The markets continue to provide difficult options to investors. In the typical market conditions of the last 50 years I think a sensible portfolio allocation was not that challenging to pick. I would choose a bit more in stocks than bonds than the commonly accepted strategy. And I would choose to put a bit more overseas and in real estate.

But if that wasn’t done and even something like 60% stocks and 40% bonds were chosen it would seem reasonable (or 60% stocks 25% bonds and 15% money market – I really prefer a substantial cushion in cash in retirement). Retirement planning is fairly complex and many adjustments are wise for an individual’s particular situation (so keep in mind this post is meant to discuss general conditions today and not suggest what is right for any specific person).

I wrote about Retirement Savings Allocation for 2010: 5% real estate, 35% global stocks, 5% money market, 55% USA stocks. This was when I was young and accumulating my retirement portfolio.

Today, investment conditions make investing in retirement more difficult than normal. With interest rates so low bonds provide little yield and have increased risk (due to how much long term bond prices would fall if interest rates rise, given how low interest rates are today). And with stocks so highly valued the likelihood of poor long term returns at these levels seems higher than normal.

So the 2 options for the simplest version of portfolio allocation are less attractive than usual, provide lower income than usual and have great risk of decline than usual. That isn’t a good situation.

View of Glacier National Park (a nice place to go in retirement, or before retirement) by John Hunter

I do think looking for dividend stocks to provide some current yield in this situation makes sense. And in so doing substitute them for a portion of the bond portfolio. This strategy isn’t without risk, but given the current markets I think it makes sense.

I have always thought including real estate as part of a portfolio was wise. It makes even more sense today. In the past Real Estate Investment Trusts (REITs) were very underrepresented in the S&P 500 index, in 2016 and 2017 quite a few REITs were added. This is useful to provide some investing in REITs for those who rely on the S&P 500 index funds for their stock investments. Still I would include REIT investments above and beyond their portion of the S&P 500 index. REITs also provide higher yields than most stocks and bonds today so they help provide current income.

While I am worried about the high valuations of stocks today I don’t see much option but to stay heavily invested in stocks. I generally am very overweight stocks in my portfolio allocation. I do think it makes sense to reduce how overweight in stocks my portfolio is (and how overweight I think is sensible in general).

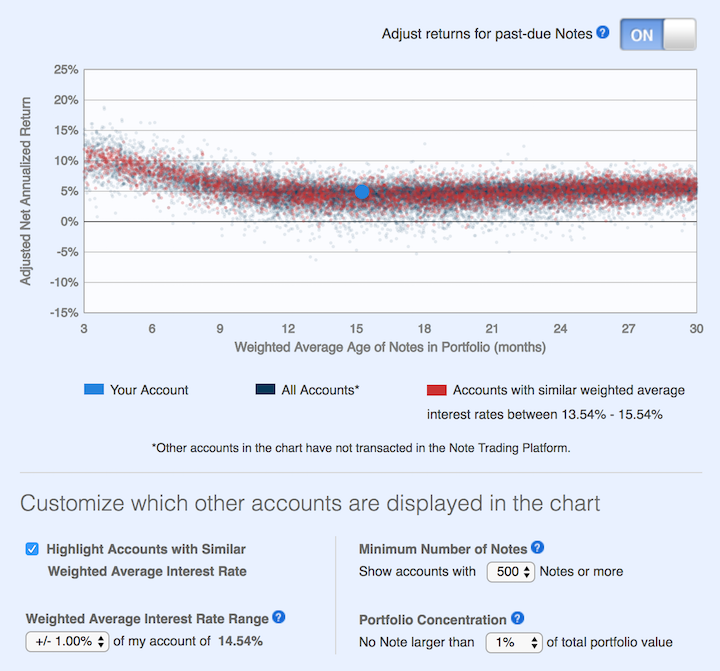

I have decided to wind down my investment test with LendingClub. I should end up with a investment return of about 5% annually. So it beat just leaving the money in the bank. But returns are eroding more recently and the risk does not seem worth the returns.

Early on I was a bit worried by how often the loan defaulted with only 0, 1 or 2 payments made. Sure, there are going to be some defaults and sometimes in extremely unlucky situation it might happen right away. But the amount of them seems to me to indicate LendingClub fails to do an adequate job of screening loan candidates.

Over time the rates LendingClub quoted for returns declined. The charges to investors for collecting on late loans were very high. It was common to see charges 9 to 10 times higher as the investor than were charged to the person that took out the loan and made the late payment.

For the last 6 months my account balance has essentially stayed the same (bouncing within the same range of value). I stopped reinvesting the payments received from LendingClub loans several months ago and have begun withdrawing the funds back to my account. I will likely just leave the funds in cash to increase my reserves given the lack of appealing investment options (and also a desire to increase my cash position in given my personal finances now and looking forward for the next year). I may invest the funds in dividend stocks depending on what happens.

This chart shows lending club returns for portfolios similar to mine. As you can see a return of about 5% is common (which is about where I am). Quite a few more than before actually have negative returns. When I started, my recollection is that their results showed no losses for well diversified portfolios.

The two problems I see are poor underwriting quality and high costs that eat into returns. I do believe the peer to peer lending model has potential as a way to diversify investments. I think it can offer decent rates and provide some balance that would normally be in the bond portion of a portfolio allocation. I am just not sold on LendingClub’s execution for delivering on that potential good investment option. At this time I don’t see another peer to peer lending options worth exploring. I will be willing to reconsider these types of investments at a later time.

I plan to just withdraw money as payments on made on the loans I participated in through LendingClub.

Related: Peer to Peer Portfolio Returns and The Decline in Returns as Loans Age (2015) – Investing in Peer to Peer Loans – Looking for Yields in Stocks and Real Estate (2012) – Where to Invest for Yield Today (2010)

I have written before about one of the most important changes I believe is needed in thinking about investing over the last few decades: Historical Stock Returns.

My belief is that there has been a fundamental change in the valuation of stocks. Long term data contains a problem in that we have generally realized that stocks are more valuable than realized 100 years ago. That means a higher based PE ratio is reasonable and it distorts at what level stocks should be seen as very overpriced.

It also depresses expected long term returns, see my original post for details.

Jeremy Grantham: The Rules Have Changed for Value Investors

Since 2000, it’s become much more complicated. The rules have shifted. We used to say that this time is never different. I think what has happened from 2000 until today is a challenge to that. Since 1998, price-earnings ratios have averaged 60 percent higher than the prior 50 years, and profit margins have averaged 20 to 30 percent higher. That’s a powerful double whammy.

Diehard Ben Grahamites underestimated what earnings and stock prices would do. That began to be a drag after 1998.

I believe he is right. I believe in the value of paying attention to historical valuation and realizing markets often go to extremes. However, if you don’t account for a fundamental shift in valuation you see the market as overvalued too often.

So why have prices risen so high without a hint of euphoria — at least until very recently — or a perfect economy? My answer is that the discount rate structure has dropped by two percentage points. The yield on stocks is down by that amount and bonds too. The market has adjusted, reflecting low rates, low inflation and high profit margins.

Again I agree. Our political parties have aided big business in undermining market through monopolistic market control and that has been consistent (and increasing) for decades now. It makes stocks more valuable. They have moats due to their monopolistic position. And they extract economic rents from their customers (granted they put a large amount of those ill gotten gains into executives pockets but even so they gains are large enough to increase the value of the stocks).

On top of these strong forces we have the incredible interest rate conditions of the last decade. This is the one that is most worrisome for stock values in my opinion. It servers to boost stock prices (due to the poor returns for interest bearing investments). And I worry at some point this will change.

There is also likely at some point to be a political return to the value of capitalism and allowing free markets to benefit society. But for now we have strong entrenched political parties in the USA that have shown they will undermine market forces and provide monopolistic pricing power to large companies that provide cash to politicians and parties in order to have those parties undermine the capitalist market system.

I believe the stock market in the USA today may well be overvalued. I don’t think it is quite as simple as some of the measures (CAPE – cyclical adjusted PE ratio or market value to USA GDP) make it out to be though. As I have said for several years, I believe we are currently living through one of the more challenging investment climates (for long term investors seeking to minimize long term risk and make decent returns over the long term). I still think it is best just to stick with long term portfolio diversification strategies (though I would boost cash holdings and reduce bonds). And since I am normally light on bonds and high on stocks, for someone like me reducing stock holding for cash is also reasonable I believe (but even doing this I am more in stocks than most portfolio allocations would suggest).

Related: Monopolies and Oligopolies do not a Free Market Make – Misuse of Statistics, Mania in Financial Markets – Interview with Investing Blogger John Hunter

This post continues our series on peer-to-peer lending (and LendingClub): Peer to Peer Portfolio Returns and The Decline in Returns as Loans Age, Investing in Peer to Peer Loans. LendingClub, and other peer-to-peer lenders let you use filters to find loans that meet your criteria. So if you chose to take more, or less, risk you can use filters to find loans fitting your preferences. Those filters can also be applied to automate your lending.

There are resources online to help you understand the past results of various investing strategies (returns based on various filters). Some filter are just a trade-off of risk for return. You can invest in grade A (a LendingClub defined category) loans that have the lowest risk, and the lowest interest rates and historical returns. Or you can increase your risk and get loans with higher interest rates and also higher historical returns (after factoring in defaults).

Description of chart: This chart shows the historical performance by grade for all issued loans.

This chart includes all loans that were issued 18 months or more before the last day of the most recently completed quarter. The historical returns data in the chart is updated monthly.

Adjusted Net Annualized Return (“Adjusted NAR”) is a cumulative, annualized measure of the return on all of the money invested in loans over the life of those loans, with an adjustment for estimated future losses.

LendingClub lets you set filters to use to automatically invest in new loans as funds are available to invest (either you adding in new money or receiving payments on existing loans). This is a nice feature, there are items you can’t filter on however, such as job title. And also you can’t make trade-offs, say given x, y and z strong points and a nice interest rate in this loan I will accept a bit lower value on another factor.

So I find I have to be a bit less forgiving on the filter criteria and then manually make some judgements on other loans. For me I add a bit higher risk on my manual selections. I would imagine most people don’t bother with this, just using filters to do all the investing for them. And I think that is fine.

Practically what I do so that I can make some selections manually is to set the criteria to only be 98% invested. This will cause it to automatically invest any amount over 2% that is not invested. You can set this to whatever level you want and also is how you can make payments to yourself. I will say I think one of the lamest “features” of LendingClub is that is has no ability to send you regular monthly checks. So you have to manually deal with it.

It should be simple for them to let you set a value like send me $200 on the 15th of each month. And then it manages the re-investments knowing that and your outstanding loans. But they still don’t offer that feature.

As I said one of the factors in setting filters is managing risk v. reward but the other is really about weaknesses in the algorithm setting rates. You can just see it as risk-reward trade-off but I think it is more sensible to see 2 different things. The algorithm weaknesses are factors that will fluctuate over time as the algorithm and underwriting standards are improved. For example, loans in California had worse returns (according to every site I found accessing past results). There is no reason for this to be true. If a person with the exactly same profile is riskier in California that should be reflected in higher rates and thus bring the return into balance. My guess is this type of factor will be eliminated over time. But if not, or until it is, fixed filtering out loans to California makes sense.

Once you set your filter criteria then you select what balance you want between A, B, C, D, E and FG loans. I set mine to

A 2%

B 16%

C 50%

D 20%

E 10%

I actually have a bit over 1% in FG (but I select those myself). In 2015 the makeup of the loans given by LendingClub was A 17%, B 26%, C 28%, D 15%, E 10%, F and G 4%.

Related: Where to Invest for Yield Today (2010) – Default Rates on Loans by Credit Score – Investing in Stocks That Have Raised Dividends Consistently – Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation

Sadly Lending Club uses fragile coding practices that result in sections of the site not working sometimes. Using existing filters often fails for me – the code just does nothing (it doesn’t even bother to provide feedback to the user on what it is failing to do). Using fragile coding practices sadly is common for web sites with large budgets. Instead of using reliable code they seems to get infatuated with cute design ideas and don’t bother much making the code reliable. You can code the cute design ideas reliably but often they obviously are not concerned with the robustness of the code.

Peer to peer lending has grown dramatically the last few years in the USA. The largest platforms are Lending Club (you get a $25 bonus if you sign up with this link – I don’t think I get anything?) and Prosper. I finally tried out Lending Club starting about 6 months ago. The idea is very simple, you buy fractional portions of personal loans. The loans are largely to consolidate debts and also for things such as a home improvement, major purchase, health care, etc.).

With each loan you may lend as little as $25. Lending Club (and Prosper) deal with all the underwriting, collecting payments etc.. Lending Club takes 1% of payments as a fee charged to the lenders (they also take fees from the borrowers).

Borrowers can make prepayments without penalty. Lending Club waives the 1% fee on prepayments made in the first year. This may seem a minor point, and it is really, but a bit less minor than I would have guessed. I have had 2% of loans prepaid with only an average of 3 months holding time so far – much higher than I would have guessed.

On each loan you receive the payments (less a 1% fee to Lending Club) as they are made each month. Those payments include principle and interest.

This chart shows the historical performance by grade for all issued loans that were issued 18 months or more before the last day of the most recently completed quarter. Adjusted Net Annualized Return (“Adjusted NAR”) is a cumulative, annualized measure of the return on all of the money invested in loans over the life of those loans, with an adjustment for estimated future losses. From LendingClub web site Nov 2015, see their site for updated data.

Lending Club provides you a calculated interest rate based on your actual portfolio. This is nice but it is a bit overstated in that they calculate the rate based only on invested funds. So funds that are not allocated to a loan (while they earn no interest) are not factored in to your return (though they actually reduce your return). And even once funds are allocated the actual loan can take quite some time to be issued. Some are issued within a day but also I have had many take weeks to issue (and some will fail to issue after weeks of sitting idle). I wouldn’t be surprised if Lending Club doesn’t start considering funds invested until the loan is issued (which again would inflate your reported return compared to a real return), but I am not sure how Lending Club factors it in.

This chart shows that the percentage of millionaire families by highest education level is dramatically different by education level. The data is looking at USA family income for household headed by a person over 40. For high school dropouts, fewer than 1% are millionaires; all families it is about 5%; high school graduates about 6%; 4 year college degree about 22% and graduate or professional degree about 38%.

Interesting chart based on Federal Reserve data (via the Wall Street Journal)

While the costs of higher education in the USA have become crazy the evidence still suggests education is highly correlated to income. Numerous studies still show that the investment in education pays a high return. Of course, simple correlation isn’t sufficient to make that judgement but in other studies they have attempted to use more accurate measures of the value of education to life long earnings.

Related: The Time to Payback the Investment in a College Education in the USA Today is Nearly as Low as Ever, Surprisingly – Looking at the Value of Different College Degrees – Engineering Graduates Earned a Return on Their Investment In Education of 21%

The blog post with the chart, Why Wealth Inequality Is Way More Complicated Than Just Rich and Poor has other very interesting data. Go read the full post.

Average isn’t a very good measure for economic wealth data, is is skewed horribly by the extremely wealthy, median isn’t a perfect measure but it is much better. The post includes a chart of average wealth by age which is interesting though I think the $ amounts are largely worthless (due to average being so pointless). The interesting point is there is a pretty straight line climb to a maximum at 62 and then a decline that is about as rapid as the climb in wealth.

That decline is slow for a bit, dropping, but slowly until about 70 when it drops fairly quickly. It isn’t an amazing result but still interesting. It would be nice to see this with median levels and then averaged over a 20 year period. The chart they show tells the results for some point in time (it isn’t indicated) but doesn’t give you an idea if this is a consistent result over time or something special about the measurement at the time.

They also do have a chart showing absolute wealth data as median and average to show how distorted an average is. For example, median wealth for whites 55-64 and above 65 is about $280,000 and the average for both is about $1,000,000.

Related: Highest Paying Fields at Mid Career in USA: Engineering, Science and Math – Wealthiest 1% Continue Dramatic Gains Compared to Everyone Else – Correlation is Not Causation: “Fat is Catching” Theory Exposed

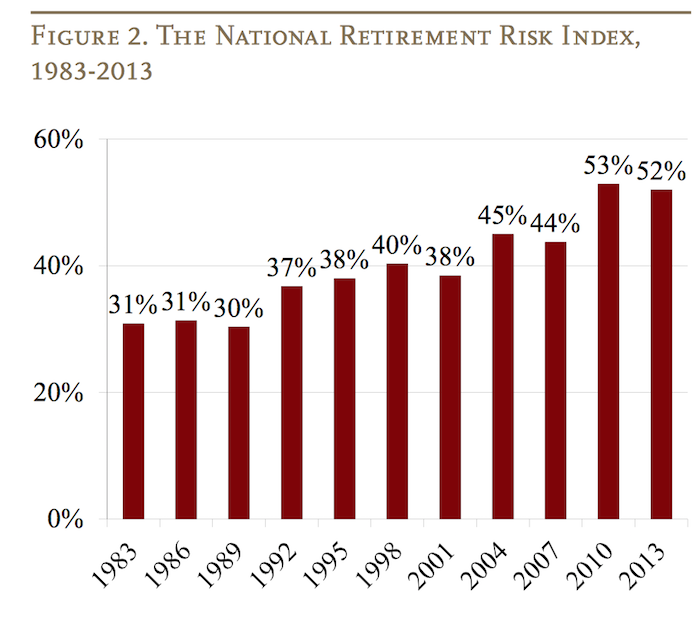

The Center for Retirement Research at Boston College is a tremendous resource for those planning for, or in, retirement. The center created the National Retirement Risk Index (NRRI) to capture a macroeconomic level measure of how those in the USA are progressing toward retirement.

Based on the Federal Reserve’s 2013 Survey of Consumer Finances the Center updated the NRRI results (the entire article is a very good read).

The lower the risk number in the chart the better, so things have not been going well since the 1990s for those in the USA saving for retirement.

As the report discusses their are significant issues with retirement planning that defy easy prediction; this makes things even more challenging for those saving for retirement. The report discusses the difficulty placed on retirees by the Fed’s extremely low interest rate policy (a policy that provides billions each year to too-big-too-fail banks – hardly the reward that should be provided for bringing the world to economic calamity but never-the-less that transfer of wealth from retirees to too-big-to-fail banks is the policy the Fed has chosen).

That exacerbates the problems of too little savings during the working career for those in the USA. The continued evidence is that those in the USA continue to spend too much today and save too little. Also you have to expect the Fed and politicians will continue to make policy that favors their friends at too-big-fail banks and hedge funds and the like. You can’t expect them to behave differently than they have been the last 50 years. That means the likely actions by the government to take from median income people to aid the richest 1% (such as bailing out the bankers with super low interest rate policies and continue to subsidize losses and privatize their winning bets) will continue. You need to have extra savings to support those policies. Of course we could change to do things differently but there is no realistic evidence of any move to do so. Retirement planning needs to be based on evidence, not hopes about how things should be.

Related: How Much of Current Income to Save for Retirement – Save What You Can, Increase Savings as You Can Do So – Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually – Retirement Planning: Looking at Assets (2012) – How Much Will I Need to Save for Retirement? (2009)

Delaying when you start collecting Social Security benefits in the USA can enhance your personal financial situation. You may start collecting benefits at 62, but each year you delay collecting increases your payment by 5% to 8% (see below). If you retire before your “normal social security retirement age” (see below) your payments are reduced from the calculated monthly payment (which is based on your earnings and the number of years you paid into the social security fund). If you delay past that age you get a 8% bonus added to your monthly payment for each year you delay.

The correct decision depends on your personal financial situation and your life expectancy. The social security payment increases are based on life expectancy for the entire population but if your life expectancy is significantly different that can change what option makes sense for you. If you live a short time you won’t make up for missing payments (the time while you delayed taking payments) with the increased monthly payment amount.

The “normal social security retirement age” is set in law and depends on when you were born. If you were born prior to 1938 it is 65 and if you are born after 1959 it is 67 (in between those dates it slowly increases. Those born in 1959 will reach the normal social security retirement age of 67 in 2026.

The social security retirement age has fallen far behind demographic trends – which is why social security deductions are so large today (it used to be social security payments for the vast majority of people did not last long at all – they died fairly quickly, that is no longer the case). The way to cope with this is either delay the retirement ago or increase the deductions. The USA has primarily increased the deductions, with a tiny adjustment of the retirement age (increasing it only 2 years over several decades). We would be better off if they moved back the normal retirement age at least another 3 to 5 years (for the payment portion – given the broken health care system in the USA retaining medicare ages as they are is wise).

In the case of early retirement, a benefit is reduced 5/9 of one percent for each month (6.7% annually) before normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month (5% annually).

For delaying your payments after you have reached normal social security retirement age increases payments by 8% annually (there were lower amounts earlier but for people deciding today that is the figure to use).

Lets take a quick look at a simple example:

Read more

Dylan Grice suggests the Cockroach Portfolio: 25% cash; 25% government bonds; 25% equities; and 25% gold. What we can learn from the cockroach

Government bonds protect against deflation (provided your money’s invested in solid government bonds and not trash). Equities offer capital growth and income. And gold, as we know, protects against currency depreciation, inflation, and financial collapse. It’s vitally important to maintain holdings in each, in my opinion.

The beauty of a ‘static’ allocation across these four asset classes is that it removes emotion from the investment process.

I don’t really agree with this but I think it is an interesting read. And I do agree the standard stock/bond/cash portfolio model is not good enough.

I would rather own real estate than gold. I doubt I would ever have more than 5% gold and only would suggest that if someone was really rich (so had money to put everywhere). Even then I imagine I would balance it with investments in other commodities.

One of the many problems with “stock” allocations is that doesn’t tell you enough. I think global exposure is wise (to some extent S&P 500 does this as many of those companies have huge international exposure – still I would go beyond that). Also I would be willing to take some stock in commodities type companies (oil and gas, mining, real estate, forests…) as a different bucket than “stocks” even though they are stocks.

And given the super low interest rates I see dividend paying stocks as an alternative to bonds.

The Cockroach Portfolio does suggest only government bonds (and is meant for the USA where those bonds are fairly sensible I think) but in the age of the internet many of my readers are global. It may well not make sense to have a huge portion of your portfolio in many countries bonds. And outside the USA I wouldn’t have such a large portion in USA bonds. And they don’t address the average maturity (at least in this article) – I would avoid longer maturities given the super low rates now. If rates were higher I would get some long term bonds.

View of Glacier National Park, from Bears Hump Trail in Waterton International Peace Park in Canada, by John Hunter

These adjustments mean I don’t have as simple a suggestion as the cockroach portfolio. But I think that is sensible. There is no one portfolio that makes sense. What portfolio is wise depends on many things.

There are many asset allocation strategies; which often are pretty similar. In general they oversimplify the situation (so an investor needs to study and adjust them to their situation – though most don’t do this, which is a problem). In general, I think asset allocation suggestions are too heavily weighted on bonds, and that is even more true today in the current environment – of could that is just my opinion.

I ran across this suggested allocation in Eyewitness to a Wall Street mugging which I think has several good values.

- It focuses on low fee, market index funds. Fees are incredibly important in determining long term investment success

- It has lower bond allocation than normal

- It has more international exposure than many – which I think is wise (this suggested portfolio is for those in the USA, USA portion should be lowered for others)

- It includes real estate (some suggested allocations miss this entirely)

In my opinion this allocation should be adjusted as you get closer to retirement (put a bit more into more stable, income producing investments).

My personal preference is to use high quality dividend stocks in the current interest rate environment. I would buy them myself which does require a bit more work than once a year rebalancing that the lazy golfer portfolio allows.

I would also include 10% for Vanguard emerging markets fund (VWO) (for sake of a rule of thumb reduce Inflation Protected Securities Fund to 10% if you are more than 10 years from retirement, when between 10 and 1 year from retirement put Inflation Protected Securities Fund at 15% and Total Stock Market Index Fund at 35%, when 1 year from retirement or retired lower emerging market to 5% and put 5% in money market.

Depending on your other assets this portfolio should be adjusted (large real estate holdings [large net value on personal home, investment real estate…] can mean less real estate in this portfolio, 401k holdings may mean you want to tweak this [TIAA CREF has a very good real estate fund, if you have access to it you might make real estate a high value in your 401k and then adjust your lazy portfolio], large pension means you can lower income producing assets, how close you are to retirement, etc.).

The Lazy Golfer Portfolio (Annually rebalance the fund on your birthday and ignore Wall Street for the remaining 364 days of the year) contains 5 Vanguard index funds

- 40% Total Stock Market Index Fund (VTSMX)

- 20% Total International Stock Index Fund (VGTSX)

- 20% Inflation Protected Securities Fund (VIPSX)

- 10% Total Bond Market Index Fund (VBMFX)

- 10% REIT Index Fund (VGSIX)

Related: Retirement Planning, Looking at Asset Allocation – Lazy Portfolio Results – Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation – Starting Retirement Account Allocations for Someone Under 40 – Taking a Look at Some Dividend Aristocrats