The $1.9 trillion covid19 relief law (American Rescue Plan Act) includes large increases in health insurance subsidies in addition to the $1,400 per person payments to individuals. The law increases subsidies for 2 years.

Under the new law, nobody will have to pay more than 8.5% of their income on health insurance. The government will also pick up 100% of COBRA premiums through September. COBRA is health insurance for people who’ve lost their jobs.

“Probably about three-quarters of uninsured people in the U.S. who are citizens are going to be eligible for some sort of financial help,” said Cynthia Cox, a vice president at the Kaiser Family Foundation.

I wrote before about the fact that under the old law, based on how the subsidy worked you could lose over $5,000 in health care subsidy payments by earning just enough to no longer be eligible for the subsidy. This new law eliminates that issue (for 2 years) as health insurance costs are now subsidized so that they cost no more than 8.5% of income (instead of having a hard cut off where subsidies go to $0).

For people most people that pay for their health care themselves (instead of their employer paying) this is likely a much larger benefit than the cash payment of $1,400.

The Kaiser Family Foundation calculator lets you get a quick idea of what your approximate subsidy benefit. A 55 year old earning $55,000 would be entitled to a subsidy of $4,700 about 50% of their health insurance costs (based on the USA average). For a 50 year old the subsidy would be $2,900 or 38%. For a 60 year old the subsidy would be $6,800 or 59%. For a couple of 35 year olds and 2 children the subsidy would be $12,100 per year or 72%.

For a 35 year old couple earning $85,000 with 2 children the subsidy would be $9,600 per year or 57%. And for a 55 year old earning $85,000 the the subsidy would be $2,200 per year or 23%.

Only the family of 4 would have been eligible for any subsidies under the old law (or will be eligible after this new law expires in 2 years). And the single 55 year old earning more than $80,000 is not eligible for the $1,400 payment but would receive $2,200 as a health care subsidy.

This is a huge personal finance benefit that has not been widely discussed but will have a huge impact on people’s financial health for the next 2 years.

Factfulness by Hans Rosling (of TED talks and Gapminder charts fame) is an exceptionally good book. It provides great insight into how to think more effectively and how to understand the reality of the world we live in (versus the large distortions so common in most people’s vision of the world). You can take a quick quiz to see how well you understand the world

The truth of the very widespread increase in wealth around the globe has influenced my investing strategy for decades. It should be influencing yours, is it?

Data is extremely valuable in helping us make decisions and evaluating the effectiveness of policy. However it is critical to be careful. It is very easy to focus on meeting targets that seem sensible – increasing the number of hospital beds – but that lead to less effective policy.

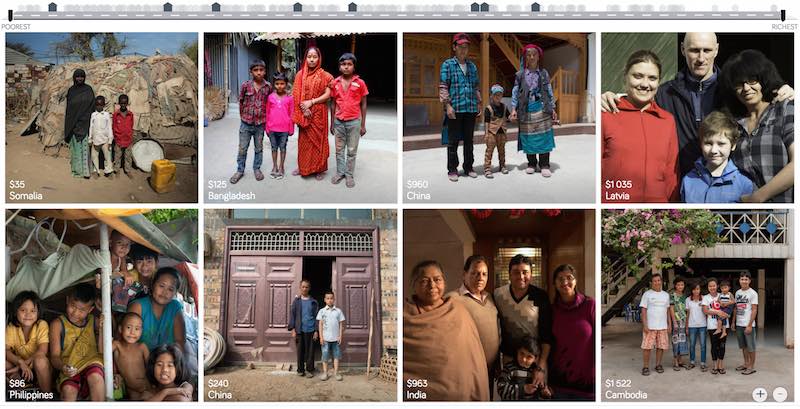

Dollar street provides photos of people at all 4 income levels from around the globe. This illustrates Hans’ point that what determines how people live and what their circumstances look like is mostly a matter of income not the country they live in. It is simple idea but one that runs counter to much of the economic discussion focused so much on national boundaries. National boundaries do matter and the laws and economic reality of the national economy has a large impact but the issues for people at each level of income are much more tied to those in their level of income anywhere in the world than they are tied to their nation.

The book relentlessly points out the great progress that has been made globally over the last 50 years and how that progress continues today and looks to be set to continue in the future. We have plenty of areas to work on improving but we should be aware of how much progress we have been making. As he points out frequently he has continually seen huge underestimation of the economic conditions in the world today. This book does a great job of presenting the real success we have achieved and the progress we can look forward to in the future.

* In 2017

Level 1 has 0.75 billion people living on less than $2 per day.

Level 2 has 3.3 billion people living on incomes between $2 to $8 per day.

Level 3 has 2.5 billion people living on $8 to $32 per day.

Level 4 has 0.9 billion people living on more than $32 per day.

Related: GDP Growth Per Capita for Selected Countries from 1970 to 2010 (Korea, China, Singapore, Brazil) – Stock Market Capitalization by Country from 2000 to 2016 – Ignorance of Capitalism Leads us Astray – Wealthiest 1% Continue Dramatic Gains Compared to Everyone Else

The USA is currently looking to pass a tax bill. Actually the Republican party has decided to not seek bipartisan solutions so it is the Republicans that are looking to change the tax policy. They wish to call it tax reform but they are reforming nearly nothing. They are mainly moving around tax breaks to different people. The main aim seems to be to reduce taxes without reducing spending which given the huge annual deficit the USA government currently runs that means really this is a plan to shift taxes to the grandchildren of people living right now.

And within lowering taxes for some people today while placing those payments onto their grandchildren there is a bit of shifting around who will pay what now. Mostly this amounts to lowering the taxes on the rich today – along with some lowering of many people’s taxes that are in the middle class.

When you run a huge budget deficit (and have a huge amount of debt outstanding) “cutting taxes today” is just shifting taxes to the kids, grandkids and great-grandkids of those avoiding the taxes today. Truly cutting taxes (versus shifting them to a future generation) requires cutting the outstanding debt (which represents future tax increases) in addition to cutting current taxes.

The White House, Washington DC by John Hunter. See more of my photos of Washington DC.

To find reform ideas in the proposals requires using an extremely broad definition of what reform means. There are some attempts to reduce some favors in the tax code now for special interests. But these are minor compared to the goal of shifting the tax burden to grandchildren from those alive today.

One of the other goals is to reduce the corporate tax rate. This goal doesn’t look so great politically, so they are trying to minimize any focus on this. I think likely a reduction in the corporate tax rate is wise. This is mainly due, not to some principle that 25% corporate tax rate is better than a 35% rate (with all the system-wide effects that results in). Mainly a lower rate is needed when you consider the global economic system and the tax rates of other countries with an understanding of the global economy today. What must be sacrificed to reach a 20% corporate rate seems unreasonable to me, so 25% rate seems more sensible, but at this time they are trying to stretch to a 20% rate (and leave future generations to pay for the difference).

I support the effort to lower the corporate tax rate. In order to pay for that reducing some deductions is sensible. The plans have some of that and while each tax break has special interests benefiting from them I would support adding to the decreases in deductions. I would go along with a 20% rate if that was necessary, but think 25% or 22% or something would be better.

The most ludicrous part of the plan is the favors for trust fund babies. Eliminating the most capitalist friendly tax (the estate tax) and providing trust fund babies not only free inheritance without limit but stepping up the cost basis of investments is indefensible (economically indefensible, politically the Republicans obviously feel favors for trust fund babies are wise).

See my Curious Cat Tax Proposals blog post from 2016 for more of my ideas on how tax reform should be done.

The current deficit spending is made to look much less bad than it really is due to incredibly low interest rates. Given the inevitable rise in interest rates over the next 30 years the debt we pile on future generations is going to be much greater than it appears in an extremely low interest rate environment.

There are essentially 4 areas of significant federal spending.

- interest on the debt – this can’t be changed, it is set by the market

- spending on the department of defense (including spending on veterans)

- social security

- medicare and medicaid

There is no political will to reduce the costs of social security. I would raise the age at which you can begining taking payments and reduce payments to the rich. But this won’t pass, so that won’t change.

The Republicans have greatly increased spending by the department of defense so obviously this results in a tax increase (just on our descendants because they chose not to pay for the higher level of spending they voted for)

The latest massive breach of USA citizen’s private information by poorly run companies once again shows how we are voting for the wrong type of people. We need to start electing people that fix problems instead of watching things burn.

It is not impossible to improve if you elect people that care about making things better. If you elect people that are driven mainly by doing favors for those giving them cash you get the system we have now.

I believe in designing systems that use markets to create the best solutions to desired outcomes (this is the basic idea of real capitalism – instead of the crony capitalism we have been infected with). Europe has much more respect for citizen’s privacy that the USA does. Europe has much more effect laws on protecting citizen’s privacy. For decades the 2 political parties in the USA have taken large cash donations (and more, future cushy jobs…) to allow the current system to punish citizen’s as their private information is abused and they are expected to spend their time and resources to fix the problems created by the identity theft the lack of decent systems in the USA to stop identity theft. And the design by the 2 parties to put the cost of dealing with it on voters and the benefits (of selling private consumer information and using poor security practices to create problems that voters have to clean up) to those giving the parties cash.

We need to stop voting for such corrupt parties and such poor representatives of our interests (though they are very good representatives of those paying them cash).

So what is a simple starting point for taking the burden of dealing with the easy identity theft our political parties and companies that don’t care about the costs of their sloppy practices on society are?

- Force those approving false credit to pay. Anytime you have to fix credit given falsely in your name they must pay you. Say, $1,000 minimum.

- Force those providing false information about you to pay. If credit bureaus report false information about you that you must correct it is $50 if it is fixed within 7 days of a simple internet form being completed. If it takes 30 days the cost is $150. If they require you to provide additional information, additional costs accrue. They must provide your the original documentation on the loans.

- Give consumer automatic and free control over the use of their private information.

Obviously, credit freezes, and managing that status must be free. - Any organization that collects private financial information must have liability insurance. That insurance will automatically pay per security breach. For name + SSN ($150) + Date of birth ($20) + cell phone number ($20) + current address ($100) + credit card number ($50) + email address ($10) + mother’s maiden name ($25), etc. If you do not collect SSN, credit card number, cell phone number or current address this will not apply. I haven’t given it any thought, but there should be some level of private information that pushes you into the category of the organization that must have liability coverage (what that is can be worked out).

- The funds for those security breaches are paid to the Consumer Financial Protection Bureau and used to

- create better security practices for private information

- fund enforcement of those better security practices

- fund law enforcement investigations and criminal prosecution of those abusing private financial information

This idea needs to be expanded beyond my 1 hour of thinking about it, but it is sad that in 1 hour I can think of much more effective ideas than our political parties have put in place in 20 years.

The reliance on SSN as a identifier for people is something that shouldn’t have been allowed. It is one of many things that should be fixed and it should be fixed quickly.

The organization created here needs to focus on privacy of data. They need to encourage the use of encryption. They need to be given a seat at the table to counter those seeking to promote hacking (both leaving insecure software in place and creating insecurity in the software ecosystem to exploit and be exploited by criminals and other states) to benefit state sponsored spying. That debate will result in tradeoffs. Sometimes they will decide to allow our private information to be put at risk for other benefits. But they need to accept the responsibility of doing so. It would likely be sensible to charge the departments leaving open security holes and creating security holes anytime it becomes obvious that they are responsible for the harm to us. Otherwise they pretend there are not costs to the very bad security practices that our government has been encouraging (even as crazy as it sounds building backdoors into software – which is a security disaster obviously).

Other than the extremely sad state of affairs in health care in the USA (with the Republicans focusing on making it much worse) the biggest threat to our personal finances is likely the lack of security in our financial system (though to be fair there are other plausible candidates – very high debt level…).

Related: Protecting Your Privacy and Security (2015) – Making Credit Cards More Secure and Useful (2014) – Governments Shouldn’t Prevent Citizens from Having Secure Software Solutions USA Congress Further Aids Those Giving Them Cash Risks Economic Calamity Again – Security, Verification of Change – 8 Million New Potential Victims of Identity Theft (2008)

The Great Convergence by Richard Baldwin makes some interesting points about “globalization.” I actually find the long term history the most interesting aspect. It is very easy for people today to forget the recently rich “West” has not always been so dominant.

That shows how quickly things changed. The industrialization of Europe and the USA was an incredibly powerful global economic force. The rapid economic gains of Japan, Korea, Singapore, China and India in the last 50 years should be understood in the context of the last 200 years not just the last 100 years.

A central point Richard advocates for in the book is realizing that the current conditions are different from the conditions in which traditional economic theory (including comparative advantage) hold. The reasoning and argument for this claim are a bit too complex to make sensibly in this post but the book does that fairly well (not convincingly in my opinion, but enough to make the argument that we can’t assume traditional economic theory for international trade is completely valid given the current conditions).

I don’t expect this blog post to convince people. I don’t even think his book will. But he makes a case that is worth listen to. And I believe he is onto something. I have for years been seeing the strains of “comparative advantage” in our current world economy. That doesn’t mean I am not mainly a fan of freer trade. I am. I don’t think complex trade deals such as TPP are the right move. And I do think more care needs to be taken to consider current economic conditions and factor that into our trade policies.

Richard Baldwin uses 3 costs and the economic consequences of those changing over time to show globalizations history, where we are today and where we are going.

It isn’t very easy to follow but the book provides lots of explanation for the dramatic consequences of these costs changing over time.

One of his themes is that mobility of labor is still fairly costly. It isn’t easy to move people from one place to another. Though he does discuss how alternatives that are similar to this (for example telepresence and remote controlled robots to allow a highly technical person to operate remotely) without actually do moving the person are going to have huge economic consequences.

The “high spillovers” are the positive externalities that spin off of a highly knowledgable workforce.

Even though there are plenty of ways to improve the economic conditions for most people today is very good compared to similar people 50 years ago. There are a few, small population segments that there are arguments for being worse off, but these are a tiny percentage of the global population.

However, we humans often compare ourselves to whoever is better off than us and feel jealous. So instead of appreciating good roads, food, shelter, health care, etc. we see where things could be better (either our parents had it a bit better or these people I see on TV or in this other country, etc.). It is good to see how we could improve if we then take action to improve. To just be frustrated that others have it better doesn’t do any good, it doesn’t seem to me.

There are significant ways governments can help or hinder the economic well being of their citizens. I am a big believer in the power of capitalism to provide wealth to society. That isn’t the same as supporting the huge push to “crony capitalism” that many of the political parties throughout the world are promoting. The “capitalism” in that phrase exists for alliteration, the real meaning is the word crony.

street scene in Seoul, South Korea (photo by John Hunter)

These Are the World’s Most Innovative Economies

These type of rankings are far from accurate, what does most innovative really mean? But they do provide some insight and I think those at the top of the list do have practices worth examining. And I do believe those near the top of this list are doing a better job of providing for the economic future of their citizens than other countries. But the reality is much messier than a ranking illustrates.

With that in mind the ranking shows

- Korea

- Sweden

- Germany

- Switzerland

- Finland

- Singapore

- Japan

- Denmark

- USA

One thing that is obvious is the ranking is very biased toward already rich countries. When you look at the measures they use to rank it is easy to see this is a strong bias with their method.

China is 21st. Malaysia is 23rd and an interesting country doing very well compared to median income (I am just guessing without actually plotting data). Hong Kong is 35th, which is lower than I imagine most people would have predicted. Thailand is 44th. Brazil is 46th and even with their problems seems low. Brazil has a great deal of potential if they can take care of serious problems that their economy faces.

In a previous post I examined the GDP Growth Per Capita for Selected Countries from 1970 to 2010, Korea is the country that grew the most (not China, Japan, Singapore…).

Related: Leading Countries for Economic Freedom: Hong Kong, Singapore, New Zealand, Switzerland – Economic Consequences Flow from Failing to Follow Real Capitalist Model and Living Beyond Our Means – Easiest Countries in Which to Operate a Businesses (2011)

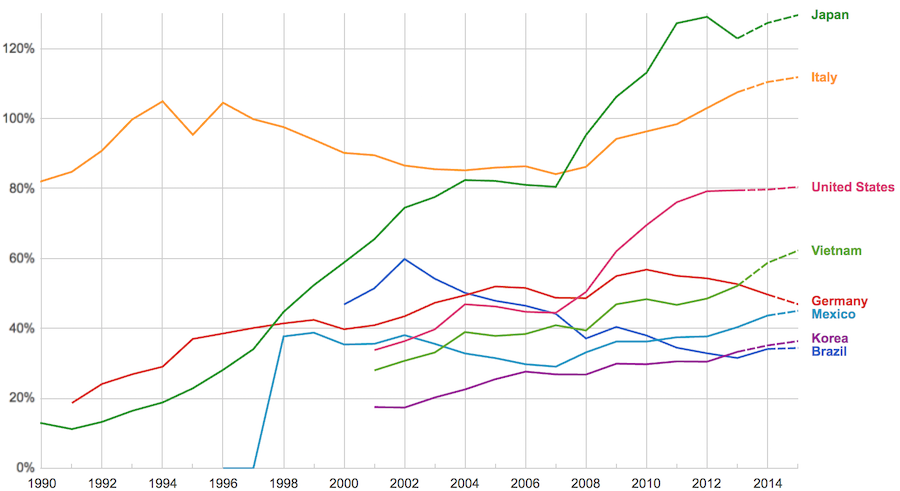

The data, from IMF, does not include China or India.

The chart shows data for net debt (gross debt reduced by certain assets: gold, currency deposits, debt securities etc.).

Viewing our post on the data in 2014 we can see that the USA improved on the expectations, managing to hold net debt to 80% instead of increasing to 88% as expected. Nearly every country managed to take on less debt than predicted (Vietnam took on more, but is very low so this is not a problem).

Taking on debt to invest in valuable resources (building roads, mass transit, internet infrastructure, education, environmental regulation and enforcement, health care, renewable energy…) that will boost long term economic performance can be very useful. The tricky part is knowing the debt levels doesn’t tell you whether the debt was taken on for investment or just to let current taxpayers send the bills for their consumption to their grandchildren.

Also government debt can become a huge burden on the economy (especially if the debt is owed outside the country). The general consensus today seems to be that 100% net debt level is the maximum safe amount and increasing beyond that gets riskier and riskier.

Even if some lobbyists and their friends in Washington DC try to distract from the long term failure of the USA health care system the data continues to pour in about how bad it is.

U.S. Health-Care System Ranks as One of the Least-Efficient

None of these rankings are perfect and neither is this one. But it is clear beyond any doubt that the USA healthcare system is extremely costly for no better health results than other rich countries (and even more expensive with again no better results than most poor countries). It is a huge drain on the economy that we continue to allow lobbyists and special interests to take advantage of the rest of us via the Democrats and Republican parties actions over the last few decades.

We have to improve. The costs imposed on everyone to support those benefiting from this decades old transfer of economic wealth to health care special interests should no longer be accepted.

The top 5 countries are: Hong Kong, Singapore, Spain, South Korea and Japan. The first four have costs about 25% of the USA. Japan costs about 40% of the USA per person cost.

Mylan’s despicable actions with Epi-pen and the direct participation of both political parties in increasing the costs foisted on the health care system by Mylan is just one in hundreds of the individual actions that continue to saddle the rest of USA economy with huge costs.

Related: Out of Pocket “Maximum”, Understanding USA Health Care Costs – Decades Later The USA Health Care System is Still a Deadly Disease for Our Economy – 2015 Health Care Price Report, Costs in the USA and Elsewhere – USA Health Care Spending 2013: $2.9 trillion $9,255 per person and 17.4% of GDP – USA Spends $7,960 Compared to Around $3,800 for Other Rich Countries on Health Care with No Better Health Results (2009 data)

The International Federation of Health Plans has published the 2015 Comparative Price Report, Variation in Medical and Hospital Prices by Country. Once again this illustrates the excessive cost of health care in the USA. See related posts for some of our previous posts on this topic.

The damage to the USA economy due to inflated health care costs is huge. A significant portion of the excessive costs are due to policies the government enacts (which only make sense if you believe the cash given to politicians by those seeking to retain the excessive costs structure in the USA the last few decades buy the votes of the political parties and the individual politicians).

In 2015, Humira (a drug from Abbvie to treat rheumatoid arthritis that is either the highest grossing drug in the world, or close to it) costs $2,669 on average in the USA; $822 in Switzerland; $1,362 in the United Kingdom. This is the cost of a 28 day supply.

All the prices shown here are for the prices reported are the average allowed costs, which include both member cost sharing and health plan payment. So it only includes costs for those covered by health plans (it doesn’t include even much larger price tags given those without insurance in the USA).

Harvoni (a drug from Gilead to treat hepatitis C is also near the top of drugs with the largest revenue worldwide). This is also a drug that has been used as a lightning rod for the whole area of overpriced drugs. One interesting thing is this is actually one that is not nearly as inflated in the USA over other countries nearly as much as most are. Again, for a 28 day supply the costs are $16,861 in Switzerland; $22,554 in the United Kingdom and $32,114 in the USA. Obviously quite a lot but “only” double the cost in the USA instead of over triple for Humira (from Switzerland to the USA).

Tecfidera is prescribed to treat relapsing multiple sclerosis. The cost for a 30 day supply vary from $663 in the United Kingdom to $5,089 in the USA ($1,855 Switzerland).

There are actually some drugs that are more expensive outside the USA (though it is rare). OxyContin is prescribed to treat severe ongoing pain and is also abused a great deal. The prices vary from $95 in Switzerland to $590 in the United Kingdom ($265 in United States).

The report also includes the cost of medical procedures. For both the drugs and the procedures they include not only average but measures to show how variable the pricing is. As you would expect (if you pay attention to the massive pricing variation in the USA system) the variation in the cost of medical procedures is wide. For an appendectomy in the USA the 25th percentile of cost was $9,322 and for the 95th was $33,250; the average USA cost was $15,930. The average cost in Switzerland was $6,040 and in the United Kingdom was $8,009.

As has been obvious for decades the USA needs to stop allowing those benefiting from the massively large excessive health care costs in the USA from buying the Democrats and Republicans support to keep prices so high. But there has been very little good movement on this front in decades.

Related: USA Heath Care System Needs Reform – USA Health Care Spending 2013: $2.9 trillion $9,255 per person and 17.4% of GDP – Decades Later The USA Health Care System is Still a Deadly Disease for Our Economy – USA Spends $7,960 per person Compared to Around $3,800 for Other Rich Countries on Health Care with No Better Health Results (2009) – Drug Prices in the USA (2005)

We have tax plans from the major USA Presidential candidates. I don’t like any of them, though I actually like Ted Cruz’s plan more than the others, but it has a huge problem. His plan doesn’t fund the government he wants, not even just as poorly as we have been doing. He would increase the debt substantially.

My plan would have 3 parts. I like a flat tax, I doubt it will ever happen, but if we could get one I would be happy. Cruz proposes that (at 10%). I am fine with his proposal to eliminate all deductions but mortgage interest and charity. I would definitely tweak that some – no more than $50,000 in mortgage interest deduction a year and the same for charity. Basically subsidizing it a bit for the non-rich is fine. Subsidizing these for the rich seems silly so I would cap the deductions in some way. I also wouldn’t mind an almost flat tax, say 12% up to $200,000 and 15% after that (or some such rates).

Cruz’s rate is far too low given the government he wants. The government budget is largely: Social Security, Medicare and Military. Then you also have debt payment which have to be paid. Those 4 things are over 80% of the spending. All the other things are just in the last 20%, you can cut some of that but realistically you can’t cut much (in percentage terms – you can cut hundreds of billions theoretically but it is unlikely and even if you did it isn’t a huge change).

We are piling on more debt than we should. Therefore we should increase revenue, not reduce it. But if we can’t increase it (for political reasons) we definitely should not reduce it until we have shown that we have cut spending below revenue for 2 full years. After that, great, then decrease rates.

The White House, Washington DC by John Hunter. See more of my photos of Washington DC.

The VAT tax on businesses replacing the corporate tax system is in Cruz’s plan and this is the best option for corporate taxes in my opinion. Another decent option is just to pass through all the earnings to the owners (I first heard this proposal from my Economics professor in College) and tax them on the earnings.

Increasing the giveaways to trust-fund baby as Cruz and Trump propose is the single worst tax policy change that can be made. I have explained previously how bad an idea this is: The estate tax is the most capitalist tax that exists. The trust-fund-baby favors should be reduced not increased. I would roll back to the Reagan Administration policy on estate tax rates.