 percent in April.”

The Curious Cat Investing, Economics and Personal Finance Carnival is published twice each month with links to new, related, interesting content online. Also see related books and articles.

- A Nation of Public Housing by Neal Peirce – “One government agency manages 80 percent of the housing stock — all called public housing. It checks your age and whether you’re married to decide whether and when you’re eligible for an apartment.” Racial quotas are used, unmarried people can’t apply until they turn 35. Any guess on what country this is? The same country is ranked as the easiest, or close to it, country run business in the world.

- China’s end game:the dark side of a great deleveraging by Dee Woo – “The dilemma is that business entities will need more and more credit to achieve the same economic result, therefore will be more and more leveraged, less and less able to service the debt, more and more prone to insolvency and bankruptcy. It will reach a turning point when the increasing number of insolvencies and bankruptcies initiate an accelerating downward spiral for underling assets prices and drive up the non-performing loan ratio for the banks. And then the over-stretched banking system will implode. A full blown economic crisis will come in full force. The chain of reaction is clearly set in the motion now.

…

The biggest problem for China is the state, central enterprises and crony capitalists wield too much power over national economy, have too much monopoly power over wealth creation and income distribution, and much of the GDP growth and vested interest groups’ economic progress are made on the expanse of average consumers stuck in deteriorating relative poverty.” - Challenges faced by middle-class L.A. families by Meg Sullivan – “Managing the volume of possessions was such a crushing problem in many homes that it actually elevated levels of stress hormones for mothers. Only 25 percent of garages could be used to store cars because they were so packed with stuff.” (read the book: Life at Home in the Twenty-First Century)

- USA Social Security Disability Insurance (SSDI) by John Hunter – Benefits have a maximum of $2,346/month (in 2011). The average benefit payment now is $1,111. More than 8.7 million people are received disability benefits currently (partially disabilities are not eligible for SSDI.

Shaker Village of Pleasant Hill, Kentucky by John Hunter

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival. This carnival is different than many blog carnivals: I select posts on those topics from what I read (instead of posting those that submit to the carnival as many carnivals do). If you would like to host the carnival add a comment below.

Mushroom, Rocky Gap State Park, Maryland, USA by John Hunter

- The U.S. Content of “Made in China” by Galina Hale and Bart Hobijn (SF Federal Reserve) – “Goods and services from China accounted for only 2.7% of U.S. personal consumption expenditures in 2010, of which less than half reflected the actual costs of Chinese imports. The rest went to U.S. businesses and workers transporting, selling, and marketing goods carrying the “Made in China” label.”

- 7 equations to build a secure retirement by Robert Powell – the equations are not complex but might scare those that don’t like math. Even without really understanding the equations the text is useful.

- Stock Market Capitalization by Country from 1990 to 2010 by John Hunter – The USA was 32.5% of the total stock market capitalization of the global stock markets in 1990. The USA grew to 46.9% as the tech, finance and housing bubbles were all underway (also Japan was stagnating and the Chinese stock market hadn’t started booming to a significant extent) in 2000. By 2010 the USA was back down to 31.4%.

- 5 stages of retirement crisis–and what to do about yours by Jim Jubak – “Certainly you weren’t planning for three-month Treasury bills to be paying you 0.08% or 10-year Treasuries 1.61%. And you’re worried by projections that say the real return on stocks going forward is going to be more like 5% (if we’re lucky) than the 7.5% real return that has been the assumption of choice recently. (That assumption replaces the 10% assumption that was the common wisdom in the years before the 2000 bear market.)

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival. The carnival is published twice each month with links to new, related, interesting content online. Greece just voted for the party that wants to attempt to keep Greece in the Eurozone. We will see how that works. I don’t think the odds are great unless Greece is willing to substantially change their recent (last few decades) running of their economy.

- Big Investors Don’t Know Where to Put Their Cash by Sven Böll and Martin Hesse – “‘In the past, we searched for risk-free returns.’ He pauses for effect. ‘Today we know that what we mainly have are investments with return-free risk.’… Corporate bonds and the sovereign debt of emerging economies, once something for the intrepid, are suddenly seen as safe havens.”

- Are More Bailouts to Banker and Politicians the Answer to the Credit Crisis Aftermath? by John Hunter – “It feels to me similar to a situation where I have maxed out 8 credit cards and have a little bit left on my 9th. You can say that failing to approve my 10th credit card will lead to immediate pain. Not just to me, but all those I owe money to. That is true. But wasn’t the time to intervene likely when I maxed out my 2nd credit card and get me to change my behavior of living beyond my means then?”

- The Great Recession is changing our behavior–in ways that point to slower growth for a longer period of time by Jim Jubak – “The third, most powerful in its effects and the least obvious, is the way that the Great Recession has undermined existing belief in financial security. That decline in real and perceived security is likely to change where people put their money, what kinds of returns they think they can count on, and, therefore, how much money they think they can spend and how much they have to put away.”

- A Global Perfect Storm by Nouriel Roubini – “To prevent a disorderly outcome in the eurozone, today’s fiscal austerity should be much more gradual, a growth compact should complement the EU’s new fiscal compact, and a fiscal union with debt mutualization (Eurobonds) should be implemented. In addition, a full banking union, starting with eurozone-wide deposit insurance, should be initiated, and moves toward greater political integration must be considered, even as Greece leaves the eurozone.

CommentsUnfortunately, Germany resists all of these key policy measures…”

My parents in front of the Acropolis in Athens, Greece. Photo by John Hunter, see more of my photos.

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival. This carnival is different than other carnivals: I select posts, and articles, from what I read (instead of posting those that submit to the carnival as many carnivals do). If you would like to host the carnival add a comment below.

- How Much Should You Contribute To Your 401k? by David Weliver – “If your employer matches 401k funds, contribute enough to get the full match. Do this first. Even if you’re in debt. Even if you don’t put in a penny more. Next, if you can contribute to a Roth IRA, work on contributing the full $5,000 a year to that account before you contribute elsewhere.”

- USA’s creaking infrastructure holds back economy by Paul Davidson – “The U.S. is spending about half of the $2.2 trillion that it should over a five-year period to repair and expand overburdened infrastructure, says Andrew Herrmann, president of the American Society of Civil Engineers.

Inland waterways, for example, carry coal to power plants, iron ore to steel mills and grain to export terminals. But inadequate investment led to nearly 80,000 hours of lock outages in fiscal 2010, four times more than in fiscal 2000. Most of the nation’s 200 or so locks are past their 50-year design life.” - Earth to Dimon: Banks Don’t Have a Right to Profit by Yves Smith – “banks that exist only by virtue of state-granted charters — and more recently, huge transfers from the public — have persuaded public officials and regulators that they have a God-granted right not just to high levels of profit but also high levels of employee and executive compensation.”

- Road Map for Saving Health Care with Fareed Zakaria – “our [USA] out-of-control health care costs continue to climb. No other nation spends more than 12 percent of its economy on health care. America spends 17 percent. What’s more, we don’t really benefit from the huge price tag. Our healthy life expectancy, the standard measurement, ranks only 29th in the world, behind Slovenia… All of them, including free market havens like Taiwan, have found that they need to use an insurance or government sponsored model. And all of them provide universal health care at much, much lower costs than we do.”

Sunrise at Angkor Wat, Siem Reap, Cambodia by John Hunter