The Dividend Aristocrats index measures the performance of S&P 500 companies “that have followed a policy of increasing dividends every year for at least 25 consecutive years.” S&P makes additions and deletions from the index annually. This year 10 companies were added and 1 was deleted.

| Stock | Yield |

|

div/share 2011 | div/share 2000 | % increase |

|---|---|---|---|---|---|

| AT&T (T) | 6% | $1.72 | $1.006 | 72% | |

| HCP Inc (HCP) | 4.9% | $1.92 | $1.47 | 31% | |

| Sysco (SYY) | 3.7% | $1.04 | $0.24 | 333% | |

| Nucor (NUE) | 3.7% | $1.45 | $0.15 | 867% | |

| Illinois Tool Works (ITW) | 3.1% | $1.40 | $0.38 | 268% | |

| Genuine Parts (GPC) | 3.1% | $1.80 | $1.10 | 64% | |

| Medtronic (MDT) | 2.8% | $0.936 | $0.181 | 417% | |

| Colgate-Palmolive (CL) | 2.6% | $2.27 | $0.632 | 259% | |

| T-Rowe Price (TROW) | 2.9% | $1.24 | $0.27 | 359% | |

| Franklin Resources (BEN) | 1.2% | $1.00 | $.0245 | 308% |

You can’t expect members of the Dividend Aristocrats to match the dividend increases shown here. As companies stay in this screen of companies the rate of growth often decreases as they mature. Also some have already increased the payout rate (so have had an increasing payout rate boost dividend increases) significantly.

The chart also shows that a smaller current yield need not dissuade investing in a company even when your target is dividend yield, giving the large dividend increase in just 10 years. Nucor yielded just 1.5% in 2000 (at a price of $10). Ignoring reinvested dividends your current yield on that investment would be 14.5%. To make the math easy 10 shares in 2000 cost $100, and they paid $1.50 in dividends (%1.5). Dividends have now increase so those 10 shares are paying $14.50 in dividends (14.5%). Of course Nucor worked out very well; that type of return is not common. But the idea to consider is that the long term dividend yield is not only a matter of looking at the current yield.

The period from 2000 to 2011 was hardly a strong one economically. Yet look at how many of these companies dramatically increased their dividend payouts. Even in tough economic times many companies do well.

Related: Looking for Dividend Stocks in the Current Extremely Low Interest Rate Environment – Where to Invest for Yield Today – 10 Stocks for Income Investors

Chart by Curious Cat Economics Blog using data from the Wind Energy Association. 2011 data is for the capacity on June 30, 2011. Chart may be used with attribution as specified here.

Chart by Curious Cat Economics Blog using data from the Wind Energy Association. 2011 data is for the capacity on June 30, 2011. Chart may be used with attribution as specified here._________________________

In 2007 wind energy capacity reached 1% of global electricity needs. In just 4 years wind energy capacity has grown to reach 2.5% of global electricity demand. And by the end of 2011 it will be close to 3%.

By the end of 2011 globally wind energy capacity will exceed 240,000 MW of capacity. As of June 30, 2011 capacity stood at 215,000. And at the end of 2010 it was 196,000.

As the chart shows Chinese wind energy capacity has been exploding. From the end of 2005 through the end of 2011 they increased capacity by over 3,400%. Global capacity increased by 233% in that period. The 8 countries shown in the chart made up 79% of wind energy capacity in 2005 and 82% at the end of 2010. So obviously many of other countries are managing to add capacity nearly as quickly as the leading countries.

USA capacity grew 339% from 2005 through 2010 (far below China but above the global increase). Germany and Spain were leaders in building capacity early; from 2005 to 2010 Germany only increased 48% and Spain just 106%. Japan is an obvious omission from this list; given the size of their economy. Obviously they have relied heavily on nuclear energy. It will be interesting to see if Japan attempts to add significant wind and solar energy capacity in the near future.

Related: Nuclear Power Production by Country from 1985-2009 – Top Countries For Renewable Energy Capacity – Wind Power Capacity Up 170% Worldwide from 2005-2009 – USA Wind Power Installed Capacity 1981 to 2005 – Oil Consumption by Country 1990-2009

I am frustrated that we have largely allowed those that don’t believe in capitalism to claim their beliefs are capitalist. I believe capitalism is the best system to provide economic gain to human society. When we allow non-capitalist to claim their ideas are capitalist we often lose by allowing bad policies to be adopted and failing to adopt more capitalist ideas.

Robber barons and their ilk are not capitalists. Those attacked today as capitalists are much more like European nobility that fought to let the nobility take most of the economic profit from everyone else.

Capitalism is a wonderful thing.

The foolish economic policies the politicians we have elected over and over again for decades are idiotic and not capitalist (they are somewhat capitalist but the things people are complaining about are not capitalism but the corruption of the system by those subverting capitalism). They are the result of favoring cronyism and bribery over capitalist regulated markets.

What we need to do is not throw out the capitalists. We need to actually throw out those that say their cronyistic policies are capitalist.

Capitalism is an economic system designed to achieve economic gain for a society. Adam Smith (and others) understood that if those with power to destroy the functioning of markets (for personal gain) were allowed to do so then the benefits capitalism can produce are reduced. And they definitely would try to (according to the believes fundamental to the capitalist model) so a capitalist system has to account for that.

“Free” markets are good. But in capitalism “free” markets means markets where no entity has “market” power – that is the ability to move the market. This is the idea of perfect competition. In the real world this doesn’t happen but capitalist understand the weakness of unfree markets and that has to be dealt with. Things start to get messy here. There is no perfect way to do this and I don’t know of anyone (that I don’t think is naive) that thinks this can be done in some way that avoid economic friction (loss to the society from what is possible in some ideal state).

Now those that like cronyism and letting whoever has the clout do whatever they want have tried to say capitalism means doing whatever you want to get as much capital as you want. It doesn’t. Capitalism isn’t about letting whoever has the gold get more. It is an economic system to provide gain to society by setting up rules that result in market forces brining benefit to society.

Those thinking about setting up the rules for a capitalist system understood that many people are going to try and get away with taking what isn’t theirs. So you have to enforce the rule of law. You have to prevent those that seek to destroy markets and take personal gains they should not be able to (due to being allowed to collude with other market players, collude with politicians to gain political concessions that destroy market functions…).

I happen to believe capitalism is the best economic system we have by far.

I happen to believe those that have increasingly turned out system into one where croynism is destroying markets to give gains to a few parties dominates are creating great damage. But the problem is not that these people show capitalism is bad. Instead these people show the dangers of not putting in the effort to retain capitalist ideas: your economy suffers and people suffer.

Trying to create significant supplementary income is not easy. There are lots of people selling get rich quick schemes and ways to earn big money for little effort. But those schemes don’t offer what they claim (they just don’t work for any, but a few people).

In trying to figure out a good way to create another income stream I thought of the idea of consulting over the internet in very small chunks of time. I explored the options to be a consultant that way and they were not good. But the idea seemed excellent to me and I worked with a friend to develop the idea of us creating such a online service. The potential was great I think. The end service would provide value to those seeking answers and those providing consultation (and to us).

We did get a domain and plan out the service and begin coding the application but didn’t progress very far. It was still a great idea and something I planned to consider if I had a bit more time. Well there is now an offering that appears to actually be fairly decent (on first glance): Minute Box.

Minute Box allows you several of the things we planned on offering (but not all of them – at least not yet). You can register as an expert and then be available for those wanting advice. You sign in when you are available to answer questions (and people can send you a note while you are offline). You set your rate. Essentially IM is used for consultation and the billing is taken care of by Minute Box.

One of the keys is matching people to experts well. Minute Box does one thing we planned on doing, which is to emphasize the experts tapping those that already value their advice. This would work very well for bloggers and those with an online presence and reputation.

I signed up and created my expert account, so if you want to get some advice from me you can get consulting by the minute from John Hunter.

I think this consulting by the minute model is a great way to create a secondary income stream for those that have a positive online reputation. You can adjust your pay to manage demand. If you have a free week and want to make some extra income you can reduce your rate and offer your readers a special discount. This is potentially a great way to capitalize on your expertise. I haven’t had much experience with Minute Box yet so it isn’t certain they are the answer (but I haven’t seen any other solution that is very good). And no matter the service provider used, I believe the internet enabled micro consulting is a great way to provide some extra income and make your personal finances more robust.

The range of advice you can offer is huge. For nearly anything there are people that need advice: how to cook thanksgiving dinner, helping a child with math homework, fashion advice, editing a resume, which mortgage offer is better in a specific situation, fixing a bug in a WordPress blog, what are good plants for a shady area… The list is nearly endless.

I wish I had been able to create a web site to facilitate this process. I believe the potential is huge. That is why I was so interested in making this idea work. It is the only web business I have seriously considered (and even started). I have numerous web sites but they involve providing content online not any software as service businesses.

Related: Earning More Money – Save Some of Each Raise – If you can’t pay cash, earn more money or save until you have the cash

I try to find global economic data on manufacturing and manufacturing jobs, but it isn’t easy. This is one of the areas I will be working on with the time I have freed up by moving to Malaysia (and taking a “sabbatical” [it isn’t really a sabbatical, I guess, just me studying and working on what I want to instead of what someone pays me to]).

I found some interesting data from the USA census bureau on manufacturing employment in several countries (it would be interesting to see the data for more countries but for now I am limited to this data). Sadly they just use indexed data (I would rather see raw data). This data for example lets you see the changes in countries but I don’t see any way to compare the absolute values between countries – all you can compare is the changes between countries.

The data is all indexed at 2002 = 100. Interestingly the USA has increased output per hour much more than any other country since 2002. The USA index stands at 146, the next highest is Sweden at 127 then the UK at 120. Italy is the only country tracked that fell since 2002, to 94. Japan (the 3rd largest manufacturer and 2nd largest of the countries include, China isn’t included) only increased to 113. Germany (4th and 3rd) increased to 111.

The data also lets you look back from 1990 to 2002 and again the USA has increased productivity very well (2nd most) – the value in 1990 was 58. Sweden actually had the largest gain from 1990-2002, rising from 49. In 1990 Japan stood at 71 and Germany 70.

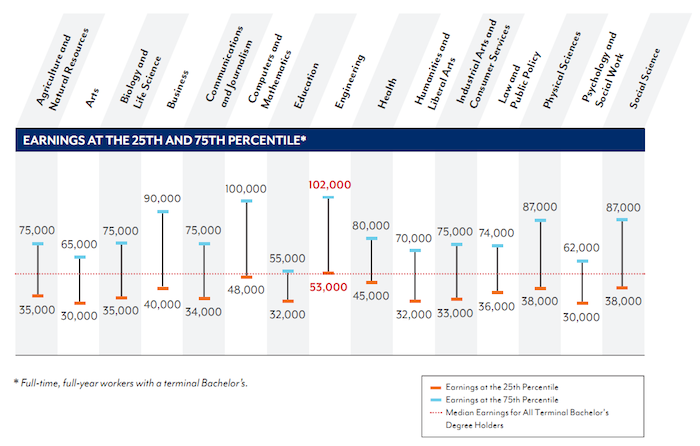

Georgetown University Center on Education and the Workforce has produced a new report looking at the value of different college degrees in the USA. I have seen a great increase in discussions of the “bubble” in education. Those articles often say a college degree doesn’t assure the success it used to. The data I review seems to show extremely large benefits for those with a college degree (higher salaries but, much more importantly, in my opinion, they also have much lower unemployment rates).

Those benefits are greatest for several majors including science, math and engineering. The problem I see is not so much that significant benefits are lacking for college degrees but the huge increases in costs of getting a degree are so large that for some majors the cost is just so large that even with the benefits it is arguable whether it is worth the cost (while a few decades ago the benefits were universal and so large the economic benefit was not debatable).

The authors of the report found that all undergraduate majors are worthwhile, even taking into account the cost of college and lost earnings. However, the lifetime advantage ranges from $1,090,000 for Engineering majors to $241,000 for Education majors. As I have written frequently on the Curious Cat Science and Engineering blog, engineering degrees are very financially rewarding.

The top 10 majors with the highest median earnings for new graduates are:

- Petroleum Engineer ($120,000)

- Pharmacy/pharmaceutical Sciences and Administration ($105,000)

- Mathematics and Computer Sciences ($98,000)

- Aerospace Engineering ($87,000)

- Chemical Engineering ($86,000)

- Electrical Engineering ($85,000)

- Naval Architecture and Marine Engineering ($82,000)

- Mechanical Engineering, Metallurgical Engineering and Mining and Mineral Engineering (each with median earnings of $80,000)

Related: 10 Jobs That Provide a Great Return on Investment – Mathematicians Top List of Best Occupations – New Graduates Should Live Frugally

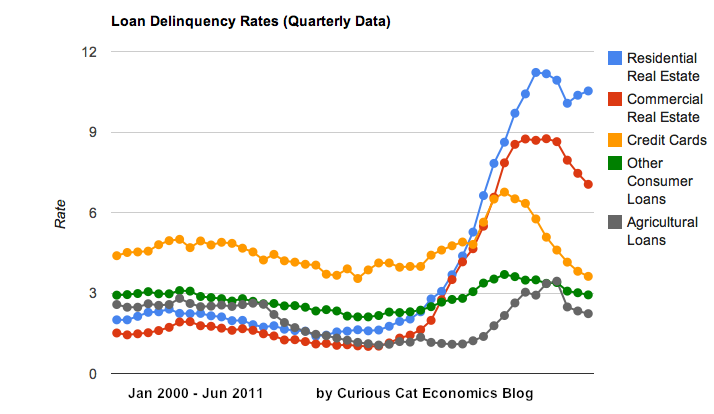

Chart showing loan delinquency rates from 2000-2011, shows seasonally adjusted data for all banks for consumer and real estate loans. The chart is available for use with attribution. Data from the Federal Reserve.

Residential real estate delinquency rates increased in the first half of 2011 in the USA. Other debt delinquency rates decreased. Credit card delinquency rates have actually reached a 17 year low.

While the job market remains poor and the serious long term problems created by governments spending beyond their means (for decades) and allowing too big to fail institutions to destroy economic wealth and create great risk for world economic stability the USA economy does exhibit positive signs. The economy continues to grow – slowly but still growing. And the reduction in delinquency rates is a good sign. Though the residential and business real estate rates are far far too high.

Related: Consumer and Real Estate Loan Delinquency Rates 2000-2010 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Government Debt as Percent of GDP 1998-2010 for OECD

After World War II essentially the only significantly large industrial base was in the USA. The USA was emerging as a national power in the early 1900’s. The wake of World War I and World War II left a very odd situation. You had many formerly very rich countries that were devastated and one rich country that wasn’t. Devastation is not easy to overcome in even 20 years. So for a good 2 decades the USA got wealthier and wealthier even while other formerly rich countries were re-developing their countries rapidly.

This made the USA even richer as selling to all those around the world was pretty easy, just creating enough stuff was the hardest part. Almost none of the current emerging markets were doing much of anything economically. This resulted in the USA being able to live incredibly well and generate enormous wealth.

The main legacy of this is a huge benefit to the USA – enormous wealth and experience. However, it seems to have left people thinking the USA is just suppose to be enormously wealthy always no matter if we throw away hundreds of billions a year on a broken health care system, provide huge benefits to political donors (farmers or bankers or phone oligopolists or robbers of the public domain [preventing innovation through repressive, outdated “intellectual property” regimes]), spending many hundreds of billions yearly on military expenditures far beyond those of any other country… It doesn’t work that way.

You can waste huge amounts of economic benefit when you are the dominant economic power globally. And when you were as rich as the USA was in the 1950s and 1960s more and more people felt they deserved to be favored with economic gifts. So for a a few decades the USA used the excess wealth to pay off all sorts of special interests and still do very well economically. The only thing surprising is how long we have been able to keep this up.

It isn’t rational to base expectations on periods when we were granted economic wealth largely by virtue of the world industrial production, other than ours, being destroyed. This isn’t the only reason we were wealthy, we do many things very well (compared to other countries) entrepreneurship, less corruption (still way too much but less than average), from 1950 to about 1990 an equitable distribution of economic gains, until recently a good advanced education system, a brilliant system to turn science and engineering breakthroughs into economic profit (that in the last few decades other countries are starting to do, but they are still way behind)…

From 1970s until say the 2000s we could use our accumulated wealth to live off and allow huge inefficiencies to continue (lousy job of regulating banks, lousy job of subsidizing farming, lousy job of subsidizing lousy food [making it cheap to eat unhealthy food and expensive to eat healthy food], lousy job of controlling the costs of higher education, lousy job of getting people to realize they cannot expect to live far beyond most everyone else in the world just because they were born in the USA…

Read more

I believe long term disability insurance is a must for a safe personal financial plan. The risk of not being covered isn’t worth it. An office worker should have a very low risk of something happening that qualifies you for receiving benefits (even with fairly serious injuries for a hunter-gatherer or farmer they can earn a living).

That is actually the perfect situation for insurance. Insurance should be cheap when the risk is small. You want insurance for unlikely but very costly events. You don’t want insurance for likely and inexpensive events (paying the middle man just adds to the cost).

I believe, other than health insurance it is the most important insurance. For someone with dependents life insurance can be important too. And auto and homeowners insurance are also important. Insurance if an important part of a smart personal finance. It is wise to chose high deductibles (to reduce cost).

In many things I believe you can chose what you want to do and just deal with the results. Forgoing health or disability insurance I think don’t fall into that category. Just always have those coverages. I think doing without is just a bad idea.

When I would have had gaps in coverage from work, I have purchased disability insurance myself.

I am all in favor of saving money. About the only 2 things I don’t believe in saving money being very important are health and disability insurance. Get high deductible insurance in general (you should insure against small loses). And with disability insurance you can reduce the cost by having the insurance only start after 6 or 12 months (I chose 12). As you get close to retirement (say 5 years) the risk is much less, you only have so many earning years left. If you wanted to save some money at that point it might be ok if you have saved well for retirement and have a cushion (in case you have to retire 3 year early). Long term care insurance may well be wise to get (if you didn’t when it was cheaper and you were younger. Long term care insurance is really tricky and very tied to whatever our politicians decide not to do (or do) about the broken health care system we have in the USA. The cost also becomes higher as it is moving toward a likely event, instead of a unlikely event (as you age you are more frail).

Related: How to Protect Your Financial Health – Personal Finance Basics: Avoid Debt

It is very simple. Adam Smith understood it and commented on it. If you allow businesses to have control of the market they will take benefits they don’t deserve at the expense of society. And many business will seek every opportunity to collude with other businesses to stop the free market from reducing their profits and instead instituting anti-competitive practices. Unless you stop this you don’t get the benefits of free market capitalism. Free markets (where perfect competition exists, meaning no player can control the market) distribute the gains to society by allowing those that provide services in an open market efficiently and effectively to profit.

Those that conflate freedom in every form and free markets don’t understand that free markets are a tool to and end (economic well being for a society) not a good in and of themselves. Politically many of these people just believe in everyone having freedom to do whatever they want. Promoting that political viewpoint is fine.

When we allow them to discredit free market capitalism by equating anti-market policies as being free market capitalism we risk losing a great benefit to society. People, see the policies that encourage allowing a few to collude and take “monopoly rents” and to disrupt markets, and to have politicians create strong special interest policies at the expense of society are bad (pretty much anyone, conservative liberal, anything other than those not interested in economics see this).

When people get the message that collusion, anti-competitive markets, political special interest driven policies… are what free market capitalism is we risk losing even more of the benefits free markets provide (than we are losing now). That so few seem to care about the benefit capitalism can provide that they willingly (I suppose some are so foolish they don’t understand, but that can’t be the majority) sacrifice capitalism to pay off political backers by supporting anti-market policies.

Allowing businesses to buy off politicians (and large swaths of the “news media” talking heads that spout illogical nonsense) to give them the right to tap monopoly profits based on un-free markets (where they use market power to extract monopoly rents) is extremely foolish. Yet the USA has allowed this to go on for decades (well really a lot longer – it is basically just a modification of the trust busting that Teddy Roosevelt tried). It is becoming more of an issue because we are allowing more of the gains to be driven by anti-competitive forces (than at least since the boom trust times) and we just don’t have nearly as much loot to allow so much pilfering and still have plenty left over to please most people.

I am amazed and disgusted that we have, for at least a decade or two, allowed talking head to claim capitalist and market support for their special interest anti-market policies. It is an indictment of our educational system that such foolish commentary is popular.

Free Texts Pose Threat to Carriers

This is exactly the type of behavior supported by the actions of the politicians you elect (if you live in the USA).

It is ludicrous that we provide extremely anti-market policies to help huge companies extract monopoly profits on public resources such as the spectrum of the airwaves. It is an obvious natural monopoly. It obviously should be managed as one. Several bandwidth providers provide bandwidth and charge a regulated rate. And let those using it do as they wish. Don’t allowing ludicrous fees extracted by anti-free-market forces such as those supporting such companies behavior at Verizon, AT&T…

Related: Financial Transactions Tax to Pay Off Wall Street Welfare Debt – Extremely Poor Broadband for the USA (brought to us by the same bought and paid for political and commentary class) – Ignorance of Capitalism – Monopolies and Oligopolies do not a Free Market Make