There are many good economic reasons to have multi-generational (at least 3 generations) households. There are some good social reasons too. There can be interpersonal benefits but also annoyances (which I think is why they decreased – plus we could afford it, the USA was living extremely richly).

The Return of the Multi-Generational Family Household

…

This represents a significant trend reversal. Starting right after World War II, the extended family household fell out of favor with the American public. In 1940, about a quarter of the population lived in one; by 1980, just 12% did. A range of demographic factors likely contributed to this decline, among them the rapid growth of the nuclear-family-centered suburbs; the decline in the share of immigrants in the population; and the sharp rise in the health and economic well-being of adults ages 65 and older.

…

Another factor has been the big wave of immigration, dominated by Latin Americans and Asians, that began around 1970. Like their European counterparts from earlier centuries, these modern immigrants are far more inclined than native-born Americans to live in multi-generational family households.

However, the trend reversal has also played out among native-born Americans. And for all groups, the move into multi-generational family households has accelerated during the Great Recession that began at the end of 2007.

The percentage of the population in such households now is 16%, still significantly below the high of 24.7% in 1940.

Related: Mortgage Rates Falling on Fed Housing Focus – Personal Finance Basics: Long-term Care Insurance – Bankruptcies Among Seniors Soaring (2008)

Buying investments when prices are low is often a good investment strategy. Sometimes the prices just get lower, so it doesn’t always work. But, most likely the USA housing market will turn around, at some point. Buying real estate before prices start to rise may well be a very profitable investment. And rental property can be a very good investment, even without price appreciation, if the rental income provides a nice cash flow. This is especially true with interest rates so low (so a decent cash flow is very attractive compared to other investments). Of course, real estate investing also has challenges.

The HomeVestors-Local Market Monitor Best Markets to Invest in Rental Property ranking forecasts the expected performance of rental real estate properties, specifically single-family homes maintained as rental properties. The rankings show the extra return, or risk-return premium, that an investor must demand from rental property in a local market. The risk-return premium can be added to the regular capitalization rate to produce a risk-adjusted cap rate at full occupancy for a local market. The ranking is calculated based on three-year forecasts of home prices (reflecting underlying home-price appreciation potential) and gross rents (as a proxy for potential investor cash flow). Of course, this is based on the creators expectation (and therefore hardly to be relied upon – they have no track record to measure against yet) but it is interesting.

The Top 10 markets in the new ranking are:

- Las Vegas, Nevada

- Detroit, Michigan

- Warren, Michigan

- Orlando, Florida

- Bakersfield, California

- Tampa-St. Petersburg, Florida

- Phoenix, Arizona

- Ft. Lauderdale, Florida

- Rochester, New York

- Stockton, California

Obviously their expectations favor cities that have seen drastic price declines. And that makes sense, as long as those cities rental markets are steady and housing prices stabilize.

An interesting piece of data: HomeVestors and Local Market Monitor estimate that approximately 14% of single-family homes in the USA are maintained as rental properties.

I do believe rental property investments in many markets in the USA may well be quite wise. Investing in rental properties is much more difficult than say stocks and has some high costs (if you chose to higher a property manager, for example). Real estate also requires a long term (5+ year commitments) to have reasonable expectations of successful investing results.

Related: Apartment Vacancies Fall to Lowest in 3 Years in the USA (April 2011) – Home Values and Rental Rates – Landlords See Increase in Apartment Rentals (June 2010)

I am renting my house in Arlington, Virginia. If you are interested here is a great house with a large yard in a wonderful, quiet neighborhood near the Washington DC metro, great restaurants, parks, shopping and more. See more pictures of the house and floorplans.

Related: backyard wildlife – Apartment Vacancies Fall to Lowest in 3 Years in the USA – Apartment Rents Rise, Slightly, for First Time in 5 Quarters (April 2010)

Read more

Apartment Vacancies in U.S. Fall to Lowest in Almost Three Years

…

Effective rents, or what tenants actually pay, increased in 75 of the 82 markets Reis tracks, to an average $991 a month from $967 a year earlier and $986 in the fourth quarter. Landlords’ asking rents also climbed, to $1,047 from $1,027 a year earlier and $1,043 in the previous quarter, according to the report.

…

San Jose, California, had the most growth in effective rents during the past year, with 5.2 percent, followed by suburban Virginia and New York City, according to Reis. Effective rents declined 1.5 percent in Las Vegas during the year and grew the least in Orlando, Florida; and Colorado Springs, Colorado.

Rents have been slowly recovering the last year, after the economic shocks of the credit crisis. People, moved back into parents house and more people started sharing apartments and houses in the last few years as people where thrown out of jobs due to the after effects of the financial actions by large financial institutions. Slowly the economy has been recovering and jobs have been slowly growing and as a result the rental market has been strengthening .

Also the decline in construction the last few years has decreased the normal addition to supply. At the same time the population has continued growing. Some areas of the country seem to still have a large overcapacity in housing but areas that are adding jobs (such as Northern Virginia and New York City) are seeing increasing rents.

I have 2 properties for rent in Arlington, Virginia.

Related: Landlords See Increase in Apartment Rentals (July 2010) – USA Housing Inventory Puts Pressure on Prices (Sep 2010) – Apartment Rents Rise, Slightly, for First Time in 5 Quarters (Apr 2010) – It’s Now a Renter’s Market (Apr 2009) – Housing Rents Falling in the USA (Feb 2009)

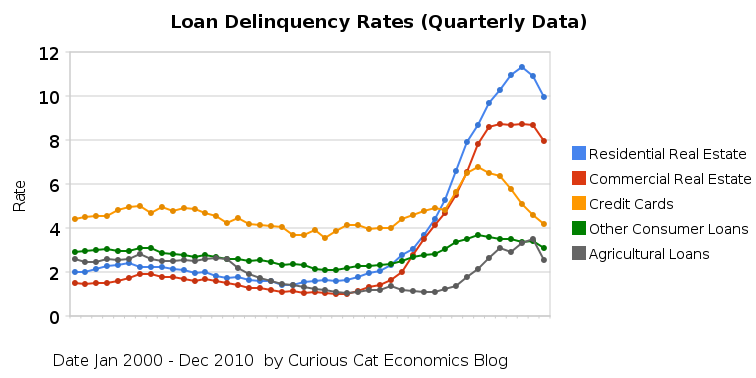

The chart shows the total percent of delinquent loans by commercial banks in the USA.

The second half of 2010 saw real estate, agricultural, credit card and other loan delinquencies decrease. The rates are still quite high but at least are moving in the right direction. Residential real estate delinquencies decreased 138 basis points in the second half of 2010, to 9.94%, which brought them to just below the rate at the end of 2009. In the second half of 2010, commercial real estate delinquencies decreased 77 basis points to 7.97% (which was also exactly 77 basis points less than at the end of 2009. Agricultural loan delinquencies decreased 76 basis points, to 2.55% (down 53 basis points from the end of 2009). Consumer loan delinquencies decreased, with credit card delinquencies down 90 basis points to 4.17% and other consumer loan delinquencies down 27 basis points to 3.1%. The credit card delinquency rate decreased a very impressive 219 basis points in 210.

Related: Real Estate and Consumer Loan Delinquency Rates 2000 through June 2010 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Bond Rates Remain Low, Little Change in Late 2009 – posts with charts showing economic data

Read more

Law enforcement officers, pre-Kindergarten through 12th grade teachers and firefighters/emergency medical technicians can contribute to community revitalization while becoming homeowners through HUD’s Good Neighbor Next Door Sales Program. HUD (United States Department of Housing and Urban Development) offers a substantial incentive in the form of a discount of 50% from the list price of the home. In return you must commit to live in the property for 36 months as your sole residence.

Eligible Single Family homes located in revitalization areas (there are hundreds of revitalization areas across the country. HUD is always working with localities to designate new areas) are listed exclusively for sales through the Good Neighbor Next Door Sales program. Properties are available for purchase through the program for five days.

Check the listings for your state. Follow the instructions to submit your interest in purchasing a specific home. If more than one person submits on a single home a selection will be made by random lottery. You must meet the requirements for a law enforcement officer, teacher, firefighter or emergency medical technician and comply with HUD’s regulations for the program.

HUD requires that you sign a second mortgage and note for the discount amount. No interest or payments are required on this “silent second” provided that you fulfill the three-year occupancy requirement.

Related: Fixed Mortgage Rates Reach New Low – Your Home as an Investment – articles on home ownership

I am looking at mortgage refinance options now (with rates being so low). I am looking at 20 year fixed rate loans with cash out (with over 20% down). The 20 year term will reduce my loan term a bit, and the final monthly cost should actually be not much higher than my current payment (with taking some cash out), I think. Do any readers have opinions on these lenders (or others with competitive offers – low rates and low expenses)?

Total Mortgage – 20 year fixed rate 3.875%, total fees and points not provided :-(, apr 4.15%

American United Mortgage – 20 year fixed rate 4% [same as 30 year rate :-(], fees $2,995 (0 points), apr 4.26%

Aim Loan – 20 year fixed rate 3.875%, fees (about $4,100 I think), apr 4.02%

These are some of the best deals I have been able to find. However, companies can play games with fees and hide excessive costs in requirements they don’t consider fees (appraisal costs…). Rates can bounce around for a specific lender, so I think it make sense to watch several (not just pick out he lowest one on whatever date you first look).

Suggestions on how to tell whether specific lenders good faith estimates are accurate and comparable would be especially appreciated.

Edits:

RoundPoint – looks good, low rates, low fees, good reviews on Zillow.

Amerisave – 20 year fixed rate 3.75%, total fees and points $3,418, apr 3.87% (removed as an option – they don’t respond to customer have tons of negative reviews online about problems, poor service, etc.

Related: Fixed Mortgage Rates Reach New Low – Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Mortgage Rates and the Fed Funds Rate – Mortgage terms

U.S. Home Prices Face Three-Year Drop as Supply Gains

…

Sales of new and existing homes fell to the lowest levels on record in July as a federal tax credit for buyers expired and U.S. unemployment remained near a 26-year high.

…

There were 4 million homes listed with brokers for sale as of July. It would take a record 12.5 months for those properties to be sold at that month’s sales pace, according to the Chicago- based Realtors group.

…

In addition to the as many as 8 million properties vacant or in foreclosure, owners of another 3.8 million homes — 5 percent of U.S. households — said they are “very likely” to put their properties on the market within six months if there is improvement, according to a survey by Seattle-based Zillow.

…

Owners of about 11 million homes, or 23 percent of households with a mortgage, owed more than their property was worth as of June 30, according to CoreLogic. Another 2.4 million borrowers had less than 5 percent equity in their houses and probably would lose money on a sale after paying broker fees and closing costs, CoreLogic said Aug 25.

The shadow inventory, poor job market and low net home equity positions continue to put a huge amount of pressure on the housing market. Very low interest rates help support the market but not much else does. In some locations the rental market is starting to help. But the tightening of credit standards is reducing the pool of potential buyers. While it is a good thing (because credit standards were far too loose) it still will extend the duration of a bear housing market.

I would be looking to buy now, if I didn’t own a house already (and was planning on staying long term).

Related: Real Estate and Consumer Loan Delinquency Rates 2000-2010 – 10 million More Renters In the Next 5 Years – The Value of Home Ownership – Nearly 10% of Mortgages Delinquent or in Foreclosure (Dec 2008)

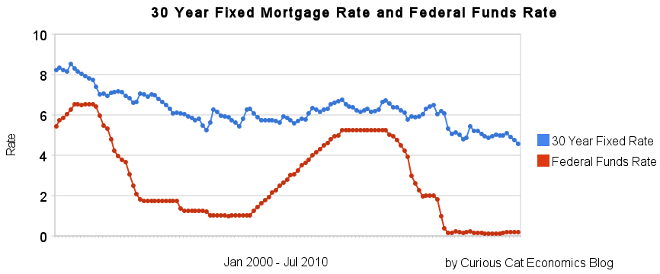

30 year fixed mortgage rates have declined sharply recently to close to 4.5%.

If you are considering refinancing a mortgage now may well be a very good time. If you are not, you maybe should consider it. If so look to shorten the length. If you originally took out a 30 year mortgage and now have, for example, 24 years let, don’t add 6 years to your repayment term by getting a new 30 year mortgage. Instead, look to shorten your pay back period with a 20 year mortgage. The 20 year mortgage will have an even lower rate than the 30 year mortgage.

If you plan on staying in the house, a fixed rate mortgage is definitely the better option, in my opinion. If you are going to move (and sell your hose) in a few years, an adjustable rate mortgage may make sense, but I would learn toward a fixed rate mortgage unless you are absolutely sure (because situations can change and you may decide you want to stay).

The poor economy, unemployment rate still at 9.5%, has the Fed continuing massive intervention into the economy. The Fed is keeping the fed funds rate at close to 0%.

If you are looking at a new real estate purchase, financing a 30 year mortgage sure is attractive at rates under to 4.5%.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – 30 Year Fixed Mortgage Rates Remain Low (Dec 2009) – Lowest 30 Year Fixed Mortgage Rates in 37 Years – What are mortgage definitions

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

Renter Nation by Gene Epstein

…

Demographics also will deal home sellers and builders a clear blow. Not surprisingly, the home-ownership rate tends to rise with age. For example, while the overall U.S. rate is 67.2%, the rate for households headed by someone under 35 is just 38.9%.

Thus, whenever the age distribution of households tilts in favor of younger adults, the overall home-ownership rate declines.

…

Largely because the echo boomers are more numerous than the baby busters, there are now more U.S. residents aged 15 to 29 than 30 to 44. So five years from now, the nation will have more 20-to-34-year-olds than 35-to-49-year-olds.

…

Dallas-based Axiometrics tracks monthly price and occupancy data on apartments in 305 markets around the country. Its research chief, Jay Denton, reports that, on new leases written through this year’s first six months, effective rents—those after all concessions are taken into account—rose a robust 3.2%, after declining through 2009 and much of 2008. And occupancy growth, adds Denton, is close to the best he’s seen in the past 13 years.

Related: articles on real estate investing – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Apartment-vacancy Rate is 7.8%, a 23-year High (Nov 2009)