Where is the economy headed? With the troubles of huge debt (by governments and consumers) and the possible collapse of the Euro it is very hard to be certain. And where is the stock market headed? That is also difficult to predict. Of course, where the stock market is headed in the short term is never easy to predict. If you can predict, you should be rich (though it likely takes a bit more, knowing how much to risk…).

At least by knowing what has happened you can be ahead of where many people are. The USA economy has not been in a recession, we have actually been growing. Just doing so very slowly. And doing so without many added jobs. Companies however, have been doing very well.

For investors knowing if this is a positive trend that can be expected to continue or an aberration is key. But I have no way of knowing. My guess is it is at least partially something that will continue (but maybe a portion of the gains are an aberration) – but this is just a guess. This bloomberg article looks more at the issue.

…

The margins of non-financial companies in the U.S., a widely used measure of profitability, reached 15 percent in the third quarter, according to data from Moody’s Analytics Inc. in West Chester, Pennsylvania. That was the highest level since 1969. When the recession ended in the second quarter of 2009, the comparable number was 8.7 percent.

The most compelling data supporting my belief is the long term trend.

But where this trend ends and starts reversing won’t be obvious until years after it happens. But investors that can predict (or guess) margin changes will likely be rewarded financially.

Related: The Economy is Weak and Prospects May be Grim, But Many Companies Have Rosy Prospects – Is the Stock Market Efficient? – Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation

Trying to create significant supplementary income is not easy. There are lots of people selling get rich quick schemes and ways to earn big money for little effort. But those schemes don’t offer what they claim (they just don’t work for any, but a few people).

In trying to figure out a good way to create another income stream I thought of the idea of consulting over the internet in very small chunks of time. I explored the options to be a consultant that way and they were not good. But the idea seemed excellent to me and I worked with a friend to develop the idea of us creating such a online service. The potential was great I think. The end service would provide value to those seeking answers and those providing consultation (and to us).

We did get a domain and plan out the service and begin coding the application but didn’t progress very far. It was still a great idea and something I planned to consider if I had a bit more time. Well there is now an offering that appears to actually be fairly decent (on first glance): Minute Box.

Minute Box allows you several of the things we planned on offering (but not all of them – at least not yet). You can register as an expert and then be available for those wanting advice. You sign in when you are available to answer questions (and people can send you a note while you are offline). You set your rate. Essentially IM is used for consultation and the billing is taken care of by Minute Box.

One of the keys is matching people to experts well. Minute Box does one thing we planned on doing, which is to emphasize the experts tapping those that already value their advice. This would work very well for bloggers and those with an online presence and reputation.

I signed up and created my expert account, so if you want to get some advice from me you can get consulting by the minute from John Hunter.

I think this consulting by the minute model is a great way to create a secondary income stream for those that have a positive online reputation. You can adjust your pay to manage demand. If you have a free week and want to make some extra income you can reduce your rate and offer your readers a special discount. This is potentially a great way to capitalize on your expertise. I haven’t had much experience with Minute Box yet so it isn’t certain they are the answer (but I haven’t seen any other solution that is very good). And no matter the service provider used, I believe the internet enabled micro consulting is a great way to provide some extra income and make your personal finances more robust.

The range of advice you can offer is huge. For nearly anything there are people that need advice: how to cook thanksgiving dinner, helping a child with math homework, fashion advice, editing a resume, which mortgage offer is better in a specific situation, fixing a bug in a WordPress blog, what are good plants for a shady area… The list is nearly endless.

I wish I had been able to create a web site to facilitate this process. I believe the potential is huge. That is why I was so interested in making this idea work. It is the only web business I have seriously considered (and even started). I have numerous web sites but they involve providing content online not any software as service businesses.

Related: Earning More Money – Save Some of Each Raise – If you can’t pay cash, earn more money or save until you have the cash

I try to find global economic data on manufacturing and manufacturing jobs, but it isn’t easy. This is one of the areas I will be working on with the time I have freed up by moving to Malaysia (and taking a “sabbatical” [it isn’t really a sabbatical, I guess, just me studying and working on what I want to instead of what someone pays me to]).

I found some interesting data from the USA census bureau on manufacturing employment in several countries (it would be interesting to see the data for more countries but for now I am limited to this data). Sadly they just use indexed data (I would rather see raw data). This data for example lets you see the changes in countries but I don’t see any way to compare the absolute values between countries – all you can compare is the changes between countries.

The data is all indexed at 2002 = 100. Interestingly the USA has increased output per hour much more than any other country since 2002. The USA index stands at 146, the next highest is Sweden at 127 then the UK at 120. Italy is the only country tracked that fell since 2002, to 94. Japan (the 3rd largest manufacturer and 2nd largest of the countries include, China isn’t included) only increased to 113. Germany (4th and 3rd) increased to 111.

The data also lets you look back from 1990 to 2002 and again the USA has increased productivity very well (2nd most) – the value in 1990 was 58. Sweden actually had the largest gain from 1990-2002, rising from 49. In 1990 Japan stood at 71 and Germany 70.

Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts and articles.

- How the Plummeting Price of Cocaine Fueled the Nationwide Drop in Violent Crime – “But it’s not only a growing supply of product that led to the collapse of the cocaine market. Newfound competition in the form of locally-produced methamphetamines and prescription narcotics would continue to drive business away from cocaine… At a certain point the decision matrix for entering a life of drug-related crime collapses for all but those with no other alternate financial sources or for those with a personal interest in the craft.”

- Eight Reasons to be Bullish on the US Dollar by Steen Jakobsen and Michael Shedlock – “58% of the US dollar index is the Euro, and the Euro is a basket case. European banks are in worse shape than their US counterparts, and a breakup of the Eurozone that I expect will certainly exacerbate the problem.”

Video: Bogle says Market are About Fairly Valued Today- Investing in an Engineering Degree Provides a Lifetime Advantage of $1,090,000 by John Hunter – “the lifetime advantage ranges from $1,090,000 for Engineering majors to $241,000 for Education majors”

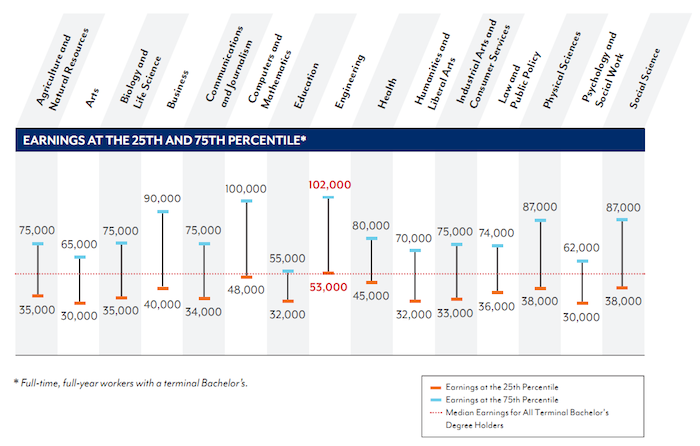

Georgetown University Center on Education and the Workforce has produced a new report looking at the value of different college degrees in the USA. I have seen a great increase in discussions of the “bubble” in education. Those articles often say a college degree doesn’t assure the success it used to. The data I review seems to show extremely large benefits for those with a college degree (higher salaries but, much more importantly, in my opinion, they also have much lower unemployment rates).

Those benefits are greatest for several majors including science, math and engineering. The problem I see is not so much that significant benefits are lacking for college degrees but the huge increases in costs of getting a degree are so large that for some majors the cost is just so large that even with the benefits it is arguable whether it is worth the cost (while a few decades ago the benefits were universal and so large the economic benefit was not debatable).

The authors of the report found that all undergraduate majors are worthwhile, even taking into account the cost of college and lost earnings. However, the lifetime advantage ranges from $1,090,000 for Engineering majors to $241,000 for Education majors. As I have written frequently on the Curious Cat Science and Engineering blog, engineering degrees are very financially rewarding.

The top 10 majors with the highest median earnings for new graduates are:

- Petroleum Engineer ($120,000)

- Pharmacy/pharmaceutical Sciences and Administration ($105,000)

- Mathematics and Computer Sciences ($98,000)

- Aerospace Engineering ($87,000)

- Chemical Engineering ($86,000)

- Electrical Engineering ($85,000)

- Naval Architecture and Marine Engineering ($82,000)

- Mechanical Engineering, Metallurgical Engineering and Mining and Mineral Engineering (each with median earnings of $80,000)

Related: 10 Jobs That Provide a Great Return on Investment – Mathematicians Top List of Best Occupations – New Graduates Should Live Frugally

The increases in income inequality creates problems and increases serious risks. Some people have a political ideology that drives their thoughts on any economic policy. I instead, look to economic issues if they benefit society. The reason capitalism is great is because society benefits. The policies that create huge income inequality are bad for society and should be changed.

Sadly the strong support for policies to elevate trust fund babies in the USA have created a society where economic wealth in the USA is now greatly defined by how rich your parents are instead of your ability and effort. The USA used to have great social mobility now we have changed society to become more like feudal Europe, while Scandinavia has become more like the USA used to be for social mobility.

Related: Economic Fault, Income Inequality – Middle Class Families from 1970-2005 – Income Inequality in the USA (2006) – The Widening “Marriage Gap” is Breeding Income Inequality

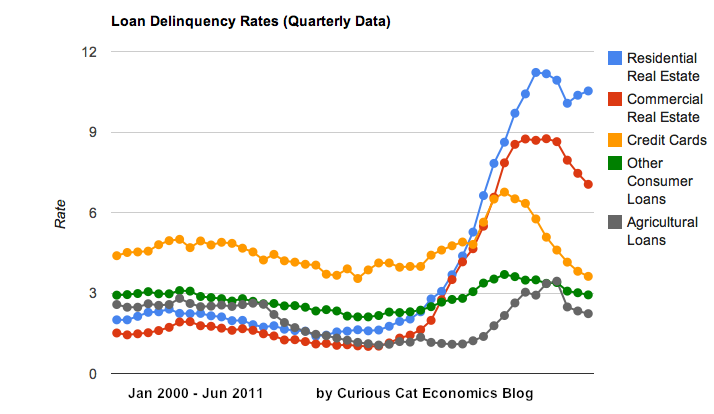

Chart showing loan delinquency rates from 2000-2011, shows seasonally adjusted data for all banks for consumer and real estate loans. The chart is available for use with attribution. Data from the Federal Reserve.

Residential real estate delinquency rates increased in the first half of 2011 in the USA. Other debt delinquency rates decreased. Credit card delinquency rates have actually reached a 17 year low.

While the job market remains poor and the serious long term problems created by governments spending beyond their means (for decades) and allowing too big to fail institutions to destroy economic wealth and create great risk for world economic stability the USA economy does exhibit positive signs. The economy continues to grow – slowly but still growing. And the reduction in delinquency rates is a good sign. Though the residential and business real estate rates are far far too high.

Related: Consumer and Real Estate Loan Delinquency Rates 2000-2010 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Government Debt as Percent of GDP 1998-2010 for OECD