The largest manufacturing countries are China, USA, Japan and then Germany. These 4 are far in the lead, and very firmly in their positions. Only the USA and China are close, and the momentum of China is likely moving it quickly ahead – even with their current struggles.

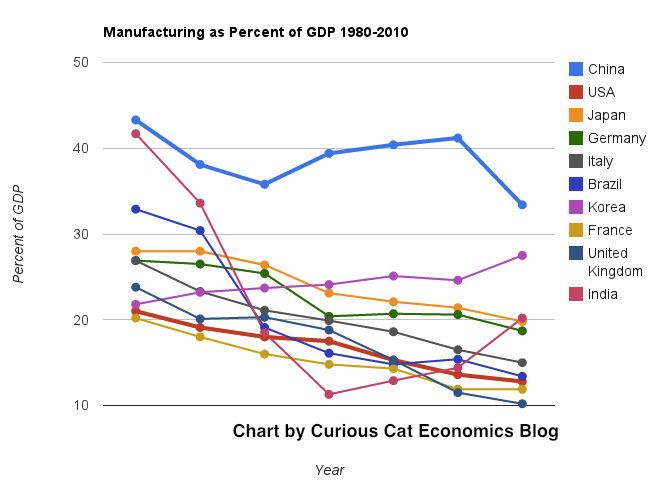

The chart below shows manufacturing production by country as a percent of GDP of the 10 countries that manufacture the most. China has over 30% of the GDP from manufacturing, though the GDP share fell dramatically from 2005 and is solidly in the lead.

Nearly every country is decreasing the percentage of their economic output from manufacturing. Korea is the only exception, in this group. I would expect Korea to start following the general trend. Also China has reduced less than others, I expect China will also move toward the trend shown by the others (from 2005 to 2010 they certainly did).

For the 10 largest manufacturing countries in 2010, the overall manufacturing GDP percentage was 24.9% of GDP in 1980 and dropped to 17.7% in 2010. The point often missed by those looking at their country is most of these countries are growing manufacturing, they are just growing the rest of their economy more rapidly. It isn’t accurate to see this as a decline of manufacturing. It is manufacturing growing more slowly than (information technology, health care, etc.).

This chart shows manufacturing output, as percent of GDP, by country and was created by the Curious Cat Economics Blog based on UN data. You may use the chart with attribution.

The manufacturing share of the USA economy dropped from 21% in 1980 to 18% in 1990, 15% in 2000 and 13% in 2010. Still, as previous posts show, the USA manufacturing output has grown substantially: over 300% since 1980, and 175% since 1990. The proportion of manufacturing output by the USA (for the top 10 manufacturers) has declined from 33% in 1980, 32% in 1990, 35% in 2000 to 26% in 2010. If you exclude China, the USA was 36% of the manufacturing output of these 10 countries in 1980 and 36% in 2010. China’s share grew from 7.5% to 27% during that period.

The United Kingdom has seen manufacturing fall all the way to 10% of GDP, manufacturing little more than they did 15 years ago. Japan is the only other country growing manufacturing so slowly (but Japan has one of the highest proportion of GDP from manufacturing – at 20%). Japan manufactures very well actually, the costs are very high and so they have challenges but they have continued to manufacture quite a bit, even if they are not growing output much.

I’m really too lazy for any ongoing budgeting. This is the model I have used: write down your big expense (rent, car payment, required student loan payment…). Get the total take home pay each month subtract your big expenses. If that is negative you better do something else (make more money, get rid of big expenses).

Big monthly expenses:

- Rent: $900

- Car payment + insurance: $300

- Cash (miscellaneous spending food, gas, cloths, books…): $450

- Utilities+ (heat, electricity, phone, internet…): $250

Take home pay: $2,800.

That leaves $900/month ($2,800 – $1,900). Decide how to allocate that – toward your IRA, saving to buy a house or take a vacation, eating out (above what was allocated above for cash), pay off debt (if you have it…), build up an emergency fund, save to buy a new MacBook Pro with Retina display…

If I decided to allocate $300 to my IRA (or increase my 401k) I would just set that up automatically each month. Then say I decided to put $400 toward other savings I would have that go to my savings account each month. And I decided I could use the $200 to pamper myself I just leave that in my checking account and what is in checking is what I have to spend.

I just don’t spend more than that. Just like when I was in college I had little spending money. I could spend that. I couldn’t spend any more, I didn’t have it. If I were to go over (I never did), but if I were to have (say my credit card bill exceeded my checking account balance), I would have had to reduce my cash the next month. I reality I would have something like $2,000 extra in the checking account so no bills would be a problem (and just view $2,000 as 0).

In 6 months see where things stand. Is it really working? Did you mess up and forget some expenses… If you need to adjust, do so. Re-examine every 6 months (or every year, if you are doing pretty well).

Take a portion of each raise (50% maybe) and devote it to personal finance goals (paying off debt, retirement savings, building up emergency fund, saving for big purcahse, investing, give more to charity…); don’t just use it to increase spending. Use no more than half (or whatever level you set) of the raise to increase your current spending.

Related: Personal Finance Basics: Avoid Debt – Investing in Stocks That Have Raised Dividends Consistently

The basics of retirement planning are not tricky. Save 10-15% of your income for about 40 years working career (likely over 15%, if you don’t have some pension or social security – with some pension around 10+% may be enough depending on lots of factors). That should get you in the ballpark of what you need to retire.

Of course the details are much much more complicated. But without understanding any of the details you can do what is the minimum you need to do – save 10% for retirement of all your income. See my retirement investing related posts for more details. Only if you actually understand all the details and have a good explanation for exactly why your financial situation allows less than 10% of income to be saved for retirement every year after age 25 should feel comfortable doing so.

There is value in the simple rules, when you know they are vast oversimplifications. I am amazed how many professionals don’t understand how oversimplified the rules of thumb are.

Here is one thing I see ignored nearly universally. I am sure some professions don’t but most do. If you have retirement assest such as a pension or social security (something that functions as an annuity, or an actually annuity) that is often a hugely important part of your retirement portfolio. Yet many don’t consider this when setting asset allocations in retirement. That is a mistake, in my opinion.

A reliable annuity is most like a bond (for asset allocation purposes). Lets look at an example for if you have $1,500 a month from a pension or social security and $500,000 in other financial assets. $1,500 * 12 gives $18,000 in annual income.

To get $18,000 in income from an bond/CD… yielding 3% you need $600,000. That means, at 3%, $600,000 yields $18,000 a year.

Ignoring this financial asset worth the equivalent of $600,000 when considering how to invest you $500,000 is a big mistake. Granted, I believe the advice is often too biased toward bonds in the first place (so reducing that allocation sounds good to me). To me it doesn’t make sense to invest that $500,000 the same way as someone else that didn’t have that $18,000 annuity is a mistake.

I also don’t think it makes sense to just say well I have $1,100,000 and I want to be %50 in bonds and 50% in stocks so I have “$600,000 in bonds now” (not really after all…) so the $500,000 should all be in stocks. Ignoring the annuity value is a mistake but I don’t think it is as simple as just treating it as though it were the equivalent amount actually invested.

Related: Immediate Annuities – Managing Retirement Investment Risks – How to Protect Your Financial Health – Many Retirees Face Prospect of Outliving Savings

I really can’t figure out which currency is something I would want to hold if I had the option. It doesn’t really matter, since I am not going to act on it in a very direct way (maybe if I felt very strongly I would do something but it would probably be pretty limited), but I still keep thinking about this issue out of curiosity.

The USA dollar seems lousy to me. Huge debt (both government and consumer). Government debt is huge on the books and huge off the books (state and local retirement – and federal medical care [social security is really in much better shape than people think, though it also has issues 30 + years out}).

The Euro seemed a bit lame 3 years ago. Today it seems crazy to think at least one Euro country won’t default in the next 3 years – and likely more. And if they take steps to avoid that it seems like it is going to make the case for the Euro worse).

The Japanese Yen is much stronger than makes any sense to me. I think it is mainly because of how lousy all the options are. The huge government debt (worse than almost anywhere) and lousy demographics (and the refusal to deal with demographics with immigration or something) are big problems. The biggest reason for strength is that the individuals have huge savings (when your citizens own the debt it is much less horrible than when others do – especially when you are looking at currency value).

The Chinese Yuan is the best looking at the economic data. The problem is economic data is questionable for the best cases (looking at the USA, Japan…). China’s economic data is far from transparent. There is also great political and social risk. The current worries of a real estate bubble seems justified to me and China just this week took exactly the wrong action – trying to prop up the bubble (in order to decrease the economic slowdown). I can see either of these cases playing out 10 years from now: It was obvious the Yuan was the strongest currency you are an idiot for not being able to see that or It was obvious China was a bubble with unsustainable policies and likely social upheaval thinking that was anything but a sign to sell the Yuan was foolish.

Given all this I think I weakly come down on the side that the Yuan is likely to be the strongest.

The safest play I think is the US dollar (as lousy as it is on an absolute basis the options make it look almost good). It could get clobbered. But that seems less likely than the others getting clobbered.

Smaller currencies have some promise but they can be swamped by global moves. I really have no idea about the Brazilian Real. That might actually be a really good option. The Australian Dollar and Canadian Dollar may also. But those economies are really small. I don’t trust India: they have many good macro-economic factors but the climate for business leaves far too much to be desired (as does the pace of progress fixing those weaknesses). Many economist like them due to demographic factors. I understand that demographic factors will help, but without systemic reform I question how well India can do (it certainly has the potential to do amazingly well, but they seem to be significantly farther away from reaching their potential compared to many countries).

The Singapore Dollar seems good on many levels, but the economy is small. I am not really sure about emerging economies, there currencies can get swamped in a hurry. Thailand and Indonesia experienced this recently. Thailand, Indonesia and Malaysia are interesting to me in thinking about what their currencies may experience, I would like to read more on this.

This is more an intellectual and curiosity exercise than something I see directly tied to my investing strategy. But having clear answers of what I thought reasonable scenarios were for currencies going forward that would factor into my investing decisions. Right now, the confusing this causes me, leads me to favor companies that should be fine whatever happens: Apple, Google, Toyota, Intel (I don’t really like Facebook overall but in this way they fit). Lots of the stocks in my 12 stocks for 10 years portfolio, you might notice.

Related: Is the Euro Going to Survive in the Long Run? – Why the Dollar is Falling – Strong Singapore Dollar – Warren Buffett Cautions Against Buying Long Term USD Bonds

3 Economic Misconceptions That Need to Die

…

Just 6.4% of nondurable goods — things like food, clothing and toys — purchased in the U.S. are made in China; 76.2% are made in America. For durable goods — things like cars and furniture — 12% are made in China; 66.6% are made in America.

Those numbers are significantly less than I expected but the concept matches my understanding – that we greatly underestimate the purchasing of USA goods and services.

We have an inflated notion of how large the China macro economic numbers are for the USA (both debt and manufacturing exports to us). The China growth in both is still amazingly large: we just overestimate the totals today. We also forget that 25 years ago both numbers (imports from China and USA government debt owned by China) were close to 0.

We also greatly underestimate how much manufacturing the USA does, as I have been writing about for years. In fact, until 2010, the USA manufactured more than China.

Who owns the rest? The largest holder of U.S. debt is the federal government itself. Various government trust funds like the Social Security trust fund own about $4.4 trillion worth of Treasury securities. The Federal Reserve owns another $1.6 trillion.

Ok, this figure is a bit misleading. But even if you thrown out the accounting games 1.13/8.9 = 12.7%. That is a great deal. But it isn’t a majority of the debt or anything remotely close. Other foreign investors own $3.5 trillion trillion in federal debt (Japan $1 trillion, UK $500 billion). The $4.6 trillion of federal debt owned by foreigners is a huge problem. With investors getting paid so little for that debt though it isn’t one now. But it is a huge potential problem. If interest reates increase it will be a huge transfer of wealth from the USA to others.

The oil figure is a bit less meaningful, I think. Oil import are hugely fungible. The USA cutting back Middle East imports and pushing up imports from Canada, Mexico, Nigeria… doesn’t change the importance of Middle East oil to the USA in reality (the data might seem to suggest that but it is misleading due to the fungible nature of oil trading). Whether we get it directly from the Middle East or not our demand (and imports) creates more demand for Middle East oil. It is true the USA has greatly increased domestic production recently (and actually decreased the use of oil in 2009). So while I believe the data on Middle East oil I think that it is a bit misleading. If we had 0 direct imports from there we would still be greatly dependent on Middle East oil (because if France and China and India… were not getting their oil there they would buy it where we buy ours… Still the USA uses far more oil than any other country and is extremely dependent on imports. Several other countries are also extremely dependent on oil imports, including the next two top oil consuming countries: China, Japan.

Related: Oil Production by Country 1999-2009 – Government Debt as Percentage of GDP 1990-2009: USA, Japan, Germany, China… – Manufacturing Output as a Percent of GDP by Country – The Relative Economic Position of the USA is Likely to Decline

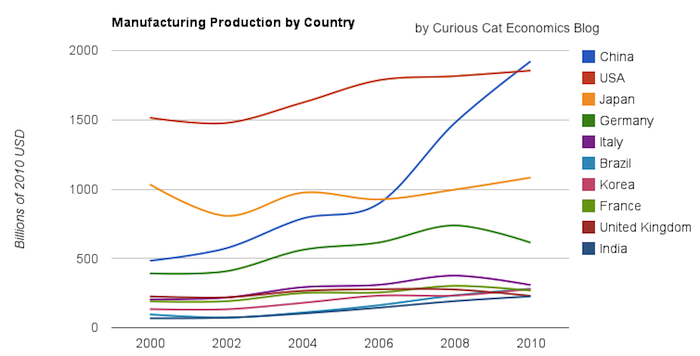

Chart of manufacturing production by the top 10 manufacturing countries (2000 to 2010). The chart was created by the Curious Cat Economics Blog. You may use the chart with attribution. All data is shown in 2010 USD (United States Dollar).

In my last post I looked at the output of the top 10 manufacturing countries with a focus on 1980 to 2010. Here I take a closer look at the last 10 years.

In 2010, China took the lead as the world’s leading manufacturing country from the USA. In 1995 the USA was actually very close to losing the lead to Japan (though you wouldn’t think it looking at the recent data). I believe China will be different, I believe China is going to build on their lead. As I discussed in the last post the data doesn’t support any decline in Chinese manufacturing (or significant moves away from China toward other South-East Asian countries). Indonesia has grown quickly (and have the most manufacturing production, of those discussed), but their total manufacturing output is less than China grew by per year for the last 5 years.

The four largest countries are pretty solidly in their positions now: the order will likely be China, USA, Japan, Germany for 10 years (or longer): though I could always be surprised. In the last decade China relentlessly moved past the other 3, to move from 4th to 1st. Other than that though, those 3 only strengthened their position against their nearest competitors. Brazil, Korea or India would need to increase production quite rapidly to catch Germany sooner. After the first 4 though the situation is very fluid.

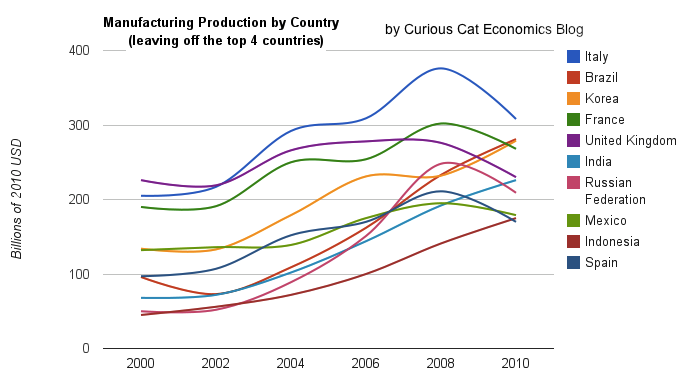

Taking a closure look at the large group of countries after top 4. Chart of manufacturing production from 2000-2010.

Chart of manufacturing production by the leading manufacturing countries (2000 to 2010). The top 4 countries are left off to look more closely at history of the next group. The chart was created by the Curious Cat Economics Blog based on UN data. You may use the chart with attribution.

Removing the top 4 to take a close look at the data on the other largest manufacturing countries we see that there are many countries bunched together. It is still hard to see, but if you look closely, you can make out that some countries are growing well, for example: Brazil, India and Indonesia. Other countries (most in Europe, as well as Mexico) did not fare well in the last decade.

The UK had a particularly bad decade, moving from first place in this group (5th in the world) to 5th in this group and likely to be passed by India in 2011. Europe has 4 countries in this list (if you exclude Russia) and they do not appear likely to do particularly well in the next decade, in my opinion. I would certainly expect Brazil, India, Korea and Indonesia to out produce Italy, France, UK and Spain in 2020. In 2010 the total was $976 billion by the European 4 to $961 billion by the non-European 4. In 2000 it was $718 billion for the European 4 to $343 billion (remember all the data is in 2010 USD).

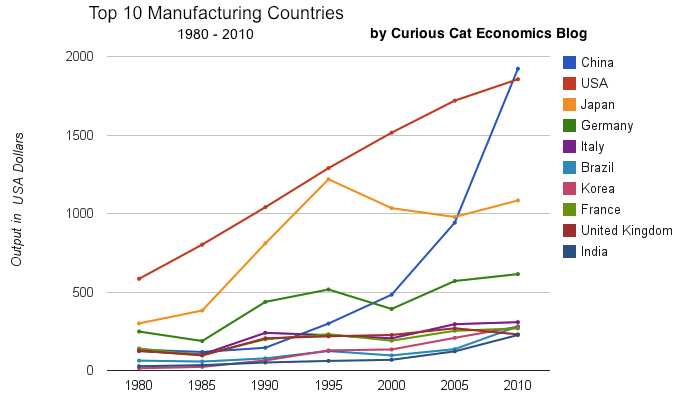

Chart of output by top 10 manufacturing countries from 1980 to 2010. The chart was created by the Curious Cat Economics Blog based on UN data. You may use the chart with attribution.

China has finally actually taken the lead as the largest manufacturer in the world. Reading many news sources and blogs you may have thought the USA lost the lead a couple of decades ago, but you would be wrong. In 1995 it looked like Japan was poised to take the lead in manufacturing production, but they have slumped since then (still they are solidly the 3rd biggest manufacturer). China has been growing manufacturing output enormously for 20 years, and they have now taken the lead from the USA.

As I have been saying for years the biggest economic story about manufacturing is the dramatic and long term increase of productive capacity in China. The next is the continuing global decline in manufacturing employment: increased productivity has seen production rise year after year and employment fall. What is the next most interesting stories is debatable: I would say the continuing failure to appreciate the continuing strong manufacturing production increases by the USA. Another candidate is the the decline in Japan. Another is the increase in several other counties: Korea, Brazil, India, Indonesia…

Looking more closely at some of the long term data shows how much China stands out. From 1980 to 2010 China increased output 1345%. The total top 10 group increased output 302% (all data is in current USD so inflation accounts for most of the gain, 100 1980-USD equal 280 2010-USD). From 1995 to 2010 China increased output 543%. The group increased 64%. For 1980-2010, the results for the other 3 largest manufacturing countries are: USA up 218%, Japan up 261% and Germany up 148% (other countries doing very well are Korea up 1893% and India up 737%). Looking at the last half of that period, from 1995-2010 the: USA up 44%, Japan down 11% and Germany up 19%.

One thing to remember about adjusting manufacturing data for inflation is that often the products created in later years are superior and cost less. So that a computer manufactured in 1990 which added $5,000 to the manufacturing total is far inferior to one in 2010 that added just $1,000. This point is mainly to say that while the increase in manufacturing in real (not inflated dollars) is not as high as it might seem the real value of manufacturing good did likely increase a great deal. But the economic data is based on price so manufacturing increases are reduced by cost decreases. Computers are the most obvious example, but it is also true with many other manufactured goods.

You can that the other largest manufacturing countries fail to keep up with the increases of the entire group of the top 10. China’s gains are just too large for others to match. If you remove China’s results (just to compare how the non-China countries are doing) from 1980-2010 the increase was 216% (so compared to the other 9 top manufacturers over this period the USA was even and Japan better than the average and Germany was worse). And from 1995-2010 the top 9 group (top 10, less China) increased just 28%: so the USA beat while Japan and Germany did worse than the other 9 as a group.

The Dividend Aristocrats index measures the performance of S&P 500 companies “that have followed a policy of increasing dividends every year for at least 25 consecutive years.” S&P makes additions and deletions from the index annually. This year 10 companies were added and 1 was deleted.

| Stock | Yield |

|

div/share 2011 | div/share 2000 | % increase |

|---|---|---|---|---|---|

| AT&T (T) | 6% | $1.72 | $1.006 | 72% | |

| HCP Inc (HCP) | 4.9% | $1.92 | $1.47 | 31% | |

| Sysco (SYY) | 3.7% | $1.04 | $0.24 | 333% | |

| Nucor (NUE) | 3.7% | $1.45 | $0.15 | 867% | |

| Illinois Tool Works (ITW) | 3.1% | $1.40 | $0.38 | 268% | |

| Genuine Parts (GPC) | 3.1% | $1.80 | $1.10 | 64% | |

| Medtronic (MDT) | 2.8% | $0.936 | $0.181 | 417% | |

| Colgate-Palmolive (CL) | 2.6% | $2.27 | $0.632 | 259% | |

| T-Rowe Price (TROW) | 2.9% | $1.24 | $0.27 | 359% | |

| Franklin Resources (BEN) | 1.2% | $1.00 | $.0245 | 308% |

You can’t expect members of the Dividend Aristocrats to match the dividend increases shown here. As companies stay in this screen of companies the rate of growth often decreases as they mature. Also some have already increased the payout rate (so have had an increasing payout rate boost dividend increases) significantly.

The chart also shows that a smaller current yield need not dissuade investing in a company even when your target is dividend yield, giving the large dividend increase in just 10 years. Nucor yielded just 1.5% in 2000 (at a price of $10). Ignoring reinvested dividends your current yield on that investment would be 14.5%. To make the math easy 10 shares in 2000 cost $100, and they paid $1.50 in dividends (%1.5). Dividends have now increase so those 10 shares are paying $14.50 in dividends (14.5%). Of course Nucor worked out very well; that type of return is not common. But the idea to consider is that the long term dividend yield is not only a matter of looking at the current yield.

The period from 2000 to 2011 was hardly a strong one economically. Yet look at how many of these companies dramatically increased their dividend payouts. Even in tough economic times many companies do well.

Related: Looking for Dividend Stocks in the Current Extremely Low Interest Rate Environment – Where to Invest for Yield Today – 10 Stocks for Income Investors

Chart by Curious Cat Economics Blog using data from the Wind Energy Association. 2011 data is for the capacity on June 30, 2011. Chart may be used with attribution as specified here.

Chart by Curious Cat Economics Blog using data from the Wind Energy Association. 2011 data is for the capacity on June 30, 2011. Chart may be used with attribution as specified here._________________________

In 2007 wind energy capacity reached 1% of global electricity needs. In just 4 years wind energy capacity has grown to reach 2.5% of global electricity demand. And by the end of 2011 it will be close to 3%.

By the end of 2011 globally wind energy capacity will exceed 240,000 MW of capacity. As of June 30, 2011 capacity stood at 215,000. And at the end of 2010 it was 196,000.

As the chart shows Chinese wind energy capacity has been exploding. From the end of 2005 through the end of 2011 they increased capacity by over 3,400%. Global capacity increased by 233% in that period. The 8 countries shown in the chart made up 79% of wind energy capacity in 2005 and 82% at the end of 2010. So obviously many of other countries are managing to add capacity nearly as quickly as the leading countries.

USA capacity grew 339% from 2005 through 2010 (far below China but above the global increase). Germany and Spain were leaders in building capacity early; from 2005 to 2010 Germany only increased 48% and Spain just 106%. Japan is an obvious omission from this list; given the size of their economy. Obviously they have relied heavily on nuclear energy. It will be interesting to see if Japan attempts to add significant wind and solar energy capacity in the near future.

Related: Nuclear Power Production by Country from 1985-2009 – Top Countries For Renewable Energy Capacity – Wind Power Capacity Up 170% Worldwide from 2005-2009 – USA Wind Power Installed Capacity 1981 to 2005 – Oil Consumption by Country 1990-2009

Trying to create significant supplementary income is not easy. There are lots of people selling get rich quick schemes and ways to earn big money for little effort. But those schemes don’t offer what they claim (they just don’t work for any, but a few people).

In trying to figure out a good way to create another income stream I thought of the idea of consulting over the internet in very small chunks of time. I explored the options to be a consultant that way and they were not good. But the idea seemed excellent to me and I worked with a friend to develop the idea of us creating such a online service. The potential was great I think. The end service would provide value to those seeking answers and those providing consultation (and to us).

We did get a domain and plan out the service and begin coding the application but didn’t progress very far. It was still a great idea and something I planned to consider if I had a bit more time. Well there is now an offering that appears to actually be fairly decent (on first glance): Minute Box.

Minute Box allows you several of the things we planned on offering (but not all of them – at least not yet). You can register as an expert and then be available for those wanting advice. You sign in when you are available to answer questions (and people can send you a note while you are offline). You set your rate. Essentially IM is used for consultation and the billing is taken care of by Minute Box.

One of the keys is matching people to experts well. Minute Box does one thing we planned on doing, which is to emphasize the experts tapping those that already value their advice. This would work very well for bloggers and those with an online presence and reputation.

I signed up and created my expert account, so if you want to get some advice from me you can get consulting by the minute from John Hunter.

I think this consulting by the minute model is a great way to create a secondary income stream for those that have a positive online reputation. You can adjust your pay to manage demand. If you have a free week and want to make some extra income you can reduce your rate and offer your readers a special discount. This is potentially a great way to capitalize on your expertise. I haven’t had much experience with Minute Box yet so it isn’t certain they are the answer (but I haven’t seen any other solution that is very good). And no matter the service provider used, I believe the internet enabled micro consulting is a great way to provide some extra income and make your personal finances more robust.

The range of advice you can offer is huge. For nearly anything there are people that need advice: how to cook thanksgiving dinner, helping a child with math homework, fashion advice, editing a resume, which mortgage offer is better in a specific situation, fixing a bug in a WordPress blog, what are good plants for a shady area… The list is nearly endless.

I wish I had been able to create a web site to facilitate this process. I believe the potential is huge. That is why I was so interested in making this idea work. It is the only web business I have seriously considered (and even started). I have numerous web sites but they involve providing content online not any software as service businesses.

Related: Earning More Money – Save Some of Each Raise – If you can’t pay cash, earn more money or save until you have the cash