3 Nobel prize winning economists, Robert C. Merton, Robert Solow and Paul Samuelson, took questions about the impending retirement savings crisis from PBS NewsHour correspondent Paul Solman in October 2008. Paul Solman asked them about their personal portfolios in the clip shown above.

Robert Merton tells his portfolio portfolio is in a Global Index Fund, Treasury Inflation-Protected Securities, and one hedge fund. He said he had been invested in a TIAA commercial real estate fund until recently, but sold in early 2008 when he worried commercial real estate prices had increased too far. He also sold out his Municipal bond holdings.

Robert Solow says he has no idea of his portfolio.

Paul Samuelson declined to say. He did offer that timing is not something investors can successfully do. He stated that timing the selling of assets was not as difficult as timing when to get back in. And that markets move very quickly so you can miss out on big gains. 2009 provided a great example of this. Many people sold stocks in late 2008 and early 2009. And most did not get back in. In 2009 the S&P 500 was up 26%.

Related: Retirement Savings Allocation for 2010 – How Much Will I Need to Save for Retirement? – Gen X Retirement – Many Retirees Face Prospect of Outliving Savings

I adjusted my future retirement account 401(k) allocations today. I do not have as favorable an opinion of investing in the stock market today as I did a year ago. I would likely have allocated 20% to a money market fund except my 401(k) actually has two options – 1 paying 0.0% and the other paying -.02%.

They seem to believe they should make a significant profit while providing a horrible return (they are still taking over .5% of assets in fees – even though rates do not cover their fees). Those running funds have very little interest in providing value for 401(k) participants – they are mainly interested in raising fees (though supposedly they are suppose to be run by people with a fiduciary responsibility to the investors). Unfortunately most 401(k)s lock you away from the best options for an investor (such as Vanguard Funds).

My current allocation for future funds is 40% to USA stocks, 40% to Global stocks and 20% to inflation adjusted bonds. My current allocation in this retirement account is 10% real estate, 35% global stocks, 55% USA stocks. For all my retirement savings it is probably about 5% real estate, 35% global stocks, 5% money market, 55% USA stocks (which is a fairly aggressive mix).

As I have said many times I do not like bonds at this time. I don’t think the interest nearly justifies the risk of capital loss (due to inflation or interest rate risk). Inflation protected bonds are a much more acceptable option for someone that is worried about inflation (like I am over the next 10-20 years).

A number of the stock fund (even bond fund) options in my 401(k) have expense ratios above 1%. That is unacceptable. The average fees on the options I chose were .5%.

With my employee match I am adding over 10% of my income to my 401(k), which I think is a good aim for most everyone. Far too many people are unwilling to forgo luxuries to save appropriately for their retirement. This is a sign of financial illiteracy and an unwillingness to accept the responsibilities of modern life.

Related: Investing – My Thoughts at the End of 2009 – 401(k)s are a Great Way to Save for Retirement – Saving for Retirement – Managing Retirement Investment Risks

I have discussed the advantage of using credit unions over trying to cope with a bank since so many banks constantly try to trick customers into paying huge fees. Here are some resources to help:

- Find a local credit union (site broke link so I removed the link) – with an overview of services offered

- Find a local credit union from (NCAU) with links to Financial Performance Report data.

- Credit Unions have National Credit Union Share Insurance Fund (NCUSIF) (“backed by the full faith and credit of the U.S. Government”) instead of FDIC. The limits on the share insurance are the same as the limits on FDIC, currently $250,000 per individual account holder. Use the link to make sure your credit union provides NCUSIF coverage.

You can also get credit cards through your credit union. In general credit unions are much more interested in trying to provide the customer value instead of trying to stick them with huge fees. But don’t just trust your credit union, check out the rates and fees they charge and comparison shop for the best credit card.

Related: posts on banking – FDIC Study of Bank Overdraft Fees – Credit Unions Slowly Fill Payday Lenders Void

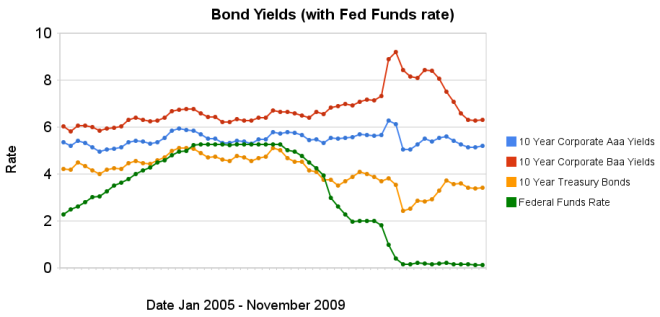

Chart showing corporate and government bond yields from 2005-2009 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields from 2005-2009 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have remained low, with little change over the last 4 months. Earlier in the year, yield spreads decreased dramatically, and those reductions have remained over the last 4 months. The federal funds rate remains under .25%.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Continued Large Spreads Between Corporate and Government Bond Yields (April 2009) – Chart Shows Wild Swings in Bond Yields (Jan 2009) – investing and economic charts

The behavior of banks is despicable enough when they are merely trying to trick educated, financially secure people out of their money. Banks charged $38.5 billion in fees last year according to the Financial Times. But that behavior, toward the poor, by banks (paying millions to hundreds of executives for, I guess, getting congress to send the companies billions) is immoral.

The Gates Foundation has decided to go into improving financial services for the poor. The are supporting micro-credit but also micro finance. Saving is key for poor people to get and stay out of poverty. Most already save money informally but want better, safer options. Setting aside money in a safe place will allow poor people to weather setbacks, build assets and financial security, and invest in opportunities for the next generation. Formal savings accounts also help them keep more of what they earn and easily access their money when they need it.

The poor need better banking options in poor countries. But the poor need better banking options in at least one rich country (the only one I know is the USA and banks in the USA provide lousy options for the poor). Credit Unions are much more likely to actually try and provide value to customers. Unfortunately banks in the USA seem to operate on the principle that customer are suckers that exist to pay for Porches for the children of bank executives.

Related: FDIC Study of Bank Overdraft Fees – Microfinancing Entrepreneurs – Incredibly Bad Customer Service from Discover Card – 10 Things Your Bank Won’t Tell You

The Society for Actuaries has published a good resource: Managing post-retirement risks.

…

Many investors try to own some assets whose value may grow in times of inflation. However, this sometimes will trade inflation risk for investment risk.

• Common stocks have outperformed inflation in the long run, but are

poor short-term hedges. The historically higher returns from stocks

are not guaranteed and may vary greatly during retirement years.

…

Retirement planning should not rely heavily on income from a bridge job. Many retirees welcome the chance to change careers and move into an area with less pay but more job satisfaction, or with fewer demands on their time and energy.

Terminating employment before age 65 may make it difficult to find a source of affordable health insurance before Medicare is available.

…

Insurance for long-term care covers disabilities so severe that assistance is needed with daily activities such as bathing, dressing and eating. Some policies require a nursing home stay; others do not. The cost of long-term care insurance is much less if purchased at younger ages, well before anticipated need.

The full document is well worth reading.

Related: Many Retirees Face Prospect of Outliving Savings – How to Protect Your Financial Health – Financial Planning Made Easy – personal finance tips

Surging U.S. Savings Rate Reduces Dependence on China

…

Nouriel Roubini, an economics professor at New York University and chairman of RGE Monitor, forecasts that the savings rate will ultimately reach 10 percent to 11 percent. What’s critical, he said in a Bloomberg Television interview on June 24, is how quickly it increases.

A rapid rise in the next year because of a collapse in consumption would push the economy, already in its deepest contraction in 50 years, further into recession, he said. If it occurs over a few years, the economy may grow.

…

From 1960 until 1990, households socked away an average of about 9 percent of their after-tax income, government figures show. Americans got out of the habit in the 1990s as they saw their wealth build up in other ways, first through surging stock prices and then soaring home values, Gramley said.

That process has now gone into reverse. U.S. household wealth fell by $1.3 trillion in the first quarter of this year, with net worth for households and nonprofit groups reaching the lowest level since 2004, according to a Fed report. Wealth plunged by a record $4.9 trillion in the last quarter of 2008.

Edmund Phelps, winner of the Nobel Prize in economics in 2006 and a professor at Columbia University in New York, said it may take as long as 15 years for households to rebuild what they lost in the recession.

As I have been saying the living beyond our means must stop. Those that think health of an economy is only the GDP forget that if the GDP is high due to spending tomorrows earnings today that is not healthy. Roubini correctly indicates the speed at which savings increases could easily determine the time we crawl out of the recession. I hope the savings rate does increase to over 10 percent.

If we do that over 3 years that would be wonderful. But it is more important we save more. If that means a longer recession to pay off the excessive spending over the last few decades so be it. And it is going to take a lot longer than a few years to pay off those debts. It is just how quickly we really start to make a dent in paying them off that is in question now (or whether we continue to live beyond our means, which I think it still very possible – and unhealthy).

Related: Will Americans Actually Save and Worsen the Recession? – Can I Afford That? – $2,540,000,000,000 in USA Consumer Debt (April 2008) – Paying for Over-spending

One factor you must understand when evaluating economic data is that the data is far from straight forward. Even theoretically it is often confusing what something like “savings rate” should represent. And even if that were completely clear the ability to get data that accurately measures what is desired is often difficult if not impossible. Therefore most often there is plenty of question about economic conditions even when examining the best available data. Learning about these realities is important if you wish to be financially literate.

Bigger U.S. Savings Than Official Stats Suggest

A closer look, however, shows that Americans have tightened their belts more sharply than the numbers report. The reason? Official figures for personal spending include a lot of categories, such as Medicare outlays, that are not under the control of households. They also include items, such as education spending, that should be treated as investment in the future rather than current consumption.

After removing these spending categories from the data, let’s call what’s left “pocketbook” spending – the money that consumers actually lay out at retailers and other businesses. By this measure, Americans have cut consumption by $200 billion, or 3.1%, over the past year. This explains why the downturn has hit Main Street hard.

…

Finally, for technical reasons the BEA throws in some “spending” categories where no money actually changes hands. The biggest is “rent on owner-occupied housing,” the money that people supposedly pay themselves for living in their own homes. Despite the housing bust, this number rose by 2.6% over the past year, to $1.1 trillion.

…

A closer look at BEA numbers shows that Americans reduced spending by 3.1% in the past year, indicating that the savings rate has risen to 6.4%

He raises good issues to consider though I am not sure I agree 100% with his reasoning.

Related: The USA Should Reduce Personal and Government Debt – Financial Markets with Robert Shiller – Save Some of Each Raise – Over 500,000 Jobs Disappeared in November (2008)

John Bogle was the founder of Vanguard Group and a well respected investment mind. He has written several good books including: The Little Book of Common Sense Investing, Common Sense on Mutual Funds and Bogle on Mutual Funds. This interview from 2006 discusses the state of the retirement system, before the credit crisis.

Frontline: How do they get away with that? Don’t they have to fund them?

John Bogle: No, they don’t, because a lot of it is based on assumptions. Our corporations are now assuming that future returns in their pension plan will be about 8.5 percent per year, and that’s not going to happen. The future returns in the bond market will be about 4.5 percent, and maybe if we’re lucky 7.5 percent on stocks. Call it a 6 percent return — before you deduct the cost of investing all that money, the turnover cost, the management fees. So maybe a 5 percent return is going to be possible, in my judgment, and they are estimating 8.5 percent.

Why? Because when they do it that way, corporation earnings become greatly overstated, and all the executives get nice, big bonuses. They are using pension plan assumptions as a way to manage corporate earnings and meet the expectations of Wall Street.

Frontline: So if a company overstates the value of its pension plan assets, it makes the company look better to Wall Street, so there’s an incentive to kind of exaggerate, if not cheat.

John Bogle: That is precisely correct. And let me clear on the cheating: It’s legal cheating; it’s not illegal cheating. In other words, you can change any reasonable set of numbers — and corporations have done this, have raised the pension assumption from 7 percent to 8.5 percent — and all of a sudden that corporation will report an earnings gain for the year rather than an earnings loss that they would otherwise have. Simple, legal.

The entire PBS series (from 2006) on 401(k)s (including interviews with Elizabeth Warren, David Wray and Alicia Munnell) is worth reading.

In February of 2009 he spoke to the House of Representatives committee exploring retirement security.

Read more

Home Ownership Shelter, or Burden?

The other area of concentrated distress is subprime mortgages, which increased their share of the American mortgage market from 7% in 2001 to over 20% in 2006. According to the Mortgage Bankers Association, the delinquency rate was 22% in the fourth quarter of 2008, compared with only 5% for prime loans.

…

“Perhaps the most compelling argument for housing as a means of wealth accumulation”, argues Richard Green of the University of Southern California, “is that it gives households a default mechanism for savings.” Because people have to pay off a mortgage, they increase their home equity and save more than they otherwise would. This is indeed a strong argument: social-science research finds that people save more if they do so automatically rather than having to choose to set something aside every month.

Yet there are other ways to create “default savings”, such as companies offering automatic deductions to retirement plans. In any case, some of the financial snake oil peddled at the height of the housing bubble was bad for saving.

The debate over whether home ownership is a wise investment or not, is contentious (more so in the last year than it was several years ago). I believe in most cases it probably is wise, but there are certainly cases where it is not. If you put yourself in too much debt that is often a big problem. I also think you should save a down payment first. If you are going to move (or have good odds you may want to) then renting is often the better option.

The “default saving” feature is one of the large benefits of home ownership. That benefit is destroyed when you take out loans against the rising value of the house. And in fact this can not just remove the benefit but turn into a negative. If you spend money you should have (increasing your debt) that can not only remove you default saving benefit but actual make your debt situation worse than if you never bought.

Related: Your Home as an Investment – Nearly 10% of Mortgages Delinquent or in Foreclosure – Housing Rents Falling in the USA – Ignorance of Many Mortgage Holders