It is very simple. Adam Smith understood it and commented on it. If you allow businesses to have control of the market they will take benefits they don’t deserve at the expense of society. And many business will seek every opportunity to collude with other businesses to stop the free market from reducing their profits and instead instituting anti-competitive practices. Unless you stop this you don’t get the benefits of free market capitalism. Free markets (where perfect competition exists, meaning no player can control the market) distribute the gains to society by allowing those that provide services in an open market efficiently and effectively to profit.

Those that conflate freedom in every form and free markets don’t understand that free markets are a tool to and end (economic well being for a society) not a good in and of themselves. Politically many of these people just believe in everyone having freedom to do whatever they want. Promoting that political viewpoint is fine.

When we allow them to discredit free market capitalism by equating anti-market policies as being free market capitalism we risk losing a great benefit to society. People, see the policies that encourage allowing a few to collude and take “monopoly rents” and to disrupt markets, and to have politicians create strong special interest policies at the expense of society are bad (pretty much anyone, conservative liberal, anything other than those not interested in economics see this).

When people get the message that collusion, anti-competitive markets, political special interest driven policies… are what free market capitalism is we risk losing even more of the benefits free markets provide (than we are losing now). That so few seem to care about the benefit capitalism can provide that they willingly (I suppose some are so foolish they don’t understand, but that can’t be the majority) sacrifice capitalism to pay off political backers by supporting anti-market policies.

Allowing businesses to buy off politicians (and large swaths of the “news media” talking heads that spout illogical nonsense) to give them the right to tap monopoly profits based on un-free markets (where they use market power to extract monopoly rents) is extremely foolish. Yet the USA has allowed this to go on for decades (well really a lot longer – it is basically just a modification of the trust busting that Teddy Roosevelt tried). It is becoming more of an issue because we are allowing more of the gains to be driven by anti-competitive forces (than at least since the boom trust times) and we just don’t have nearly as much loot to allow so much pilfering and still have plenty left over to please most people.

I am amazed and disgusted that we have, for at least a decade or two, allowed talking head to claim capitalist and market support for their special interest anti-market policies. It is an indictment of our educational system that such foolish commentary is popular.

Free Texts Pose Threat to Carriers

This is exactly the type of behavior supported by the actions of the politicians you elect (if you live in the USA).

It is ludicrous that we provide extremely anti-market policies to help huge companies extract monopoly profits on public resources such as the spectrum of the airwaves. It is an obvious natural monopoly. It obviously should be managed as one. Several bandwidth providers provide bandwidth and charge a regulated rate. And let those using it do as they wish. Don’t allowing ludicrous fees extracted by anti-free-market forces such as those supporting such companies behavior at Verizon, AT&T…

Related: Financial Transactions Tax to Pay Off Wall Street Welfare Debt – Extremely Poor Broadband for the USA (brought to us by the same bought and paid for political and commentary class) – Ignorance of Capitalism – Monopolies and Oligopolies do not a Free Market Make

Most people know living without health insurance is very risky (and shouldn’t be done). But people are much less aware of the importance of long term disability insurance. The census bureau estimates that you have a 20% chance you will be disabled in your lifetime. A disability can decrease your earning power and also can increase your expenses (to cope with your disability). In my opinion your emergency fund is best used for short term disability insurance.

One of the most important things you can do is be sure you have disability coverage. In the USA about 50% of the jobs provide coverage. If your job does not you should get insurance yourself. Many companies may not pay for disability insurance but may allow you to pay for it (this often can be the best option as the company can gain a better price than individuals but you have to check out the details). Also social security includes some disability insurance coverage but it is very limited. Relying on social security alone is not wise. For one thing it does not protect you from being unable to do your current job but will only pay benefits if you are unfit to do any job.

There are numerous factors to consider for disability insurance. Normally a long term disability insurance policy will pay 50-60% of your salary (be sure to check and see, and check if there is any cap). The terms of the policy will also determine how long you will be paid, being paid until at least 65 is what I would suggest – but some only pay for a limited number of years.

Often policies will offer pro-rated benefits if you earning power is reduced by a disability but you are still able to earn something. So you may have a policy that pay 60% of your original salary but if you make 50% of your previous salary then the payout is reduce to say 20%. So if you originally made $80,000 and now, due to a disability (not just losing your job), you could no longer do your job but could do one that paid less – say $40,000. You would then get your new salary of $40,000 + $16,000 in disability payments or $56,000.

Another detail you should check is whether the payments you will receive are indexed to inflation. In addition, make sure the policy is guaranteed renewable. You also want to buy from a reputable insurance company (check AM Best, Moody’s, Weiss rating agencies). It doesn’t help to have a guaranteed renewable policy if the insurance company goes out of business.

Another thing to consider is buying additional disability coverage. For example, if your company provides a 60% coverage policy it is often possible to purchase addition coverage (to provide additional benefits of 10% or 20% or more of your current salary).

A rough guide is disability insurance will cost 1-2% of the income replaced. For example, a policy replacing $50,000 per year of annual salary would cost about $1,000 per year. Of course, the older or sicker you are the higher the cost. Premiums are based on risk factors, so if you have health risks that will cost more. And, as age is a significant disability factor, the older you are the higher the cost will be.

Remember if you have disability insurance through work, and lose you job you need to get your own disability insurance. This is yet another reason to have an adequate emergency fund.

Related: Personal Finance Basics: Long-term Care Insurance – Personal Finance Basics: Health Insurance – How to Protect Your Financial Health – Life Happens: disability insurance

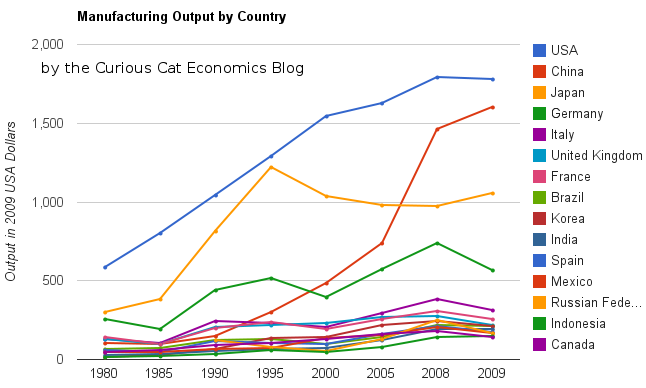

China continues to grow manufacturing is output. In 2009, the USA, and most countries saw declines in manufacturing production. China, however, continued to grow. China is now finally approaching the level of manufacturing done in USA. The latest data again shows the USA is the largest manufacturer but China looks poised to take over the number one spot soon.

The chart showing manufacturing output by country was created by the Curious Cat Economics Blog based on UN data (in 2009 USA dollars). You may use the chart with attribution.

The large decline in Germany was 23%. This was a 18% decline in Euro terms, and when you added the decline of the Euro the total USA dollar decline was 23%. Quite extraordinary. Most European countries were down over 15%. In fact, so extraordinary it makes me question the data. World economic data is useful and interesting but it isn’t perfect. USA manufacturing declined just .5%. China increased manufacturing production by 9%.

The last 2 years, China has stopped separating out mining and utilities from manufacturing. The percentage of manufacturing (to manufacturing, mining and utilities) was 78% for 2005-2007 (I used 78% of the manufacturing, mining and utilities figure provided in the 2008 and 2009 data – but that could be wrong). The unadjusted 2009 China total was $2.05 trillion and for the USA the total manufacturing, mining and utilities was $2.33 trillion. In 2009, the manufacturing total was 76% of USA manufacturing, mining and utilities. The percentage varies significantly between countries (the Russian federation is about 55% and Japan about 91%) and various over time as a countries economy changes.

The big, long term story remains the same. China has continued to grow manufacturing output tremendously. I see very little data to support the stories about manufacturing having to leave China to go elsewhere (especially when you look at the “lower wages” counties mentioned in news stories – they are not growing at any significant rate). The USA is still manufacturing a huge amount and that production has steadily grown over time.

When you look back over the period from 1980 to today you can see

- The biggest story is the growth in Chinese manufacturing

- The USA started out the largest and has grown significantly

- Japan did very well from 1980 to 1995, and since they have struggled

- The USA, China, Japan are really far ahead of other countries in total manufacturing output, and Germany is solidly in 4th place.

- After that the countries are fairly closely grouped together. Though there are significant trends hidden by the scale of this graph, which I will explore in future posts. South Korea has growth significantly over this period, for example.

- The biggest macro trend that the data shows, but is not so visible in this chart (other than China’s growth), is the very strong performance of emerging markets (and in fact some counties have fully become manufacturing powerhouses during this period, most notably China but also, South Korea and Brazil). And I see that continuing going forward (though that is speculation).

Two more interesting pieces of data. Italy is the 5th largest manufacturing country, I don’t think many people would guess that. Since 1980 Italy surpassed the UK and France but China rocketed passed them. And Indonesia has moved into 14th place, edging out Canada in 2009.

I plan to take more time in 2011 to look at global manufacturing and other global economic data more closely and to write about it here.

Related: Data on the Largest Manufacturing Countries in 2008 – Top 12 Manufacturing Countries in 2007 – Top 10 Manufacturing Countries 2006 – Leading global manufacturers in 2004

Options strike most as exotic investment transactions. And some option strategies can be risky. But stock options can also be used in ways that are not risky. Call options give you the right to buy a stock at a certain price (the strike price) on, or before, a certain date (the expiration date). So if you want to speculate that a stock will go up in a short period of time you can buy call options. This is a risky investment strategy – though it can pay off well if you speculate correctly.

Someone has to sell the call option. The seller gives the buyer the right to buy a stock at a certain price by a certain date. A speculator can do this and take the risk that the price will not rise to the level where a person chooses to exerciser their option. The also carries a significant risk, as if the stock price rises the speculator that sold the option has to either buy the option back (at a significant cost) or provide the stock (which they would have to purchase on the market). In order to trade in options you must be approved by the broker (at least in the USA) as an investor with the knowledge, finances and goals for which options trading is appropriate.

An investor can also sell an option to buy a stock they own – this is called selling a covered call option. This means you get the price the speculator is willing to pay to buy the option and may have to sell the stock you own if the person holding the option chooses to exercise it.

Lets look at an example. Lets say you own some Amazon stock. Read more

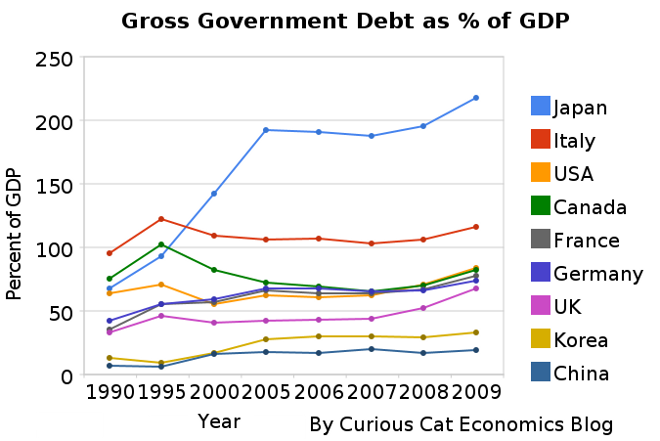

The world today has a much different economic landscape than just 20 years ago. China’s amazing economic growth is likely the biggest story. But the overwhelming success of many other countries is also a huge story. Today it is not the developing world that has governments spending taxes they promise their grandchildren will pay, but instead the richest countries on earth that choose to spend today and pay tomorrow. While “developing” countries have well balanced government budgets overall.

The chart shows gross government debt as percentage GDP from 1990-2009. By Curious Cat Investing and Economics Blog, Creative Commons Attribution. Data source: IMF

The chart shows gross government debt as percentage GDP from 1990-2009. By Curious Cat Investing and Economics Blog, Creative Commons Attribution. Data source: IMF___________________________

There are plenty of reasons to question this data but I think it gives a decent overall picture of where things stand. It may seem like government debt should be an easy figure to know but even just agreeing what would be the most reasonable figure for one country is very difficult, comparing between countries gets even more difficult and the political pressures to reduces how bad the data looks encourages countries to try and make the figures look as good as they can.

The poster child for irresponsible spending is Japan which has gross government debt of 218% of GDP (Japan’s 2009 figure is an IMF estimate). Greece is at 115%. Gross debt is not the only important figure. Government debt held within the country is much less damaging than debt held by those outside the country. Japan holds a large portion of its own debt. If foreigners own your debt then debt payments you make each year are paid outside your country and it is in essence a tax of a portion of your economic production that must be paid. If the debt is internal it mean taxpayers have to support bond holders each year (but at least when those bondholders spend the money it stays within your economy).

Read more

401(k), IRAs and 403(b) retirement accounts are a very smart way to invest in your future. The tax deferral is a huge benefit. And with Roth IRAs and Roth 401(k)s you can even get tax exempt distributions when you retire – which is a huge benefit. Especially if you don’t retire before the bill for all the delayed taxes of the last 20 years starts to be paid. The supposed “tax cuts” that merely shifted taxes from those spending money the last 10 years to those that have to pay for all the stuff the government spent on them has to be paid for. And that will likely happen with higher tax rates courtesy of the last 10 years of not paying the taxes to pay for what the government was spending.

When looking at your 401(k) and 403(b) investment options be sure to pay close attention to expenses for the funds. Some fund families try to get people to investing in high expense funds, that are nearly identical to low expense funds. The investor losses big and the fund companies take big profits. Those people serving on the boards of those funds should be fired. They obviously are not managing with the investors interests at heart (as they are obligated to do – they are suppose to represent the investors in the funds not the friends they have making money off the investors).

Here is an example (that I ran across last week) expense differences for funds that have essentially identical investment objectives and plans in the same retirement plan options: .39% (a respectable rate, though more than it really should be) for [seeks a favorable long-term rate of return from a diversified portfolio selected to track the overall market for common stocks publicly traded in the U.S., as represented by a broad stock market index.], .86% [for “The account seeks a favorable long-term total return, mainly from capital appreciation, by investing primarily in a portfolio of equity securities selected to track the overall U.S. equity markets based on a market index.”]. Do not rely on your fund provider to have your interests at heart (and unfortunately many companies don’t seek the best investment options for their employees either).

The .47% added expense isn’t much to miss for 1 year. However, over the life of your retirement account, this is tens of thousands of dollars you will lose just with this one mistake. Personal financial literacy is an easy way to make yourself large amounts of money over the long term. It isn’t very sexy to get .47% extra every year but it is extremely rewarding.

$200,000 at 6% for 25 years grows to $858,000

$200,000 at 6.47% for 25 years grows to $958,000

So in this case, $100,000 for you, instead of just paying the fund company a bit extra every year to let them add to their McMansions. In reality it will be much more than a $100,000 mistake for you if you save enough for retirement. But if you save far too little (as most people do) one advantage is the mistake will be less costly because your low retirement account value reduces the loss you will take.

Related: 401(k)s are a Great Way to Save for Retirement – Retirement Savings Allocation for 2010 – Many Retirees Face Prospect of Outliving Savings

Read more

Another blog asks: Does Income Change Who You Are as a Spender? or your Tastes?

I would think in most cases more income should change your spending habits. Unless your tastes are so far below your income that additional income makes no difference then it should.

I save money for retirement, emergency fund, an addition to my house… If I have get another $50,000 a year I can think of good ways to spend it (for me I would save lots of it, but I could also spend some). If now I think I can give $100 to some charity I might give $200 if I have a bunch more money. I buy Odwalla juice, which is pretty crazy expensive, but compared to my overall spending it doesn’t amount to much. But in my first few years of work life I wouldn’t have. I eat out a lot because I like that better than cooking. If I couldn’t afford it then I would eat out less.

I would also “buy” more free time. I would take advantage of the extra cash to cut back at work so I had more time to spend however I wanted. And I would buy a Droid Incredible.

I’d probably buy a solar energy system and battery backup if I had a ton of extra cash… I’d try some services to do things I would like to do but don’t have time for. I like photography and posting my photos online. But I am far behind and have a bunch I would like to do. If I had a bunch of extra cash I would pay someone to take my photos and post them how I want. I would buy a slide scanner and scan a bunch of my Dad’s old slides (or pay to have it done). If I had an fortune I would buy a place with indoor basketball court (or one that where I could build one) and fly first class or use Net Jets and travel a bunch more. Unfortunately I don’t foresee those things happening 🙁

So yeah I would definitely change my spending habits. It isn’t really changing my tastes. I have the tastes now, I just figure given my financial situation it isn’t worth the money (and some I couldn’t even get people to lend me enough money to buy) for some things. But if I had a bunch more money I would buy them.

A mistake many people make is increasing spending too much as income increases. I definitely suggest avoiding this risky behavior. It is fine to add some expenses but make sure you are adding to your retirement account, emergency fund, general savings with part of the raise. And it is risky to develop expensive tastes that you continue if you income declines (or lock into long term expenses – new car, mortgage…). So enjoy, but be careful.

Photo by John Hunter, Swiftcurrent Lake trail in the Many Glaciers area of Glacier National Park.

Related: Using Your Credit Card Properly – Trying to Keep up with the Jones – How Rich Are You?

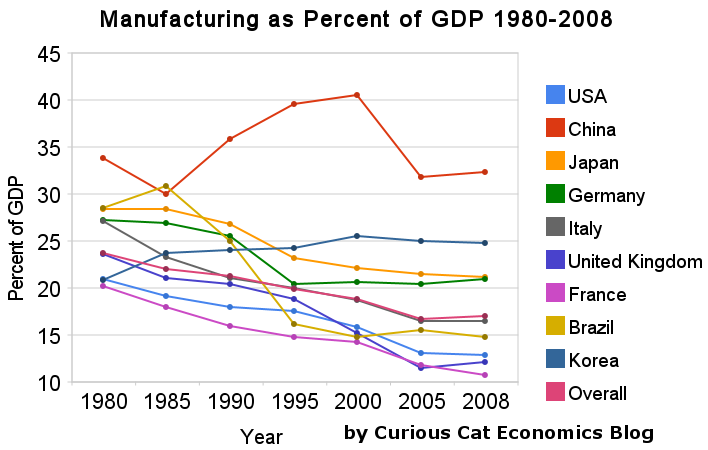

In previous posts I have shown data for global manufacturing output by country. One of the things those posts have showed is that manufacturing output in China is growing tremendously, but it is also growing in the United States. The chart below shows manufacturing production by country as a percent of GDP. China dominates again, with over 30% of the GDP from manufacturing.

Chart showing manufacturing output, as percent of GDP, by country was created by the Curious Cat Economics Blog based on UN data* (based on current USA dollars). You may use the chart with attribution.

For the 14 biggest manufacturing countries in 2008, the overall manufacturing GDP percentage was 23.7% of GDP in 1980 and dropped to 17% in 2008. I left India (15% in 1980, 15% in 2008), Mexico (20%, 18%), Canada (17%, 13%), Spain (25%, 14%) and Russia (21% in 1990 [it was part of USSR in 1980], 15%) off the chart.

Over the last few decades Korea, and to some extent China, are the only countries that have increased the percent of GDP from manufacturing. China has not only grown manufacturing activity tremendously but also other areas of the economy (construction, mining, information technology). The countries with the largest manufacturing portions of their economies in 2008 were: China 32%, South Korea 25%, Japan and Germany at 21%. The next highest is Mexico at 18% which declined slightly over the last 15 years (with NAFTA in place). Globally, while manufacturing has grown, other areas of economic activity have been growing faster than manufacturing.

The manufacturing share of the USA economy dropped from 21% in 1980 to 18% in 1990, 16% in 2000 and 13% in 2008. Still as previous posts show the USA manufacturing output has grown substantially: over 300% since 1980, and 175% since 1990. The proportion of manufacturing output by the USA (for the top 14 manufacturers) has declined from 31% in 1980, 28% in 1990, 32% in 2000 to 24% in 2008. The proportion of USA manufacturing has declined from 33% in 1980, 29% in 1990, 36% in 2000 to 30% in 2008. While manufacturing output has grown in the USA it has done so more slowly than the economy overall.

Related: The Relative Economic Position of the USA is Likely to Decline – Manufacturing Data, Accuracy Questions – Top 12 Manufacturing Countries in 2007 – Manufacturing Employment Data: 1979 to 2007 – USA Manufacturing Output Continues to Increase (over the long term)

* I made edits to the 1980 Brazil manufacturing data and 1980, 1985 and 2008 China manufacturing data because the UN data only showed manufacturing data combined with mining and utility data. And I am using older UN data that had manufacturing separated from mining and utility figures for China in the other years.

Many aspects of personal finance can get a bit confusing or require some study to understand. But really much of it isn’t very complicated. Debt is often toxic to personal financial success. The simple step you can take to avoid the problems many face is to just not buy things until you save up for them. If you want some new shoes or new Droid Incredible or to go see a football game (American or World Cup style) that is fine. Just save up the money and then spend it.

If you limit your borrowing you will get ahead financially. I think borrowing for a home is fine (I suggest saving up a 20% down-payment – or at least 10%, and many banks are again requiring this sensible step). And don’t overextend yourself – borrow what you can comfortably afford – even if you run into financial difficulty. It might be likely you earn more 5 years from now, but it is certainly possible you will earn less. Remember that.

Borrowing for school is fine but be careful. Huge education debts are a large burden. Don’t ignore this factor when selecting a school. And don’t fall prey to the for-profit education scams that have become very prevalent. I would be very very skeptical of any for profit educational institution and would much prefer long term public or private institutions with long term success (colleges, universities and community colleges). Technical training can be very good but you have to be very careful to not be taken advantage of.

Borrowing for a car is ok, but I would avoid it if possible. And other than that I would avoid debt, if at all possible. If you want a big expensive wedding, fine, save up the money. If you want a vacation to East Africa, great, save up the money. If you want the latest, new tech gadget, great save up the money first.

And saving up for your emergency fund (if it isn’t fully funded already) and for retirement should be right after food, shelter, health and disability insurance and any debt you already have to be paying back. After you have committed money to your emergency fund and retirement then choose what to do with your remaining discretionary income. It is critical to have built up an emergency fund so if you have any emergency you can tap that without going into debt and digging yourself a personal financial hole you have to dig out of.

Personal financial success is not some get rich quick scheme or magic. Success is Achieved by doing some really simple things well. It is not complicated but that isn’t the same thing as easy. Showing restraint is not what we are urged to do by the marketers. So while not buying what you can’t afford is not exactly an amazing insight, hundreds of millions of people (in the USA and Europe I know, and probably everywhere that consumer debt is easy to get) fail financially just because they refuse to follow this advice.

Related: Avoid credit card debt – How to Protect Your Financial Health – Curious Cat personal finance basics – Can I Afford That?

The Wall Street Journal wrote “Their Fair Share” in July of 2008 claiming that the rich are paying their fair share of taxes.

Wow. The Wall Street Journal against a tax cut? Well I guess if it is a tax on the poor they don’t support cutting those taxes. I think it may well make sense to reduce the social security and medicare taxes on the working poor (including the company share). Of all the taxes we have this is the one I would reduce, if I reduced any (given the huge amount of government debt any reduction may well be unwise). But reducing income taxes for those under the median income doesn’t seem like something worth doing to me.

They seem to ignore that income inequality has drastically increased. When you have a system that puts a huge percentage of the cash in a few people’s pockets of course those people end up paying a lot of cash per person. One affect of massive wealth concentration is that the limited people all the money is flowing to naturally will pay an increasing portion of taxes.

It is fine to argue that the rich pay too much tax, if you want. I don’t agree. I think Warren Buffett explains the issue much more clearly and truthfully when he says he, and all his fellow, billionaires (and those attempting to join the club) pay a lower percent of taxes on income than their secretaries do. He offers $1 million to any of them that prove that isn’t true.

And I guess you can say that the top 22% of the income paying the top 40% of the taxes is “steeply progressive.” I wouldn’t call that steep, but… It is nice the graphic is at least decently honest. Saying just “top 1% of taxpayers, those who earn above $388,806, paid 40% of all income ” is fairly misleading. It is much more honest (I believe) to say that “the top 1% (that made 22% of the income) paid…” Those with the top 22% of income paid 40% of the taxes, the next 15% payed 20%, the next 31% paid 26% the next 20% 11% and the final 12% paid 3%. That is progressive. From my perspective it could be more progressive but I can see others saying it it progressive enough.

If 22% to 40% is “steeply” progressive what is 1% to 22%? The income distribution seems to be what? very hugely massively almost asymptotently progressive? The to 1% of people, by income, take 22% of the income, the next 4% take the next 15% of the total income, the next 20% take 31%, the next 25% take 30% and the bottom 50% take 12%. This level of income inequality is much more a source of concern than any concern someone should have about a slightly progressive tax result.

Related: House Votes to Restore Partial Estate Tax on the Very Richest: Over $7 Million – IRS Tax data – Rich Americans Sue to Keep Evidence of Their Tax Evasion From the Justice Department

Read more