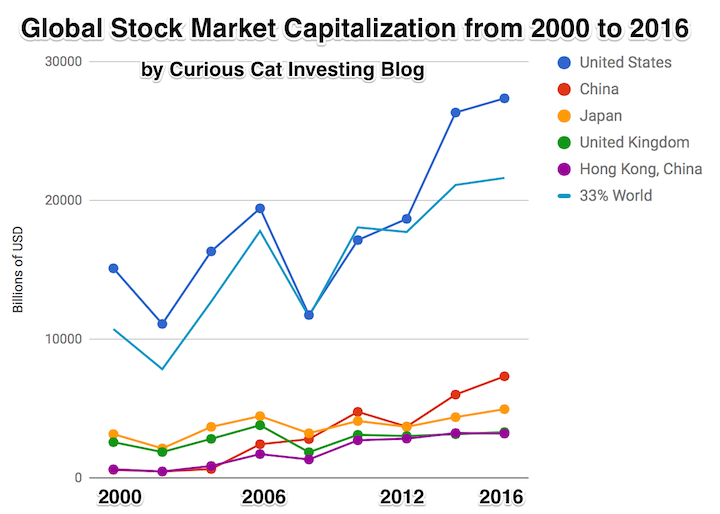

The total stock market capitalization by country gives some insight but it is also data that is a bit muddy. The data doesn’t tell you how the economies of the countries are doing as there is quite a bit of room for misinterpreting the data.

Apple, Alphabet, Intel, 3M, Abbvie… all are included in the USA market capitalization but much of their sales, earnings and employment are overseas. And USA companies have done very well in global markets so the USA totals are not just an indication how the USA has performed but includes great gains made by profiting from global growth. Also you may be surprised to learn that 26% of USA equities are owned by investors outside the USA.

The chart shows the top countries based on stock market capitalization, with data from 2000 to 2016. The chart was created by Curious Cat Investing and Economics Blog may be used with attribution. Data from the World Bank.

It is important to keep in mind the data is shown in current USA dollars, so large swings in exchange rates can have a large impact.

China’s performance has been remarkable. China also shows some of the challenges in collecting this data. I am fairly certain Alibaba (BABA), one of the 10 most valuable companies in the world and a Chinese company has the stock issued in the USA (even this is confusing as it is a complex arrangement but the only publicly traded stock is traded in the USA). And many other Chinese companies are traded this way and therefore are not included in the Chinese total value. In addition Hong Kong is part of China but also separate. The data is reported separately by the world bank and I include them that way in the charts.

As with so much recent economic data China’s performance here is remarkable. China grew from 1.8% of world capitalization in 2000 to 6.9% in 2012 and 11.2% in 2016. Adding Hong Kong to China’s totals shows 3.7% in 2000 with growth to to 12.2% in 2012 and 16.2% in 2016. If you look at my post global stock market capitalization from 2000 to 2012 you will see significantly different historical data for Hong Kong. Collecting this data is much more complex than people realize and data determinations can change over the years resulting in changes in historical data.

The chart shows the 1/3 of the total global market capitalization in order to have the chart display look better (and it also makes it easier to compare the USA performance to the total global performance). The USA market capitalization was at 46.9% of the global market cap in 2000 and fell to 31.6% in 2000 before rising to 42% in 2016. This shows that the USA has largely held its own globally as measured by market cap. This may not seem impressive but when you consider that China has grown from 3.7% to 16.2% you can see that for the market cap outside of China the USA has actually gained quite a bit of ground. This is the result of what I mentioned before – how well USA companies have done at capture global markets (especially in high technology areas with very high profits and therefore very high market caps).

The latest massive breach of USA citizen’s private information by poorly run companies once again shows how we are voting for the wrong type of people. We need to start electing people that fix problems instead of watching things burn.

It is not impossible to improve if you elect people that care about making things better. If you elect people that are driven mainly by doing favors for those giving them cash you get the system we have now.

I believe in designing systems that use markets to create the best solutions to desired outcomes (this is the basic idea of real capitalism – instead of the crony capitalism we have been infected with). Europe has much more respect for citizen’s privacy that the USA does. Europe has much more effect laws on protecting citizen’s privacy. For decades the 2 political parties in the USA have taken large cash donations (and more, future cushy jobs…) to allow the current system to punish citizen’s as their private information is abused and they are expected to spend their time and resources to fix the problems created by the identity theft the lack of decent systems in the USA to stop identity theft. And the design by the 2 parties to put the cost of dealing with it on voters and the benefits (of selling private consumer information and using poor security practices to create problems that voters have to clean up) to those giving the parties cash.

We need to stop voting for such corrupt parties and such poor representatives of our interests (though they are very good representatives of those paying them cash).

So what is a simple starting point for taking the burden of dealing with the easy identity theft our political parties and companies that don’t care about the costs of their sloppy practices on society are?

- Force those approving false credit to pay. Anytime you have to fix credit given falsely in your name they must pay you. Say, $1,000 minimum.

- Force those providing false information about you to pay. If credit bureaus report false information about you that you must correct it is $50 if it is fixed within 7 days of a simple internet form being completed. If it takes 30 days the cost is $150. If they require you to provide additional information, additional costs accrue. They must provide your the original documentation on the loans.

- Give consumer automatic and free control over the use of their private information.

Obviously, credit freezes, and managing that status must be free. - Any organization that collects private financial information must have liability insurance. That insurance will automatically pay per security breach. For name + SSN ($150) + Date of birth ($20) + cell phone number ($20) + current address ($100) + credit card number ($50) + email address ($10) + mother’s maiden name ($25), etc. If you do not collect SSN, credit card number, cell phone number or current address this will not apply. I haven’t given it any thought, but there should be some level of private information that pushes you into the category of the organization that must have liability coverage (what that is can be worked out).

- The funds for those security breaches are paid to the Consumer Financial Protection Bureau and used to

- create better security practices for private information

- fund enforcement of those better security practices

- fund law enforcement investigations and criminal prosecution of those abusing private financial information

This idea needs to be expanded beyond my 1 hour of thinking about it, but it is sad that in 1 hour I can think of much more effective ideas than our political parties have put in place in 20 years.

The reliance on SSN as a identifier for people is something that shouldn’t have been allowed. It is one of many things that should be fixed and it should be fixed quickly.

The organization created here needs to focus on privacy of data. They need to encourage the use of encryption. They need to be given a seat at the table to counter those seeking to promote hacking (both leaving insecure software in place and creating insecurity in the software ecosystem to exploit and be exploited by criminals and other states) to benefit state sponsored spying. That debate will result in tradeoffs. Sometimes they will decide to allow our private information to be put at risk for other benefits. But they need to accept the responsibility of doing so. It would likely be sensible to charge the departments leaving open security holes and creating security holes anytime it becomes obvious that they are responsible for the harm to us. Otherwise they pretend there are not costs to the very bad security practices that our government has been encouraging (even as crazy as it sounds building backdoors into software – which is a security disaster obviously).

Other than the extremely sad state of affairs in health care in the USA (with the Republicans focusing on making it much worse) the biggest threat to our personal finances is likely the lack of security in our financial system (though to be fair there are other plausible candidates – very high debt level…).

Related: Protecting Your Privacy and Security (2015) – Making Credit Cards More Secure and Useful (2014) – Governments Shouldn’t Prevent Citizens from Having Secure Software Solutions USA Congress Further Aids Those Giving Them Cash Risks Economic Calamity Again – Security, Verification of Change – 8 Million New Potential Victims of Identity Theft (2008)

Health Savings Accounts (HSA) allow you to save money in order to pay health expenses in a tax free account. They are similar to an IRA but are for health expenses.

Eligibility is limited to those with high deductible health care plans.

HSA funds can be saved over the years. Flexible spending accounts are somewhat similar but that money can not be rolled from one year to the next. The idea with HSA is you can save money in good years so you have money to pay health care expenses in years when you have them.

Health Savings Accounts are meant to cover deductibles, co-pays, uncovered health needs etc. that those stuck with the current USA health care system have to deal with. HSA are best used by people who are healthy, as the idea is to save up money during healthy years so there is a cushion of funds to pay health expenses later.

Health Savings Accounts are not a substitute for health care insurance. The health care system in the USA is so exorbitantly expensive only the very richest could save enough even for relatively minor health needs that are free to all citizens in most rich countries. HSA are legally available to you without health insurance but doing without health insurance in the USA is a disastrous personal financial action in the USA.

And the system is even worse in having ludicrously high charges that all insurance companies get huge discounts on. But if you try to use the USA health system without insurance the unconscionable charges that no insurance company pays will be billed to you. Even if your insurance company paid nothing, the reduction in fees just due to providers not charging the massive uninsured premium charges is critical.

Your HSA contribution is taken out of your paycheck on a pre-tax basis and grows tax deferred.

Withdrawals from an HSA for qualified medical expenses are free from federal income tax. At age 65, you can withdraw money from the HSA to use in retirement for expenses not related to health care. You will owe taxes at this time, but no penalty.

Related: 2015 Health Care Price Report, Costs in the USA and Elsewhere – Health Insurance Considerations for Digital Nomads – Personal Finance Basics: Health Insurance

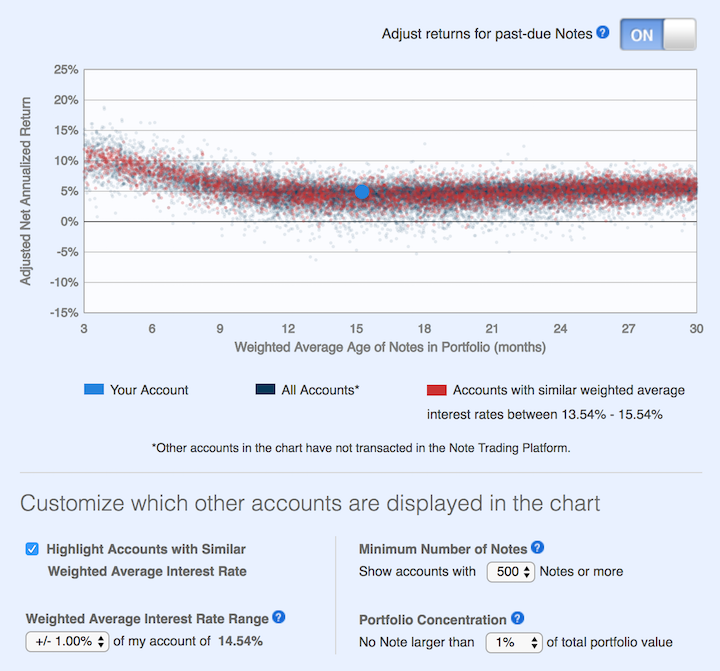

I have decided to wind down my investment test with LendingClub. I should end up with a investment return of about 5% annually. So it beat just leaving the money in the bank. But returns are eroding more recently and the risk does not seem worth the returns.

Early on I was a bit worried by how often the loan defaulted with only 0, 1 or 2 payments made. Sure, there are going to be some defaults and sometimes in extremely unlucky situation it might happen right away. But the amount of them seems to me to indicate LendingClub fails to do an adequate job of screening loan candidates.

Over time the rates LendingClub quoted for returns declined. The charges to investors for collecting on late loans were very high. It was common to see charges 9 to 10 times higher as the investor than were charged to the person that took out the loan and made the late payment.

For the last 6 months my account balance has essentially stayed the same (bouncing within the same range of value). I stopped reinvesting the payments received from LendingClub loans several months ago and have begun withdrawing the funds back to my account. I will likely just leave the funds in cash to increase my reserves given the lack of appealing investment options (and also a desire to increase my cash position in given my personal finances now and looking forward for the next year). I may invest the funds in dividend stocks depending on what happens.

This chart shows lending club returns for portfolios similar to mine. As you can see a return of about 5% is common (which is about where I am). Quite a few more than before actually have negative returns. When I started, my recollection is that their results showed no losses for well diversified portfolios.

The two problems I see are poor underwriting quality and high costs that eat into returns. I do believe the peer to peer lending model has potential as a way to diversify investments. I think it can offer decent rates and provide some balance that would normally be in the bond portion of a portfolio allocation. I am just not sold on LendingClub’s execution for delivering on that potential good investment option. At this time I don’t see another peer to peer lending options worth exploring. I will be willing to reconsider these types of investments at a later time.

I plan to just withdraw money as payments on made on the loans I participated in through LendingClub.

Related: Peer to Peer Portfolio Returns and The Decline in Returns as Loans Age (2015) – Investing in Peer to Peer Loans – Looking for Yields in Stocks and Real Estate (2012) – Where to Invest for Yield Today (2010)

We have written about the massive changes in manufacturing globally over the last few decades. As we have shown, the data shows that the USA remained the largest manufacturer until 2010 when China finally took over as the largest.

The massive declines in manufacturing employment were global. It led many to believe jobs were moving from the USA to China but much more accurately jobs were being eliminated everywhere. China lost more manufacturing jobs than the USA during the 1990s and early 2000s.

The manufacturing job losses have been caused by productivity improvements. And those productivity improvements have provided us much cheaper access to manufacturing goods. That continued downward pressure on prices has been a big factor in the drastic decline in inflation. The threat of excessive inflation, which was so feared in the 1980s, has been replaced by the opposite problem – the threat of deflation.

One aspect of the productivity improvement has been the global supply chains that have allowed companies to increase efficiency. The requirements of managing global supply chains are extremely complex and likely would not be possible without software to aid in the complex task.

In his book, The Great Convergence, Richard Baldwin discussed how important the decline in shipping costs had in the economics of the last 50 years (we wrote about this book in: Historical Global Economic Data and Current Issues for Globalization). Those declines in prices, aided by other factors, increased the importance of supply chains.

The last few decades have also seen dramatic changes in supply chains due to the internet. The time from manufacture to consumer has been shaved by direct shipment to consumers and nearly direct shipment to consumers via companies such as Amazon. Again software plays a central role in tying the manufacturing floor to a nearly instantaneous status of incoming orders from end users. Or in the case of software and entertainment, companies like Apple and Netflix have replaced the entire supply chain of manufacturing physical goods (DVDs, CDs…) with software.

These changes in addition to increasing efficiency are again decreasing jobs by increasing the efficiency of the economy. These changes cause harm to those that are being squeezed (both employees and companies) while the economy overall gets more goods at lower prices to consumers.

This post lists the 20 publicly traded companies with the largest market capitalization as of today. Since my February 2016 list of the 20 most valuable stocks many of the market caps have increased significantly.

| Company | Country | Market Capitalization | |

|---|---|---|---|

| 1 | Apple | USA | $825 billion |

| 2 | Alphabet (GOOGL) | USA | $652 billion |

| 3 | Microsoft | USA | $525 billion |

| 4 | Amazon | USA | $466 billion |

| 5 | USA | $437 billion | |

| 6 | Berkshire Hathaway | USA | $403 billion |

| 7 | Exxon Mobil | USA | $350 billion |

| 8 | Johnson & Johnson | USA | $334 billion |

| 9 | Samsung | Korea | $316 billion** |

| 10 | Tencent | China | $314 billion* |

Apple gained an amazing $284 billion in market cap since my February 2016 post. Only 12 companies (including Apple) are worth more than $284 billion. Amazon soared $204 billion (a 78% increase). Alphabet (Google) gained $156 billion in market cap.

Samsung soared $163 billion (a 107% gain) and Tencent soared $144 billion (a 85% gain) to move from outside the top 20 to become the 9th and 10th most valuable companies and the most valuable based outside the USA.

Facebook gained $126 billion and Microsoft gained $117 billion. GE lost $60 billion to drop out of the top ten. Wells Fargo also dropped out of the top 10.

The next ten most valuable companies:

| Company | Country | Market Capitalization | |

|---|---|---|---|

| 11 | JPMorgan Chase | USA | $308 billion |

| 12 | Alibaba | China | $298 billion |

| 13 | Wells Fargo | USA | $261 billion |

| 14 | Industrial & Commercial Bank of China | China | $258 billion* |

| 15 | Nestle | Switzerland | $253 billion |

| 16 | GE | USA | $240 billion |

| 17 | Bank of America | USA | $238 billion |

| 18 | Roche | Switzerland | $231 billion |

| 19 | Walmart | USA | $228 billion |

| 20 | China Mobile | China | $225 billion* |

Market capitalization shown are of the close of business May 12th, as shown on Google Finance.

In the 20 most valuable companies list there are 13 USA companies, 4 Chinese companies, 2 Swiss companies and 1 Korean company.

Alibaba (China) soared $131 billion (78%) and climbed to the 11th spot (from outside the top 20 last time). Bank of America soared $105 billion (up 79%).

Verizon was one of 2 companies in the top 20 to lose value in the period, Verizon declined $23 billion (over 10%) and dropped out of the top 20.

The total value of the top 20 gained $1.3 trillion since my February, 2016 post: growing from $5.9 trillion to $7.2 trillion. Remember, the companies making up the top 20 has changed.

Related: Global Stock Market Capitalization from 2000 to 2012 – Stock Market Capitalization by Country from 1990 to 2010 – Historical Stock Returns

A few other companies of interest (based on their market capitalization):

Read more

I have written before about one of the most important changes I believe is needed in thinking about investing over the last few decades: Historical Stock Returns.

My belief is that there has been a fundamental change in the valuation of stocks. Long term data contains a problem in that we have generally realized that stocks are more valuable than realized 100 years ago. That means a higher based PE ratio is reasonable and it distorts at what level stocks should be seen as very overpriced.

It also depresses expected long term returns, see my original post for details.

Jeremy Grantham: The Rules Have Changed for Value Investors

Since 2000, it’s become much more complicated. The rules have shifted. We used to say that this time is never different. I think what has happened from 2000 until today is a challenge to that. Since 1998, price-earnings ratios have averaged 60 percent higher than the prior 50 years, and profit margins have averaged 20 to 30 percent higher. That’s a powerful double whammy.

Diehard Ben Grahamites underestimated what earnings and stock prices would do. That began to be a drag after 1998.

I believe he is right. I believe in the value of paying attention to historical valuation and realizing markets often go to extremes. However, if you don’t account for a fundamental shift in valuation you see the market as overvalued too often.

So why have prices risen so high without a hint of euphoria — at least until very recently — or a perfect economy? My answer is that the discount rate structure has dropped by two percentage points. The yield on stocks is down by that amount and bonds too. The market has adjusted, reflecting low rates, low inflation and high profit margins.

Again I agree. Our political parties have aided big business in undermining market through monopolistic market control and that has been consistent (and increasing) for decades now. It makes stocks more valuable. They have moats due to their monopolistic position. And they extract economic rents from their customers (granted they put a large amount of those ill gotten gains into executives pockets but even so they gains are large enough to increase the value of the stocks).

On top of these strong forces we have the incredible interest rate conditions of the last decade. This is the one that is most worrisome for stock values in my opinion. It servers to boost stock prices (due to the poor returns for interest bearing investments). And I worry at some point this will change.

There is also likely at some point to be a political return to the value of capitalism and allowing free markets to benefit society. But for now we have strong entrenched political parties in the USA that have shown they will undermine market forces and provide monopolistic pricing power to large companies that provide cash to politicians and parties in order to have those parties undermine the capitalist market system.

I believe the stock market in the USA today may well be overvalued. I don’t think it is quite as simple as some of the measures (CAPE – cyclical adjusted PE ratio or market value to USA GDP) make it out to be though. As I have said for several years, I believe we are currently living through one of the more challenging investment climates (for long term investors seeking to minimize long term risk and make decent returns over the long term). I still think it is best just to stick with long term portfolio diversification strategies (though I would boost cash holdings and reduce bonds). And since I am normally light on bonds and high on stocks, for someone like me reducing stock holding for cash is also reasonable I believe (but even doing this I am more in stocks than most portfolio allocations would suggest).

Related: Monopolies and Oligopolies do not a Free Market Make – Misuse of Statistics, Mania in Financial Markets – Interview with Investing Blogger John Hunter

The Great Convergence by Richard Baldwin makes some interesting points about “globalization.” I actually find the long term history the most interesting aspect. It is very easy for people today to forget the recently rich “West” has not always been so dominant.

That shows how quickly things changed. The industrialization of Europe and the USA was an incredibly powerful global economic force. The rapid economic gains of Japan, Korea, Singapore, China and India in the last 50 years should be understood in the context of the last 200 years not just the last 100 years.

A central point Richard advocates for in the book is realizing that the current conditions are different from the conditions in which traditional economic theory (including comparative advantage) hold. The reasoning and argument for this claim are a bit too complex to make sensibly in this post but the book does that fairly well (not convincingly in my opinion, but enough to make the argument that we can’t assume traditional economic theory for international trade is completely valid given the current conditions).

I don’t expect this blog post to convince people. I don’t even think his book will. But he makes a case that is worth listen to. And I believe he is onto something. I have for years been seeing the strains of “comparative advantage” in our current world economy. That doesn’t mean I am not mainly a fan of freer trade. I am. I don’t think complex trade deals such as TPP are the right move. And I do think more care needs to be taken to consider current economic conditions and factor that into our trade policies.

Richard Baldwin uses 3 costs and the economic consequences of those changing over time to show globalizations history, where we are today and where we are going.

It isn’t very easy to follow but the book provides lots of explanation for the dramatic consequences of these costs changing over time.

One of his themes is that mobility of labor is still fairly costly. It isn’t easy to move people from one place to another. Though he does discuss how alternatives that are similar to this (for example telepresence and remote controlled robots to allow a highly technical person to operate remotely) without actually do moving the person are going to have huge economic consequences.

The “high spillovers” are the positive externalities that spin off of a highly knowledgable workforce.

As usual the 2016 Letter to Berkshire Hathaway shareholders by Warren Buffet provides great thoughts for investors.

American business – and consequently a basket of stocks – is virtually certain to be worth far more in the years ahead. Innovation, productivity gains, entrepreneurial spirit and an abundance of capital will see to that. Ever-present naysayers may prosper by marketing their gloomy forecasts. But heaven help them if they act on the nonsense they peddle.

Warren is not a fan of market timing, for good reason. I do think he may be a bit overly-optimistic. It is not something innate about the geography of the USA that means whoever is within that area will prosper over the long term. Our actions as a society materially impact our long term success. Yes, we have done very well economically and we have many factors continuing to make that likely to continue. But it is not certain.

Those willing to challenge rosy projections serve a useful purpose. But investors must be careful not to lose out on gains. Timing the market is rarely successful. Even in the cases where people do reasonable well getting out of a highly priced market they often fail to get back into the market until after they lose money on the effort (they may save a bit on the downside but then don’t get back in until they missed more upside than they saved on the downside).

- understand all exposures that might cause a policy to incur losses;

- conservatively assess the likelihood of any exposure actually causing a loss and the probable cost if it does;

- set a premium that, on average, will deliver a profit after both prospective loss costs and operating expenses are covered; and

- (4) be willing to walk away if the appropriate premium can’t be obtained.

Many insurers pass the first three tests and flunk the fourth. They simply can’t turn their back on business that is being eagerly written by their competitors. That old line, “The other guy is doing it, so we must as well,” spells trouble in any business, but in none more so than insurance.

Must of Berkshire Hathaway’s success is due to what seem like fairly easy things to do. For example, what Warren discusses here. This reinforces a point that is often overlooked which is the management philosophy that has helped Berkshire Hathaway achieve their success. Every year Warren Buffett praises the senior managers at various Berkshire Hathaway companies for good reason.

The fairly simple idea of hiring trustworthy, capable and ethical people and giving them freedom to manage for the long term seems too easy to provide an advantage. But it does. Warren Buffett is very careful to pick people that are more concerned with providing value to customers over the long term than promoting themselves and seeking massive short term rewards for themselves. This simple act of hiring people that are willing to put customers and shareholders before themselves allows your organizations to function in its long term best interest.

In so many other companies short term incentives destroy value (Warren’s point 4 above). This failure can extend to companies Warren is significantly invested in: such as the long term and deep seeded mismanagement at Wells Fargo due to very poor leadership at that company for years. But in general, Berkshire Hathaway is much better at avoiding these toxic behaviors driven by very poor executive leadership when compared to other companies.

The importance of Berkshire Hathaway focusing on the long term and not getting distracted by short term financial measures is vastly under-appreciated.

By focusing managers and CEOs on actually running the business Berkshire Hathaway again does well compared to their competitors. Far too many companies spend the time of executives on playing financial games to divert huge payments to themselves that they then try to claim are not really costs. This is enormously costly to investors and our economy.

Diversification and keeping down fees are the investing strategies that will help more investors than anything else.

Related: Warren Buffett’s 2011 Letter to Shareholders – Warren Buffett’s 2010 Letter to Shareholders – Warren Buffett’s 2005 Shareholder Letter

Even though there are plenty of ways to improve the economic conditions for most people today is very good compared to similar people 50 years ago. There are a few, small population segments that there are arguments for being worse off, but these are a tiny percentage of the global population.

However, we humans often compare ourselves to whoever is better off than us and feel jealous. So instead of appreciating good roads, food, shelter, health care, etc. we see where things could be better (either our parents had it a bit better or these people I see on TV or in this other country, etc.). It is good to see how we could improve if we then take action to improve. To just be frustrated that others have it better doesn’t do any good, it doesn’t seem to me.

There are significant ways governments can help or hinder the economic well being of their citizens. I am a big believer in the power of capitalism to provide wealth to society. That isn’t the same as supporting the huge push to “crony capitalism” that many of the political parties throughout the world are promoting. The “capitalism” in that phrase exists for alliteration, the real meaning is the word crony.

street scene in Seoul, South Korea (photo by John Hunter)

These Are the World’s Most Innovative Economies

These type of rankings are far from accurate, what does most innovative really mean? But they do provide some insight and I think those at the top of the list do have practices worth examining. And I do believe those near the top of this list are doing a better job of providing for the economic future of their citizens than other countries. But the reality is much messier than a ranking illustrates.

With that in mind the ranking shows

- Korea

- Sweden

- Germany

- Switzerland

- Finland

- Singapore

- Japan

- Denmark

- USA

One thing that is obvious is the ranking is very biased toward already rich countries. When you look at the measures they use to rank it is easy to see this is a strong bias with their method.

China is 21st. Malaysia is 23rd and an interesting country doing very well compared to median income (I am just guessing without actually plotting data). Hong Kong is 35th, which is lower than I imagine most people would have predicted. Thailand is 44th. Brazil is 46th and even with their problems seems low. Brazil has a great deal of potential if they can take care of serious problems that their economy faces.

In a previous post I examined the GDP Growth Per Capita for Selected Countries from 1970 to 2010, Korea is the country that grew the most (not China, Japan, Singapore…).

Related: Leading Countries for Economic Freedom: Hong Kong, Singapore, New Zealand, Switzerland – Economic Consequences Flow from Failing to Follow Real Capitalist Model and Living Beyond Our Means – Easiest Countries in Which to Operate a Businesses (2011)