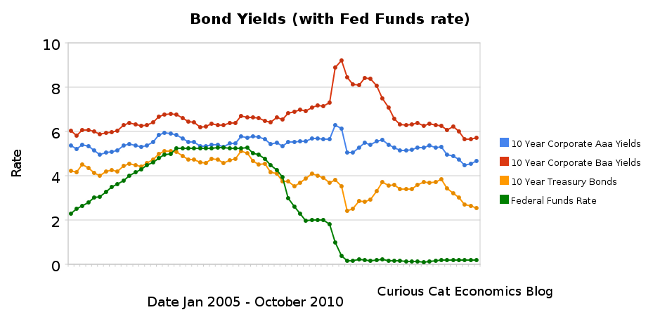

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have dropped even lower over the last 6 months, dramatically so for treasury bonds. 10 year Aaa corporate bonds yields have decreased 61 basis points to 4.68%. 10 year Baa yields have decreased 53 basis points to 5.72%. 10 year USA treasury bonds have decreased an amazing 169 basis points to a incredibly low yield of %2.54. The federal funds rate remains under .25%.

The Fed continues to try and discourage saving and encourage spending by punishing savers with policies to drive interest rates far below what the market alone would set. Partially this is a continuation of their subsidy to the large banks that caused the credit crisis. And partially it is an attempt to find a way to encourage spending to try and build job creation in the economy. The Fed announced they are taking huge steps to purchase $600 billion more bonds in an attempt to lower rates even further (much of the impact has been priced into the market as they have been saying they will take this action – but the size is larger than the consensus expectation). I do not think this is a sensible move.

Savers do not have many good options for safely investing retirement assets for a reasonable income. The best options are probably to hold short term bonds and money markets and hope that the Fed finally stops making things so difficult for them. But that will take awhile. I think investing in medium or long term bonds (over 4 years) is crazy at these rates (especially government bonds – unless you are a large bank that can get essentially free money from the Fed to then loan the government and make a profit). Dividends stocks may be a good alternative for some more yield (but this needs to be done carefully to not take unwise risks). And I think you to look at investing overseas because these fiscal policies are just too damaging to savers to continue to just wait for a decent rate of return in bonds in the USA. But there are not many good options. TIPS, inflation protected bonds, are another option to consider (mainly as a less bad, of bad choices).

It is a great time to take on debt however (as often is the case, there are benefits and costs to economic conditions). If you have a mortgage, and can qualify, or are looking to buy a home, mortgage rates are amazingly low.

Related: Bond Rates Remain Low, Little Change in Last 6 Months (April 2010) – Bond Yields Change Little Over Previous Months (December 2009) – Chart Shows Wild Swings in Bond Yields in Late 2008 – Government Debt as Percentage of GDP 1990-2009 in USA, Japan, Germany, China…

Dividends Beating Bond Yields by Most in 15 Years

Kraft Foods Inc. and DuPont Co. are among 68 companies in the Standard & Poor’s 500 Index with payouts that top the 3.78 percent average rate in credit markets, based on data since 1995 compiled by Bloomberg and Bank of America Corp. While Johnson & Johnson sold 10-year debt at a record low interest rate of 2.95 percent last month, shares of the world’s largest health products maker pay 3.66 percent.

The combination of record-low interest rates, potential profit growth of 36 percent this year and a slowing economy has forced investors into the relative value reversal. For John Carey of Pioneer Investment Management and Federated Investors Inc.’s Linda Duessel, whose firms oversee $566 billion, it means stocks are cheap after companies raised payouts by 6.8 percent in the second quarter

…

S&P 500 companies’ cash probably has grown to a record for a seventh straight quarter, according to S&P. For companies that reported so far, balances increased to $824.8 billion in the period ended June 30 from the first three months of the year, based on data from the New York-based firm.

Cash represents 10.2 percent of total assets at S&P 500 companies, excluding banks and financial firms, according to data compiled by Bloomberg. That’s higher than the 9.5 percent at the end of the second quarter last year, 8.4 percent in 2008 and 7.95 percent in 2007.

“The economy is slowing down, but productivity has been so great in this country and companies have been able to make good profits,”

10-year Treasury note yields were as low as 2.42% last month. The combination of continued extraordinarily low interest rates and good earnings increase this odd situation where dividends increase and interest yields fall. Extremely low yields aimed at by the Fed continue to aid banks and those that caused the credit crisis a huge deal and harm investors.

Money markets and bonds are not attractive places to invest now. Putting money in those places is still necessary for diversification (and as a safety net – especially in cases like 401-k plans where options are often very limited). Seeking out solid companies with strong long term prospects that pay reasonable dividends is a very sensible strategy today.

Related: Where to Invest for Yield Today – S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 – 10 Stocks for Income Investors – Bond Yields Show Dramatic Increase in Investor Confidence (Aug 2009)

U.S. Investors Regain Majority Holding of Treasuries

Mutual funds, households and banks have boosted the domestic share of the $8.18 trillion in tradable U.S. debt to 50.2 percent as of May, according to the most recent Treasury Department data.

…

The biggest jump in demand this year among domestic buyers of Treasuries has been commercial lenders. Bank holdings of Treasury and agency securities increased 5 percent to $1.57 trillion last month, according to the latest data available from the Fed.

…

The Fed’s decision to hold its target for the overnight lending rate at a record low has made it possible for banks to borrow at near-zero interest rates to finance purchases of longer-term and higher-yielding Treasuries while lending less.

I must say, unless you are getting special government interest free loans to invest in treasuries (like those that caused the credit crisis are) it seems crazy to me to invest at these low rates. In retirement, it probably does make sense to have some just as a diversification measure but other than that I would certainly reduce my holdings from what they would have been 10 years ago.

If politicians or the fed would just give special favors to me to borrow billions and essentially 0% and then lend it back for more I would take that deal.

But if I am not granted the welfare Chase, Goldman Sachs, Citibank and the rest are (with huge amounts of free money and bailouts if their bets fail) buying extremely low yield government debt is not an investment I want. I don’t think betting on deflation is not a bet I want to take. Inflation seems a bigger risk to me. But people get to make their own decisions, and we will see which investors are right.

Related: Paying Back Direct Cash from Taxpayers Does not Excuse Bank Misdeeds – Can Bankers Avoid Taking Responsibility Again? – What the Financial Sector Did to Us

Buffett Expects “Terrible Problem” for Municipal Debt

Berkshire’s investment portfolio included municipal bonds valued at less than $3.9 billion as of March 31, down from more than $4.7 billion at the end of 2008. The company had a maximum of $16 billion at risk in derivatives tied to such debt, according to the company’s annual report for 2009.

…

Buffett said last month that the U.S. may feel compelled to rescue a state facing default after the government committed $700 billion to bail out financial firms and automakers. “It would be hard in the end for the federal government to turn away a state having extreme financial difficulty when they’ve gone to General Motors and other entities and saved them,”

…

About $14.5 billion of municipal bonds defaulted in 2008 and 2009… Many those were securities backed by revenue from nursing homes, property developments and other projects without claim to government tax revenue.

…

Defaults by local governments with the power to raise taxes are less common. Jefferson County, Alabama, defaulted on more than $3 billion of bonds backed by sewer fees after the deals grew more costly in the wake of the credit crisis in 2008. Vallejo, California, filed for bankruptcy in 2008 after its tax revenue tumbled.

Related: USA State Governments Have $1,000,000,000,000 in Unfunded Retirement Obligations – Buffett on Need to Reduce Government Deficits – Politicians Again Raising Taxes On Your Children

Bill Gross Warning May Catch Bond Investors Off-Guard

The prospect of a strengthening U.S. economy and rising interest rates makes an “argument to not own as many” bonds, Gross said in the interview.

…

Treasuries have rallied for almost three decades, pushing the yield on the 10-year Treasury note from a high of 15.8 percent in September 1981 to 3.89 percent as of yesterday. The yield reached a record low of 2.03 percent in December 2008 during the height of the credit crunch.

Excess borrowing in nations including the U.S., U.K. and Japan will eventually lead to inflation as governments sell record amounts of debt to finance surging deficits, Gross said.

“People have been making money on fixed income for so long, people assume it’s going to continue when mathematically, it cannot,” said Eigen, whose fund is the third-best selling bond fund this year, according to Morningstar. “When people finally start to lose money in fixed-income, they won’t hesitate to pull money out very soon,” he said.

John Hancock Funds President and Chief Executive Officer Keith Hartstein said retail investors are already late in reversing their rush into bond funds, repeating the perennial mistake of looking to past performance to make current allocation decisions.

I agree bonds don’t look to be an appealing investment. They still may be a smart way to diversify your portfolio. I am investing some of my retirement plan in inflation adjusted bonds and continue to purchase them. My portfolio is already significantly under-weighted in bonds. I would not be buying them if it were not just to provide a small increasing of my bond holdings.

Related: Municipal Bonds, After Tax Return – 10 Stocks for Income Investors – Bond Yields Show Dramatic Increase in Investor Confidence – Investors Sell TIPS as They Foresee Tame Inflation

Yields are staying amazingly low today. Due to the credit crisis the federal reserve is shifting hundreds of billions of dollars from savers to bankers to allow banks to make up for losses they experienced (both in losses on bad loans and huge cash payments made to hundreds of executives over more than a decade). For that reason (and others) yields are extremely low now which is a great burden on those that saved and counted on reasonable investment yield.

Don’t be fooled by apologist for those causing the credit crisis that try and excuse their behavior and act as those paying back the bailout payments means they paid back the favors they were given. They have received much more from the policies of the federal reserve that has taken hundreds of billions of dollars from savers and given it to bankers. It has the same effect as a direct tax on savers being paid to bankers.

What is an investor/saver to do? James Jubak provides some excellent advice.

How to maximize what your cash pays even when nothing is paying much of anything now

You could lock your money up for decades and get 4.56% in a 30-year Treasury bond but 30 years is forever. And besides interest rates have to go up from today’s lows and that means bond prices will be coming down, probably fast enough to eat up all the interest that bond pays and more.

…

Not if you remember that interest rates are going up in most of the world (except maybe Europe and Japan) quite dramatically over the next 12 months. A year from now, perhaps sooner, you’ll be able to get yields swell north of anything you can find now.

That pretty much means that you’re guaranteed to lose money two ways by locking it up for the long term now.

…

For the short term you need to put your cash into something that’s as safe as possible but that offers you as much income as possible—and that doesn’t lock up your money for very long.

My choice dividend paying stocks—if they pay a high dividend, are extremely liquid, and are battle tested.

Whether you agree with his suggestions in the article is up to you. But even if you don’t he provides a very good overview of the options and risks that you have to navigate now as an investor seeking investments that provide a decent yield. I agree with him that interest rates seem likely to rise, making bonds an investment I largely avoid now myself.

Related: posts on financial literacy – Jubak Picks 10 Stocks for Income Investors – S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 – Bond Yields Show Dramatic Increase in Investor Confidence

TIPS Drive Away Biggest Bond Bulls Seeing Inflation

…

TIPS pay interest on a principal amount that rises with consumer prices. Their face value is protected against deflation, because the principal can’t fall below par. The benchmark 1.375 10-year Treasury-Inflation Protected Security due January 2020 yields 1.45 percent.

That’s 2.25 percentage points less than Treasuries of similar maturity that don’t provide protection from rising prices. The difference, known as the breakeven rate, reflects the pace of inflation investors expect over the life of the securities. The spread has fallen from the peak this year of 2.49 percentage points on Jan. 11.

I believe that the risks of inflation are so low that TIPS are not a good way to invest some of your investment portfolio. At these low rates I agree TIPS are hardly a wonderful investment but I think it is worth sacrificing some yield to gain if inflation does return in a few years. But the argument for not buying TIPS is also sensible I think.

Related: Bond Yields Show Dramatic Increase in Investor Confidence – Who Will Buy All the USA’s Debt? – Retirement Savings Allocation for 2010 – posts on bonds

3 Nobel prize winning economists, Robert C. Merton, Robert Solow and Paul Samuelson, took questions about the impending retirement savings crisis from PBS NewsHour correspondent Paul Solman in October 2008. Paul Solman asked them about their personal portfolios in the clip shown above.

Robert Merton tells his portfolio portfolio is in a Global Index Fund, Treasury Inflation-Protected Securities, and one hedge fund. He said he had been invested in a TIAA commercial real estate fund until recently, but sold in early 2008 when he worried commercial real estate prices had increased too far. He also sold out his Municipal bond holdings.

Robert Solow says he has no idea of his portfolio.

Paul Samuelson declined to say. He did offer that timing is not something investors can successfully do. He stated that timing the selling of assets was not as difficult as timing when to get back in. And that markets move very quickly so you can miss out on big gains. 2009 provided a great example of this. Many people sold stocks in late 2008 and early 2009. And most did not get back in. In 2009 the S&P 500 was up 26%.

Related: Retirement Savings Allocation for 2010 – How Much Will I Need to Save for Retirement? – Gen X Retirement – Many Retirees Face Prospect of Outliving Savings

I adjusted my future retirement account 401(k) allocations today. I do not have as favorable an opinion of investing in the stock market today as I did a year ago. I would likely have allocated 20% to a money market fund except my 401(k) actually has two options – 1 paying 0.0% and the other paying -.02%.

They seem to believe they should make a significant profit while providing a horrible return (they are still taking over .5% of assets in fees – even though rates do not cover their fees). Those running funds have very little interest in providing value for 401(k) participants – they are mainly interested in raising fees (though supposedly they are suppose to be run by people with a fiduciary responsibility to the investors). Unfortunately most 401(k)s lock you away from the best options for an investor (such as Vanguard Funds).

My current allocation for future funds is 40% to USA stocks, 40% to Global stocks and 20% to inflation adjusted bonds. My current allocation in this retirement account is 10% real estate, 35% global stocks, 55% USA stocks. For all my retirement savings it is probably about 5% real estate, 35% global stocks, 5% money market, 55% USA stocks (which is a fairly aggressive mix).

As I have said many times I do not like bonds at this time. I don’t think the interest nearly justifies the risk of capital loss (due to inflation or interest rate risk). Inflation protected bonds are a much more acceptable option for someone that is worried about inflation (like I am over the next 10-20 years).

A number of the stock fund (even bond fund) options in my 401(k) have expense ratios above 1%. That is unacceptable. The average fees on the options I chose were .5%.

With my employee match I am adding over 10% of my income to my 401(k), which I think is a good aim for most everyone. Far too many people are unwilling to forgo luxuries to save appropriately for their retirement. This is a sign of financial illiteracy and an unwillingness to accept the responsibilities of modern life.

Related: Investing – My Thoughts at the End of 2009 – 401(k)s are a Great Way to Save for Retirement – Saving for Retirement – Managing Retirement Investment Risks

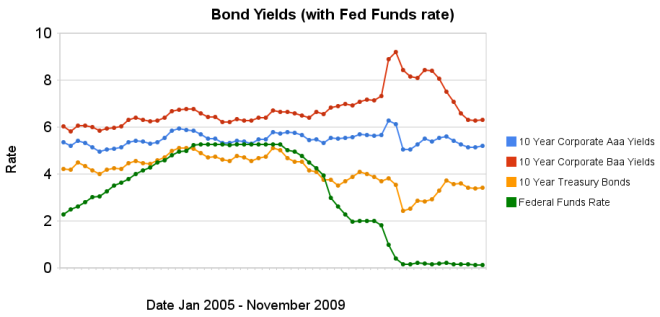

Chart showing corporate and government bond yields from 2005-2009 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields from 2005-2009 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have remained low, with little change over the last 4 months. Earlier in the year, yield spreads decreased dramatically, and those reductions have remained over the last 4 months. The federal funds rate remains under .25%.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Continued Large Spreads Between Corporate and Government Bond Yields (April 2009) – Chart Shows Wild Swings in Bond Yields (Jan 2009) – investing and economic charts