I have written before about one of the most important changes I believe is needed in thinking about investing over the last few decades: Historical Stock Returns.

My belief is that there has been a fundamental change in the valuation of stocks. Long term data contains a problem in that we have generally realized that stocks are more valuable than realized 100 years ago. That means a higher based PE ratio is reasonable and it distorts at what level stocks should be seen as very overpriced.

It also depresses expected long term returns, see my original post for details.

Jeremy Grantham: The Rules Have Changed for Value Investors

Since 2000, it’s become much more complicated. The rules have shifted. We used to say that this time is never different. I think what has happened from 2000 until today is a challenge to that. Since 1998, price-earnings ratios have averaged 60 percent higher than the prior 50 years, and profit margins have averaged 20 to 30 percent higher. That’s a powerful double whammy.

Diehard Ben Grahamites underestimated what earnings and stock prices would do. That began to be a drag after 1998.

I believe he is right. I believe in the value of paying attention to historical valuation and realizing markets often go to extremes. However, if you don’t account for a fundamental shift in valuation you see the market as overvalued too often.

So why have prices risen so high without a hint of euphoria — at least until very recently — or a perfect economy? My answer is that the discount rate structure has dropped by two percentage points. The yield on stocks is down by that amount and bonds too. The market has adjusted, reflecting low rates, low inflation and high profit margins.

Again I agree. Our political parties have aided big business in undermining market through monopolistic market control and that has been consistent (and increasing) for decades now. It makes stocks more valuable. They have moats due to their monopolistic position. And they extract economic rents from their customers (granted they put a large amount of those ill gotten gains into executives pockets but even so they gains are large enough to increase the value of the stocks).

On top of these strong forces we have the incredible interest rate conditions of the last decade. This is the one that is most worrisome for stock values in my opinion. It servers to boost stock prices (due to the poor returns for interest bearing investments). And I worry at some point this will change.

There is also likely at some point to be a political return to the value of capitalism and allowing free markets to benefit society. But for now we have strong entrenched political parties in the USA that have shown they will undermine market forces and provide monopolistic pricing power to large companies that provide cash to politicians and parties in order to have those parties undermine the capitalist market system.

I believe the stock market in the USA today may well be overvalued. I don’t think it is quite as simple as some of the measures (CAPE – cyclical adjusted PE ratio or market value to USA GDP) make it out to be though. As I have said for several years, I believe we are currently living through one of the more challenging investment climates (for long term investors seeking to minimize long term risk and make decent returns over the long term). I still think it is best just to stick with long term portfolio diversification strategies (though I would boost cash holdings and reduce bonds). And since I am normally light on bonds and high on stocks, for someone like me reducing stock holding for cash is also reasonable I believe (but even doing this I am more in stocks than most portfolio allocations would suggest).

Related: Monopolies and Oligopolies do not a Free Market Make – Misuse of Statistics, Mania in Financial Markets – Interview with Investing Blogger John Hunter

Even though there are plenty of ways to improve the economic conditions for most people today is very good compared to similar people 50 years ago. There are a few, small population segments that there are arguments for being worse off, but these are a tiny percentage of the global population.

However, we humans often compare ourselves to whoever is better off than us and feel jealous. So instead of appreciating good roads, food, shelter, health care, etc. we see where things could be better (either our parents had it a bit better or these people I see on TV or in this other country, etc.). It is good to see how we could improve if we then take action to improve. To just be frustrated that others have it better doesn’t do any good, it doesn’t seem to me.

There are significant ways governments can help or hinder the economic well being of their citizens. I am a big believer in the power of capitalism to provide wealth to society. That isn’t the same as supporting the huge push to “crony capitalism” that many of the political parties throughout the world are promoting. The “capitalism” in that phrase exists for alliteration, the real meaning is the word crony.

street scene in Seoul, South Korea (photo by John Hunter)

These Are the World’s Most Innovative Economies

These type of rankings are far from accurate, what does most innovative really mean? But they do provide some insight and I think those at the top of the list do have practices worth examining. And I do believe those near the top of this list are doing a better job of providing for the economic future of their citizens than other countries. But the reality is much messier than a ranking illustrates.

With that in mind the ranking shows

- Korea

- Sweden

- Germany

- Switzerland

- Finland

- Singapore

- Japan

- Denmark

- USA

One thing that is obvious is the ranking is very biased toward already rich countries. When you look at the measures they use to rank it is easy to see this is a strong bias with their method.

China is 21st. Malaysia is 23rd and an interesting country doing very well compared to median income (I am just guessing without actually plotting data). Hong Kong is 35th, which is lower than I imagine most people would have predicted. Thailand is 44th. Brazil is 46th and even with their problems seems low. Brazil has a great deal of potential if they can take care of serious problems that their economy faces.

In a previous post I examined the GDP Growth Per Capita for Selected Countries from 1970 to 2010, Korea is the country that grew the most (not China, Japan, Singapore…).

Related: Leading Countries for Economic Freedom: Hong Kong, Singapore, New Zealand, Switzerland – Economic Consequences Flow from Failing to Follow Real Capitalist Model and Living Beyond Our Means – Easiest Countries in Which to Operate a Businesses (2011)

My comments on a post by Kiva about their decision to end the Kiva Zip (direct to people loans – no intermediary financial institution) program in Kenya.

I do think it is very important to retain an infrastructure for those people you got to try the new effort with, as I believe Kiva will. This has to be part of any innovation efforts – a budget to include unwinding the effort in a way that is in keeping with Kiva’s mission to help people. I strongly believe in efforts to avoid abandoning those who worked with you in general, but for those taking loans from Kiva it is much more important than normal.

Keep up the good work. And keep challenging Kiva to get better and not get complacent when things are not going as well as they should. I am happy to continue to lend to Kiva but I also am concerned that the focus on making a difference and making people’s lives better can be lost in the desire to grow.

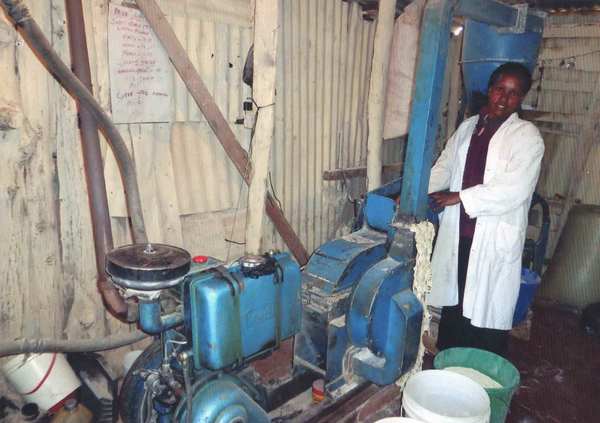

I made a loan via Kiva zip for Hilda to buy a posho mill machine. The loan was repaid in full.

The Curious Cats group on Kiva has made over $27,000 in loans to entrepreneurs around the world (the way Kiva works the groups, they don’t include Kiva Zip loans). You can join us. I believe in the model of micro-finance (Investing in the Poorest of the Poor [this one is grants instead of loans]), though I also believe we need more data on real experience of borrowers. Kiva Zip gives loans directly to people with a 0% interest rate. Normal Kiva loans have financial institutions (some of which are charities but they still have expenses) make the loans and Kiva lenders provide capital (at 0%) but the borrowers have to pay interest (the idea is they pay lower interest since the financial institution has a 0% cost of capital).

Related: Kiva Loans to Entrepreneurs in Columbia, India and Kenya – Kiva Loans Give Entrepreneurs a Chance to Succeed (2011) – Using Capitalism to Create Better Lives in Mali (2009)

This richest 1% continue to take advantage of economic conditions to amass more and more wealth at an astonishing rate. These conditions are perpetuated significantly by corrupt politicians that have been paid lots of cash by the rich to carry out their wishes.

One thing people in rich countries forget is how many of them are in the 1% globally. The 1% isn’t just Bill Gates and Warren Buffett. 1% of the world’s population is about 72 million people (about 47 million adults). Owning $1 million in assets puts you in the top .7% of wealthy adults (Global Wealth Report 2013’ by Credit Suisse). That report has a cutoff of US $798,000 to make the global 1%. They sensibly only count adults in the population so wealth of $798,000 puts you in the top 1% for all adults.

$100,000 puts you in the top 9% of wealthiest people on earth. Even $10,000 in net wealth puts you in the top 30% of wealthiest people. So while you think about how unfair it is that the system is rigged to support the top .01% of wealthy people also remember it is rigged to support more than 50% of the people reading this blog (the global 1%).

I do agree we should move away from electing corrupt politicians (which is the vast majority of them in DC today) and allowing them to continue perverting the economic system to favor those giving them lots of cash. Those perversions go far beyond the most obnoxious favoring of too-big-to-fail banking executives and in many ways extend to policies the USA forces on vassal states (UK, Canada, Australia, France, Germany, Japan…) (such as those favoring the copyright cartel, etc.).

Those actions to favor the very richest by the USA government (including significantly in the foreign policy – largely economic policy – those large donor demand for their cash) benefit the global 1% that are located in the USA. This corruption sadly overlays some very good economic foundations in the USA that allowed it to build on the advantages after World War II and become the economic power it is. The corrupt political system aids the richest but also damages the USA economy. Likely it damages other economies more and so even this ends up benefiting the 38% of the global .7% that live in the USA. But we would be better off if the corrupt political practices could be reduced and the economy could power economic gains to the entire economy not siphon off so many of those benefits to those coopting the political process.

The USA is home to 38% of top .7% globally (over $1,000,000 in net assets).

| country | % of top .7% richest | % of global population |

|---|---|---|

| USA | 38.3% | 4.5% |

| Japan | 8.6% | 1.8% |

| France | 7.5% | .9% |

| UK | 6.1% | .9% |

| Germany | 5.9% | 1.1% |

| other interesting countries | ||

| China | 3.4% | 19.2% |

| Korea | 1% | .7% |

| Brazil | .6% | 2.8% |

| India | .5% | 17.5 |

| Indonesia | .3% | 3.5% |

Oxfam published a report on these problems that has some very good information: Political capture and economic inequality

I like charity that provides leveraged impact. I like charity that is aimed at building long term improvement. I like entrepreneurship. I like people having work they enjoy and can be proud of. And I like people having enough money for necessities and some treats and luxuries.

I think sites like oDesk provide a potentially great way for people to lead productive and rewarding lives. They allow people far from rich countries to tap into the market demand in rich counties. They also allow people to have flexible work arrangements (if someone wants a part time job or to work from home that is fine).

These benefits are also true in the USA and other rich countries (even geography – there are many parts of the USA without great job markets, especially many rural areas). The biggest problem with rich country residents succeeding on something like oDesk is they need quite a bit more money than people from other countries to get by (especially in the USA with health care being so messed up). There are a great deal of very successful technology people on oDesk (and even just freelancing in other ways), but it is still a small group that is capable and lucky enough to pull in large paychecks (it isn’t only technology but that is the majority of high paying jobs I think on oDesk).

But in poor countries with still easily 2 billion and probably much more there is a huge supply of good workers. There is a demand for work to be done. oDesk does a decent job of matching these two but that process could use a great deal of improvement.

I think if I became mega rich one of the projects I would have would be to create an organization to help facilitate those interested in internet based jobs in poor countries to make a living. It takes hard work. Very good communication is one big key to success (I have repeatedly had problems with capable people just not really able to do what was expected in communications). I think a support structure to help with that and with project management would be very good. Also to help with building skills.

If I were in a different place financially (and I were good at marketing which I am not) I would think about creating a company to do this profitably. The hard part for someone in a rich country to do this is that either they have to take very little (basically do it as charity) or they have to take so much cash off the top that I think it makes it hard to build the business.

But building successful organizations that can grow and provide good jobs to those without many opportunities but who are willing to work is something I value. I did since I was a kid living in Nigeria (for a year). I didn’t see this solution then but the idea of economic well being and good jobs and a strong economy being the key driver to better lives has always been my vision.

This contrast to many that see giving cash and good to those in need as good charity. I realize sometimes that is what is needed – especially in emergencies. But the real powerful change comes from strong economy providing people the opportunity to have a great job.

I share Dr. Deming’s personal aim was to advance commerce, prosperity and peace.

Related: Commerce Takes More People Out of Poverty Than Aid – Investing in the Poorest of the Poor – I am a big fan of helping improve the economic lives of those in the world by harnessing appropriate technology and capitalism – A nonprofit in Queens taught people to write iPhone apps — and their incomes jumped from $15k to $72k

Bono (who is fairly well known 🙂 as the lead singer for U2): “Commerce — entrepreneurial capitalism — takes more people out of poverty than aid, of course, we know that.”

That is my belief and something I believe in strongly. Real capitalism will bring people out of poverty. That isn’t the same thing as any businesses will do that. Businesses that use monopolistic powers to extract benefits to themselves and suppress free markets may well do more damage than good. But we will continue to bring more people out of poverty through economic development and capitalism than through aid.

Related: Helping Capitalism Make the World Better – Kiva – Giving Entrepreneurs an Opportunity to Succeed – Dr. Deming’s personal aim was to advance commerce, prosperity and peace – Business 901 Podcast with Me: Deming’s Management Ideas Today – Monopolies and Oligopolies do not a Free Market Make

Bain Capital is a product of the Great Deformation by David Stockman

…

Except Mitt Romney was not a businessman; he was a master financial speculator who bought, sold, flipped, and stripped businesses. He did not build enterprises the old-fashioned way—out of inspiration, perspiration, and a long slog in the free market fostering a new product, service, or process of production. Instead, he spent his 15 years raising debt in prodigious amounts on Wall Street so that Bain could purchase the pots and pans and castoffs of corporate America, leverage them to the hilt, gussy them up as reborn “roll-ups,” and then deliver them back to Wall Street for resale—the faster the better.

That is the modus operandi of the leveraged-buyout business, and in an honest free-market economy, there wouldn’t be much scope for it because it creates little of economic value. But we have a rigged system—a regime of crony capitalism—where the tax code heavily favors debt and capital gains, and the central bank purposefully enables rampant speculation by propping up the price of financial assets and battering down the cost of leveraged finance.

So the vast outpouring of LBOs in recent decades has been the consequence of bad policy, not the product of capitalist enterprise.

I abhor the subsidies provided to those that saddle corporations (that build up value through decades of hard work by employees) with huge debt. The actions of leveraged by out firms are atrocious. They seek to pretend that business is once again the land of the amoral behavior, as the robber barron’s sought to convince society of long ago. Those that saddle corporations (that have an obligation to those that built them up) with huge debt are despicable.

Those same despicable people then take huge amounts of cash (for themselves) from the debt they saddled the corporation with.

Quite a few smart people have figured out how to pay congress to allow those smart people to take huge profits out of businesses. By being smart enough to have congress create laws to allow their behavior they can say it was just doing what the law allowed. When you conspire with the authorities to create a system to drain cash from legitimate businesses into your pocket you can claim you are acting legally (if you do so by having them change the law, instead of having them just ignore the existing laws). But what is being done (for decades by both parties) by those we continue to elect to allow this behavior shows just how corrupt the system is.

It is sad we allow those politicians who payoff those that give them large amount of cash, at the expense of our society, to remain in office. But we don’t even discuss the issues in any significant sense. Those using this cronyism and corruption know they are continuing to be given the open door to continue their very destructive ways. These are smart people. They know how to use public apathy and rhetoric to keep from discussing the important issues. It is going to take us to stop the corrupting cronyism that has taken over our political parties.

Related: Too Much Leverage Killed Mervyns – Failed Executives Use Leverage to Increase Their Pay, Let Others Bailouts Later – Executives Treating Corporate Treasuries as Their Money, A Sad State of Affairs – CEOs Plundering Corporate Coffers – Leverage, Complex Deals and Mania – Looting: Bankruptcy for Profit

I have donated more to Tricke Up than any other charity for about 20 years now. There is a great deal of hardship in the world. It can seem like what you do doesn’t make a big dent in the hardship. But effective help makes a huge difference to those involved.

My personality is to think systemically. To help put a band aid on the current visible issue just doesn’t excite me. Lots of people are most excited to help whoever happens to be in their view right now. I care much more about creating systems that will produce benefits over and over into the future. This view is very helpful for an investor.

Trickle Up invests in helping people create better lives for themselves. It provides some assistance and “teaches people to fish” rather than just giving them some fish to help them today.

The stories in this video show examples of the largest potential for entrepreneurship. While creating a few huge visible successes (like Google, Apple…) is exciting the benefits of hundreds of millions of people having small financial success (compared to others) but hugely personally transforming success is more important. Capitalism is visible in these successes. What people often think of as capitalism (Wall Street) has much more resonance with royalty based economic systems than free market (free of market dominating anti-competitive and anti-market behavior) capitalism.

Related: Kiva Loans Give Entrepreneurs a Chance to Succeed – Micro-credit Research – Using Capitalism in Mali to Create Better Lives

I am frustrated that we have largely allowed those that don’t believe in capitalism to claim their beliefs are capitalist. I believe capitalism is the best system to provide economic gain to human society. When we allow non-capitalist to claim their ideas are capitalist we often lose by allowing bad policies to be adopted and failing to adopt more capitalist ideas.

Robber barons and their ilk are not capitalists. Those attacked today as capitalists are much more like European nobility that fought to let the nobility take most of the economic profit from everyone else.

Capitalism is a wonderful thing.

The foolish economic policies the politicians we have elected over and over again for decades are idiotic and not capitalist (they are somewhat capitalist but the things people are complaining about are not capitalism but the corruption of the system by those subverting capitalism). They are the result of favoring cronyism and bribery over capitalist regulated markets.

What we need to do is not throw out the capitalists. We need to actually throw out those that say their cronyistic policies are capitalist.

Capitalism is an economic system designed to achieve economic gain for a society. Adam Smith (and others) understood that if those with power to destroy the functioning of markets (for personal gain) were allowed to do so then the benefits capitalism can produce are reduced. And they definitely would try to (according to the believes fundamental to the capitalist model) so a capitalist system has to account for that.

“Free” markets are good. But in capitalism “free” markets means markets where no entity has “market” power – that is the ability to move the market. This is the idea of perfect competition. In the real world this doesn’t happen but capitalist understand the weakness of unfree markets and that has to be dealt with. Things start to get messy here. There is no perfect way to do this and I don’t know of anyone (that I don’t think is naive) that thinks this can be done in some way that avoid economic friction (loss to the society from what is possible in some ideal state).

Now those that like cronyism and letting whoever has the clout do whatever they want have tried to say capitalism means doing whatever you want to get as much capital as you want. It doesn’t. Capitalism isn’t about letting whoever has the gold get more. It is an economic system to provide gain to society by setting up rules that result in market forces brining benefit to society.

Those thinking about setting up the rules for a capitalist system understood that many people are going to try and get away with taking what isn’t theirs. So you have to enforce the rule of law. You have to prevent those that seek to destroy markets and take personal gains they should not be able to (due to being allowed to collude with other market players, collude with politicians to gain political concessions that destroy market functions…).

I happen to believe capitalism is the best economic system we have by far.

I happen to believe those that have increasingly turned out system into one where croynism is destroying markets to give gains to a few parties dominates are creating great damage. But the problem is not that these people show capitalism is bad. Instead these people show the dangers of not putting in the effort to retain capitalist ideas: your economy suffers and people suffer.

Manuel De Jesus, miller and farmer in El Salvador, will use his loan to buy parts for this milling euipment.

There is a great deal focus recently on the “99%” (via occupy wall street and the like). The truth is these are mainly about the 5% or 10% (those rich, but not quite as rich as the richest 1% – and much further from the richest than they were a few decades ago). As I have written before, most of those in the USA (also Europe, Japan…) are rich (though this is changing, a greater percentage of the USA is not rich, looking globally, than maybe any point since the 1930s).

We get confused because many near us are even richer and think that means the rest of us are very poor. But those in the USA are often in the 5% or 10% – not the 30% or 60% or 90% they seem to think they are. $50,000 in annual income puts you in the top 1% globally. $25,000 puts you in the top 10%.

I agree with the desire to reduce the political and market corruption, as I have written for years.

For the 99% (or the 90% anyway), I really think the best things are government policies that reduce corruption and increase market forces. Letting actually capitalism work instead of political and corporate cronyism failing to let markets work as they should. Also giving education and the chance to build a better life for yourself are important. Thankfully many countries have been doing very well on this front: Singapore, Korea, Brazil, Ghana, China… That doesn’t mean there are not huge issues to still address for most of the 90%, there are.

Microfinance in general, and Kiva in particular, are one great way to help. Again it isn’t perfect. And those getting the loans are not given an easy life. They are given a chance to try and build there business to improve there economic condition. This isn’t a certain success. And I do worry that taking on too high an interest rate, or loan amount, can leave people worse off than before. But when looking at the system of microfinance I really like the opportunity it gives people, who haven’t been given many.

Those getting loans have to make smart personal finance and business decisions. If they do well they can greatly improve their financial situation. I made several more loans today, using money repaid by previous borrowers. I try to find loans where I am able to help fund a investment that will improve capacity (but that isn’t always possible) – a new machine that makes them more efficient for example. I also try to avoid loans where the interest rate is over 30% (which might seem very high, but rates below 20% are very rare given the economics of these loans – they are very costly to service). What Kiva does is provide the funds people like me lend as interest free loans to the partner banks. The idea is that this allows partner banks to provide more capital for loans (obviously) and at a lower rate because the bank isn’t having to pay interest on the funds.

My loans today went to: Mali, Honduras, Senegal, Ecuador, Togo, Philippines and in the photo above El Salvador. The Curious Cat Kivans group has now lent $12,925 in 320 loans. We now have 11 members, join up and help give people an opportunity to improve their economic condition.

Related: More Kiva Entrepreneur Loans: Kenya, Honduras, Armenia… – Using Capitalism in Mali to Create Better Lives – Funding Entrepreneurs in Nicaragua, Ghana, Viet Nam, Togo and Tanzania