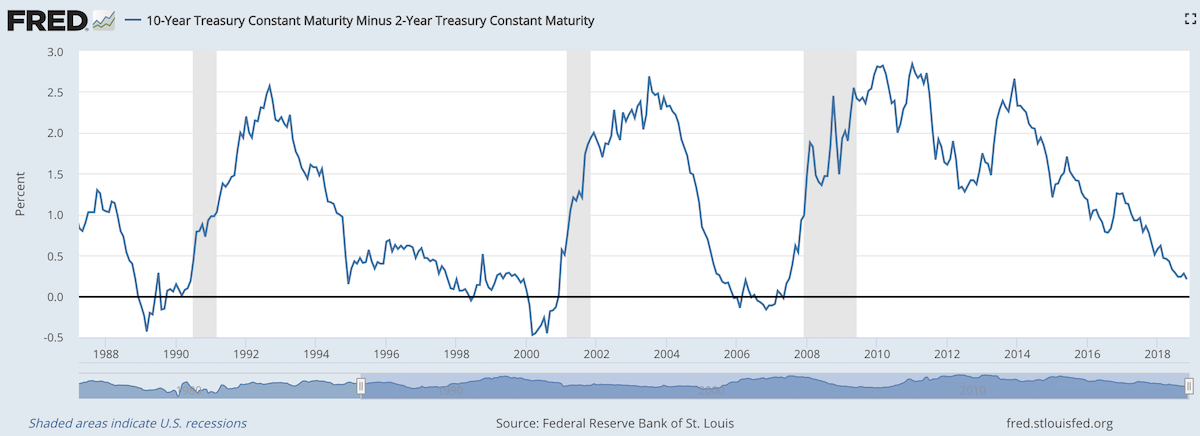

When 2 year US government bonds yield more than the 10 year US government bonds a recession is likely to appear soon. This chart shows why this is seen as such a reliable predictor.

The chart shows the 10 year yield minus the 2 year yield. So when the value falls below 0 that means the 2 year yield is higher. Each time that happened, since 1988, a recession has followed (the grey shaded areas in the chart).

Do note that there were very small inversions in 1998 and 2006 that did not result in a recession in the near term. Also note that in every case the yield curve was no longer inverted by the time a recession actually started.

The reason why this phenomenon is getting so much attention recently is another thing that is apparent when looking at this chart, the 2 and 10 year yields are getting close to equal. But you can also see we are no closer than 1994 and the USA economy held off a recession for 7 more years.

Since 1970 the average length of time from the inversion of the 10 to 2 year yield curve has been 12 months (with a low of 6 months in 1973 and a high of 17 months, before the great recession of 2008).

In addition to a possibly impending yield curve inversion it has been a long time since the last recession which makes many investors and economists nervous that one may be due.

Related: 30 Year Fixed Mortgage Rates are not correlated with the Fed Funds Rate – Bond Yields Stay Very Low, Treasury Yields Drop Even More (2010) – Looking for Dividend Stocks in the Current Extremely Low Interest Rate Environment (2011) – Stock Market Capitalization by Country from 2000 to 2016

Another thing to note about yield curves at this time is that the US Federal Reserve continues to hold an enormous amount of long term government debt (trillions of dollars) which it has never done before the credit crisis of 2008. This reduces the long term yield since if they sold those assets that would add a huge amount of supply. How this impacts the predictive value of this measure will have to be seen. Also, one way for the Fed to delay the inversion would be to sell some of those bonds and drive up long term rates.

Apple analysts are of no value to investors

If the stock moved more than 2% on any uptick in volume, I had to write a story explaining why. After dealing with that every day for about three years, I realized the overwhelming majority of analysts had no better clue than I did about what was moving Cisco’s stock.

Most investors know this, but if you don’t remember this lesson. The “explanations” you hear from media often are just as useless as horoscopes. A bunch of meaningless words presented in the hopes you don’t realize they are empty words.

The talking heads (and writers) need to say something. It would be much more useful if they took the time to do some research and put in some thought but they seem to be driven by the need to fill space instead of the need to inform.

It is also a huge waste of time, explaining random variation.

Related: Fooled by Randomness – Seeing Patterns Where None Exists – Illusions, Optical and Other – Understanding Data

As usual the 2016 Letter to Berkshire Hathaway shareholders by Warren Buffet provides great thoughts for investors.

American business – and consequently a basket of stocks – is virtually certain to be worth far more in the years ahead. Innovation, productivity gains, entrepreneurial spirit and an abundance of capital will see to that. Ever-present naysayers may prosper by marketing their gloomy forecasts. But heaven help them if they act on the nonsense they peddle.

Warren is not a fan of market timing, for good reason. I do think he may be a bit overly-optimistic. It is not something innate about the geography of the USA that means whoever is within that area will prosper over the long term. Our actions as a society materially impact our long term success. Yes, we have done very well economically and we have many factors continuing to make that likely to continue. But it is not certain.

Those willing to challenge rosy projections serve a useful purpose. But investors must be careful not to lose out on gains. Timing the market is rarely successful. Even in the cases where people do reasonable well getting out of a highly priced market they often fail to get back into the market until after they lose money on the effort (they may save a bit on the downside but then don’t get back in until they missed more upside than they saved on the downside).

- understand all exposures that might cause a policy to incur losses;

- conservatively assess the likelihood of any exposure actually causing a loss and the probable cost if it does;

- set a premium that, on average, will deliver a profit after both prospective loss costs and operating expenses are covered; and

- (4) be willing to walk away if the appropriate premium can’t be obtained.

Many insurers pass the first three tests and flunk the fourth. They simply can’t turn their back on business that is being eagerly written by their competitors. That old line, “The other guy is doing it, so we must as well,” spells trouble in any business, but in none more so than insurance.

Must of Berkshire Hathaway’s success is due to what seem like fairly easy things to do. For example, what Warren discusses here. This reinforces a point that is often overlooked which is the management philosophy that has helped Berkshire Hathaway achieve their success. Every year Warren Buffett praises the senior managers at various Berkshire Hathaway companies for good reason.

The fairly simple idea of hiring trustworthy, capable and ethical people and giving them freedom to manage for the long term seems too easy to provide an advantage. But it does. Warren Buffett is very careful to pick people that are more concerned with providing value to customers over the long term than promoting themselves and seeking massive short term rewards for themselves. This simple act of hiring people that are willing to put customers and shareholders before themselves allows your organizations to function in its long term best interest.

In so many other companies short term incentives destroy value (Warren’s point 4 above). This failure can extend to companies Warren is significantly invested in: such as the long term and deep seeded mismanagement at Wells Fargo due to very poor leadership at that company for years. But in general, Berkshire Hathaway is much better at avoiding these toxic behaviors driven by very poor executive leadership when compared to other companies.

The importance of Berkshire Hathaway focusing on the long term and not getting distracted by short term financial measures is vastly under-appreciated.

By focusing managers and CEOs on actually running the business Berkshire Hathaway again does well compared to their competitors. Far too many companies spend the time of executives on playing financial games to divert huge payments to themselves that they then try to claim are not really costs. This is enormously costly to investors and our economy.

Diversification and keeping down fees are the investing strategies that will help more investors than anything else.

Related: Warren Buffett’s 2011 Letter to Shareholders – Warren Buffett’s 2010 Letter to Shareholders – Warren Buffett’s 2005 Shareholder Letter

The report, The Dwindling Taxable Share Of U.S. Corporate Stock, from the Brookings Institution Tax Policy Center includes some amazing data.

In 1965 foreign ownership of USA stocks totaled about 2%, in 1990 it had risen to 10% and by 2015 to 26%. That the foreign ownership is so high surprised me. Holdings in retirement accounts (defined benefit accounts, IRAs etc.) was under 10% in 1965, rose to over 30% in 1990 and to about 40% in 2015. The holdings in retirement accounts doesn’t really surprise me.

The combination of these factors (and a few others) has decreased the holding of USA stocks that are taxable in the USA from 84% in 1965 to 24% in 2015. From the report

As with much economic data it isn’t an easy matter to determine what values to use in order to get figures such as “foreign ownership.” Still this is very interesting data, and as the report suggests further research in this area would be useful.

Related: There is No Such Thing as “True Unemployment Rate” – The 20 Most Valuable Companies in the World – February 2016 (top 10 all based in the USA) – Why China’s Economic Data is Questionable – Data provides an imperfect proxy for reality (we often forget the proxy nature of data)

We have tax plans from the major USA Presidential candidates. I don’t like any of them, though I actually like Ted Cruz’s plan more than the others, but it has a huge problem. His plan doesn’t fund the government he wants, not even just as poorly as we have been doing. He would increase the debt substantially.

My plan would have 3 parts. I like a flat tax, I doubt it will ever happen, but if we could get one I would be happy. Cruz proposes that (at 10%). I am fine with his proposal to eliminate all deductions but mortgage interest and charity. I would definitely tweak that some – no more than $50,000 in mortgage interest deduction a year and the same for charity. Basically subsidizing it a bit for the non-rich is fine. Subsidizing these for the rich seems silly so I would cap the deductions in some way. I also wouldn’t mind an almost flat tax, say 12% up to $200,000 and 15% after that (or some such rates).

Cruz’s rate is far too low given the government he wants. The government budget is largely: Social Security, Medicare and Military. Then you also have debt payment which have to be paid. Those 4 things are over 80% of the spending. All the other things are just in the last 20%, you can cut some of that but realistically you can’t cut much (in percentage terms – you can cut hundreds of billions theoretically but it is unlikely and even if you did it isn’t a huge change).

We are piling on more debt than we should. Therefore we should increase revenue, not reduce it. But if we can’t increase it (for political reasons) we definitely should not reduce it until we have shown that we have cut spending below revenue for 2 full years. After that, great, then decrease rates.

The White House, Washington DC by John Hunter. See more of my photos of Washington DC.

The VAT tax on businesses replacing the corporate tax system is in Cruz’s plan and this is the best option for corporate taxes in my opinion. Another decent option is just to pass through all the earnings to the owners (I first heard this proposal from my Economics professor in College) and tax them on the earnings.

Increasing the giveaways to trust-fund baby as Cruz and Trump propose is the single worst tax policy change that can be made. I have explained previously how bad an idea this is: The estate tax is the most capitalist tax that exists. The trust-fund-baby favors should be reduced not increased. I would roll back to the Reagan Administration policy on estate tax rates.

Alphabet (Google) writes how they purchased 3.2 million shares this quarter in their earnings release:

In Q1 2016, we repurchased 3.2 million shares of Alphabet Class C capital stock for an aggregate amount of $2.3 billion, of which $2.1 billion was paid during the quarter. The total remaining authorization for future repurchases is approximately $1.4 billion. The authorization has no expiration date.

And they tout non-GAAP earnings, while of course reporting the GAAP earnings as required. One of the things executives like about non-GAAP earnings is they pretend the stock they give away to themselves doesn’t have a cost to shareholders. When you call attention to spending over $2 billion in the quarter to buy back 3.2 million shares it seems silly to then claim that the stock you gave away shouldn’t be considered as an expense.

How can you pay over $2 billion just to get back the stock you gave away and also pretend that money is not really a cost? And on top of that you promote the buyback as evidence that the stock is really worth more than you paid (after all why would you pay more than it is worth). But when you give the stock away to yourself that shouldn’t be seen as a cost? It is amazing they can do this and think they are not doing anything wrong.

And where does Google stand compared to last year for outstanding shares? 689,498,000 last year compared to 699,311,000 now. So nearly 10,000,000 more shares outstanding, even after they bought back 3.2 million this quarter. In the previous quarter there where 697,025,000 shares outstanding. All these figures are weighted-average diluted share balances for the entire quarter.

Google CEO, Sundar Pichai, got a $100 million stock award in 2015 (before being promoted to CEO). After the promotion he will be taking an additional “$209 million in stock granted every other year (he has to stay at Google for four years after each grant to cash them out).” He was granted $335 million in stock in 2014 and $78 million in 2013. You can see how quickly the executives paying themselves this well (this is 1 executive, a highly ranked one but still just 1) can dilute stockholders positions even with multi billion dollar buybacks in a quarter.

You don’t hear companies promoting how much dilution they are imposing on shareholders in order to provide windfalls for executives. I wonder why? No I don’t. I do wonder why reporters promote the buybacks and ignore the fact that the dilution is so extreme that it even overwhelms billions of dollars in buybacks.

Alphabet reported $6.02 a share in earnings and $7.50 a share in non-GAAP “earnings” for the latest quarter.

As I have said before I believe Google’s ability to extract enormous profit from their search dominance (as well as YouTube and adwords) makes it a very compelling long term investment. It would be better if the executives were not allowed to take such huge slices from the cash flow Google generates. But it is able to sustain those raids on stockholder equity and still be a good investment and appears likely to be able to continue to do so. Though I think they would be better off reducing the amount executives take going forward.

Related: Google Diluted Shareholder Equity by 1% a year (2009-2013) – Executives Again Treating Corporate Treasuries as Their Money (2011) – Another Year of CEO’s Taking Hugely Excessive Pay (2009) –

Credit scores are far from a great measure of whether a person is a great credit risk for a specific loan, in my opinion. However, they are very widely used and therefor, very important. They also are somewhat useful. And lenders don’t base judgement solely on credit scores, they consider many other factors, if they have any sense at all.

Credit scores range from 300 to 850. They are calculated by various credit reporting organizations, including FICO. They factor in payment history, percent of outstanding credit available that is used, credit report checks, length of outstanding credit accounts, etc..

Metlife report on consumers and credit scores provides some interesting data.

| Credit score range | Default rate* |

|---|---|

| 740-850 | .4% |

| 680-739 | 2.8% |

| 620-679 | 7.5% |

| 550-619 | 17% |

| 300-459 | 33.8% |

* Default rate in this case means, 90 days past due. MetLife got this data from the Consumer Financial Health Study dataset**.

Peer to peer lending platform, Lending Club, limits loans to those with a minimum credit score of 660 (remember there are multiple organizations that provide credit scores, this minimum is based on Lending Club’s score). In general I see scores above 700 in A and B loans, scores from 650-700 in C and D loans. Remember the credit score is not the only factor setting the rate (you will see scores above 700 in the C loans sometimes, etc.). Credit scores provide some insight but are just 1 factor in approving loans or setting rates (an important one but not a completely dominant one).

About 38% of people have credit scores from 750-850. Another 37% from 600-749 and about 25% from 350-599.

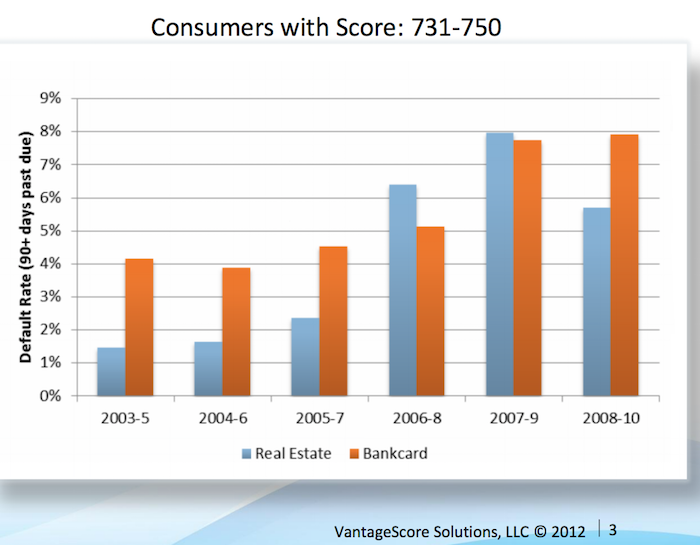

Vantage Score decided to make their score range go up to 1000, not the standard 850. Maybe a 750 score for them is comparable to 680? They say super-prime is 900+ (750-850 on more common scale), prime is 701-900 (680-739), near-prime 641-700 (620-679), subprime 501-640 (550-619). Anyway that chart shows the changing default rates from 2003 to 2010 by type of loan.

This Federal Reserve report on meeting between Federal Reserve Board staff and Fair Isaac Corporation (FICO) 20 June 2013 has some interesting material.

For guidance, the following table generally matches a borrower’s odds-of-default with the corresponding FICO 8 score (calculated on performance from Oct 2008 – Oct 2010). Of course, the range of scores and odds-of-default [the data is related to mortgages] will vary with each model as creditors develop and validate their own credit scoring models.

Odds-of Default FICO 8 Score percent of population** 5:1 610 9% 10:1 645 9% 20:1 685 6% 30:1 705 6% 40:1 720 6% 50:1 735 9% 100:1 770 30%

As you can see at a 610 level, 20 loans out of 100 defaulted. At 685 just 5 in 100 defaulted and at 770 just 1 in 100 did.

** I had to adjust this, because the report didn’t report it in this form, so it a very approximate measure (I made estimates for something like scores from 735 to 769 etc.). Again this is data from the Oct 2008 – Oct 2010 period. The rest of the population (about 25%) would have scores below 610.

Related: The Impact of Credit Scores and Jumbo Size on Mortgage Rates (2009) – Your FICO credit score explained – $2,540,000,000,000 in USA Consumer Debt

This page references a Fed report (that I can’t find) that found the following default rates on new loans for the two years after origination, 2000-2002:

| Credit score range | Default rate* |

|---|---|

| under 520 | 41% |

| 520-559 | 28% |

| 560-599 | 23% |

| 600-639 | 16% |

| 640-679 | 9% |

| 680-719 | 4.4% |

| over 720 | <1% |

The Consumer Financial Health Study respondents were asked to self-assess their credit quality and for permission to pull their actual credit scores.8 Forty-five percent of survey participants granted permission, yielding an “opt-in” sample size of 3,215. We appended two objective measures of creditworthiness to the dataset: Experian provided VantageScore 3.0 credit scores, and LexisNexis Risk Solutions provided RiskView scores. VantageScore is a generic credit scoring model that was created by the three major credit bureaus (Equifax, Experian and TransUnion) and, in addition to tradeline data, includes rent, utility and cell phone payment data when it is available in consumer credit files.

Health insurance options are confusing for those of us in the USA (those outside the USA are free of the frustrations of USA health care system). One of the features of a health insurance plan in the USA is the out-of-pocket “maximum.”

Now if you think you understand english you might think this is the maximum you have to pay out of your pocket. If you understand how horrible the USA health care system is and how nothing is easy, you probably suspect it isn’t a maximum at all. I find myself thinking that I don’t really understand what this seemingly simple value actually means, so I decided to research it and write this blog post.

First of all you have to pay the monthly premiums (assuming your employer doesn’t pay them for you), probably a few hundred or more dollars every month. Then the coverage likely has a deductible maximum for the year.

For this example, for 1 person the insurance costs $300/month with a yearly deductible maximum of $5,000. And the insurance plan says there is an out-of-pocket “maximum” of $6,500. Well 12 *$300 + $5,000 = $8,600. So, as you can probably guess, out-of-pocket “maximum” doesn’t actually mean the maximum out of your pocket. In fact the $8,600 is excluded from the out-of-pocket maximum calculation altogether.

So, you then might think ok, my actual out-of-pocket maximum (the most I will have to pay all year for health care) is $8,600 + $6,500 = $15,100. But that isn’t right either.

First, this is only for covered medical expenses, uncovered medical expenses are not included. This makes some sense, certainly, but in your planning, you can’t think your health care costs are capped at $15,100. Especially since in the USA lots of health care will be uncovered (dental care is often excluded, mental health care may well be limited, certain types of treatment may not be covered, prescription glasses, non-prescription drugs, addiction treatment…).

Remember, USA health care coverage isn’t even just limited by the type of care. For example, even if fixing your injured leg is covered, if you don’t do it using exactly the right places (where your health plan covers the cost), it may be considered to be uncovered care. In general, emergency care is more flexible for what is covered, but the horror stories of dealing with health insurers refusal to pay for provided health care adds risk to any health care someone gets in the USA.

Here is a good explanation of out-of-pocket cost questions (in this quote looking at out of network costs): “Out of Pocket Maximum” and health insurance plan terminology and calculation?

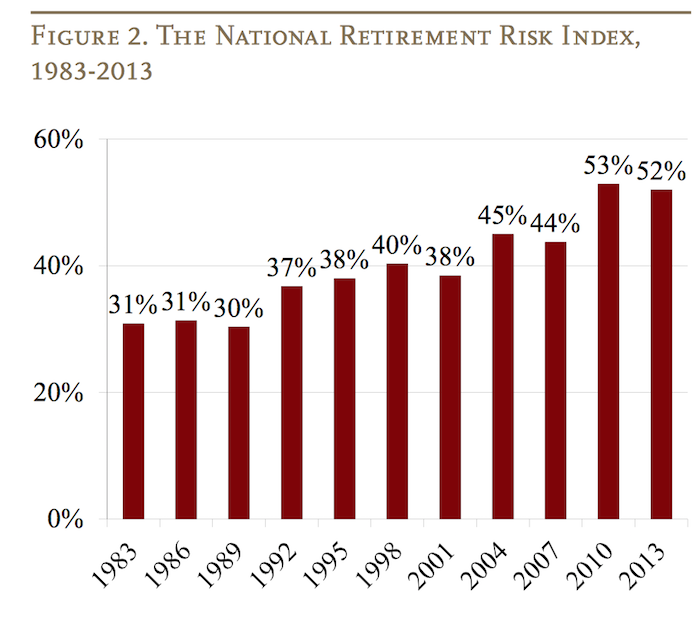

The Center for Retirement Research at Boston College is a tremendous resource for those planning for, or in, retirement. The center created the National Retirement Risk Index (NRRI) to capture a macroeconomic level measure of how those in the USA are progressing toward retirement.

Based on the Federal Reserve’s 2013 Survey of Consumer Finances the Center updated the NRRI results (the entire article is a very good read).

The lower the risk number in the chart the better, so things have not been going well since the 1990s for those in the USA saving for retirement.

As the report discusses their are significant issues with retirement planning that defy easy prediction; this makes things even more challenging for those saving for retirement. The report discusses the difficulty placed on retirees by the Fed’s extremely low interest rate policy (a policy that provides billions each year to too-big-too-fail banks – hardly the reward that should be provided for bringing the world to economic calamity but never-the-less that transfer of wealth from retirees to too-big-to-fail banks is the policy the Fed has chosen).

That exacerbates the problems of too little savings during the working career for those in the USA. The continued evidence is that those in the USA continue to spend too much today and save too little. Also you have to expect the Fed and politicians will continue to make policy that favors their friends at too-big-fail banks and hedge funds and the like. You can’t expect them to behave differently than they have been the last 50 years. That means the likely actions by the government to take from median income people to aid the richest 1% (such as bailing out the bankers with super low interest rate policies and continue to subsidize losses and privatize their winning bets) will continue. You need to have extra savings to support those policies. Of course we could change to do things differently but there is no realistic evidence of any move to do so. Retirement planning needs to be based on evidence, not hopes about how things should be.

Related: How Much of Current Income to Save for Retirement – Save What You Can, Increase Savings as You Can Do So – Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually – Retirement Planning: Looking at Assets (2012) – How Much Will I Need to Save for Retirement? (2009)

Insurance can be annoying as you pay for something you hope not to use. I don’t recall ever getting a payment on life insurance, homeowners insurance, disability insurance or auto insurance. And that I haven’t had a claim is good. On health insurance I have had minor things covered like a physical or dentist and that is it.

Health insurance is critical in the USA. One insurance that people often don’t think of however is disability insurance. Disability insurance is a very important insurance that too many people don’t consider (many jobs offer it, though not all, and some may take a year before you are covered). Studies show that a 20 year old has a 30% chance of becoming disabled before reaching retirement age. In the USA, the Social Security Administration provides disability benefits for total disabilities.

In the USA you may be eligible for social security disability payments but it is a small amount (so not sufficient by itself). But if you are living overseas and not paying social security I am not sure if you are covered, even for the limited coverage it provides.

I am not sure what the situation is for citizens of other countries, maybe they have better safety nets for people (I would imagine Europe does, but many places probably don’t).

I had been living in Malaysia for several years and am now going nomadic (an increasingly popular choice for a small but determined group of people) and insurance is important for people living overseas and traveling. For nomads or frequent travelers global health insurance is good (though usually it will exclude the USA if you are not a “USA 1%er”(or world .2%)/very-rich as the extremely broken USA health care system is crazy – you can be covered globally excluding the USA for about 1/6 of that same coverage excluding the USA, depending, of course on your coverage). Special care for travelers and nomads should be paid to coverage to return you home if you are very sick or injured.

Disability insurance is something thing digital nomads should pay attention to. But it is normally ignored. And it is a bit tricky as insurance companies are generally extremely slow to catch up to what the world is doing and disability insurance seems to be stuck in the old notions about how tied people were to one country (as are other things – demanding physical addresses even if they know you are nomadic…, basing rules on silly ideas about where you happen to be at some point in time with customer hostile breaking of internet services that have been paid for etc.).

Related: Personal Finance Basics: Long Term Disability Insurance – The Growing Market for International Travel for Medical Care – Long Term Care Insurance: Financially Wise but Current Options are Less Than Ideal