It is a shame that it is no surprise when a bank lies to you. I got a “priority notice” from my mortgage company that my 30 year fixed load could be reduced. They show big huge figures showing current interest rate, new interest rate, potential yearly savings of over $5,000… Complete lies. They are claiming savings with a completely different mortgage, a 5/30 year adjustable rate mortgage (which you have to turn over the paper and note they list “mortgage product: 5/1 ARM” and then know what that means).

Then they go on for a page with all sorts of text seemingly designed to confuse fools. Obviously they try to claim the savings are what is important and the different mortgages, risks of rising interest rates etc. are not important [why don’t they just make it a 30 year mortgage at the low rate, if they think the interest rate risk they try to stick the client with is such an unimportant detail that isn’t even mentioned on the front page with the “comparison” mortgage rates]).

Anyone that trusts any company that so blatantly tries to fool you is crazy. When they are not shy about using such obviously deceitful tactics you can’t trust them to do much much worse in ways that are very difficult to protect yourself from.

As I have said before, don’t trust your bank. More than any other companies I see, financial institution, treat customers as fools to be fleeced not customers to provide value to. It really is amazing people defend banks paying obscene bonuses to those that are able to fool financial illiterates into stupid decisions. The company trying to deceive in this case, did indeed fail (and was saved by the FDIC). Financial institutions have decided that they will just focus on tricking those that are not financially literate out of as much money as they possibly can. If you don’t educate yourself you are at great risk to be taken advantage of by financial institutions focused on finding people they can take advantage of.

Related: FDIC Study of Bank Overdraft Fees – Ignorance of Many Mortgage Holders – Don’t Let the Credit Card Companies Play You for a Fool – Customer Hostility from Discover Card – Legislation to Address the Worst Credit Card Fee Abuse – Maybe

Home prices in the United States rose 0.3% on a seasonally-adjusted basis from June to July, according to the Federal Housing Finance Agency’s monthly House Price Index. The previously reported 0.5% increase in June was revised downward to a 0.1% increase. For the 12 months ending in July, U.S. prices fell 4.2%. The U.S. index is 10.5% below its April 2007 peak.

The FHFA monthly index is calculated using purchase prices of houses backing mortgages that have been sold to or guaranteed by Fannie Mae or Freddie Mac. Read the full press release. The Case-Shiller Home Price Indices also have increased (10 and 20 city indices) for June and July.

I am still not convinced we have seen the bottom of the housing price declines nationwide. The economy is still in very fragile territory. But the data does show the declining prices have been stopped in many locations, at least for a while. If job losses continue housing prices may well resume the decline. The commercial real estate market seems to be even weaker than housing.

Related: The Value of Home Ownership – Housing Prices Post Record Declines (April 2008) – posts on economic data – real estate articles

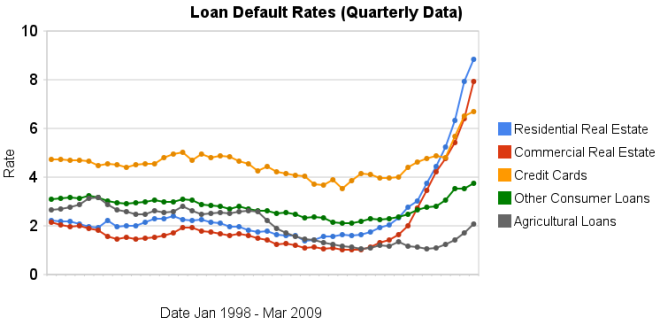

Chart showing loan delinquency rates for real estate, consumer and agricultural loans for 1998 to 2009 by the Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing loan delinquency rates for real estate, consumer and agricultural loans for 1998 to 2009 by the Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Delinquency rates on commercial (up another 151 basis points) and residential (93 basis points) real estate continued to increase dramatically in the second quarter. Credit card delinquency rates increased but only by 20 basis points.

Real estate delinquency rates exploded in 2008. In the 4th quarter of 2007 residential delinquency rates were 3.02% by the 4th quarter of 2008 they were 6.34% and in the 2nd quarter of this year they were 8.84% (582 basis points above the 4th quarter of 2007). Commercial real estate delinquency rates were at 2.74% in the 4th quarter of 2007, 5.43% in the fourth quarter of 2008 and 7.91% in the 2nd quarter of 2009 (a 517 basis point increase).

Credit card delinquency rates were much higher than real estate default rates for the last 10 years (the 4-5% range while real estate hovered above or below 2%). Now they are over 200 and 300 basis points bellow residential and commercial delinquency rates respectively. From 4.8% in the 3rd quarter 2008 to 5.66% in the 4th and 6.5% in the 1st quarter of 2009.

The delinquency rate on other consumer loans and agricultural loan delinquency rates are up but nowhere near the amounts of real estate or credit cards.

As I wrote recently bond yields in the last few months show a dramatic increase in investor confidence for corporate bonds.

Related: Loan Delinquency Rates: 1998-2009 – The Impact of Credit Scores and Jumbo Size on Mortgage Rates – 30 Year Mortgage Rate and Federal Funds Rate Chart

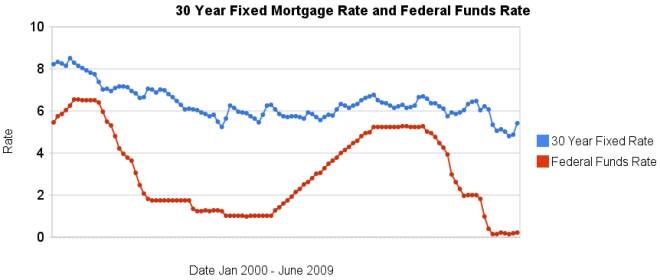

Once again the data shows that the 30 year fixed mortgage rates are not directly related to federal funds rates. In June the fed funds rate increased 3 basis points, 30 year mortgage rates increased 56 basis points. Since January the fed funds rate is up 6 basis points is up while 30 year mortgage rates are up 36 basis points. Home prices have continued to fall even with the very low mortgage rates.

Related: Mortgage Rates: 6 Month and 5 Year Charts – historical comparison of 30 year fixed mortgage rates and the federal funds rate – posts on financial literacy – GM and Citigroup Replaced by Cisco and Travelers in the Dow – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

Another wave of foreclosures is poised to strike

…

Mark Zandi of Moody’s Economy.com estimates that 15.4 million homeowners — or about 1 in 5 of those with first mortgages — owe more on their homes than they are worth.

…

Government and company reports show that the number of completed foreclosures nationwide slowed sharply late last year and into early this year, largely because of various moratoriums in effect during much of the first quarter.

But anecdotal reports indicate that foreclosure sales have started to climb again in the second quarter. And the pipeline is clearly getting fuller. In the first quarter, some 1.8 million homeowners nationwide fell behind on their loans by 60 to 90 days, a 15% increase from the prior quarter, according to Moody’s Economy.com. The research firm said that loan defaults rose sharply as well, to 844,000 in the first three months of this year.

…

Even as defaults among subprime borrowers have trended lower this year, newly initiated foreclosures involving prime mortgage loans saw a significant increase in the first quarter, jumping 21.5% from the fourth quarter, according to a government report of loan data from national banks and federally regulated thrifts.

This is more bad news for the economy. As I have been saying the economy is still in serious trouble. Cleaning up the damage caused by living beyond our means for decades does not get cleaned up quickly. This are actually going as well as could be hoped for, I think. We need to hope the remainder of this year sees the economy stabilize and then hope 2010 brings some good news.

Related: Nearly 10% of Mortgages Delinquent or in Foreclosure – Over Half of 2008 Foreclosures From Just 35 Counties – How Much Worse Can the Mortgage Crisis Get? (March 2008) – Mortgage Rates Falling on Fed Housing Focus

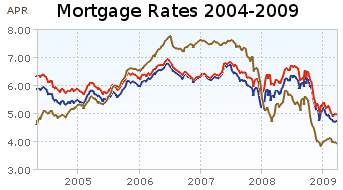

Showing mortgage rates over the last 6 months. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate.

Showing mortgage rates over the last 6 months. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate.

Showing mortgage rates over the last 5 years. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate. From Yahoo Finance, for conventional loans in Virginia.

Showing mortgage rates over the last 5 years. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate. From Yahoo Finance, for conventional loans in Virginia.

The 6 month chart shows that mortgage rates have been declining ever so slightly. Rates on a 1 year adjustable mortgage fell from 5.5 to 4% and have stayed near 4% for all of 2009. 30 and 15 year rates (15 year rates staying about 25 basis points cheaper) have declined from 6.5%, 6 months ago to about 5% at the start of the year and have moved around slightly since. This is while the yield 10 year government treasuries have been rising (normally 30 year fixed rate mortgages track moves in the 10 year government bond). The federal reserve has been buying bonds in order to push down the yield (and stimulate mortgage financing and other borrowing).

Mortgage rates certainly could fall further but the current rates are extremely attractive and I just locked in a mortgage refinance for myself. I am getting a 20 year fixed rate mortgage; I didn’t want to extend the mortgage period by getting another 30 year fixed rate mortgage. For me, the risk of increasing rates outweigh the benefits of picking up a bit lower rate given the current economic conditions. But I can certainly understand the decision to hold out a bit longer in the hopes of getting a better rate. If I had to guess I would say rates will be lower during the next 3 months, but I am not confident enough to hold off, and so I decided to move now.

Related: Mortgage Rates Falling on Fed Housing Focus – posts on mortgages – 30 Year Fixed Mortgage Rates and the Fed Funds Rate – Continued Large Spreads Between Corporate and Government Bond Yields – Lowest 30 Year Fixed Mortgage Rates in 37 Years –

Mortgages Falling to 4% Become Bernanke Housing Focus by Brian Louis and Kathleen M. Howley

…

Conventional mortgages averaged 4.61 percent in 1951, 4 percent when backed by the Veterans Administration, and 4.25 percent by the Federal Housing Administration, according to The Postwar Residential Mortgage Market, a 1961 book written by Saul Klaman and published by Princeton University Press. Rates during the 1930s were as high as 7 percent.

…

Mortgages were cheaper through most of the 1940s, ranging from about 4 percent to 5.7 percent, depending on whether the lender was a life insurer, a commercial bank or a savings and loan. In that era, most loans were for 14 years and less.

…

The central bank has purchased more than $300 billion of mortgage-backed securities in 2009 through the week ended April 8, helping to cut home-loan rates to 4.82 percent last week from 5.1 percent at the start of the year, according to Freddie Mac data.

…

The difference between 30-year mortgage rates and 10-year Treasury yields has narrowed to about 2.2 percent from 3.1 percent in December, which was the widest since 1986. The spread remains almost 0.7 percentage point above the average of the past decade, data compiled by Bloomberg show. Rates for 15-year mortgages are about 1.8 percent above 10-year Treasury yields, compared with an average 1.4 percent since 1999.

Excellent article with interesting historical information. I don’t believe mortgage rates will fall to 4% but differences of opinion about the future is one function of markets. Those that predict correctly can make a profit. I am thinking of refinancing a mortgage and I think I am getting close to pulling the trigger. If I was confident they would keep falling I would wait. It just seems to me the huge increase in federal debt and huge outstanding consumer debt along with very low USA saving will not keep interest rates so low. However, as I have mentioned previously, it is interesting that the Fed is directly targeting mortgage rates and possible they can push them lower. The 10 year bond yield has been increasing lately so the slight fall in mortgage rates over the last month are due to the reduced spread (that I can see decreasing – the biggest question for me is how much that spread can decrease).

Related: Fed to Start Buying Treasury Bonds Today – Federal Reserve to Buy $1.2T in Bonds, Mortgage-Backed Securities – Low Mortgage Rates Not Available to Everyone – what do mortgage terms mean?

William Black wrote The Best Way to Rob a Bank Is to Own One: How Corporate Executives and Politicians Looted the S&L. I think he a bit off on the “owning one,” being the best way to loot. The looters are not owners, they are executives that loot from owners, taxpayers, customers… And those looters pay politicians a great deal of money to help them. He appeared on Bill Moneys Journal discussing the huge mess we know are in and how little is being done to hold those responsible for the enormous crisis created by them.

…

The FBI publicly warned, in September 2004 that there was an epidemic of mortgage fraud, that if it was allowed to continue it would produce a crisis at least as large as the Savings and Loan debacle. And that they were going to make sure that they didn’t let that happen. So what goes wrong? After 9/11, the attacks, the Justice Department transfers 500 white-collar specialists in the FBI to national terrorism. Well, we can all understand that. But then, the Bush administration refused to replace the missing 500 agents. So even today, again, as you say, this crisis is 1000 times worse, perhaps, certainly 100 times worse, than the Savings and Loan crisis. There are one-fifth as many FBI agents as worked the Savings and Loan crisis.

…

Well, certainly in the financial sphere, I am. I think, first, the policies are substantively bad. Second, I think they completely lack integrity. Third, they violate the rule of law. This is being done just like Secretary Paulson did it. In violation of the law. We adopted a law after the Savings and Loan crisis, called the Prompt Corrective Action Law. And it requires them to close these institutions. And they’re refusing to obey the law.

…

In the Savings and Loan debacle, we developed excellent ways for dealing with the frauds, and for dealing with the failed institutions. And for 15 years after the Savings and Loan crisis, didn’t matter which party was in power, the U.S. Treasury Secretary would fly over to Tokyo and tell the Japanese, “You ought to do things the way we did in the Savings and Loan crisis, because it worked really well. Instead you’re covering up the bank losses, because you know, you say you need confidence. And so, we have to lie to the people to create confidence. And it doesn’t work. You will cause your recession to continue and continue.”

…

And their ideologies, which swept away regulation. So, in the example, regulation means that cheaters don’t prosper. So, instead of being bad for capitalism, it’s what saves capitalism. “Honest purveyors prosper” is what we want. And you need regulation and law enforcement to be able to do this. The tragedy of this crisis is it didn’t need to happen at all.

Related: Fed Continues Wall Street Welfare – Credit Crisis the Result of Planned Looting of the World Economy – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals – Poll: 60% say Depression Likely – Canadian Banks Avoid Failures Common Elsewhere – Too Big to Fail – Why Pay Taxes or be Honest

Then came a shocker: Amid one of the most reckless lending sprees in history, regulators focused on the one bank that refused to play along. Beal’s moves confused and worried them, and so they began to probe him with questions. “What are you doing?” he recalls them asking. “You’re shrinking yet you’re raising capital?”

Says Beal about the scrutiny, “I just didn’t fit into any box.” One regulator, the former head of the Texas Savings & Loan Department, Charles Danny Payne, says, “I was skeptical at first, but I’ve gained a lot of confidence over the years,” adding that Beal has an “uncanny ability to sniff out deals.”

Next, the credit rating agencies started pestering him about his dwindling loan portfolio. They never downgraded him but scolded him for seeming not to have a “sustainable” business model. This while their colleagues were signing off on $32 billion of bum collateralized debt obligations issued by Merrill Lynch.

…

He thinks the government is going to be “disappointed” by its various programs to revive lending. He says Treasury Secretary Timothy Geithner’s new plan to guarantee loans to buyers of toxic assets won’t lead to many sales because the problem isn’t liquidity but price. They are not low enough. Half the country’s banks–4,000 in all–would be bust, he says, if they marked their loans to what the loans would fetch in an auction. He says banks are fooling themselves by refusing to mark busted assets down.

“Banks are on a prayer mission that somehow prices will come back and they won’t have to face reality,” Beal says. And that reality, according to Beal, is going to get a lot worse. “Unemployment is going over 10%, commercial real estate hasn’t even begun collapsing and corporate credit defaults are just getting started,” he says. His prediction: depression, without bread lines this time, thanks to the government safety net, but with equal cost to society.

There are some (very few) who succeeded in not acting like lemmings. I wish someone would explain to me why people are worthy of millions in bonuses when they just do what every single other person in their position did that was also getting millions in bonuses. Obviously they were just practicing bankruptcy for profit (which worked out incredibly well for them) and still we seem to think the only solution is to support these moral bankrupt (and now commercially bankrupt) organizations and individuals.

Related: What the Bailout and Stimulus Are and Are Not – Sound Canadian Banking System – More on Failed Executives – Jim Rogers on the Financial Market Mess

Here is a very interesting paper showing real analysis of the data to illustrate that the deteriorating condition of loans should have been caught by those financing such loans years before the mortgage crisis erupted. Understanding the Subprime Mortgage Crisis by Yuliya Demyanyk, Federal Reserve Bank of Cleveland and Otto Van Hemert, New York University.

…

In many respects, the subprime market experienced a classic lending boom-bust scenario with rapid market growth, loosening underwriting standards, deteriorating loan performance, and decreasing risk premiums.30 Argentina in 1980, Chile in 1982, Sweden, Norway, and Finland in 1992, Mexico in 1994, Thailand, Indonesia, and Korea in 1997 all experienced the culmination of a boom-bust scenario, albeit in different economic settings.

Were problems in the subprime mortgage market apparent before the actual crisis erupted in 2007? Our answer is yes, at least by the end of 2005. Using the data available only at the end of 2005, we show that the monotonic degradation of the subprime market was already apparent. Loan quality had been worsening for five years in a row at that point. Rapid appreciation in housing prices masked the deterioration in the subprime mortgage market and thus the true riskiness of subprime mortgage loans. When housing prices stopped climbing, the risk in the market became apparent.

Related: Nearly 10% of Mortgages Delinquent or in Foreclosure – How Much Worse Can the Mortgage Crisis Get? – Homes Entering Foreclosure at Record – Articles on Real Estate