I decided to take a look at some historical economic data to see if some of my beliefs were accurate (largely about how well Singapore has done) and learn a bit more while I was at it.

| country |

|

1970** |

|

2010*** |

|

% increase |

| Korea | 1,320 | 20,200 | 1,430 | |||

| China | 325 | 4,280 | 1,217 | |||

| Singapore | 4260 | 42,650 | 901 | |||

| Indonesia | 460 | 2,960 | 543 | |||

| Brazil | 1900 | 10,500 | 453 | |||

| Thailand | 850 | 4,600 | 441 | |||

| Portugal | 3,970 | 21,000 | 429 | |||

| Japan | 9,000 | 42,300 | 370 | |||

| Malaysia | 1,900 | 7,755 | 308 | |||

| Germany | 11,550 | 40,500 | 251 | |||

| UK | 10,400 | 36,300 | 249 | |||

| France | 13,600 | 40,600 | 199 | |||

| Mexico | 4,160 | 9,200 | 121 | |||

| Panama | 3,480 | 7,700 | 121 | |||

| India | 555 | 1,180 | 113 | |||

| USA | 23,350 | 47,100 | 102 | |||

| South Africa | 3,930 | 7,100 | 81 | |||

| Venezuela | 8,280 | 9,770 | 18 |

I just picked countries that interested me and seemed worth looking at. I looked for some around the starting position of Singapore and close to Singapore geographically. And looked at Panama as the closest match to Singapore (for Singapore’s main 1970 asset, convenient for shipping lanes, and very close for GDP per capita).

Malaysia and Singapore were 1 country after independence (from 1963-1965).

I can’t imagine more than a couple countries could reasonably be argued to have had better economic performance from 1970 to 2010 than Singapore (Korea? China? Who else?). Singapore had very little going for it in 1970. They had a good location for shipping and that is about it macro-economically. No natural resources. No huge storage of wealth. No preeminence in science, technology or business.

It seems to me that Singapore actually did have 1 other thing. A government that was to preside over a fantastic economic growth success. You won’t find many textbooks talking about the way to economic success is a very well run government. And there is good reason for that, I believe. Relying on a very well run government will nearly always fail. In some ways Singapore was like Japan but with significantly more government influence on the way economic development played out.

I was surprised how poorly the USA has faired. It isn’t so surprising that we lagged. People forget how rich the USA was in 1970. The USA is still very rich but bunched together with lots of other rich countries instead of way out ahead as they were in 1970. And in 1970 the lead was already contracting, for what it had been earlier. But even knowing the relative performance of the USA had lagged, I was surprised by how much it under-performed.

I was also surprised with India. I knew they have done poorly but I didn’t realize it had been this poor. The failures to greatly improve infrastructure, education and the stifling effect of their bureaucracy have been causing them great harm. They have been doing some good things in the last 10 years especially but still have a long way to go. Their premier education is actually pretty decent. The problem is the other 90% of the education is often poor and many people (especially women) hardly have any education at all. It is very hard to get ahead when you fail to take advantage of the talents of so many of your people.

Related: Singapore and Iskandar Malaysia – Chart of Largest Petroleum Consuming Countries from 1980 to 2010 – Chart of Nuclear Power Production by Country from 1985-2009 – Top Countries For Renewable Energy Capacity

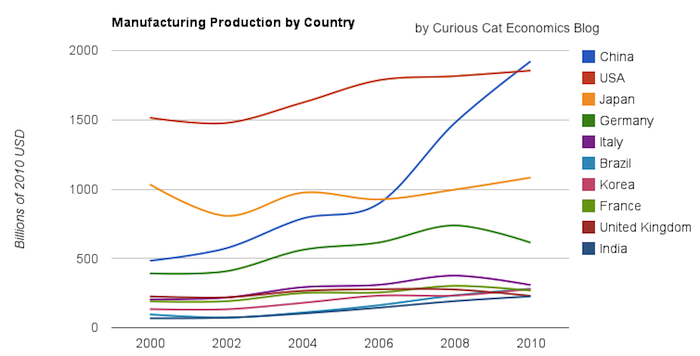

Chart of manufacturing production by the top 10 manufacturing countries (2000 to 2010). The chart was created by the Curious Cat Economics Blog. You may use the chart with attribution. All data is shown in 2010 USD (United States Dollar).

In my last post I looked at the output of the top 10 manufacturing countries with a focus on 1980 to 2010. Here I take a closer look at the last 10 years.

In 2010, China took the lead as the world’s leading manufacturing country from the USA. In 1995 the USA was actually very close to losing the lead to Japan (though you wouldn’t think it looking at the recent data). I believe China will be different, I believe China is going to build on their lead. As I discussed in the last post the data doesn’t support any decline in Chinese manufacturing (or significant moves away from China toward other South-East Asian countries). Indonesia has grown quickly (and have the most manufacturing production, of those discussed), but their total manufacturing output is less than China grew by per year for the last 5 years.

The four largest countries are pretty solidly in their positions now: the order will likely be China, USA, Japan, Germany for 10 years (or longer): though I could always be surprised. In the last decade China relentlessly moved past the other 3, to move from 4th to 1st. Other than that though, those 3 only strengthened their position against their nearest competitors. Brazil, Korea or India would need to increase production quite rapidly to catch Germany sooner. After the first 4 though the situation is very fluid.

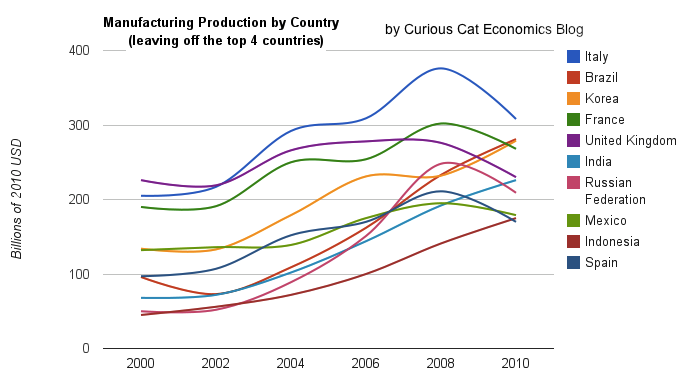

Taking a closure look at the large group of countries after top 4. Chart of manufacturing production from 2000-2010.

Chart of manufacturing production by the leading manufacturing countries (2000 to 2010). The top 4 countries are left off to look more closely at history of the next group. The chart was created by the Curious Cat Economics Blog based on UN data. You may use the chart with attribution.

Removing the top 4 to take a close look at the data on the other largest manufacturing countries we see that there are many countries bunched together. It is still hard to see, but if you look closely, you can make out that some countries are growing well, for example: Brazil, India and Indonesia. Other countries (most in Europe, as well as Mexico) did not fare well in the last decade.

The UK had a particularly bad decade, moving from first place in this group (5th in the world) to 5th in this group and likely to be passed by India in 2011. Europe has 4 countries in this list (if you exclude Russia) and they do not appear likely to do particularly well in the next decade, in my opinion. I would certainly expect Brazil, India, Korea and Indonesia to out produce Italy, France, UK and Spain in 2020. In 2010 the total was $976 billion by the European 4 to $961 billion by the non-European 4. In 2000 it was $718 billion for the European 4 to $343 billion (remember all the data is in 2010 USD).

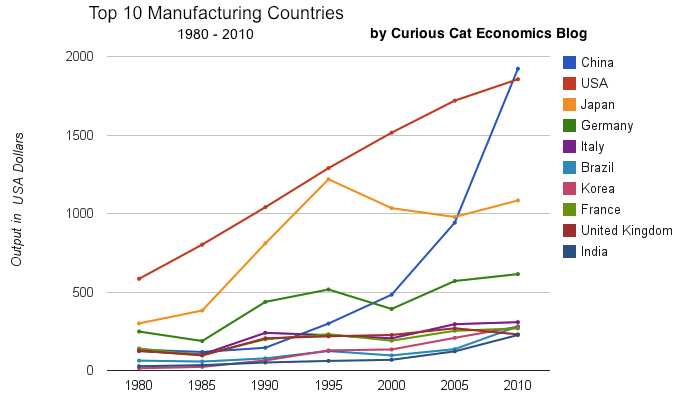

Chart of output by top 10 manufacturing countries from 1980 to 2010. The chart was created by the Curious Cat Economics Blog based on UN data. You may use the chart with attribution.

China has finally actually taken the lead as the largest manufacturer in the world. Reading many news sources and blogs you may have thought the USA lost the lead a couple of decades ago, but you would be wrong. In 1995 it looked like Japan was poised to take the lead in manufacturing production, but they have slumped since then (still they are solidly the 3rd biggest manufacturer). China has been growing manufacturing output enormously for 20 years, and they have now taken the lead from the USA.

As I have been saying for years the biggest economic story about manufacturing is the dramatic and long term increase of productive capacity in China. The next is the continuing global decline in manufacturing employment: increased productivity has seen production rise year after year and employment fall. What is the next most interesting stories is debatable: I would say the continuing failure to appreciate the continuing strong manufacturing production increases by the USA. Another candidate is the the decline in Japan. Another is the increase in several other counties: Korea, Brazil, India, Indonesia…

Looking more closely at some of the long term data shows how much China stands out. From 1980 to 2010 China increased output 1345%. The total top 10 group increased output 302% (all data is in current USD so inflation accounts for most of the gain, 100 1980-USD equal 280 2010-USD). From 1995 to 2010 China increased output 543%. The group increased 64%. For 1980-2010, the results for the other 3 largest manufacturing countries are: USA up 218%, Japan up 261% and Germany up 148% (other countries doing very well are Korea up 1893% and India up 737%). Looking at the last half of that period, from 1995-2010 the: USA up 44%, Japan down 11% and Germany up 19%.

One thing to remember about adjusting manufacturing data for inflation is that often the products created in later years are superior and cost less. So that a computer manufactured in 1990 which added $5,000 to the manufacturing total is far inferior to one in 2010 that added just $1,000. This point is mainly to say that while the increase in manufacturing in real (not inflated dollars) is not as high as it might seem the real value of manufacturing good did likely increase a great deal. But the economic data is based on price so manufacturing increases are reduced by cost decreases. Computers are the most obvious example, but it is also true with many other manufactured goods.

You can that the other largest manufacturing countries fail to keep up with the increases of the entire group of the top 10. China’s gains are just too large for others to match. If you remove China’s results (just to compare how the non-China countries are doing) from 1980-2010 the increase was 216% (so compared to the other 9 top manufacturers over this period the USA was even and Japan better than the average and Germany was worse). And from 1995-2010 the top 9 group (top 10, less China) increased just 28%: so the USA beat while Japan and Germany did worse than the other 9 as a group.

The Dividend Aristocrats index measures the performance of S&P 500 companies “that have followed a policy of increasing dividends every year for at least 25 consecutive years.” S&P makes additions and deletions from the index annually. This year 10 companies were added and 1 was deleted.

| Stock | Yield |

|

div/share 2011 | div/share 2000 | % increase |

|---|---|---|---|---|---|

| AT&T (T) | 6% | $1.72 | $1.006 | 72% | |

| HCP Inc (HCP) | 4.9% | $1.92 | $1.47 | 31% | |

| Sysco (SYY) | 3.7% | $1.04 | $0.24 | 333% | |

| Nucor (NUE) | 3.7% | $1.45 | $0.15 | 867% | |

| Illinois Tool Works (ITW) | 3.1% | $1.40 | $0.38 | 268% | |

| Genuine Parts (GPC) | 3.1% | $1.80 | $1.10 | 64% | |

| Medtronic (MDT) | 2.8% | $0.936 | $0.181 | 417% | |

| Colgate-Palmolive (CL) | 2.6% | $2.27 | $0.632 | 259% | |

| T-Rowe Price (TROW) | 2.9% | $1.24 | $0.27 | 359% | |

| Franklin Resources (BEN) | 1.2% | $1.00 | $.0245 | 308% |

You can’t expect members of the Dividend Aristocrats to match the dividend increases shown here. As companies stay in this screen of companies the rate of growth often decreases as they mature. Also some have already increased the payout rate (so have had an increasing payout rate boost dividend increases) significantly.

The chart also shows that a smaller current yield need not dissuade investing in a company even when your target is dividend yield, giving the large dividend increase in just 10 years. Nucor yielded just 1.5% in 2000 (at a price of $10). Ignoring reinvested dividends your current yield on that investment would be 14.5%. To make the math easy 10 shares in 2000 cost $100, and they paid $1.50 in dividends (%1.5). Dividends have now increase so those 10 shares are paying $14.50 in dividends (14.5%). Of course Nucor worked out very well; that type of return is not common. But the idea to consider is that the long term dividend yield is not only a matter of looking at the current yield.

The period from 2000 to 2011 was hardly a strong one economically. Yet look at how many of these companies dramatically increased their dividend payouts. Even in tough economic times many companies do well.

Related: Looking for Dividend Stocks in the Current Extremely Low Interest Rate Environment – Where to Invest for Yield Today – 10 Stocks for Income Investors

Trying to create significant supplementary income is not easy. There are lots of people selling get rich quick schemes and ways to earn big money for little effort. But those schemes don’t offer what they claim (they just don’t work for any, but a few people).

In trying to figure out a good way to create another income stream I thought of the idea of consulting over the internet in very small chunks of time. I explored the options to be a consultant that way and they were not good. But the idea seemed excellent to me and I worked with a friend to develop the idea of us creating such a online service. The potential was great I think. The end service would provide value to those seeking answers and those providing consultation (and to us).

We did get a domain and plan out the service and begin coding the application but didn’t progress very far. It was still a great idea and something I planned to consider if I had a bit more time. Well there is now an offering that appears to actually be fairly decent (on first glance): Minute Box.

Minute Box allows you several of the things we planned on offering (but not all of them – at least not yet). You can register as an expert and then be available for those wanting advice. You sign in when you are available to answer questions (and people can send you a note while you are offline). You set your rate. Essentially IM is used for consultation and the billing is taken care of by Minute Box.

One of the keys is matching people to experts well. Minute Box does one thing we planned on doing, which is to emphasize the experts tapping those that already value their advice. This would work very well for bloggers and those with an online presence and reputation.

I signed up and created my expert account, so if you want to get some advice from me you can get consulting by the minute from John Hunter.

I think this consulting by the minute model is a great way to create a secondary income stream for those that have a positive online reputation. You can adjust your pay to manage demand. If you have a free week and want to make some extra income you can reduce your rate and offer your readers a special discount. This is potentially a great way to capitalize on your expertise. I haven’t had much experience with Minute Box yet so it isn’t certain they are the answer (but I haven’t seen any other solution that is very good). And no matter the service provider used, I believe the internet enabled micro consulting is a great way to provide some extra income and make your personal finances more robust.

The range of advice you can offer is huge. For nearly anything there are people that need advice: how to cook thanksgiving dinner, helping a child with math homework, fashion advice, editing a resume, which mortgage offer is better in a specific situation, fixing a bug in a WordPress blog, what are good plants for a shady area… The list is nearly endless.

I wish I had been able to create a web site to facilitate this process. I believe the potential is huge. That is why I was so interested in making this idea work. It is the only web business I have seriously considered (and even started). I have numerous web sites but they involve providing content online not any software as service businesses.

Related: Earning More Money – Save Some of Each Raise – If you can’t pay cash, earn more money or save until you have the cash

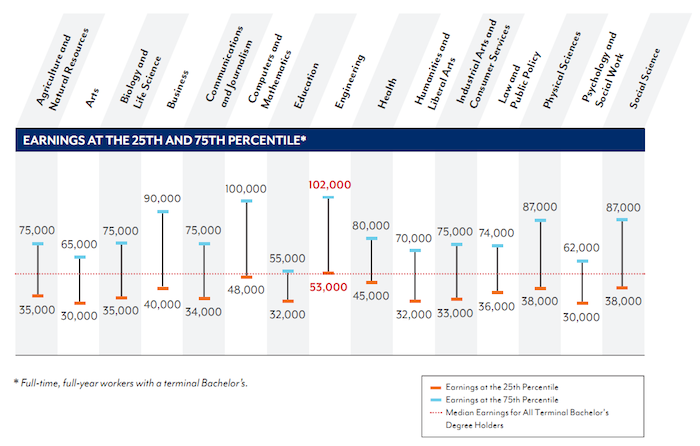

Georgetown University Center on Education and the Workforce has produced a new report looking at the value of different college degrees in the USA. I have seen a great increase in discussions of the “bubble” in education. Those articles often say a college degree doesn’t assure the success it used to. The data I review seems to show extremely large benefits for those with a college degree (higher salaries but, much more importantly, in my opinion, they also have much lower unemployment rates).

Those benefits are greatest for several majors including science, math and engineering. The problem I see is not so much that significant benefits are lacking for college degrees but the huge increases in costs of getting a degree are so large that for some majors the cost is just so large that even with the benefits it is arguable whether it is worth the cost (while a few decades ago the benefits were universal and so large the economic benefit was not debatable).

The authors of the report found that all undergraduate majors are worthwhile, even taking into account the cost of college and lost earnings. However, the lifetime advantage ranges from $1,090,000 for Engineering majors to $241,000 for Education majors. As I have written frequently on the Curious Cat Science and Engineering blog, engineering degrees are very financially rewarding.

The top 10 majors with the highest median earnings for new graduates are:

- Petroleum Engineer ($120,000)

- Pharmacy/pharmaceutical Sciences and Administration ($105,000)

- Mathematics and Computer Sciences ($98,000)

- Aerospace Engineering ($87,000)

- Chemical Engineering ($86,000)

- Electrical Engineering ($85,000)

- Naval Architecture and Marine Engineering ($82,000)

- Mechanical Engineering, Metallurgical Engineering and Mining and Mineral Engineering (each with median earnings of $80,000)

Related: 10 Jobs That Provide a Great Return on Investment – Mathematicians Top List of Best Occupations – New Graduates Should Live Frugally

After World War II essentially the only significantly large industrial base was in the USA. The USA was emerging as a national power in the early 1900’s. The wake of World War I and World War II left a very odd situation. You had many formerly very rich countries that were devastated and one rich country that wasn’t. Devastation is not easy to overcome in even 20 years. So for a good 2 decades the USA got wealthier and wealthier even while other formerly rich countries were re-developing their countries rapidly.

This made the USA even richer as selling to all those around the world was pretty easy, just creating enough stuff was the hardest part. Almost none of the current emerging markets were doing much of anything economically. This resulted in the USA being able to live incredibly well and generate enormous wealth.

The main legacy of this is a huge benefit to the USA – enormous wealth and experience. However, it seems to have left people thinking the USA is just suppose to be enormously wealthy always no matter if we throw away hundreds of billions a year on a broken health care system, provide huge benefits to political donors (farmers or bankers or phone oligopolists or robbers of the public domain [preventing innovation through repressive, outdated “intellectual property” regimes]), spending many hundreds of billions yearly on military expenditures far beyond those of any other country… It doesn’t work that way.

You can waste huge amounts of economic benefit when you are the dominant economic power globally. And when you were as rich as the USA was in the 1950s and 1960s more and more people felt they deserved to be favored with economic gifts. So for a a few decades the USA used the excess wealth to pay off all sorts of special interests and still do very well economically. The only thing surprising is how long we have been able to keep this up.

It isn’t rational to base expectations on periods when we were granted economic wealth largely by virtue of the world industrial production, other than ours, being destroyed. This isn’t the only reason we were wealthy, we do many things very well (compared to other countries) entrepreneurship, less corruption (still way too much but less than average), from 1950 to about 1990 an equitable distribution of economic gains, until recently a good advanced education system, a brilliant system to turn science and engineering breakthroughs into economic profit (that in the last few decades other countries are starting to do, but they are still way behind)…

From 1970s until say the 2000s we could use our accumulated wealth to live off and allow huge inefficiencies to continue (lousy job of regulating banks, lousy job of subsidizing farming, lousy job of subsidizing lousy food [making it cheap to eat unhealthy food and expensive to eat healthy food], lousy job of controlling the costs of higher education, lousy job of getting people to realize they cannot expect to live far beyond most everyone else in the world just because they were born in the USA…

Read more

I believe long term disability insurance is a must for a safe personal financial plan. The risk of not being covered isn’t worth it. An office worker should have a very low risk of something happening that qualifies you for receiving benefits (even with fairly serious injuries for a hunter-gatherer or farmer they can earn a living).

That is actually the perfect situation for insurance. Insurance should be cheap when the risk is small. You want insurance for unlikely but very costly events. You don’t want insurance for likely and inexpensive events (paying the middle man just adds to the cost).

I believe, other than health insurance it is the most important insurance. For someone with dependents life insurance can be important too. And auto and homeowners insurance are also important. Insurance if an important part of a smart personal finance. It is wise to chose high deductibles (to reduce cost).

In many things I believe you can chose what you want to do and just deal with the results. Forgoing health or disability insurance I think don’t fall into that category. Just always have those coverages. I think doing without is just a bad idea.

When I would have had gaps in coverage from work, I have purchased disability insurance myself.

I am all in favor of saving money. About the only 2 things I don’t believe in saving money being very important are health and disability insurance. Get high deductible insurance in general (you should insure against small loses). And with disability insurance you can reduce the cost by having the insurance only start after 6 or 12 months (I chose 12). As you get close to retirement (say 5 years) the risk is much less, you only have so many earning years left. If you wanted to save some money at that point it might be ok if you have saved well for retirement and have a cushion (in case you have to retire 3 year early). Long term care insurance may well be wise to get (if you didn’t when it was cheaper and you were younger. Long term care insurance is really tricky and very tied to whatever our politicians decide not to do (or do) about the broken health care system we have in the USA. The cost also becomes higher as it is moving toward a likely event, instead of a unlikely event (as you age you are more frail).

Related: How to Protect Your Financial Health – Personal Finance Basics: Avoid Debt

The current frustration with economic conditions in the USA and Europe has at its core two main elements. First the anti-capitalist concentration of power in a few monopolistic and oligopolistic corporations (along with the support and encouragement of governments and the governments failure to regulate markets to encourage capitalist practices). And second the consequences of living beyond our means finally becoming much more challenging.

What we have had has been very questionably capitalist. The largest reason for this “questionable” nature is not related to labor but instead to the inordinate power given to a limited number of large corporations. The corporations are suppose to not have “market power” in real capitalism. They have huge and growing market power. To me the main problem is that power disruption to the functioning of capitalist free markets.

There is also the problem that we have been living far beyond our means. This has nothing to do with capitalism or not capitalism. It is as simple as you produce 100 units of goods and use 110 that can’t continue forever. The USA started building a surplus in the 1940’s, I imagine Europe did in the 1950’s. Since about the 1980’s both areas have been living far beyond their means. While they were consuming what they saved over the previous decades it wasn’t so bad. While they mortgaged their future to live lavishly today that was worse. We continue to live beyond our means and are beginning to see some consequences but we haven’t come close to accepting the lavish lifestyles we enjoyed (while Europe and the USA lived off past gains and off very advantageous trade with the rest of the world) is not possible any longer. We can’t just have everyone in Europe and the USA live exceeding well and the rest of the world support us. Eventually we have to realize this (or in any event we will experience it, even if we don’t realize it).

Those 2 factors need to be addressed for our economic future to be as bright as it should be.

Related: Too big too fail, too big to exist – Using Capitalism in Mali to Create Better Lives – Creating a World Without Poverty

Most people know living without health insurance is very risky (and shouldn’t be done). But people are much less aware of the importance of long term disability insurance. The census bureau estimates that you have a 20% chance you will be disabled in your lifetime. A disability can decrease your earning power and also can increase your expenses (to cope with your disability). In my opinion your emergency fund is best used for short term disability insurance.

One of the most important things you can do is be sure you have disability coverage. In the USA about 50% of the jobs provide coverage. If your job does not you should get insurance yourself. Many companies may not pay for disability insurance but may allow you to pay for it (this often can be the best option as the company can gain a better price than individuals but you have to check out the details). Also social security includes some disability insurance coverage but it is very limited. Relying on social security alone is not wise. For one thing it does not protect you from being unable to do your current job but will only pay benefits if you are unfit to do any job.

There are numerous factors to consider for disability insurance. Normally a long term disability insurance policy will pay 50-60% of your salary (be sure to check and see, and check if there is any cap). The terms of the policy will also determine how long you will be paid, being paid until at least 65 is what I would suggest – but some only pay for a limited number of years.

Often policies will offer pro-rated benefits if you earning power is reduced by a disability but you are still able to earn something. So you may have a policy that pay 60% of your original salary but if you make 50% of your previous salary then the payout is reduce to say 20%. So if you originally made $80,000 and now, due to a disability (not just losing your job), you could no longer do your job but could do one that paid less – say $40,000. You would then get your new salary of $40,000 + $16,000 in disability payments or $56,000.

Another detail you should check is whether the payments you will receive are indexed to inflation. In addition, make sure the policy is guaranteed renewable. You also want to buy from a reputable insurance company (check AM Best, Moody’s, Weiss rating agencies). It doesn’t help to have a guaranteed renewable policy if the insurance company goes out of business.

Another thing to consider is buying additional disability coverage. For example, if your company provides a 60% coverage policy it is often possible to purchase addition coverage (to provide additional benefits of 10% or 20% or more of your current salary).

A rough guide is disability insurance will cost 1-2% of the income replaced. For example, a policy replacing $50,000 per year of annual salary would cost about $1,000 per year. Of course, the older or sicker you are the higher the cost. Premiums are based on risk factors, so if you have health risks that will cost more. And, as age is a significant disability factor, the older you are the higher the cost will be.

Remember if you have disability insurance through work, and lose you job you need to get your own disability insurance. This is yet another reason to have an adequate emergency fund.

Related: Personal Finance Basics: Long-term Care Insurance – Personal Finance Basics: Health Insurance – How to Protect Your Financial Health – Life Happens: disability insurance