Manufacturing is an powerful driver of economic wealth. For years I have been providing data to counter the contention that the manufacturing base of the USA is gone and the little bit left was shrinking. The latest data again shows the USA is the largest manufacturer, and manufacturing in the USA continues to grow. It is true global manufacturing has begun to grow more rapidly than USA manufacturing in the last few years. I doubt many suspect that the USA’s share of manufacturing stayed stable from 1990 to 1995 then grew to 2000 took until 2006 to return to the 1990-1995 levels and then has declined in 2007 and 2008 a bit below the 1990 level and during that entire time was growing (even in 2007 and 2008).

The USA’s share of the manufacturing output, of the countries that manufactured over $185 billion in 2008, 28% in 1990, 28% in 1995, 32% in 2000, 28% in 2005, 28% in 2006, 26% in 2007 and 24% in 2008. China’s share has grown from 4% in 1990, 6% in 1995, 10% in 2000, 13% in 2005, 14% in 2006, 16% in 2007 to 18% in 2008. Japan’s share has fallen from 22% in 1990 to 14% in 2008 (after increasing to 26% in 1995 then steadily falling). The USA has about 4.5% of the world population, China about 20%.

Based on the latest UN Data, for global manufacturing, in billions of current US dollars:

| Country | 1990 | 1995 | 2000 | 2005 | 2006 | 2007 | 2008 |

|---|---|---|---|---|---|---|---|

| USA | 1,041 | 1,289 | 1,543 | 1,624 | 1,712 | 1,756 | 1,831 |

| China | 145 | 300 | 484 | 734* | 891* | 1,106* | 1,399** |

| Japan | 810 | 1,219 | 1,034 | 979 | 927 | 923 | 1,045 |

| Germany | 438 | 517 | 392 | 571 | 608 | 711 | 767 |

| Italy | 240 | 226 | 206 | 295 | 302 | 345 | 381 |

| United Kingdom | 206 | 218 | 226 | 264 | 295 | 323 | 323 |

| France | 200 | 233 | 190 | 255 | 255 | 287 | 306 |

| Russian Federation | 120 | 64 | 45 | 124 | 157 | 206 | 256 |

| Brazil | 120 | 125 | 96 | 137 | 163 | 201 | 237 |

| Korea | 66 | 131 | 136 | 211 | 234 | 260 | 231 |

| Spain | 112 | 104 | 98 | 160 | 170 | 196 | 222 |

| Mexico | 62 | 67 | 133 | 154 | 175 | 182 | 197 |

| Canada | 92 | 100 | 129 | 168 | 182 | 197 | 195 |

| India | 51 | 61 | 69 | 122 | 141 | 177 | 188 |

* I am using the data from last year that separated the manufacturing data (this year the data does not provide separate manufacturing data for China) instead of that shown in the most recent data (which doesn’t separate manufacturing)

** The China data is not provided for manufacturing alone. The percentage of manufacturing (to manufacturing, mining and utilities) was 78% for 2005-2007 (I used 78% of the manufacturing, mining and utilities figure provided in the 2008 data).

I hope to write a series of posts examining global manufacturing data including looking at manufacturing data specifically (excluding mining and utility data).

Read more

I like to buy stocks cheap and then hold them as they rise in price. This is not a unique desire, I know. One thing this lead me to do was find a stock I liked but hold off buying it until I could buy it for less. When that works it is great. However, one thing that happened several times is that I found stocks I really liked and they just went up and went up more and kept going up. And I never owned them.

I learned, after awhile, that is was ok to buy a stock at a higher price once I realized I made a mistake. Instead of just missing out because I made a mistake and didn’t buy it at a lower price than I needed to pay today (which made it feel really lame to buy it now at a higher price) I learned to accept that buying at the higher price available today was the best option.

I have seen two types of situations where this takes place: one I realize I was just way off, it was a great deal at the price I could have bought at – I just made a mistake. And if it was still a good buy, I should buy it. Another is that the stock price goes up but new news more than makes up for the increased stock price (the news makes the value of stock increase more than the price has increased).

I missed out on the Google IPO, even though I really wanted to buy. Then the price went way up and even though I had learned this (don’t avoid buying a stock today just because you made the mistake of not buying it at a lower price earlier) tip I wanted to buy it for less than the current price and so kept not buying it (emotion is a real factor in investing and that is another thing I have realized – you need to accept it and deal with it to be a good investor). Then Google announced spectacular earnings and it was finally enough to get me to buy the stock a few days later at $219 (which was well over twice the price 6 months earlier). But it was a great buy at $219 and losing that just because I should have bought it at $119 is not wise – but something I did many times in the past.

In March of 2009 I bought some ATPG at $3.20. In August I bought more at $11. The news was bit better but really it was just a huge huge bargain at $3.20 and I should have bought a lot more. In the last 5 trading days ATPG was up $5.12 (16.78 – 11.66). A nice gain. Right now, it is up another 68 cents today at $17.43. Now this is a volatile stock and until I sell it may not turn out to be profitable investment, but the odds are good that it will.

It is also hard to know when to sell – in fact for many selling at the wrong time (either selling too late – after it collapses [for good or sell it after a collapse only to see it recover], or too early missing out on huge gains) is the biggest problem they have in becoming a successful investor). One trait of many successful investors is holding the right investments for huge gains. A few stellar performances can lift the entire portfolio to long term investing success. And if you sell those stocks early you miss huge opportunities.

Holding on for the huge gains is a mistake I do not want to make – and so when the opportunity is there for such gains I am willing to risk losing some gains for the potential of a much larger gain. Right now the balance is keeping me from selling any ATPG, though I am likely to sell some if it increases (while continuing to hold some of the position).

Related: Great Google Earnings April 2007 – Nicolas Darvas (investor and speculator) – Not Every Day is Profitable – Does a Declining Stock Market Worry You? – 401(k)s are a Great Way to Save for Retirement – Beating the Market, Suckers Game? – Sleep Well Fund

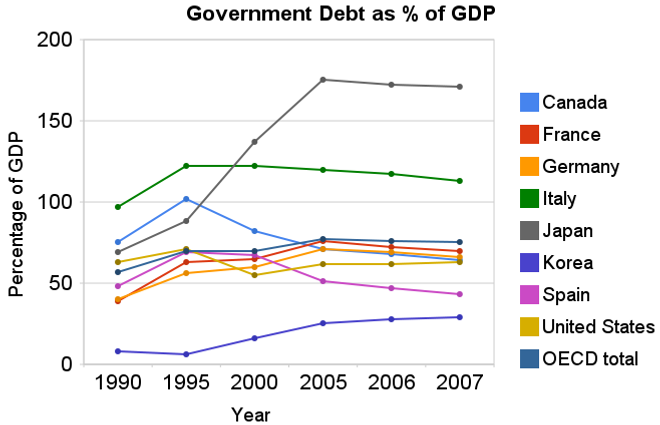

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, Sept 2009.

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, Sept 2009.For 2007 most countries slightly decreased their government debt to GDP ratio – as economic growth exceeded debt growth. The OECD is made up of countries in Europe and the USA, Japan, Korea, Australia, New Zealand and Canada. The overall OECD debt to GDP ratio decreased from 77% in 2005 to 75% in 2007. The USA moved in the opposite direction increasing from 62% to 63%: still remaining far below the OECD total. Most likely 2008, 2009 and 2010 will see both the USA and other OECD national dramatically increase the debt burden.

Compared to the OECD countries the USA is actually better than average. The chart shows the percentage of GDP that government debt represents for various countries. The USA ended 2007 at 63% while the overall OECD total is 75%. In 1990 the USA was at 63% and the OECD was at 57%. Japan is the line way at the top with a 2007 total of 171% (that is a big problem for them). Korea is in the best shape at just a 29% total in 2007 but that is an increase from just 8% in 1990.

Related: Government Debt as a Percentage of GDP Through 2006 – Oil Consumption by Country in 2007 – Federal Deficit To Double This Year – Politicians Again Raising Taxes On Your Children – True Level of USA Federal Deficit – Top 12 Manufacturing Countries in 2007

Read more

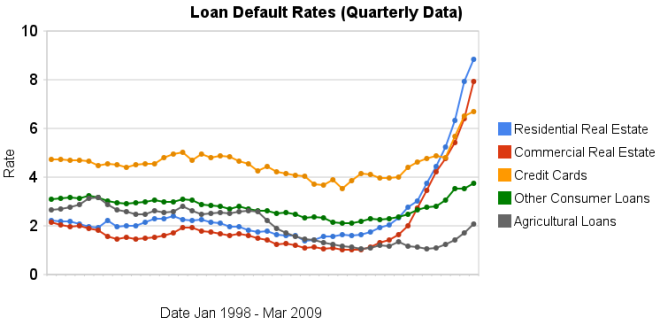

Chart showing loan delinquency rates for real estate, consumer and agricultural loans for 1998 to 2009 by the Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing loan delinquency rates for real estate, consumer and agricultural loans for 1998 to 2009 by the Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Delinquency rates on commercial (up another 151 basis points) and residential (93 basis points) real estate continued to increase dramatically in the second quarter. Credit card delinquency rates increased but only by 20 basis points.

Real estate delinquency rates exploded in 2008. In the 4th quarter of 2007 residential delinquency rates were 3.02% by the 4th quarter of 2008 they were 6.34% and in the 2nd quarter of this year they were 8.84% (582 basis points above the 4th quarter of 2007). Commercial real estate delinquency rates were at 2.74% in the 4th quarter of 2007, 5.43% in the fourth quarter of 2008 and 7.91% in the 2nd quarter of 2009 (a 517 basis point increase).

Credit card delinquency rates were much higher than real estate default rates for the last 10 years (the 4-5% range while real estate hovered above or below 2%). Now they are over 200 and 300 basis points bellow residential and commercial delinquency rates respectively. From 4.8% in the 3rd quarter 2008 to 5.66% in the 4th and 6.5% in the 1st quarter of 2009.

The delinquency rate on other consumer loans and agricultural loan delinquency rates are up but nowhere near the amounts of real estate or credit cards.

As I wrote recently bond yields in the last few months show a dramatic increase in investor confidence for corporate bonds.

Related: Loan Delinquency Rates: 1998-2009 – The Impact of Credit Scores and Jumbo Size on Mortgage Rates – 30 Year Mortgage Rate and Federal Funds Rate Chart

The largest oil consuming countries (and EU), in millions of barrels per day for 2007. China increased use by 1 billion barrels a day, the USA and Europe decreased use by 100 million barrels a day from our post last year on Oil Consumption by Country.

| Country | consumption | % of oil used | % of population | % of World GDP | % of oil used in 2006 |

|---|---|---|---|---|---|

| USA | 20.7 | 24.3 | 4.5 | 21.0 | 25.9 |

| European Union | 14.4 | 16.9 | 7.4 | 21.9 | 18.1 |

| China | 7.9 | 9.2 | 19.9 | 10.8 | 8.6 |

| Japan | 5.0 | 5.8 | 1.8 | 6.5 | 6.7 |

| India | 2.7 | 3.1 | 17.3 | 4.5 | 3.0 |

| Russia | 2.7 | 3.1 | 2.0 | 3.1 | 3.6 |

| Germany | 2.5 | 2.8 | 1.2 | 4.2 | 3.3 |

| Brazil | 2.4 | 2.7 | 2.9 | 2.8 | 2.6 |

| Canada | 2.4 | 2.7 | 0.4 | 1.9 | 2.9 |

| Mexico | 2.1 | 2.4 | 1.6 | 2.0 | 2.6 |

| South Korea | 2.1 | 2.4 | 0.7 | 1.8 | 2.7 |

Data is from CIA World Factbook 2009 (downloaded August 2009). GDP calculated using purchasing power parity from 2008 fact book with estimated 2007 data.

Related: Government Debt as a Percentage of GDP – Global Manufacturing Production by Country – Manufacturing Contracting Globally (March 2009)

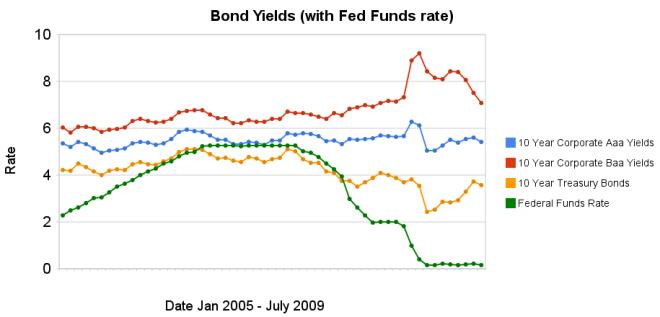

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.The changes in bond yields over the last 3 months months indicate a huge increase in investor confidence. The yield spread between corporate Baa 10 year bonds and 10 year treasury bonds increased 304 basis points from July 2008 to December 2008, indicating a huge swing in investor sentiment away from risk and to security (US government securities). From April 2009 to July 2009 the yield spread decreased by 213 basis points showing investors have moved away from government bonds and into Baa corporate bonds.

From April to July 10 year corporate Aaa yields have stayed essentially unchanged (5.39% to 5.41% in July). Baa yields plunged from 8.39% to 7.09%. And 10 year government bond yields increased from 2.93% to 3.56%. federal funds rate remains under .25%.

Investors are now willing to take risk on corporate defaults for a much lower premium (over government bond yields) than just a few months ago. This is a sign the credit crisis has eased quite dramatically, even though it is not yet over.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Continued Large Spreads Between Corporate and Government Bond Yields (April 2009) – Chart Shows Wild Swings in Bond Yields (Jan 2009) – investing and economic charts

I originally setup the 10 stocks for 10 years portfolio in April of 2005. In order to track performance created a marketocracy portfolio but had to make some minor adjustments (and marketocracy doesn’t allow Tesco to be purchased, though it is easily available as an ADR to anyone in the USA to buy in real life – it is based in England). The current marketocracy calculated annualized rate or return (which excludes Tesco) is 3.5% (the S&P 500 annualized return for the period is -1.7%) – marketocracy subtracts the equivalent of 2% of assets annually to simulate management fees – as though the portfolio were a mutual fund – so without that the return is about 5.5%).

The current stocks, in order of return:

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| Amazon – AMZN | 136% | 9% | 9% | |

| Google – GOOG | 105% | 15% | 13% | |

| Templeton Dragon Fund – TDF | 80% | 11% | 11% | |

| PetroChina – PTR | 78% | 11% | 10% | |

| Templeton Emerging Market Fund – EMF | 28% | 5% | 6% | |

| Cisco – CSCO | 15% | 6% | 8% | |

| Toyota – TM | 7% | 9% | 11% | |

| Danaher – DHR | -14% | 6% | 9% | |

| Tesco – TSCDY | -14%* | 0%* | 10% | |

| Intel – INTC | -15% | 4% | 6% | |

| Pfizer – PFE | -38% | 5% | 7% | |

| Dell | -60% | 4% | 0% |

The portfolio is beating the S&P 500 by 5.2% annually (which is actually quite good. Also it is a bit confused due to to Tesco not being included. View the current marketocracy Sleep Well portfolio page.

Related: 12 Stocks for 10 Years Update – June 2008 – posts on stocks – investing books

Read more

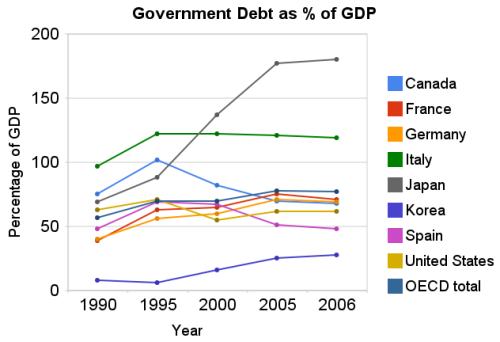

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, March 2009.

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, March 2009.The USA federal government debt is far too large, in my opinion. We have been raising taxes on future taxpayers for several decades, to finance our current spending. Within reason deficit spending is fine. What that reasonable level is however, is not easy to know. One big problem with the past few decades is that during very prosperous economic times we spent money that we didn’t have, choosing to raise taxes on the future (instead of either not spending as much or paying for what we were spending by raising taxes to pay for current spending).

By not even paying for what we are spending when times were prosperous we put ourselves in a bad situation when we have poor economic conditions – like today. If we were responsible during good economic times (and at least paid for what we spent) we could have reduced our debt as a percentage of GDP. Even if we did not pay down debt, just by not increasing the outstanding debt while the economy grew the ratio of debt to GDP would decline. Then when times were bad, we could afford to run deficits and perhaps bring the debt level up to some reasonable level (maybe 40% of GDP – though it is hard to know what the target should be, 40% seems within the realm of reason to me, for now).

There is at least one more point to remember, the figures in the chart are based on reported debt. The USA has huge liabilities that are not accounted for. So you must remember that the actually debt is much higher than reported in the official debt calculation.

Now on to the good news. As bad as the USA has been at spending tomorrows increases in taxes today, compared to the OECD countries we are actually better than average. The OECD is made up of countries in Europe, the USA, Japan, Korea, Australia, New Zealand and Canada. The chart shows the percentage of GDP that government debt represents for various countries. The USA ended 2006 at 62% while the overall OECD total is 77%. In 1990 the USA was at 63% and the OECD was at 57%. Japan is the line way at the top with a 2006 total of 180% (that is a big problem for them). Korea is in the best shape at just a 28% total in 2006 but that is an increase from just 8% in 1990.

Related: Federal Deficit To Double This Year – Politicians Again Raising Taxes On Your Children – True Level of USA Federal Deficit – Who Will Buy All the USA’s Debt? – Top 12 Manufacturing Countries in 2007 – Oil Consumption by Country

Read more

Health spending in the United States grew 6.1 percent in 2007, to $2.2 trillion or $7,421 per person.

For comparison the total GDP per person in China is $6,100. This continues the trend of health care spending taking an every increasing portion of the economic output (the economy grew by 4.8 percent in 2007). This brings health care spending to 16.2% of GDP (which is yet another, in a string of record high percentages of GDP spent on health care). In 2003 the total health care spending was 15.3 of GDP.

With the exception of prescription drugs (which grew at 1.4% in 2007, compared to the 3.5% in 2006), spending for most other health care services grew at about the same rate or faster than in 2006. Hospital spending, which accounts for about 30 percent of total health care spending, grew 7.3 percent in 2007, compared to 6.9 percent in 2006.

Spending growth for both nursing home and home health services accelerated in 2007 (4.8% v. 4.0%). Spending growth for freestanding home health care services increased to 11.3 percent. Total health care spending by public programs, such as Medicare and Medicaid, grew 6.4% in 2007 v. 8.2% in 2006. In comparison, health care spending by private sources grew 5.8% compared to 5.4%.

Private health insurance premiums grew 6.0 percent in 2007, the same rate as in 2006. Out-of-pocket spending grew 5.3 percent in 2007, an acceleration from 3.3 percent growth in 2006. Out-of-pocket spending accounted for 12.0 percent of national health spending in 2007. This share has been steadily declining both recently and over the long-run; in 1998, it accounted for 14.7 percent of health spending and, in 1968, out-of-pocket spending accounted for 34.8 percent of all health spending.

The costs for health services and supplies for 2007 were distributed among businesses (25%), households (31%), other private sponsors (4%), and governments (40%).

Decades ago Dr. Deming included excessive health care costs as one of the seven deadly diseases of western management. We have only seen the problem get worse. Finally it seems that a significant number of people are in agreement that the system is broken. Still, admitting the system is broken is not the same as agreeing on how to fix it. The way forward to workable solutions still seems very difficult.

Full press release from the United States Department of Health and Human Services.

Related: International Health Care System Performance – Personal Finance Basics: Health Insurance – Many Experts Say Health-Care System Inefficient, Wasteful – How to Improve the Health Care System

Scott Adams does a great job with Dilbert and he presents a simple, sound financial strategy in Dilbert and the Way of the Weasel, page 172, Everything you need to know about financial planning:

- Make a will.

- Pay off your credit cards.

- Get term life insurance if you have a family to support.

- Fund your 401(k) to the maximum.

- Fund your IRA to the maximum.

- Buy a house if you want to live in a house and you can afford it.

- Put six months’ expenses in a money market fund. [this was wise, given the currently very low money market rates I would use “high yield” bank savings account now, FDIC insured – John]

- Take whatever money is left over and invest 70% in a stock index fund and 30% in a bond fund through any discount broker, and never touch it until retirement.

- If any of this confuses you or you have something special going on (retirement, college planning, tax issues) hire a fee-based financial planner, not one who charges a percentage of your portfolio.