A new study, Secure Retirement, New Expectations, New Rewards: Work in Retirement for Middle Income Boomers, explores how Boomers are blurring the lines between working for pay and retirement (as I have discussed in posts previously, phased retirement).

From their report:

The define middle income as income between $25,000 and $100,000 with less than $1 million in investable assets and boomers as those born between 1946 and 1964.

Nearly 70% of retirees retired earlier than they planned to. Many did so due to health issues. Only 3% retired so they could travel more.

48% of middle income boomer retirees wish they could work. For those wishing to, but unable to work: 73% cannot due to health, 17% can’t find a job and 10% must care for a loved one.

Nearly all (94%) nonretirees who plan to work in retirement would like some kind of special work arrangement, such as flex-time or telecommuting, but only about one third (37%) of currently employed retirees have such an arrangement.

It seems to me, both employees and employers need to be more willing to adapt. Workers seem to be more willing, even though they claim they are not: this is mainly a revealed versus stated preference, they claim they won’t accept lower pay but as all those that do show, they really are willing to do so, they just prefer not to. This report is based on survey data which always has issue; nevertheless there are interesting results to consider.

61% of middle income boomers who ware working say they do so because they want to work, not because they have to work.

Only 12% of working middle income boomer retirees work full time all year. 60% work part-time. 7% are seasonal while 16% are freelance and 4% are other. Of those identifying as non-retired 75% work full time while 17% are part-time.

49% plan to work into their 70’s or until their health fails.

51% are more satisfied with their post-retirement work than their pre-retirement work. 27% are equally satisfied with their jobs.

As I have stated in previous posts I think a phased approach to retirement is the most sensible thing for society and for us as individuals. Employers need to provide workable options with part time work. The continued health care mess in the USA makes this more of a challenge than it should be. With USA health care being closely tied to employment and it costing twice as much as other rich countries (for no better results) it complicates finding workable solutions to employment. The tiny steps taken in the Affordable Care Act are not even 10% of magnitude of changes needed for the USA health care system.

Related: Providing ways for those in their 60’s and 70’s (part time schedules etc.) – Companies Keeping Older Workers as Economy Slows (2009) – Keeping Older Workers Employed (2007) – Retirement, Working Longer to Make Ends Meet

Provide easy, new access to credit facilitates sales. For that reason businesses want such easy access maintained. They don’t want people unable to buy just because they don’t have the money.

Financial institutions make a great deal of money providing easy access to credit. They don’t want to slow it down. While they do want to reduce fraud, they are perfectly happy to allow a fair amount of fraud while they can still make a lot of money.

What this means is the financial system has less incentive to eliminate identity theft than the people that have to clean up after it happens to them. There should be better ways to make identity theft much more difficult.

At a lessor level it should also be more difficult to steal one credit card (which also creates a big hassle for us, in trying to clean things up after fraud occurs). I suggested a way to make credit cards more secure and useful. When Apple Pay was announced I learned they are doing basically what I suggested.

Apple Pay doesn’t share information that can be used to steal your credit card. Apple Pay gives the retailer a 1 time use code for that purchase. It can’t be used, even if someone steals it to use your credit card for more purchases. I also believe Apple Pay doesn’t share other details with the retailer, though maybe I am wrong – I think it is just like you giving them cash (they don’t have your name, address, phone number, etc.).

Much of the information businesses share in the USA is considered private in Europe and companies are not allowed to share that personal information. This makes identity theft and invasions of your privacy more difficult. I wish the USA would move more in that direction.

If you have details stolen (a wallet…) you can put a note with credit agencies that results in them be less free to make it easy for financial institutions to give credit without sensible protections against misuse. But you can’t do this just as a matter of course. I believe we should have the ability to protect ourselves from the massive headache caused by businesses providing credit in our name. But we don’t have such protection now, because of the big money in keeping credit super easy (and thus fraud fairly easy).

Having to clean up after identity you may well have to hire someone to help clean up your credit report. To do so, look for credit repair companies with good reviews and a good reputation.

I would imagine choosing to put in extra protections against identity theft would mean we would have less easy access to credit. For example, I wish I could say you cannot provide a new credit under my name that isn’t using my address on file and without confirmation from my email. Also you are required to send an email, send a text message and send a postal letter, and update my credit agency file (in a way I can view) one week before credit is allowed.

There should also be options such as you must get a positive reply from me. A citizen choosing to have better protection against identity theft would give up immediate access to credit. But I would happily do so. I believe millions of others would too. And given how many people are victims every years, millions or hundreds of thousand a new customers for such a service would likely result.

I continue to believe the choices for investors are much more challenging than they normally are, as I have written about several times. Though maybe soon, this will just be the new normal (in which case investors won’t have the fairly easy choices they have had for much of the last 100 years).

In previous posts I have discussed the value of real estate investments in this investing climate. Real estate is one way to cope with the challenges of extremely low yields today.

There are many advantages to city property, in the right city. When I was looking at my first house I looked for something that would be easy to rent out. The most important factor to minimize vacancy is high demand. If there is high demand, the worst you should face is the need to lower your asking price.

An additional consideration in buying condos (your only option in large urban centers like New York City, seen in my photo of the Empire State Building) are condo fees. Fees and taxes can make positive cash flow a challenge and they continue when the property is vacant thus creating more risk for the investor. Of course, in popular markets and good times rents are very attractive for owners and price increases can make them great investments.

During downturns rental property that is not in high demand can be vacant no matter the price. And those properties with some, but not overwhelming, demand will face the need for dramatic rent decreases to minimize vacancy (and large declines if you need to sell). My purchase was 3 blocks from a metro stop (close in to Washington DC). All housing near metro stops in DC have high demand and that close in to the city has even higher demand.

In over 10 years I have had maybe 2 months of vacancy – the first year I messed up; I was new to trying to rent places out and believed people were going to sign the lease because they said they would but then they backed out. I think I may have had 1 more month sometime, but maybe not, I can’t really remember.

I have considered tourist property but have decided against it so far. The rental yield are higher but you have higher vacancy rates, which is manageable, but also much more property management issues to deal with. In order to cope with that you need to hire a property manager, very carefully. You need to carefully check their experience, reliability and competence.

And even for residential real estate the hassles of dealing with the property management yourself may lead investors to use property managers. This cuts into the advantages of direct real estate investments and so if you are going to use property managers then looking at REITs has to be considered. I believe if you are sensible direct real estate investments would normally return more but the risks are significantly higher and the hassle is somewhat to significantly higher. Likely the decision on whether to use direct real estate investing is more about personal preference than just a decision on which option would be a better investment.

This richest 1% continue to take advantage of economic conditions to amass more and more wealth at an astonishing rate. These conditions are perpetuated significantly by corrupt politicians that have been paid lots of cash by the rich to carry out their wishes.

One thing people in rich countries forget is how many of them are in the 1% globally. The 1% isn’t just Bill Gates and Warren Buffett. 1% of the world’s population is about 72 million people (about 47 million adults). Owning $1 million in assets puts you in the top .7% of wealthy adults (Global Wealth Report 2013’ by Credit Suisse). That report has a cutoff of US $798,000 to make the global 1%. They sensibly only count adults in the population so wealth of $798,000 puts you in the top 1% for all adults.

$100,000 puts you in the top 9% of wealthiest people on earth. Even $10,000 in net wealth puts you in the top 30% of wealthiest people. So while you think about how unfair it is that the system is rigged to support the top .01% of wealthy people also remember it is rigged to support more than 50% of the people reading this blog (the global 1%).

I do agree we should move away from electing corrupt politicians (which is the vast majority of them in DC today) and allowing them to continue perverting the economic system to favor those giving them lots of cash. Those perversions go far beyond the most obnoxious favoring of too-big-to-fail banking executives and in many ways extend to policies the USA forces on vassal states (UK, Canada, Australia, France, Germany, Japan…) (such as those favoring the copyright cartel, etc.).

Those actions to favor the very richest by the USA government (including significantly in the foreign policy – largely economic policy – those large donor demand for their cash) benefit the global 1% that are located in the USA. This corruption sadly overlays some very good economic foundations in the USA that allowed it to build on the advantages after World War II and become the economic power it is. The corrupt political system aids the richest but also damages the USA economy. Likely it damages other economies more and so even this ends up benefiting the 38% of the global .7% that live in the USA. But we would be better off if the corrupt political practices could be reduced and the economy could power economic gains to the entire economy not siphon off so many of those benefits to those coopting the political process.

The USA is home to 38% of top .7% globally (over $1,000,000 in net assets).

| country | % of top .7% richest | % of global population |

|---|---|---|

| USA | 38.3% | 4.5% |

| Japan | 8.6% | 1.8% |

| France | 7.5% | .9% |

| UK | 6.1% | .9% |

| Germany | 5.9% | 1.1% |

| other interesting countries | ||

| China | 3.4% | 19.2% |

| Korea | 1% | .7% |

| Brazil | .6% | 2.8% |

| India | .5% | 17.5 |

| Indonesia | .3% | 3.5% |

Oxfam published a report on these problems that has some very good information: Political capture and economic inequality

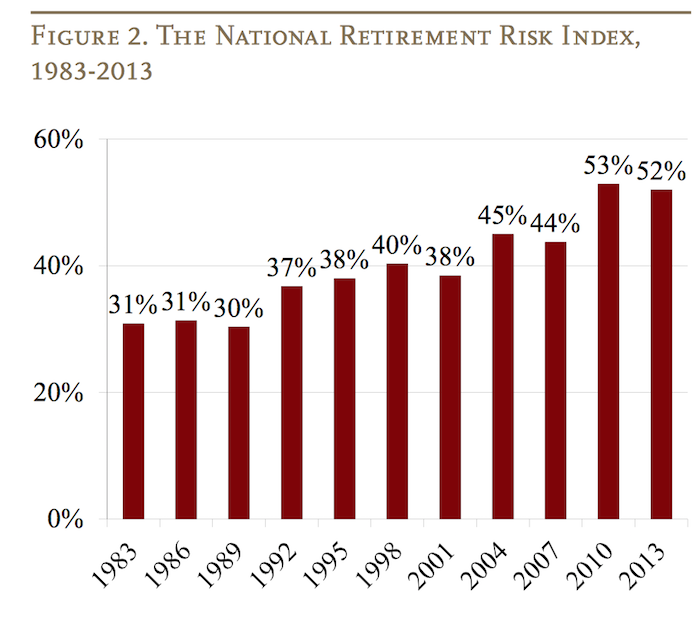

The Center for Retirement Research at Boston College is a tremendous resource for those planning for, or in, retirement. The center created the National Retirement Risk Index (NRRI) to capture a macroeconomic level measure of how those in the USA are progressing toward retirement.

Based on the Federal Reserve’s 2013 Survey of Consumer Finances the Center updated the NRRI results (the entire article is a very good read).

The lower the risk number in the chart the better, so things have not been going well since the 1990s for those in the USA saving for retirement.

As the report discusses their are significant issues with retirement planning that defy easy prediction; this makes things even more challenging for those saving for retirement. The report discusses the difficulty placed on retirees by the Fed’s extremely low interest rate policy (a policy that provides billions each year to too-big-too-fail banks – hardly the reward that should be provided for bringing the world to economic calamity but never-the-less that transfer of wealth from retirees to too-big-to-fail banks is the policy the Fed has chosen).

That exacerbates the problems of too little savings during the working career for those in the USA. The continued evidence is that those in the USA continue to spend too much today and save too little. Also you have to expect the Fed and politicians will continue to make policy that favors their friends at too-big-fail banks and hedge funds and the like. You can’t expect them to behave differently than they have been the last 50 years. That means the likely actions by the government to take from median income people to aid the richest 1% (such as bailing out the bankers with super low interest rate policies and continue to subsidize losses and privatize their winning bets) will continue. You need to have extra savings to support those policies. Of course we could change to do things differently but there is no realistic evidence of any move to do so. Retirement planning needs to be based on evidence, not hopes about how things should be.

Related: How Much of Current Income to Save for Retirement – Save What You Can, Increase Savings as You Can Do So – Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually – Retirement Planning: Looking at Assets (2012) – How Much Will I Need to Save for Retirement? (2009)

Insurance can be annoying as you pay for something you hope not to use. I don’t recall ever getting a payment on life insurance, homeowners insurance, disability insurance or auto insurance. And that I haven’t had a claim is good. On health insurance I have had minor things covered like a physical or dentist and that is it.

Health insurance is critical in the USA. One insurance that people often don’t think of however is disability insurance. Disability insurance is a very important insurance that too many people don’t consider (many jobs offer it, though not all, and some may take a year before you are covered). Studies show that a 20 year old has a 30% chance of becoming disabled before reaching retirement age. In the USA, the Social Security Administration provides disability benefits for total disabilities.

In the USA you may be eligible for social security disability payments but it is a small amount (so not sufficient by itself). But if you are living overseas and not paying social security I am not sure if you are covered, even for the limited coverage it provides.

I am not sure what the situation is for citizens of other countries, maybe they have better safety nets for people (I would imagine Europe does, but many places probably don’t).

I had been living in Malaysia for several years and am now going nomadic (an increasingly popular choice for a small but determined group of people) and insurance is important for people living overseas and traveling. For nomads or frequent travelers global health insurance is good (though usually it will exclude the USA if you are not a “USA 1%er”(or world .2%)/very-rich as the extremely broken USA health care system is crazy – you can be covered globally excluding the USA for about 1/6 of that same coverage excluding the USA, depending, of course on your coverage). Special care for travelers and nomads should be paid to coverage to return you home if you are very sick or injured.

Disability insurance is something thing digital nomads should pay attention to. But it is normally ignored. And it is a bit tricky as insurance companies are generally extremely slow to catch up to what the world is doing and disability insurance seems to be stuck in the old notions about how tied people were to one country (as are other things – demanding physical addresses even if they know you are nomadic…, basing rules on silly ideas about where you happen to be at some point in time with customer hostile breaking of internet services that have been paid for etc.).

Related: Personal Finance Basics: Long Term Disability Insurance – The Growing Market for International Travel for Medical Care – Long Term Care Insurance: Financially Wise but Current Options are Less Than Ideal

In 2013, international migrants sent $413 billion home to families and friends — three times more than the total of global foreign aid (about $135 billion). This money, known as remittances, makes a significant difference in the lives of those receiving it and plays a major role in the economies of many countries.

India received $72 billion and Egypt $18 billion in 2013.

I liked an interesting point he made. These remittences often include business advice to those relatives in the home country.

This is a great talk if you are interested in economics and global development. It is very important to understand the issues we face in helping billions living in poverty. As he says regulation of small remittences must be reduced. Policies forced by countries like the USA have damaged poor people’s lives worldwide with extremely onerous regulation.

Web site of the speaker: Dilip Ratha

Related: International Development Fair: The Human Factor – Creating a World Without Poverty – Supporting Virtual Workers – Solar Power Market Solutions For Hundreds of Millions Without Electricity

My response to a comment by John Green on Reddit

I really really like your work and webcasts (example included below).

This seems to me to make it really difficult on people trying to use judgement. Calling people’s actions “extremely paternalistic” if they are not definitely so, I think impedes debate. And I think debate should be encouraged.

When making Kiva loans I do steer away from loans with rates above 40% (I also prefer loans that are geared toward a capital investment that will increase earning power going forward though this is hard – lots of loans are essentially for inventory that will be sold at a profit so a fine use of loans but not as powerful [in my opinion] and new capital investments – say a new tool, solar power that will be resold to users…).

Just like people anywhere, people taking Kiva loans are capable of getting themselves into trouble. Choosing to allocate my lender toward certain loans does not mean I am being paternalistic.

I am not being paternalistic if I chose not to invest in the stock of some company that vastly overpays executives and uses high leverage to do very well (in good times).

I do like the idea of direct cash to people in need. I give cash that way (and in fact did it a long time ago, 20 years, for several years – before any of this new hipster cachet :-). And I still do like it.

While people question the value of a college degree a recent study by the New York Federal Reserve shows a degree is close to as valuable today as it has ever been. The costs to get that value have risen but even with the increased cost students earn on average a 15% annual rate of return on their investment.

Of course, not every student will earn that, some will earn more and some less.

…

The time required to recoup the costs of a bachelor’s degree has fallen substantially over time, from more than twenty years in the late 1970s and early 1980s to about ten years in 2013. So despite the challenges facing today’s college graduates, the value of a college degree has remained near its all-time high, while the time required to recoup the costs of the degree has remained near its all-time low.

So a college education is a great investment for most people. This can create a problem however, when people then assume that all they need to do is go to college and they will do well no matter what. The same thing happens in other markets. Real estate has proven to be a great investment. that doesn’t mean every real estate investment is good. It doesn’t mean you can ignore the costs and risks of a particular investment. The same goes for stocks.

Business should not be allowed to store credit card numbers that can be stolen and used. The credit card providers should generate a unique credit card number for the business to store that will only work for the purchaser at that business.

Also credit card providers should let me generate credit card numbers as I wish for use online (that are unique and can be stopped at any time I wish). If I get some customer hostile business that makes canceling a huge pain I should just be able to turn off that credit card “number.”

Laws should be adjusted to allow this consumer controlled spending and require that any subscription service must take the turning off of the payments as cancellation.

For some plan where the consumer agrees up front to say 12 months of payments then special timed numbers should be created where the potentially convoluted process used now remain for the first 12 months.

Also users should be able to interact with there credit reports and do things like turn on extra barriers to granting credit (things like they have to be delayed for 14 days after a text, email [to as many addresses and the consumer wants to enter] and postal notification are sent to the user. Variations on how these work is fine (for example, setting criteria for acceptance of the new credit early at the consumers option if certain conditions are met (signing into the web site and confirming information…).

Better security on the cards themselves are also needed in the USA. The costs of improvement are not just the expenses credit card and retailers face but the huge burden to consumers from abuse of the insecure system in place for more than a decade. It is well past time the USA caught up with the rest of the world for on-card security.

The providers have done a lousy job of reducing the enormous burden of fraud on consumers. As well as failing to deal adequately with customer hostile business practices (such as making canceling very cumbersome and continuing to debit the consumer’s credit card account).

Related: Protect Yourself from Credit Card Fraud – Personal Finance Tips on the Proper use of Credit Cards – Continued Credit Card Company Customer Dis-Service – Banks Hoping they Paid Politicians Enough to Protect Billions in Excessive Fees