This is a startling piece of data, from The nagging fear that QE itself may be causing deflation:

The situations have many differences, for example, China is a poor country growing rapidly, Japan was a rich country growing little (though in 1990 it showed more growth promise than today). Still this one of the more interesting pieces of data on how much a bubble China real estate has today. Japan suffered more than 2 decades of stagnation and one factor was the problems created by the real estate price bubble.

The global economic consequences of the extremely risky actions taken to bail out the failed too-big-too-fail banks including the massive quantitative easing are beyond anyones ability to really understand. We hope they won’t end badly that is all it amounts to. Noone can know how risky the actions to bail out the bankers is. The fact we not only bailed them out, but showered many billions of profit onto them (even after taking billions in fines for the numerous and continuing violations of law by those bailed out bankers), leaves me very worried.

It seems to me we have put enormous risk on and the main beneficiaries of the policies are the bankers that caused the mess and continue to violate laws without any consequences (other than taking a bit of the profit them make on illegal moves back sometimes).

The West ignored pleas for restraint at the time, then left these countries to fend for themselves. The lesson they have drawn is to tighten policy, hoard demand, hold down their currencies and keep building up foreign reserves as a safety buffer. The net effect is to perpetuate the “global savings glut” that has starved the world of demand, and that some say is the underlying of the cause of the long slump.

I hope things work out. But I fear the extremely risky behavior by the central banks and politicians could end more badly than we can even imagine.

Related: Continuing to Nurture the Too-Big-To-Fail Eco-system – The Risks of Too Big to Fail Financial Institutions Have Only Gotten Worse – USA Congress Further Aids The Bankers Giving Those Politicians Piles of Cash and Risks Economic Calamity Again – Investment Options Are Much Less Comforting Than Normal These Days

Looking at stock market capitalization by country gives some insight into how countries, and stocks, are doing. Looking at the total market capitalization by country doesn’t equate to the stock holdings by individuals in a country or the value of companies doing work in a specific country. Some countries (UK and Hong Kong, for example) have more capitalization based there than would be indicated by the size of their economy.

It is important to keep in mind the data is in current USA dollars, so big swings in exchange rates can have a big impact (and can cause swings to be exacerbated when they move in tandem with stock market movements – if for example the market declines by 15% and the currency declines by 10% against the US dollar those factors combine to move the result down).

The chart shows the top four countries based on stock market capitalization, with data from 200 to 2012. The chart created by Curious Cat Investing and Economics Blog may be used with attribution. Data from the World Bank.

As with so much recent economic data China’s performance here is remarkable. China grew from 1.8% of world capitalization in 2000 to 6.9% in 2012. And Hong Kong’s data is reported separately, as it normally is with global data sets. Adding Hong Kong to China’s totals would give 3.7% in 2000 with growth to to 8.9% in 2012 (Hong Kong stayed very stable – 1.9% in 2000, 2% in 2012). China alone (without HK) is very slightly ahead of Japan.

The first chart shows the largest 4 market capitalizations (2012: USA $18.6 trillion, China and Japan at $3.7 trillion and UK at $3 trillion). Obviously the dominance of the USA in this metric is quite impressive the next 7 countries added together don’t quite reach the USA’s stock market capitalization. I also including the data showing the global stock market capitalization divided by 3 (I just divide it by three to have the chart be more usable – it lets us see the overall global fluctuations but doesn’t cram all the other data in the lower third of the chart).

Canada is the 5th country by market capitalization (shown on the next chart) with $2 trillion. From 2000 to 2012 China’s market capitalization increased by $3.1 trillion. The USA increased by $3.6 trillion from a much larger starting point. China increased by 536% while the USA was up 23.5%. The world stock market capitalization increased 65% from 2000 to 2012.

Related: Stock Market Capitalization by Country from 1990 to 2010 – Government Debt as Percent of GDP 1998-2010 – Manufacturing Output by Country 1999-2011: China, USA, Japan, Germany

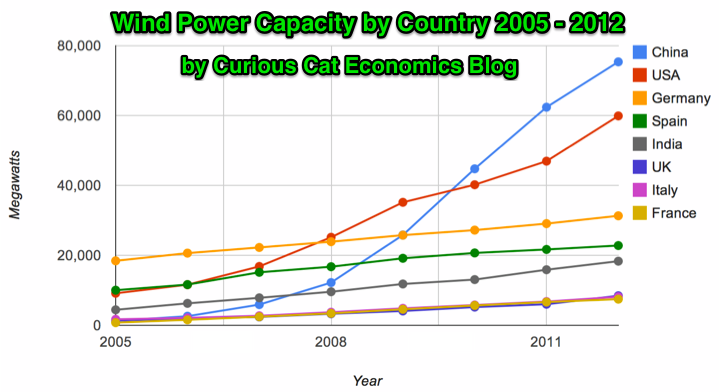

Global wind power capacity has increased 391% from 2005 to 2012. The capacity has grown to over 3% of global electricity needs.

Chart by Curious Cat Economics Blog using data from the Wind Energy Association. Chart may be used with attribution as specified here.

The 8 countries shown on the chart account for 82% of total wind energy capacity globally. From 2005 to 2012 those 8 countries have accounted for between 79 and 82% of total capacity – which is amazingly consistent.

Japan and Brazil are 13th and 15th in wind energy capacity in 2012 (both with just over one third of France’s capacity). Japan has increased capacity only 97% from 2005 to 2012 and just 13% from 2010 to 2012. Globally wind energy capacity increased 41% from 2010 to 2012. The leading 8 countries increased by 43% collectively lead by China increasing by 68% and the USA up by 49%. Germany added only 15% from 2010 through 2012 and Spain just 10%.

Brazil has been adding capacity quickly – up 170% from 2010 through 2012, by far the largest increase for a county with significant wind energy capacity. Mexico, 24th in 2012, is another country I would expect to grow above the global rate in the next 10 years (I also expect Brazil, India and Japan to do so).

In 2005 China accounted for 2% of wind energy capacity globally they accounted for 30% in 2012. The USA went from 15% to 24%, Germany from 31% to 12%, Spain from 17% to 9% and India from 8% to 7%.

Related: Global Wind Energy Capacity Exceeds 2.5% of Global Electricity Needs (2011) – Nuclear Power Generation by Country from 1985-2010 – Chart of Wind Power Generation Capacity Globally 2005 to 2012 (through June)

Printing money (and the newer fancier ways to introduce liquidity/capital) work until people realize the money is worthless. Then you have massive stagflation that is nearly impossible to get out from under. The decision by the European and USA government to bail out the too big to fail institutions and do nothing substantial to address the problem leaves an enormous risk to the global economy unaddressed and hanging directly over our heads ready to fall at any time.

The massively too big to fail financial institutions that exist on massive leverage and massive government assistance are a new (last 15? years) danger make it more likely the currency losses value rapidly as the government uses its treasury to bail out their financial friends (this isn’t like normal payback of a few million or billion dollars these could easily cost countries like the USA trillions). How to evaluate this risk and create a portfolio to cope with the risks existing today is extremely challenging – I am not sure what the answer is.

Of the big currencies, when I evaluate the USA $ on its own I think it is a piece of junk and wouldn’t wan’t my financial future resting on it. When I look at the other large currencies (Yen, Yuan, Euro) I am not sure but I think the USD (and USA economy) may be the least bad.

In many ways I think some smaller countries are sounder but smaller countries can very quickly change – go from sitting pretty to very ugly financial situations. How they will wether a financial crisis where one of the big currencies losses trust (much much more than we have seen yet) I don’t know. Still I would ideally place a bit of my financial future scattered among various of these countries (Singapore, Australia, Malaysia, Thailand, Brazil [maybe]…).

Basically I don’t know where to find safety. I think large multinational companies that have extremely strong balance sheets and businesses that seem like they could survive financial chaos (a difficult judgement to make) may well make sense (Apple, Google, Amazon, Toyota, Intel{a bit of a stretch}, Berkshire Hathaway… companies with lots of cash, little debt, low fixed costs, good profit margins that should continue [even if sales go down and they make less they should make money – which many others won’t]). Some utilities would also probably work – even though they have large fixed costs normally. Basically companies that can survive very bad economic times – they might not get rich during them but shouldn’t really have any trouble surviving (they have much better balance sheets and prospects than many governments balance sheets it seems to me).

In many ways real estate in prime areas is good for this “type” of risk (currency devaluation and financial chaos) but the end game might be so chaotic it messes that up. Still I think prime real estate assets are a decent bet to whether the crisis better than other things. And if there isn’t any crisis should do well (so that is a nice bonus).

Basically I think the risks are real and potential damage is serious. Where to hide from the storm is a much tricker question to answer. When in that situation diversification is often wise. So diversification with a focus on investments that can survive very bad economic times for years is what I believe is wise.

Related: Investing in Stocks That Have Raised Dividends Consistently – Adding More Banker and Politician Bailouts in Not the Answer –

Failures in Regulating Financial Markets Leads to Predictable Consequences – Charlie Munger’s Thoughts on the Credit Crisis and Risk – The Misuse of Statistics and Mania in Financial Markets

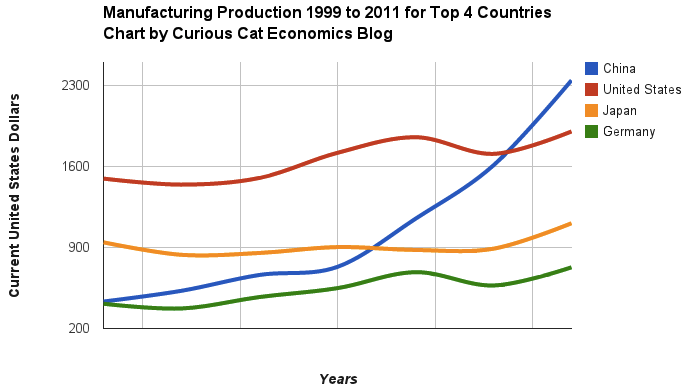

Chart of manufacturing production by China, USA, Japan and Germany from 1999 to 2011. The chart was created by the Curious Cat Economics Blog using UN data. You may use the chart with attribution. All data is shown in current USD (United States Dollar).

The story of global manufacturing production continues to be China’s growth, which is the conventional wisdom. The conventional wisdom however is not correct in the belief that the USA has failed. China shot past the USA, which dropped into 2nd place, but the USA still manufactures a great deal and has continually increased output (though very slowly in the last few years).

The story is pretty much the same as I have been writing for 8 years now. The biggest difference in that story is just that China actually finally moved into 1st place in 2010 and, maybe, the slowing of the USA growth in output (if that continues, I think the USA growth will improve). I said last year, that I expected China to build on the lead it finally took, and they did so. I expect that to continue, but I also wouldn’t be surprised to see China’s momentum slow (especially a few more years out – it may not slow for 3 or 4 more years).

As before, the four leading nations for manufacturing production remain solidly ahead of all the rest. Korea and Italy had manufacturing output of $313 billion in 2011 and Brazil moved up to $308 are in 4-6 place. Those 3 countries together could be in 4th place (ahead of just Germany). Even adding Korea and Italy together the total is short of Germany by $103 in 2011). I would expect Korea and Brazil to grow manufacturing output substantially more than Italy in the next 5 years.

The largest manufacturing countries are China, USA, Japan and then Germany. These 4 are far in the lead, and very firmly in their positions. Only the USA and China are close, and the momentum of China is likely moving it quickly ahead – even with their current struggles.

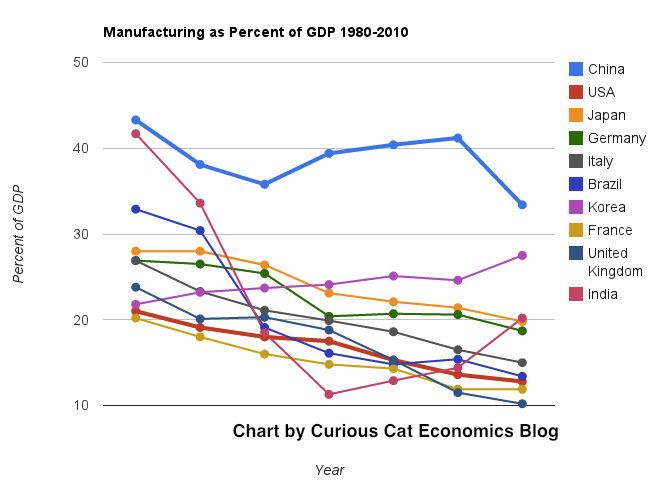

The chart below shows manufacturing production by country as a percent of GDP of the 10 countries that manufacture the most. China has over 30% of the GDP from manufacturing, though the GDP share fell dramatically from 2005 and is solidly in the lead.

Nearly every country is decreasing the percentage of their economic output from manufacturing. Korea is the only exception, in this group. I would expect Korea to start following the general trend. Also China has reduced less than others, I expect China will also move toward the trend shown by the others (from 2005 to 2010 they certainly did).

For the 10 largest manufacturing countries in 2010, the overall manufacturing GDP percentage was 24.9% of GDP in 1980 and dropped to 17.7% in 2010. The point often missed by those looking at their country is most of these countries are growing manufacturing, they are just growing the rest of their economy more rapidly. It isn’t accurate to see this as a decline of manufacturing. It is manufacturing growing more slowly than (information technology, health care, etc.).

This chart shows manufacturing output, as percent of GDP, by country and was created by the Curious Cat Economics Blog based on UN data. You may use the chart with attribution.

The manufacturing share of the USA economy dropped from 21% in 1980 to 18% in 1990, 15% in 2000 and 13% in 2010. Still, as previous posts show, the USA manufacturing output has grown substantially: over 300% since 1980, and 175% since 1990. The proportion of manufacturing output by the USA (for the top 10 manufacturers) has declined from 33% in 1980, 32% in 1990, 35% in 2000 to 26% in 2010. If you exclude China, the USA was 36% of the manufacturing output of these 10 countries in 1980 and 36% in 2010. China’s share grew from 7.5% to 27% during that period.

The United Kingdom has seen manufacturing fall all the way to 10% of GDP, manufacturing little more than they did 15 years ago. Japan is the only other country growing manufacturing so slowly (but Japan has one of the highest proportion of GDP from manufacturing – at 20%). Japan manufactures very well actually, the costs are very high and so they have challenges but they have continued to manufacture quite a bit, even if they are not growing output much.

Hong Kong again topped the rankings, followed by Singapore, New Zealand, and Switzerland. Australia and Canada tied for fifth, of the 144 countries and territories in the Fraiser Institute’s 2012 Economic Freedom of the World Report.

“The United States, like many nations, embraced heavy-handed regulation and extensive over-spending in response to the global recession and debt crises. Consequently, its level of economic freedom has dropped,” said Fred McMahon, Fraser Institute vice-president of international policy research.

The annual Economic Freedom of the World report uses 42 distinct variables to create an index ranking countries around the world based on policies that encourage economic freedom. The cornerstones of economic freedom are personal choice, voluntary exchange, freedom to compete, and security of private property. Economic freedom is measured in five different areas: (1) size of government, (2) legal structure and security of property rights, (3) access to sound money, (4) freedom to trade internationally, and (5) regulation of credit, labor, and business.

Hong Kong offers the highest level of economic freedom worldwide, with a score of 8.90 out of 10, followed by Singapore (8.69), New Zealand (8.36), Switzerland (8.24), Australia and Canada (each 7.97), Bahrain (7.94), Mauritius (7.90), Finland (7.88), Chile (7.84).

The rankings and scores of other large economies include: United States (18th), Japan (20th), Germany (31st), South Korea (37th), France (47th), Italy (83rd), Mexico (91st), Russia (95th), Brazil (105th), China (107th), and India (111th).

When looking at the changes over the past decade, some African and formerly Communist nations have shown the largest increases in economic freedom worldwide: Rwanda (44th this year, compared to 106th in 2000), Ghana (53rd, up from 101st), Romania (42nd, up from 110th), Bulgaria (47th, up from 108th), and Albania (32nd, up from 77th). During that same period the USA has dropped from 2nd to 19th.

The rankings are similar to the World Bank Rankings of easiest countries in which to do business. But they are not identical, the USA is still hanging in the top 5 in that ranking. The BRICs (Brazil, Russia, India and China) do just as poorly in both. The ranking due show the real situation of economies that are far from working well in those countries. China and Brazil, especially, have made some great strides when you look at increasing GDP and growing the economy. But there are substantial structural changes needed. India is suffering greatly from serious failures to improve basic economic fundamentals (infrastructure, universal education, eliminating petty corruption [China has serious problems with this also]…).

Singapore is again ranked first for Ease of Doing Business by the World Bank.

| Country | 2011 | 2008 | 2005 | |

|---|---|---|---|---|

| Singapore | 1 | 1 | 2 | |

| Hong Kong | 2 | 4 | 6 | |

| New Zealand | 3 | 2 | 1 | |

| United States | 4 | 3 | 3 | |

| Denmark | 5 | 5 | 7 | |

| other countries of interest | ||||

| United Kingdom | 7 | 6 | 5 | |

| Korea | 8 | 23 | 23 | |

| Canada | 13 | 8 | 4 | |

| Malaysia | 18 | |||

| Germany | 19 | 25 | 21 | |

| Japan | 20 | 12 | 12 | |

| France | 29 | 31 | 47 | |

| Mexico | 53 | 56 | 62 | |

| Ghana | 63 | |||

| China | 91 | 83 | 108 | |

| India | 132 | 122 | 138 | |

| Brazil | 126 | 122 | 122 | |

The rankings include ranking of various aspects of running a business. Some rankings for 2011: starting a business (New Zealand 1st, Singapore 4th, USA 13th, Japan 107th), Dealing with Construction Permits (Hong Kong 1st, New Zealand 2nd, Singapore 3rd, USA 17th, China 179th), protecting investors (New Zealand 1st, Singapore 2nd, Hong Kong 3rd, Malaysia 4th, USA 5th), enforcing contracts (Luxemburg 1, Korea 2, Iceland 3, Hong Kong 5, USA 7, Singapore 12, China 16, India 182), paying taxes (Maldives 1, Hong Kong 3, Singapore 4, USA 72, Japan 120, China 122, India 147).

These rankings are not the final word on exactly where each country truly ranks but they do provide a valuable source of information. With this type of data there is plenty of room for judgment and issues with the data.

Related: Easiest Countries from Which to Operate Businesses 2008 – Stock Market Capitalization by Country from 1990 to 2010 – Looking at GDP Growth Per Capita for Selected Countries from 1970 to 2010 – Top Manufacturing Countries (2000 to 2010) – Country Rank for Scientific Publications – International Health Care System Performance – Best Research University Rankings (2008)

The Curious Cat Investing, Economics and Personal Finance Carnival is published twice each month with links to new, related, interesting content online. Also see related books and articles.

- A Nation of Public Housing by Neal Peirce – “One government agency manages 80 percent of the housing stock — all called public housing. It checks your age and whether you’re married to decide whether and when you’re eligible for an apartment.” Racial quotas are used, unmarried people can’t apply until they turn 35. Any guess on what country this is? The same country is ranked as the easiest, or close to it, country run business in the world.

- China’s end game:the dark side of a great deleveraging by Dee Woo – “The dilemma is that business entities will need more and more credit to achieve the same economic result, therefore will be more and more leveraged, less and less able to service the debt, more and more prone to insolvency and bankruptcy. It will reach a turning point when the increasing number of insolvencies and bankruptcies initiate an accelerating downward spiral for underling assets prices and drive up the non-performing loan ratio for the banks. And then the over-stretched banking system will implode. A full blown economic crisis will come in full force. The chain of reaction is clearly set in the motion now.

…

The biggest problem for China is the state, central enterprises and crony capitalists wield too much power over national economy, have too much monopoly power over wealth creation and income distribution, and much of the GDP growth and vested interest groups’ economic progress are made on the expanse of average consumers stuck in deteriorating relative poverty.” - Challenges faced by middle-class L.A. families by Meg Sullivan – “Managing the volume of possessions was such a crushing problem in many homes that it actually elevated levels of stress hormones for mothers. Only 25 percent of garages could be used to store cars because they were so packed with stuff.” (read the book: Life at Home in the Twenty-First Century)

- USA Social Security Disability Insurance (SSDI) by John Hunter – Benefits have a maximum of $2,346/month (in 2011). The average benefit payment now is $1,111. More than 8.7 million people are received disability benefits currently (partially disabilities are not eligible for SSDI.

Shaker Village of Pleasant Hill, Kentucky by John Hunter

Global Trends in Renewable Energy Investment 2012

…

renewable power (excluding large hydro) accounted for 44% of new generation

capacity added worldwide in 2011, up from 34% in 2010 [and 10% in 2004]. The $237 billion invested in building these green power plants compares with $223 billion of net new expenditure annually on building additional fossil-fuelled power plants globally last year.

…

Current predictions are that total installed capacity in non-hydro renewable power will rise ninefold to 2.5Tw by 2030, with investment in assets rising from $225 billion in 2011 to $395 billion-a-year by 2020 and $460 billion-a-year by 2030

Total investment in solar in 2011 increased 52% to $147 billion, driven by a drop of 50% in photovoltaic module prices. Investment in wind dropped 12% to $84 billion, while onshore wind turbine prices fell between 5 and 10%. Biomass and waste to energy was the 3rd largest renewable sector at $11 billion in investments (down 12% from 2010).

USA investment surged 51% to $51 billion just behind China at $52 billion (China increased investment in renewable energy by 17% from 2010). German investment dropped 12% to $31 billion.

In 2011 renewable energy power capacity (excluding large hydropower), as a percentage of total system capacity, reached 9%, up from 4% in 2004. Total renewable energy generation (excluding large hydro) reached 6%, up from 4% in 2004.

Related: Top Countries For Renewable Energy Capacity – Wind Energy Capacity Exceeds 2.5% of Global Electricity Needs – Leasing or Purchasing a Solar Energy System For Your Home