Based on my thoughts on killing the Goose laying golden eggs in Iskandar Malaysia posted on a discussion forum. The government has instituted several several policies to counteract a bubble in luxury real estate prices in the region (new taxes on short term capital gains in real estate [declining amounts through year 6]), increasing limits on purchases by foreigners, new transaction fees (2% of purchase price?) for real estate transactions, requirements for larger down-payments from purchasers…

Iskandar is 5 times the size of Singapore and is in the state of Johor in Malaysia. Johor Bahru is the city which makes up much of Iskandar but as borders are currently drawn Iskandar extends beyond the borders of Johor Bahru.

The prospects for economic growth in Iskandar Malaysia in the next 5, 10 and 15 years remain very strong. They are stronger than they were 5 years ago: investments that produce economic activity (theme parks, factories, hospitals, hotels, retail, film studio…) have come online and more on being built right now.

Cooperation with Singapore is the main advantage Iskandar has (Iskandar is next to the island of Singapore similar to those areas surrounding Manhattan). It provides Iskandar world class advantages that few other locations have (it is the same advantages offered by lower cost areas extremely close to world class cities – NYC, Hong Kong, London, San Francisco etc.). Transportation connections to Singapore are critical and have not been managed as well as they should have been (only 2 bridges exist now and massive delays are common). A 3rd link should be in place today (they haven’t even approved the location yet).

A MRT connection to Singapore (Singapore’s subway system) should be a top priority of anyone with power interested in the future economic well being of Iskandar and Johor. Johor Bahru doesn’t have a light rail system yet this would be the start of it. It has been “announced” as planned for 2018 but not officially designated or funded yet.

For the first time ever average 30 year fixed mortgage rates have fallen under 4%. My guess about interests rates have not been very good the last decade or so. I can’t believe people actually want to lend at these rates but obviously I have been wrong. The risks of lending at these rates over the long term just seem way too high to take a paltry 4%. But obviously I have been wrong.

So if you didn’t refinance when I suggested it (and refinance, myself), previously, you may want to look at doing so now. Or you may believe that listen to me about interest rates doesn’t seem very wise.

I have even read that banks are reducing fees in order to encourage refinancing. Seems crazy to me, but what do I know.

You do need to have a decent loan to value ratio (certainly no more than 90%, and probably 80% would be better). That can be difficult for those that have had large decreases in their homes value. Also you need a great credit rating and a stable job situation. But if you qualify refinancing at these rates should be a great financial move for many. I’m perfectly happen to have done so earlier, I didn’t quite pick the bottom but I still think over 30 years these rates (the current rates and earlier rates of 4 1/4% or 4 3/8%) will seem like a dream.

Related: Fixed Mortgage Rates Reach New Low (August 2010) – Lowest 30 Year Fixed Mortgage Rates in 37 Years (Dec 2008) – The Impact of Credit Scores and Jumbo Size on Mortgage Rates (Jan 2009)

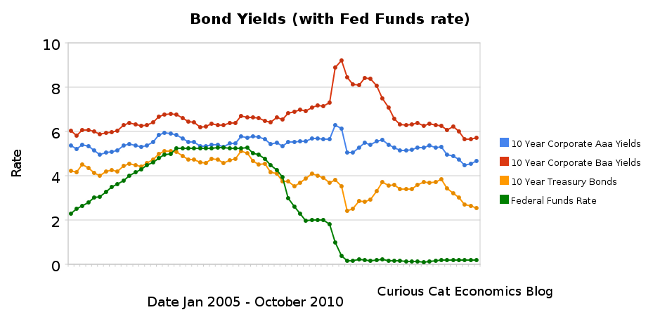

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have dropped even lower over the last 6 months, dramatically so for treasury bonds. 10 year Aaa corporate bonds yields have decreased 61 basis points to 4.68%. 10 year Baa yields have decreased 53 basis points to 5.72%. 10 year USA treasury bonds have decreased an amazing 169 basis points to a incredibly low yield of %2.54. The federal funds rate remains under .25%.

The Fed continues to try and discourage saving and encourage spending by punishing savers with policies to drive interest rates far below what the market alone would set. Partially this is a continuation of their subsidy to the large banks that caused the credit crisis. And partially it is an attempt to find a way to encourage spending to try and build job creation in the economy. The Fed announced they are taking huge steps to purchase $600 billion more bonds in an attempt to lower rates even further (much of the impact has been priced into the market as they have been saying they will take this action – but the size is larger than the consensus expectation). I do not think this is a sensible move.

Savers do not have many good options for safely investing retirement assets for a reasonable income. The best options are probably to hold short term bonds and money markets and hope that the Fed finally stops making things so difficult for them. But that will take awhile. I think investing in medium or long term bonds (over 4 years) is crazy at these rates (especially government bonds – unless you are a large bank that can get essentially free money from the Fed to then loan the government and make a profit). Dividends stocks may be a good alternative for some more yield (but this needs to be done carefully to not take unwise risks). And I think you to look at investing overseas because these fiscal policies are just too damaging to savers to continue to just wait for a decent rate of return in bonds in the USA. But there are not many good options. TIPS, inflation protected bonds, are another option to consider (mainly as a less bad, of bad choices).

It is a great time to take on debt however (as often is the case, there are benefits and costs to economic conditions). If you have a mortgage, and can qualify, or are looking to buy a home, mortgage rates are amazingly low.

Related: Bond Rates Remain Low, Little Change in Last 6 Months (April 2010) – Bond Yields Change Little Over Previous Months (December 2009) – Chart Shows Wild Swings in Bond Yields in Late 2008 – Government Debt as Percentage of GDP 1990-2009 in USA, Japan, Germany, China…

I am looking at mortgage refinance options now (with rates being so low). I am looking at 20 year fixed rate loans with cash out (with over 20% down). The 20 year term will reduce my loan term a bit, and the final monthly cost should actually be not much higher than my current payment (with taking some cash out), I think. Do any readers have opinions on these lenders (or others with competitive offers – low rates and low expenses)?

Total Mortgage – 20 year fixed rate 3.875%, total fees and points not provided :-(, apr 4.15%

American United Mortgage – 20 year fixed rate 4% [same as 30 year rate :-(], fees $2,995 (0 points), apr 4.26%

Aim Loan – 20 year fixed rate 3.875%, fees (about $4,100 I think), apr 4.02%

These are some of the best deals I have been able to find. However, companies can play games with fees and hide excessive costs in requirements they don’t consider fees (appraisal costs…). Rates can bounce around for a specific lender, so I think it make sense to watch several (not just pick out he lowest one on whatever date you first look).

Suggestions on how to tell whether specific lenders good faith estimates are accurate and comparable would be especially appreciated.

Edits:

RoundPoint – looks good, low rates, low fees, good reviews on Zillow.

Amerisave – 20 year fixed rate 3.75%, total fees and points $3,418, apr 3.87% (removed as an option – they don’t respond to customer have tons of negative reviews online about problems, poor service, etc.

Related: Fixed Mortgage Rates Reach New Low – Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Mortgage Rates and the Fed Funds Rate – Mortgage terms

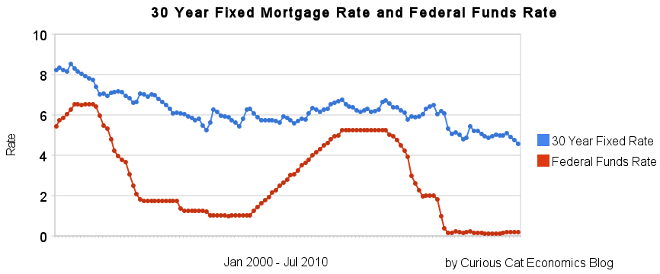

30 year fixed mortgage rates have declined sharply recently to close to 4.5%.

If you are considering refinancing a mortgage now may well be a very good time. If you are not, you maybe should consider it. If so look to shorten the length. If you originally took out a 30 year mortgage and now have, for example, 24 years let, don’t add 6 years to your repayment term by getting a new 30 year mortgage. Instead, look to shorten your pay back period with a 20 year mortgage. The 20 year mortgage will have an even lower rate than the 30 year mortgage.

If you plan on staying in the house, a fixed rate mortgage is definitely the better option, in my opinion. If you are going to move (and sell your hose) in a few years, an adjustable rate mortgage may make sense, but I would learn toward a fixed rate mortgage unless you are absolutely sure (because situations can change and you may decide you want to stay).

The poor economy, unemployment rate still at 9.5%, has the Fed continuing massive intervention into the economy. The Fed is keeping the fed funds rate at close to 0%.

If you are looking at a new real estate purchase, financing a 30 year mortgage sure is attractive at rates under to 4.5%.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – 30 Year Fixed Mortgage Rates Remain Low (Dec 2009) – Lowest 30 Year Fixed Mortgage Rates in 37 Years – What are mortgage definitions

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

The fallout of the credit crisis continues. The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 10.1% percent of all loans outstanding as of the end of the first quarter of 2010, an increase of 59 basis points from the fourth quarter of 2009, and up 94 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate decreased 106 basis points from 10.4% in the fourth quarter of 2009 to 9.40% this quarter.

The percentage of loans on which foreclosure actions were started during the first quarter was 1.23%, up 3 basis points from last quarter but down 14 basis points from one year ago.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 4.63%, an increase of five basis points from the fourth quarter of 2009 and 78 basis points from one year ago. This represents another record high. The combined percentage of loans in foreclosure or at least one payment past due was 14.0% on a non-seasonally adjusted basis, a decline from 15.0%.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 9.54%, a decrease of 13 basis points from last quarter, but an increase of 230 basis points from the first quarter of last year.

“The issue this quarter is that the seasonally adjusted delinquency rates went up while the unadjusted rates went down. Delinquency rates traditionally peak in the fourth quarter and fall in the first quarter and we saw that first quarter drop in the data. The question is whether the drop represents anything more than a normal seasonal decline or a more fundamental improvement. Most importantly, the normal seasonal drop is coming right at the point where we believe delinquencies could potentially be declining and the problem for the statistical models is determining which is which,” said Jay Brinkmann, MBA’s chief economist.

“The seasonal models say it is not a fundamental improvement and that the seasonal drop should have been larger to represent a true improvement, hence the increase in the seasonally adjusted numbers. Yet there is reason to believe the seasonally adjusted numbers could be too high. Simply put, fundamental market factors may be having a greater influence on the delinquency rates than is normally the case, but mathematical models have difficulty discerning the difference over a short period of time.

“Since discerning what represents a fundamental improvement versus a simply seasonal improvement is probably more of an art than a mathematical science at this point, the seasonally adjusted numbers should be viewed with a degree of caution.

The seasonally adjusted delinquency rate increased for all loan types with the exception of FHA loans. On a seasonally adjusted basis, the delinquency rate stood at 6.2% for prime fixed loans, 13.5% for prime ARM loans, 25.7% for subprime fixed loans, 29.1% percent for subprime ARM loans, 13.2% for FHA loans, and 8.0% for VA loans. On a non-seasonally adjusted basis, the delinquency rate fell for all loan types.

The foreclosure starts rate increased for all loan types with the exception of subprime loans. The foreclosure starts rate increased six basis points for prime fixed loans to 0.7%, 17 basis points for prime ARM loans to 2.3%, 18 basis points for FHA loans to 1.5%, and 8 basis points for VA loans to 0.9%. For subprime fixed loans, the rate decreased nine basis points to 2.6% and for subprime ARM loans the rate decreased 39 basis points to 4.3%.

Predicting is much harder than explaining past data. But I believe the odds for better reports on foreclosures and delinquencies over the next 12 months. Delinquencies may well rise. But it is certainly possibly things will get worse. And if the jobs added each month doesn’t average close to 200,000 things will likely not be very good. My guess is we will add over 2.0 million jobs in the USA in the next 12 months but that is far from certain.

Related: Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Another Wave of Foreclosures Loom (July 2009) – Nearly 10% of Mortgages Delinquent or in Foreclosure (Dec 2008)

Half of Commercial Mortgages to Be Underwater

…

We now have 2,988 banks – mostly midsized, that have these dangerous concentrations in commercial real estate lending.” As a result, the economy will face another “very serious problem” that will have to be resolved over the next three years, she said, adding that things are unlikely to return to normalcy in 2010.

…

Warren said it’s time for the government to “pull the plug” on mortgage lenders Fannie Mae and Freddie Mac. “I’m one of those people who never liked public-private partnership to begin with. I think what they did was use public when public was useful and private when private was useful,” she said. “And I think we’ve got to rethink that whole thing.”

“There is no implicit guarantee anymore,” she added. “I don’t care how big you are, if you make serious enough mistakes, then your business can be entirely wiped out.”

Financially literate people should know that the current commercial real estate market is in serious trouble. I still figure it will rebound well. I just want to wait and see how far prices fall and then try to buy when people are so frustrated they will sell at very low prices.

Related: Commercial Real Estate Market Prospects Remain Dim – Mortgage Delinquencies and Foreclosures Data Indicates 2010 Could Show Improvement – Jumbo Loan Defaults Rise at Fast Pace (Feb 2009)

Mortgage defaults hit an all-time high in July according to RealtyTrac (the data in this post is from their survey). Last month default notices nationwide were down 8% from the previous month but still up 22% from November 2008, scheduled foreclosure auctions were down 12% from the previous month but still up 32% from November 2008, and bank repossessions were flat from the previous month and down 2% from November 2008. The housing market is currently not getting worse but it is hardly improving rapidly.

“November was the fourth straight month that U.S. foreclosure activity has declined after hitting an all-time high for our report in July, and November foreclosure activity was at the lowest level we’ve seen since February,” said James J. Saccacio, chief executive officer of RealtyTrac.

Four states account for 52% of national foreclosures for the second month in a row: California, Florida, Illinois and Michigan.

Related: Mortgage Delinquencies Continue to Climb – Over Half of 2008 Foreclosures From Just 35 Counties – Nearly 10% of Mortgages Delinquent or in Foreclosure

The delinquency rate for mortgage loans rose to 9.94% of all loans outstanding at the end of the third quarter, up 108 basis points from the second quarter of 2009, and up 265 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The delinquency rate breaks the record set last quarter (since 1972).

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 4.47%, an increase of 17 basis points from the second quarter of 2009 and 150 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 14.4% on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentages of loans 90 days or more past due, loans in foreclosure, and foreclosures started all set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

“Despite the recession ending in mid-summer, the decline in mortgage performance continues. Job losses continue to increase and drive up delinquencies… Over the last year, we have seen the ranks of the unemployed increase by about 5.5 million people, increasing the number of seriously delinquent loans by almost 2 million loans,” said Jay Brinkmann, MBA’s Chief Economist.

“The performance of prime adjustable rate loans, which include pay-option ARMs in the MBA survey, continue to deteriorate with the foreclosure rate on those loans for the first time exceeding the rate for subprime fixed-rate loans. In contrast, both subprime fixed-rate and subprime adjustable rate loans saw decreases in foreclosures.”

This continues the bad news on housing. Though home sales have been picking up, the underlying strength of the housing market remains questionable. Without jobs increasing it is very difficult for the real estate market to recover.

Related: Nearly 10% of Mortgages Delinquent or in Foreclosure (Dec 2008) – Loan Default Rates Increased Dramatically in the 2nd Quarter – Another Wave of Foreclosures Loom (July 2009) – Homes Entering Foreclosure at Record (Sep 2007)

Read more

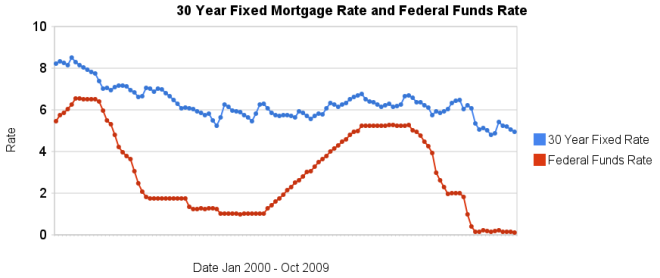

30 year fixed mortgage rates have declined a bit over the last few months and remain at very low levels.

The poor economy, Unemployment Rate Reached 10.2%, has the Fed continuing massive intervention into the economy. The Fed is keeping the fed funds rate at close to 0% (.12% in October). They also continue to hold massive amounts of long term government and mortgage debt (in order to suppress interest rates on long term bonds – by reducing the supply of such bonds in the market).

I can’t see how lending US dollars, over the long term, at 5%, makes any sense. I would much rather borrow at those rates than lend. If you have not refinanced yet, doing so now may well make sense. And if you are looking at a new real estate purchase, financing a 30 year mortgage sure is attractive at rates close to 5%.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – Lowest 30 Year Fixed Mortgage Rates in 37 Years – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score – What are mortgage definitions – Ignorance of Many Mortgage Holders

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates