This richest 1% continue to take advantage of economic conditions to amass more and more wealth at an astonishing rate. These conditions are perpetuated significantly by corrupt politicians that have been paid lots of cash by the rich to carry out their wishes.

One thing people in rich countries forget is how many of them are in the 1% globally. The 1% isn’t just Bill Gates and Warren Buffett. 1% of the world’s population is about 72 million people (about 47 million adults). Owning $1 million in assets puts you in the top .7% of wealthy adults (Global Wealth Report 2013’ by Credit Suisse). That report has a cutoff of US $798,000 to make the global 1%. They sensibly only count adults in the population so wealth of $798,000 puts you in the top 1% for all adults.

$100,000 puts you in the top 9% of wealthiest people on earth. Even $10,000 in net wealth puts you in the top 30% of wealthiest people. So while you think about how unfair it is that the system is rigged to support the top .01% of wealthy people also remember it is rigged to support more than 50% of the people reading this blog (the global 1%).

I do agree we should move away from electing corrupt politicians (which is the vast majority of them in DC today) and allowing them to continue perverting the economic system to favor those giving them lots of cash. Those perversions go far beyond the most obnoxious favoring of too-big-to-fail banking executives and in many ways extend to policies the USA forces on vassal states (UK, Canada, Australia, France, Germany, Japan…) (such as those favoring the copyright cartel, etc.).

Those actions to favor the very richest by the USA government (including significantly in the foreign policy – largely economic policy – those large donor demand for their cash) benefit the global 1% that are located in the USA. This corruption sadly overlays some very good economic foundations in the USA that allowed it to build on the advantages after World War II and become the economic power it is. The corrupt political system aids the richest but also damages the USA economy. Likely it damages other economies more and so even this ends up benefiting the 38% of the global .7% that live in the USA. But we would be better off if the corrupt political practices could be reduced and the economy could power economic gains to the entire economy not siphon off so many of those benefits to those coopting the political process.

The USA is home to 38% of top .7% globally (over $1,000,000 in net assets).

| country | % of top .7% richest | % of global population |

|---|---|---|

| USA | 38.3% | 4.5% |

| Japan | 8.6% | 1.8% |

| France | 7.5% | .9% |

| UK | 6.1% | .9% |

| Germany | 5.9% | 1.1% |

| other interesting countries | ||

| China | 3.4% | 19.2% |

| Korea | 1% | .7% |

| Brazil | .6% | 2.8% |

| India | .5% | 17.5 |

| Indonesia | .3% | 3.5% |

Oxfam published a report on these problems that has some very good information: Political capture and economic inequality

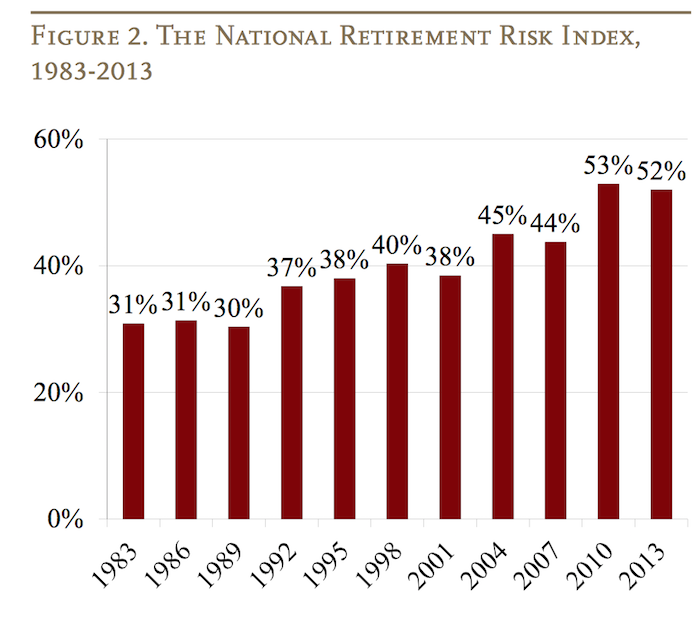

The Center for Retirement Research at Boston College is a tremendous resource for those planning for, or in, retirement. The center created the National Retirement Risk Index (NRRI) to capture a macroeconomic level measure of how those in the USA are progressing toward retirement.

Based on the Federal Reserve’s 2013 Survey of Consumer Finances the Center updated the NRRI results (the entire article is a very good read).

The lower the risk number in the chart the better, so things have not been going well since the 1990s for those in the USA saving for retirement.

As the report discusses their are significant issues with retirement planning that defy easy prediction; this makes things even more challenging for those saving for retirement. The report discusses the difficulty placed on retirees by the Fed’s extremely low interest rate policy (a policy that provides billions each year to too-big-too-fail banks – hardly the reward that should be provided for bringing the world to economic calamity but never-the-less that transfer of wealth from retirees to too-big-to-fail banks is the policy the Fed has chosen).

That exacerbates the problems of too little savings during the working career for those in the USA. The continued evidence is that those in the USA continue to spend too much today and save too little. Also you have to expect the Fed and politicians will continue to make policy that favors their friends at too-big-fail banks and hedge funds and the like. You can’t expect them to behave differently than they have been the last 50 years. That means the likely actions by the government to take from median income people to aid the richest 1% (such as bailing out the bankers with super low interest rate policies and continue to subsidize losses and privatize their winning bets) will continue. You need to have extra savings to support those policies. Of course we could change to do things differently but there is no realistic evidence of any move to do so. Retirement planning needs to be based on evidence, not hopes about how things should be.

Related: How Much of Current Income to Save for Retirement – Save What You Can, Increase Savings as You Can Do So – Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually – Retirement Planning: Looking at Assets (2012) – How Much Will I Need to Save for Retirement? (2009)

The 11 stocks for 10 years portfolio continues to do very well. It consists of stocks I would be comfortable putting away for 10 years. I look for companies with a history of large positive cash flow, that seemed likely to continue that trend.

In fact it is doing so well I am a bit worried about the valuation of some of the stocks. Or, in the case of Apple, I was heavily weighted in it and it has risen so much that, combining those two factors, it is now 20% of the portfolio. That seems excessive, so while I still like Apple – at these prices, I will sell a bit of that position.

Since April of 2005 the portfolio Marketocracy calculated annualized rate or return is 8.75% (the S&P 500 annualized return for the period is 8.55%). Marketocracy subtracts the equivalent of 2% of assets annually to simulate management fees – as though the portfolio were a mutual fund. Without that fee the return beats the S&P 500 annual return by about 220 basis points annually (10.75% to 7.55%). I also often have a bit held in cash, 5% now, for example which lowers the return.

Since the last update I have added to the Abbvie position (part of the former Abbot which was split into two companies in 2013) and sold off Tesco. I will sell TDF from the fund (I include it in the table below, since I haven’t sold it all yet, I am waiting to get a bit better price).

The current stocks, in order of return:

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| Amazon – AMZN | 556% | 8% | 8% | |

| Google – GOOG | * | 18% | 15% | |

| Apple – AAPL | 131% | 20% | 16% | |

| Danaher – DHR | 126% | 9% | 9% | |

| Templeton Dragon Fund – TDF | 120% | 2% | 0% | |

| PetroChina – PTR | 88% | 4% | 4% | |

| Intel – INTC | 78% | 8% | 8% | |

| Toyota – TM | 65% | 8% | 12% | |

| Abbvie – ABBV | 43% | 5% | 7% | |

| Cisco – CSCO | 31% | 4% | 4% | |

| Templeton Emerging Market Fund – EMF | 29%*** | 5% | 7% | |

| Pfizer – PFE | 25% | 5% | 5% | |

| Cash | – | 4% | 5% |

The current marketocracy results can be seen on the Sleep Well marketocracy portfolio page.

Related: 12 Stocks for 10 Years, Jan 2014 Update – 12 Stocks for 10 Years – 12 Stocks for 10 Years: January 2012 Update – October 2012 Update – 12 Stocks for 10 Years, Oct 2010 Update

I make some adjustments to the stock holdings over time (selling of buying a bit of the stocks depending on large price movements – this rebalances and also lets me sell a bit if I think things are getting highly priced. So I have sold some Amazon and Google as they have increased greatly. These purchases and sales are fairly small (resulting in a annual turnover rate under 2%).

I have been giving loans through Kiva for many years now. I enjoy the opportunity to help out entrepreneurs around the world. And the web site is well done to give you a psychological boost – photos of the entrepreneurs, stories on what they will do, etc..

I often have difficulty finding real entrepreneurs (many of the loans are for things like education, fixing up their house, buying motorcycle/car, etc. that may well be very important but are not really related to entrepreneurship in most cases). That is fine, in this session I had 3 loans to entrepreneurs and 2 loans for solar energy solutions for people’s homes. Improved energy, cooking or water access are some things I am happy to lend to that are not entrepreneur related. Though usually the water loans are – to an entrepreneur that will sell clean water to a neighborhood and sometimes the solar energy ones are, though not in this case.

Kelly in Medellin, Columbia is starting a shoe business.

Kelly in Medellin, Columbia is starting a shoe business.

The write-ups on Kiva are often fairly well done; targeting those interested in making loans. Kelly’s:

She works as a saleswoman in different shoe stores in the municipality of Medellin.

She wants to start her own business making and selling shoes of all styles. She wants to start this activity because she has the desire to generate the resources she needs to support herself and her education, in addition to helping with expenses at home.

She is a young, very disciplined entrepreneur. She is requesting a loan to buy a wide range of materials such as leather, soles, adhesives, and fabrics. With these elements, she can start this business and improve her quality of life.

I often screen the data on delinquencies and defaults for the partner bank in making loan decisions. It isn’t because I am worried about losing my loan (I just re-lend what I get paid back). But if I lend to organizations that are having more failures I increase their supply of money to make loans which don’t seem to be working out for borrowers as well as another lender). I want my money going to help people, not get people into a mess.

The 10 publicly traded companies with the largest market capitalizations.

| Company | Country | Market Capitalization | |

|---|---|---|---|

| 1 | Apple | USA | $626 billion |

| 2 | Exxon Mobil | USA | $405 billion |

| 3 | Microsoft | USA | $383 billion |

| 4 | USA | $379 billion | |

| 5 | Berkshire Hathaway | USA | $337 billion |

| 6 | Johnson & Johnson | USA | $295 billion |

| 7 | Wells Fargo | USA | $270 billion |

| 8 | GE | USA | $260 billion |

| 9 | Wal-Mart | USA | $246 billion |

| 10 | Alibaba | China | $246 billion |

Alibaba makes the top ten, just weeks after becoming a publicly traded company. The next ten most valuable companies:

| Company | Country | Market Capitalization | |

|---|---|---|---|

| 11 | China Mobile | China | $240 billion* |

| 12 | Hoffmann-La Roche | Switzerland | $236 billion |

| 13 | Procter & Gamble | USA | $234 billion |

| 14 | Petro China | China | $228 billion |

| 15 | ICBC (bank) | China | $228 billion** |

| 16 | Royal Dutch Shell | Netherlands | $227 billion |

| 17 | Novartis | Switzerland | $224 billion |

| 18 | Nestle | Switzerland | $224 billion*** |

| 19 | JPMorgan Chase | USA | $224 billion |

| 20 | Chevron | USA | $210 billion |

Petro China reached to top spot in 2010. I think NTT (Japan) also made the top spot (in 1999); NTT’s current market cap is $66 billion.

Market capitalization shown are of the close of business today, as shown on Yahoo Finance.

According to this March 2014 report the USA is home to 47 of the top 100 companies by market capitalization. From 2009 to 2014 that total has ranged from 37 to 47.

The range (during 2009 to 2014) of top 100 companies by country: China and Hong Kong (8 to 11), UK (8 to 11), Germany (2 to 6), France (4 to 7), Japan (2 to 6), Switzerland (3 to 5).

Related: Stock Market Capitalization by Country from 1990 to 2010 – Global Stock Market Capitalization from 2000 to 2012 – Investing in Stocks That Have Raised Dividends Consistently – The Economy is Weak and Prospects May be Grim, But Many Companies Have Rosy Prospects (2011)

A few other companies of interest:

Facebook, USA, current market cap is $210 billion.

Pfizer, USA, $184 billion.

Toyota, Japan, $182 billion.

Read more

While people question the value of a college degree a recent study by the New York Federal Reserve shows a degree is close to as valuable today as it has ever been. The costs to get that value have risen but even with the increased cost students earn on average a 15% annual rate of return on their investment.

Of course, not every student will earn that, some will earn more and some less.

…

The time required to recoup the costs of a bachelor’s degree has fallen substantially over time, from more than twenty years in the late 1970s and early 1980s to about ten years in 2013. So despite the challenges facing today’s college graduates, the value of a college degree has remained near its all-time high, while the time required to recoup the costs of the degree has remained near its all-time low.

So a college education is a great investment for most people. This can create a problem however, when people then assume that all they need to do is go to college and they will do well no matter what. The same thing happens in other markets. Real estate has proven to be a great investment. that doesn’t mean every real estate investment is good. It doesn’t mean you can ignore the costs and risks of a particular investment. The same goes for stocks.

Amazon Prepares Online Advertising Program

This is potentially a real risk to Google. The odds of such a huge success it decreases Google’s profits are tiny (I think). But there is a real risk that the increase in Google’s profits going forward are materially affected by a well done competitor to Adsense.

Adwords is Google’s platform for buying ads. Those ads are then displayed on Google’s websites and on millions of other websites. Other websites can host ads via the Adsense program. It seems to me what is really at risk is better seen as Adsense business. The business on Google’s own websites is not at risk (Google’s profit from its sites are double I think all the other sites [via Adsense] combined).

If Amazon took away 10% of what Google’s Adsense business 4 years would have been that is likely material to Google’s earning. Not huge but real.

Even losing the ads on Amazon’s web site is likely noticeable (though not a huge deal, for Google, for many companies it would be significant, I would guess).

There is even the potential Google has to reduce their profitability, on Adsense, to compete – giving web sites a better cut of revenue.

One of the things that annoy me as an investor is how happy the executives are to grant themselves huge amount of pay in general and stock in particular. The love to giveaway huge amounts of stock to themselves and their buddies and then pretend that isn’t a cost.

Thankfully the GAAP rules changed a few years ago to require making the costs of stock giveaways show up on official earnings statements. Now, the companies love to trumpet non-GAAP earnings that exclude stock based compensation to employees.

The stock based costs are huge.

SG Securities estimates that corporates bought back $480 billion in stock last year, and then reissued about $180 billion.

The theme of the article is that stock buybacks have declined drastically very recently. There has been a huge bubble recently fueled by the too-big-too-fail bailout (quantitative easing). But don’t expect the executives giving themselves tons of stock to decline.

Accounting isn’t as straight forward as people who have never looked at it would like to think. While giving away stock is definately a cost, it isn’t a cash cost. The cash flow statement is best for looking at cash anyway. And the better your company does the more the free spirited giveaway of stock costs (both in your reduced share of the well performing company and the higher cost to buy back the shares they gave away).

They have excuses that they hire people who are not motivated enough to do their job for their pay so they need to offer stock options as a extra payment. But the main reason they like it is they can pretend that the pay to employees isn’t costing as much as it is because we gave them stock options not cash. As if paying $1 billion in cash is somehow more costly than giving away options and then spending $1 billion on buybacks of the stock they gave away.

Options make a lot of sense for small private companies. In a very limited way they can make sense as companies grow. But the practices of executives in huge bureaucracies giving away large amounts of your equity, on top of huge paychecks, is very harmful.

Related: Apple’s Outstanding Shares Increased from 848 to 939 million shares from 2006 to 2013 (while I think Apple’s large buyback is good, the huge share giveaways continue and are bad policy) – Google is Diluting Shareholder Equity by 1% a year (2009-2013) – Executives Again Treating Corporate Treasuries as Their Money

Hedge funds seek to pay the managers extremely well and claim to justify enormous paydays with claims of superior returns. Markets provide lots of volatility from which lots of different performances will result. Claiming the random variation that resulted in the superior performance of there portfolio as evidence the deserve to take huge payments for themselves from the current returns is not sensible. But plenty of rich people fall for it.

As I have written before: Avoiding Hedge Fund Investments is One of the Benefits of Being in the 99%.

This is pretty well understood by most knowledgeable investors, financial planners and investing experts. But funds that charge huge fees continue to get away with it. If you are smart you will avoid them. A few simple investing rules get you well into the top 10% of investors

- seek low fees

- diversify – pay attention to risk of portfolio overall

- limit trading (low turnover)

- use tax advantage accounts wisely (in the USA 401(k)s and IRAs)

From a personal finance perspective, saving money is a key. Most people fail at being decent investors before they even get a chance to invest by spending more than they can afford and failing to save, and even worse going into debt (other than to some extent for college education and house). Consistently putting aside 10-20% of your income and investing wisely will put you in good shape over the long term.

Options can be used as an aggressive strategy to make money with investments. By following news events for quite a few different companies you can put yourself in the position to act when stories break, or events occur which can cause mini trends in their stock price.

Volatile stocks with frequent news provide the opportunity to make money on large changes in price. Amazon is a company an Amazon that often makes headlines. Recently, they have been in the news quite a bit, and savvy binary options traders have been cleaning up.

Binary options are a type of option in which the payoff can take only two possible outcomes. The cash-or-nothing binary option pays some fixed amount of cash if the option expires in-the-money while the asset-or-nothing pays the value of the underlying security.

For example, a purchase is made of a binary cash-or-nothing call option on Amazon at $320 with a binary payoff of $1000. Then, if at the future maturity date, the stock is trading at or above $320, $1000 is received. If its stock is trading below $100, nothing is received. An investor could also sell a put where they would make a payoff if the conditions are met and have to payoff nothing if the conditions are not met.

Examples of big news in the recent past

Amazon Fire Cell Phone – Earlier this year, we watched as Jeff Bezos unveiled the new Amazon Fire 3-D cell phone. As happens in most cases when a company unveils a great new product, we saw this cell phone cause Amazon’s stock price to go through the roof. So, as a trader, seeing the unveiling happen first hand would indicate that the value of Amazon was going to rise, and give the trader unique opportunity to make trades on realistic expectations with this asset.