Drug giant GlaxoSmithKline pledges cheap medicine for world’s poor

In a major change of strategy, the new head of GlaxoSmithKline, Andrew Witty, has told the Guardian he will slash prices on all medicines in the poorest countries, give back profits to be spent on hospitals and clinics and – most ground-breaking of all – share knowledge about potential drugs that are currently protected by patents.

Witty says he believes drug companies have an obligation to help the poor get treatment. He challenges other pharmaceutical giants to follow his lead.

…

He said that GSK will:

• Cut its prices for all drugs in the 50 least developed countries to no more than 25% of the levels in the UK and US – and less if possible – and make drugs more affordable in middle-Âincome countries such as Brazil and India.

• Put any chemicals or processes over which it has intellectual property rights that are relevant to finding drugs for neglected diseases into a “patent pool”, so they can be explored by other researchers.

• Reinvest 20% of any profits it makes in the least developed countries in hospitals, clinics and staff.

• Invite scientists from other companies, NGOs or governments to join the hunt for tropical disease treatments at its dedicated institute at Tres Cantos, Spain.

The extent of the changes Witty is setting in train is likely to stun drug company critics and other pharmaceutical companies, who risk being left exposed.

This is a good move by GSK.

Related: Shop Around for Drugs – Traveling To Avoid USA Health Care Costs – International Development Fair: The Human Factor

I have been curious how Kiva deals with currency risk. Kiva is a great resource for providing micro-lending and the opportunity to engage in choosing who you will lend to. But my transactions are all in US$ and the loans in the field are in the local currency. This creates an issue of what happens when currency values fluctuate. I asked a question on the Kiva LinkedIn group (an excerpt is shown here):

A lender takes out a loan of $100 with 10 months to repay. If the loan is in the local currency, what if the value of that currency during the 10 months declines by 20%? Then the bank has received all their money back but they owe Kiva $100 but they only have $80 worth of the local currency (again ignore that the payments are made monthly – since it doesn’t effect the issue at hand – currency rates). Hows does Kiva deal with this currency risk? Do the local partner banks take the risk…?

I was directed to a great slideshow showing Kiva’s lending policies. It turns out Kiva does have the local banks take the currency risk. So they have to pay back $100, if the local currency value is now $80, they would have a loss, of course the local currency value could also have risen, then the local bank has a gain.

They have a chart showing the cost of capital to local Kiva lenders at 0-1% plus currency exchange risk (which they say some banks choose to hedge and others just take the risk), which is about the lowest cost of capital around. Kiva charges no interest on the loans to the local banks. The costs come from the requirements (the cost of adding a profile – the time of staff of the bank to add the information…) of using the Kiva website.

Updates

1) Kiva updated their policy to put any currency loss greater than 20% on the lenders (up to 20% losses are taken by the bank, above 20% are taken by those lending through Kiva). But the banks can chose to take the currency risk, which they could do to encourage lenders to select their loans to fund.

2) They updated it again to make it a decision by the bank, which means often the lenders bear the risk (it is stated on each loan how the risk is assigned)

Curious Cat Kiva connections: Curious Cats Kiva lending team – Curious Cat Kivans – Funding Entrepreneurs in Nicaragua, Ghana, Viet Nam, Togo and Tanzania – Kiva Fellows Blog: Nepalese Entrepreneur Success – Kiva related blog posts

See more photos from my visit to Parfrey’s Glen Natural Area in Wisconsin, about an hour outside of Madison. It really was amazingly beautiful – the pictures do not do it justice. The Parfrey’s Glen trail is under a mile but well worth visiting. If you want to hike more try the Ice Age National Scenic Trail or nearby Devil’s Lake State Park. The top photo is of me (John Hunter) at nearby Durwood’s Glen. The yellow flower is from Parfrey’s Glen.

Related: Clifton Gorge State Nature Preserve, Ohio – Mesa Trail Boulder, Colorado – Nature Recreation Declining – Mason Neck State Park, Virginia

I have made some additional loans through Kiva, $250 for 5 loans in: Nicaragua, Ghana, Viet Nam, Togo and Tanzania. I have now made 37 loans for a total of $1,775. 5 loans of $250 have been paid back (and I relent the proceeds). Kiva says 5.64% are delinquent. While they show my delinquency rate they don’t show me which loans are delinquent. Frankly I think that figure may be in error (maybe it is counting one that was delinquent but is not now – see next paragraph). In any event all loans appear to have been paid off in full on time or are being paid in full now on time.

In any event no loans are in default. One loan in Kenya for bike repair shop (that for whatever reason I especially liked) and did connect me more to the troubles in Kenya recently. Kiva mentioned many banks were having trouble keeping in touch with clients as many people fled violence. For two months there was no activity then there was a payment for 3 full months. I was happy when a new payment came in, not for the money being repaid (which shows again that my aim with this money is not a return for me but to provide opportunities to entrepreneurs), but for confirmation he was doing well.

Photo of Cesar Augusto SantamarÃa Escoto in his welding workshop, Chinandega, Nicaragua.

If you have a Kiva page, let me know and I will add a link to it on the Curious Cat Kivans page.

Related: Provide a Helping Hand – Microfinancing Entrepreneurs – Entrepreneurship posts on the Curious Cat Science and Engineering blog

Singapore’s Social Entrepreneur Diana Saw makes things Bloom in Cambodia

The decision was swift as it was simple: move to Cambodia to provide jobs for poor women. I first

visited Phnom Penh in April 2006 and was back the next month to look for a house.

…

I approached the job placement arm of an NGO in Phnom Penh (PP). There are many NGOs who train poor Cambodians, but what this country needs is jobs. You can train people all you like, but if no one employs them, you’ll have frustrated skilled people who are unable to use their

skills.

…

Bloom has a savings plan for staff. Every month staff are encouraged to put away a percentage of their income which goes towards buying a sewing machine. Bloom will then subsidize the cost of the machine. With the machine, workers will be able to become small business owners, supplying bags not only to Bloom, but to other sellers, like small shops in the tourist markets.

Related: Bloom Bags Blog – Using Capitalism to Make the World Better – Make the World a Better Place – Kiva – Provide a Helping Hand – Aim for everybody to gain: workers, customers, suppliers, shareholders… – Obscene CEO Pay

- We believe in the right of all people to a decent life, free of poverty, and with access to education

- We believe you can be rich by helping the poor

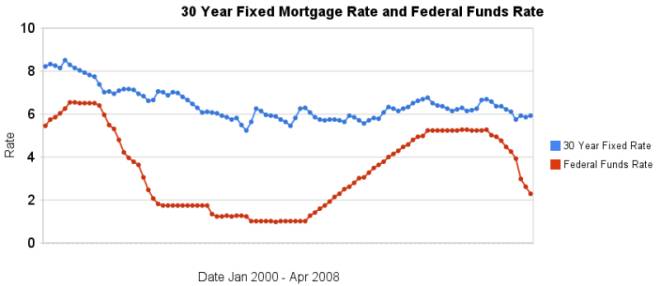

The recent drastic reductions again emphasize (once again) that changes in the federal funds rate are not correlated with changes in the 30 year fixed mortgage rate. In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points.

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Related: real estate articles – Affect of Fed Funds Rates Changes on Mortgage Rates – How Not to Convert Equity – more posts on financial literacy

Read more

The Clifton Gorge State Nature Preserve in Ohio is quite a nice short hike. Photos by John Hunter. If anyone knows what the green beetle is please add a comment.

I visited the preserve last year. Other sites from the trip include: Rocky Gap State Park, Maryland and Coopers Rock State Forest, West Virginia.

More photos: Mount Saint Helens National Volcanic Monument – Capital Crescent Trail (Washington DC) – travel photo directory – Grand Teton National Park

Creating a World Without Poverty by Muhammah Yunus (founder of the Grameen Bank and 2006 Nobel Peace Prize recipient). Giving people the opportunity to advance economically is something I see as very important. It is hard to imagine in the USA when those that are seen as poor have air conditioning, indoor plumbing, cars, TVs, electricity… but billions of people would love to approach such material wealth.

When you really have to struggle to put food on your plate or get clean water economic concerns are critically important. Economic progress may well decide whether your children live or not. Muhammah Yunus’ new book is a good read to hopefully encourage more people to realize there really are much more important things than your fourth pair or shoes (to say nothing of you 20th pair) or expensive wine or a newer car or…

Microfinance is a great system where those that have been lucky to receive material wealth can help provide opportunity to others. Loans of $200-$500 can make a huge difference in an entrepreneurs life. Just giving them the chance to use their intellect and hard work to create a life where they can get raise themselves slightly can change their lives, their children’s lives and together with others perhaps their community.

Trickle Up, Kiva and Grameen Bank are three great ways to help give entrepreneurs a chance to improve their lives. As I have mentioned before if you are a Kiva lender add a comment with your Kiva page and I will add a link to: Curious Cat Kiva Supporters. I will say I am happy with the success of this blog in general, the thing that disappoints me is how few links we have on that page.

Related: Microfinancing Entrepreneurs – Interview with Mohammad Yunus – Trying to Keep up with the Jones – Providing a Helping Hand via Kiva – Curious Cat Science and Engineering blog posts on appropriate technology

More photos from my visit to Rocky Gap State Park, Maryland. Photos by John Hunter.

Related: Nature Recreation Declining – travel lodging options

More travel photo essays: Shenandoah National Park, Virginia – Rocky Mountain National Park – Monocacy Aqueduct, Maryland

1,000 True Fans by Kevin Kelly

But the long tail is a decidedly mixed blessing for creators. Individual artists, producers, inventors and makers are overlooked in the equation. The long tail does not raise the sales of creators much, but it does add massive competition and endless downward pressure on prices.

…

Assume conservatively that your True Fans will each spend one day’s wages per year in support of what you do. That “one-day-wage” is an average, because of course your truest fans will spend a lot more than that. Let’s peg that per diem each True Fan spends at $100 per year. If you have 1,000 fans that sums up to $100,000 per year, which minus some modest expenses, is a living for most folks.

…

I am suggesting there is a home for creatives in between poverty and stardom. Somewhere lower than stratospheric bestsellerdom, but higher than the obscurity of the long tail.

Another interesting idea from Kevin Kelly. I like real life examples of applying economic and financial thinking, which I think his post does well. We have more options that just working for some organization. I have a bit of work to do to gain myself 1,000 fans and quite a bit more to get to 1,000 true fans. But I am making some progress in that direction.

Related: Who Influences Your Thinking – Street Use with Kevin Kelly – Signs You Have a Great Job… or Not – Curious Cat Investing Search