I believe it is wise from an environmental and economic viewpoint to invest in renewable energy projects. I believe the costs of fossil fuel based energy will continue to increase. Renewable energy is continuing to improve and when considering the negative externalities caused by oil, gas and coal and the continuing improvement in wind, solar and geothermal generation investment in renewable energy are going to payoff well for countries.

| Top countries for installed renewable energy capacity | ||

|---|---|---|

| Rank | Country | Capacity (GigaWatts) |

| 1 | China | 103.4 |

| 2 | USA | 58.0 |

| 3 | Germany | 48.9 |

| 4 | Spain | 27.8 |

| 5 | Japan | 26.0 |

| 6 | India | 18.7 |

| 7 | Italy | 16.7 |

| 8 | Brazil | 13.8 |

| 9 | France | 9.6 |

The largest increases in renewable energy capacity by country from 2005 to 2010 are: China (up 106%), South Korea (up 88%), Turkey (up 85%), Germany (up 67%), Italy and Japan (up 45%). All the data is from the Pew Clean Engery Program report: Who’s Winning the Clean Energy Race? (pdf).

…

India is poised to take a leadership role in the solar sector, with a target of deploying 20 GW by 2020. In 2010, the country set about getting its National Solar Mission in place by permitting 0.5 GW worth of large solar thermal capacity and a modest 150 MW worth of photovoltaic (PV) solar.

My guess is that the stimulus packages in several countries contributed greatly to the increases (notably Germany and Italy targeted green investments – as did China to some extent, in Wind Energy). Spain took a hit as debt levels caused the government to cut spending. I would imagine this is likely to happen in Italy (and was expected to happen in Germany – the extent of decreases is less certain after the earthquake in Japan).

Related: Chart of oil consumption by country from 1990-2009 – Wind Power Capacity Up 170% Worldwide from 2005-2009 – Japan to Add Personal Solar Subsidies (2008) – Chart of Top Nuclear Power Generating Countries from 1985 to 2009 – Wind Power has the Potential to Produce 20% of Electricity Supply by 2030

The biggest investing failing is not saving any money – so failing to invest. But once people actually save the next biggest issue I see is people confusing the investment risk of one investment in isolation from the investment risk of that investment within their portfolio.

It is not less risky to have your entire retirement in treasury bills than to have a portfolio of stocks, bonds, international stocks, treasury bills, REITs… This is because their are not just risk of an investment declining in value. There are inflation risks, taxation risks… In addition, right now markets are extremely distorted due to the years of bailouts to large banks by the central banks (where they are artificially keeping short term rates extremely low passing benefits to investment bankers and penalizing individual investors in treasury bills and other short term debt instruments). There is also safety (for long term investments – 10, 20, 30… years) in achieving higher returns to gain additional assets – increased savings provide additional safety.

Yes, developing markets are volatile and will go up and down a lot. No, it is not risky to put 5% of your retirement account in such investments if you have 0% now. I think it is much riskier to not have any real developing market exposure (granted even just having an S&P 500 index fund you have some – because lots of those companies are going to make a great deal in developing markets over the next 20 years).

I believe treating very long term investments (20, 30, 40… years) as though the month to month or even year to year volatility were of much interest leads people to invest far too conservatively and exacerbates the problem of not saving enough.

Now as the investment horizon shrinks it is increasing import to look at moving some of the portfolio into assets that are very stable (treasury bills, bank savings account…). Having 5 years of spending in such assets makes great sense to me. And the whole portfolio should be shifted to have a higher emphasis on preservation of capital and income (I like dividends stocks that have historically increased dividends yearly and are likely to continue). And the same time, even when you are retired, if you saved properly, a big part of your portfolio should still include assets that will be volatile and have good prospects for long term appreciation.

Related: books on investing – Where to Invest for Yield Today – Lazy Portfolios Seven-year Winning Streak (2009) – Fed Continues Wall Street Welfare (2008), now bankers pay themselves huge bonuses because the Fed transferred investment returns to too-big-to-fail-banks from retirees, and others, investing in t-bills.

The 12 stock for 10 years portfolio consists of stocks I would be comfortable putting into an IRA for 10 years. My main criteria was companies with a history of large positive cash flow, that seemed likely to continue that trend.

In the original portfolio I created in April of 2005, I included Dell. Apple was one of the stocks I was considering but I chose not to include it. That has turned out to be a very bad mistake (though even with that the annualized return for the portfolio is beating the S&P 6%). As I have said the last few updates, I was considering dropping Dell. Since the last update, Dell has been dropped and replaced with Apple. This is the first decision to drop an original selection (First Data restructured and so it was removed).

The current marketocracy* calculated annualized rate or return (which excludes Tesco) is 6.8% (the S&P 500 annualized return for the period is 2.6%) – marketocracy subtracts the equivalent of 2% of assets annually to simulate management fees – as though the portfolio were a mutual fund – so without that (it is not like this portfolio takes much management), the return beats the S&P 500 annual return by about 6.2% (it would be a bit less with Tesco, but still close to 6%).

The current stocks, in order of return:

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| Amazon – AMZN | 330% | 11% | 7% | |

| Google – GOOG | 184% | 17% | 15% | |

| PetroChina – PTR | 102% | 7% | 6% | |

| Templeton Dragon Fund – TDF | 100% | 11% | 10% | |

| Templeton Emerging Market Fund – EMF | 76% | 6% | 6% | |

| Danaher – DHR | 22% | 9% | 10% | |

| Cisco – CSCO | 18% | 6% | 7% | |

| Apple – AAPL | 12% | 5% | 6% | |

| Tesco – TSCDY | -2%** | 0%* | 10% | |

| Toyota – TM | -5% | 7% | 10% | |

| Intel – INTC | -8% | 5% | 8% | |

| Pfizer – PFE | -27% | 5% | 7% |

The current marketocracy results can be seen on the Sleep Well marketocracy portfolio page.

Related: 11 Stocks for 10 Years, July 2010 Update – 12 Stocks for 10 Years, July 2009 Update – Retirement Savings Allocation for 2010 – posts on stocks – investing books

Read more

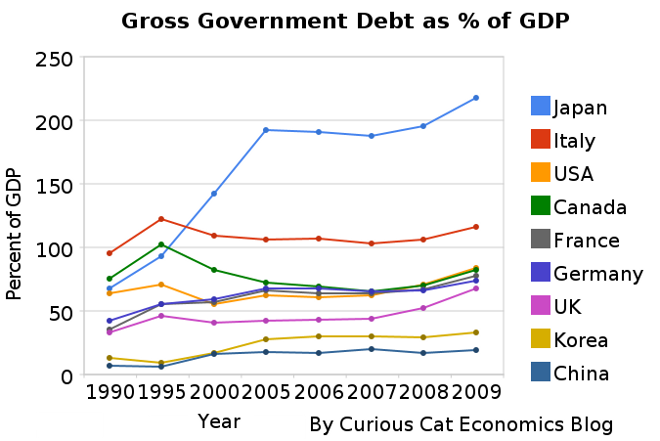

The world today has a much different economic landscape than just 20 years ago. China’s amazing economic growth is likely the biggest story. But the overwhelming success of many other countries is also a huge story. Today it is not the developing world that has governments spending taxes they promise their grandchildren will pay, but instead the richest countries on earth that choose to spend today and pay tomorrow. While “developing” countries have well balanced government budgets overall.

The chart shows gross government debt as percentage GDP from 1990-2009. By Curious Cat Investing and Economics Blog, Creative Commons Attribution. Data source: IMF

The chart shows gross government debt as percentage GDP from 1990-2009. By Curious Cat Investing and Economics Blog, Creative Commons Attribution. Data source: IMF___________________________

There are plenty of reasons to question this data but I think it gives a decent overall picture of where things stand. It may seem like government debt should be an easy figure to know but even just agreeing what would be the most reasonable figure for one country is very difficult, comparing between countries gets even more difficult and the political pressures to reduces how bad the data looks encourages countries to try and make the figures look as good as they can.

The poster child for irresponsible spending is Japan which has gross government debt of 218% of GDP (Japan’s 2009 figure is an IMF estimate). Greece is at 115%. Gross debt is not the only important figure. Government debt held within the country is much less damaging than debt held by those outside the country. Japan holds a large portion of its own debt. If foreigners own your debt then debt payments you make each year are paid outside your country and it is in essence a tax of a portion of your economic production that must be paid. If the debt is internal it mean taxpayers have to support bond holders each year (but at least when those bondholders spend the money it stays within your economy).

Read more

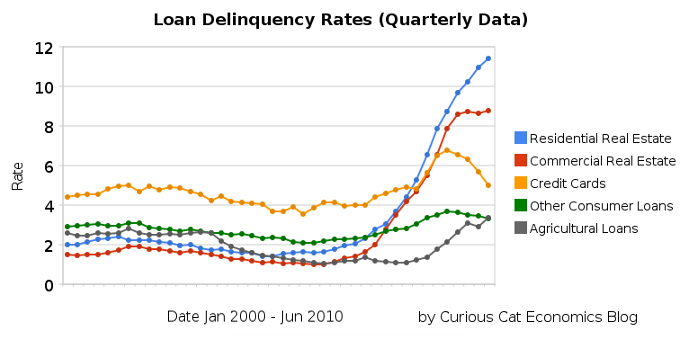

The chart shows the total percent of delinquent loans by commercial banks in the USA.

The first half of 2010 saw residential real estate delinquencies continue to increase and other consumer loan delinquencies decreasing (both trends continue those of the last half of 2009). Residential real estate delinquencies increased 118 basis points to 11.4%. Commercial real estate delinquencies increased just 7 basis points to 8.79%. Agricultural loan delinquencies also increased (25 basis points) though to just 3.35%. Consumer loan delinquencies decreased, with credit card delinquencies down 131 basis points to 5.01% and other consumer loan delinquencies down 15 basis points to 3.34%.

Related: Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Bond Rates Remain Low, Little Change in Late 2009 – Government Debt as Percentage of GDP 1990-2008 – USA, Japan, Germany… –posts with charts showing economic data

Read more

401(k), IRAs and 403(b) retirement accounts are a very smart way to invest in your future. The tax deferral is a huge benefit. And with Roth IRAs and Roth 401(k)s you can even get tax exempt distributions when you retire – which is a huge benefit. Especially if you don’t retire before the bill for all the delayed taxes of the last 20 years starts to be paid. The supposed “tax cuts” that merely shifted taxes from those spending money the last 10 years to those that have to pay for all the stuff the government spent on them has to be paid for. And that will likely happen with higher tax rates courtesy of the last 10 years of not paying the taxes to pay for what the government was spending.

When looking at your 401(k) and 403(b) investment options be sure to pay close attention to expenses for the funds. Some fund families try to get people to investing in high expense funds, that are nearly identical to low expense funds. The investor losses big and the fund companies take big profits. Those people serving on the boards of those funds should be fired. They obviously are not managing with the investors interests at heart (as they are obligated to do – they are suppose to represent the investors in the funds not the friends they have making money off the investors).

Here is an example (that I ran across last week) expense differences for funds that have essentially identical investment objectives and plans in the same retirement plan options: .39% (a respectable rate, though more than it really should be) for [seeks a favorable long-term rate of return from a diversified portfolio selected to track the overall market for common stocks publicly traded in the U.S., as represented by a broad stock market index.], .86% [for “The account seeks a favorable long-term total return, mainly from capital appreciation, by investing primarily in a portfolio of equity securities selected to track the overall U.S. equity markets based on a market index.”]. Do not rely on your fund provider to have your interests at heart (and unfortunately many companies don’t seek the best investment options for their employees either).

The .47% added expense isn’t much to miss for 1 year. However, over the life of your retirement account, this is tens of thousands of dollars you will lose just with this one mistake. Personal financial literacy is an easy way to make yourself large amounts of money over the long term. It isn’t very sexy to get .47% extra every year but it is extremely rewarding.

$200,000 at 6% for 25 years grows to $858,000

$200,000 at 6.47% for 25 years grows to $958,000

So in this case, $100,000 for you, instead of just paying the fund company a bit extra every year to let them add to their McMansions. In reality it will be much more than a $100,000 mistake for you if you save enough for retirement. But if you save far too little (as most people do) one advantage is the mistake will be less costly because your low retirement account value reduces the loss you will take.

Related: 401(k)s are a Great Way to Save for Retirement – Retirement Savings Allocation for 2010 – Many Retirees Face Prospect of Outliving Savings

Read more

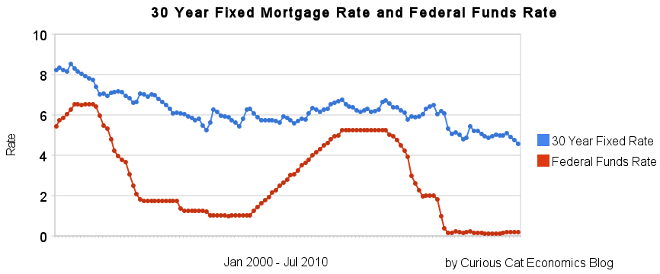

30 year fixed mortgage rates have declined sharply recently to close to 4.5%.

If you are considering refinancing a mortgage now may well be a very good time. If you are not, you maybe should consider it. If so look to shorten the length. If you originally took out a 30 year mortgage and now have, for example, 24 years let, don’t add 6 years to your repayment term by getting a new 30 year mortgage. Instead, look to shorten your pay back period with a 20 year mortgage. The 20 year mortgage will have an even lower rate than the 30 year mortgage.

If you plan on staying in the house, a fixed rate mortgage is definitely the better option, in my opinion. If you are going to move (and sell your hose) in a few years, an adjustable rate mortgage may make sense, but I would learn toward a fixed rate mortgage unless you are absolutely sure (because situations can change and you may decide you want to stay).

The poor economy, unemployment rate still at 9.5%, has the Fed continuing massive intervention into the economy. The Fed is keeping the fed funds rate at close to 0%.

If you are looking at a new real estate purchase, financing a 30 year mortgage sure is attractive at rates under to 4.5%.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – 30 Year Fixed Mortgage Rates Remain Low (Dec 2009) – Lowest 30 Year Fixed Mortgage Rates in 37 Years – What are mortgage definitions

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

I read various things stating that the USA is behaving in socialist (or similar ways). And there are often attempts to state that what the writer desires is capitalism and what they don’t like is an attack on motherhood, apple pie and capitalism.

I’m not sure when or where those writers would say capitalism did exist. It is true we have corporations using their power (political power and market power [oligopolies, monopolies]) to serve their interests. This would not surprise Adam Smith at all, from the Wealth of Nations:

He knew that is what they would attempt to do and said they had to be regulated to allow capitalism to function (but many that say they want capitalism don’t want any regulation of the sort they don’t want). Some seem to agree that some regulation is needed but any regulation they don’t want is seen as “socialist” or “anti-capitalist” or… At least the Libertarians are very consistent about practically no regulation – I question that being capitalism, but at least I understand their position.

Maybe the amount of direct cash payments and sheer amount of not very indirect subsidies (free money from the Fed, huge government contracts to political friends, tax breaks for big contributors [hedge fund managers, corporations using offshore tax havens…], quotas to aid political contributors) have been very high recently. But those changes are more a matter of degree than a qualitative change from the few years before that and few year before that and so on.

I am not sure if people are thinking back to the days when we had large trusts as “capitalism”? Some people equate “capitalism” with essentially no government (no FDA, no SEC, no DoD, no FDIC, no EPA…) – so then maybe the wild west or Afghanistan today is capitalism. I don’t. I would say that we have been become less interested in maintaining a free market (allowing oligopolies and monopolies to exist and distort markets) and an excessive amount of letting those with gold pay politicians to get special deals lately (the last 20-30 years). But it is really just a matter of being worse in those areas not some huge qualitative change.

We broke up trusts for awhile but lately have been supporting those with lots of clout using the clout to prevent competition.

Of course perfect competition is not really reasonable to expect in many markets in the real world. But the aim of shooting toward open and competitive markets is just not something we seem to have paid much attention to for decades. I’m not sure when we did. And paying attention to sensible things like externalities is still very weak. Even in the trust busting era the actions (to move toward a more capitalist economy where markets could function more freely) were fought by many. And while the efforts made a huge difference, it isn’t as though they went to anything close to perfect competition.

Countries like Hong Kong (questionably a “country”) and Singapore do lots of things that are nice capitalistic practices. But they have plenty of practices that are not very capitalistic. I’m not really sure what paragons of Capitalism those that appose regulating markets suggest as better models than the USA. Perhaps they believe the USA is the most capitalistic but it is still not capitalistic enough. A perfectly reasonable positions, I would think, but I am not sure if that is their belief or not.

Related: Ignorance of Capitalism – USA Spent $2.2 Trillion, 16.2% of GDP, on Health Care in 2007

Another blog asks: Does Income Change Who You Are as a Spender? or your Tastes?

I would think in most cases more income should change your spending habits. Unless your tastes are so far below your income that additional income makes no difference then it should.

I save money for retirement, emergency fund, an addition to my house… If I have get another $50,000 a year I can think of good ways to spend it (for me I would save lots of it, but I could also spend some). If now I think I can give $100 to some charity I might give $200 if I have a bunch more money. I buy Odwalla juice, which is pretty crazy expensive, but compared to my overall spending it doesn’t amount to much. But in my first few years of work life I wouldn’t have. I eat out a lot because I like that better than cooking. If I couldn’t afford it then I would eat out less.

I would also “buy” more free time. I would take advantage of the extra cash to cut back at work so I had more time to spend however I wanted. And I would buy a Droid Incredible.

I’d probably buy a solar energy system and battery backup if I had a ton of extra cash… I’d try some services to do things I would like to do but don’t have time for. I like photography and posting my photos online. But I am far behind and have a bunch I would like to do. If I had a bunch of extra cash I would pay someone to take my photos and post them how I want. I would buy a slide scanner and scan a bunch of my Dad’s old slides (or pay to have it done). If I had an fortune I would buy a place with indoor basketball court (or one that where I could build one) and fly first class or use Net Jets and travel a bunch more. Unfortunately I don’t foresee those things happening 🙁

So yeah I would definitely change my spending habits. It isn’t really changing my tastes. I have the tastes now, I just figure given my financial situation it isn’t worth the money (and some I couldn’t even get people to lend me enough money to buy) for some things. But if I had a bunch more money I would buy them.

A mistake many people make is increasing spending too much as income increases. I definitely suggest avoiding this risky behavior. It is fine to add some expenses but make sure you are adding to your retirement account, emergency fund, general savings with part of the raise. And it is risky to develop expensive tastes that you continue if you income declines (or lock into long term expenses – new car, mortgage…). So enjoy, but be careful.

Photo by John Hunter, Swiftcurrent Lake trail in the Many Glaciers area of Glacier National Park.

Related: Using Your Credit Card Properly – Trying to Keep up with the Jones – How Rich Are You?

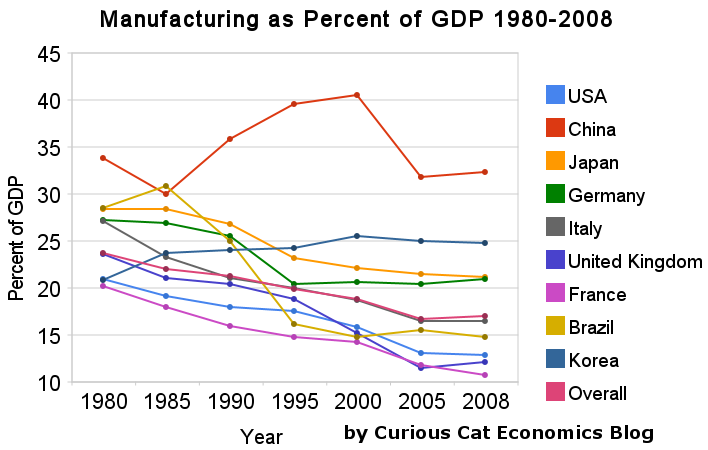

In previous posts I have shown data for global manufacturing output by country. One of the things those posts have showed is that manufacturing output in China is growing tremendously, but it is also growing in the United States. The chart below shows manufacturing production by country as a percent of GDP. China dominates again, with over 30% of the GDP from manufacturing.

Chart showing manufacturing output, as percent of GDP, by country was created by the Curious Cat Economics Blog based on UN data* (based on current USA dollars). You may use the chart with attribution.

For the 14 biggest manufacturing countries in 2008, the overall manufacturing GDP percentage was 23.7% of GDP in 1980 and dropped to 17% in 2008. I left India (15% in 1980, 15% in 2008), Mexico (20%, 18%), Canada (17%, 13%), Spain (25%, 14%) and Russia (21% in 1990 [it was part of USSR in 1980], 15%) off the chart.

Over the last few decades Korea, and to some extent China, are the only countries that have increased the percent of GDP from manufacturing. China has not only grown manufacturing activity tremendously but also other areas of the economy (construction, mining, information technology). The countries with the largest manufacturing portions of their economies in 2008 were: China 32%, South Korea 25%, Japan and Germany at 21%. The next highest is Mexico at 18% which declined slightly over the last 15 years (with NAFTA in place). Globally, while manufacturing has grown, other areas of economic activity have been growing faster than manufacturing.

The manufacturing share of the USA economy dropped from 21% in 1980 to 18% in 1990, 16% in 2000 and 13% in 2008. Still as previous posts show the USA manufacturing output has grown substantially: over 300% since 1980, and 175% since 1990. The proportion of manufacturing output by the USA (for the top 14 manufacturers) has declined from 31% in 1980, 28% in 1990, 32% in 2000 to 24% in 2008. The proportion of USA manufacturing has declined from 33% in 1980, 29% in 1990, 36% in 2000 to 30% in 2008. While manufacturing output has grown in the USA it has done so more slowly than the economy overall.

Related: The Relative Economic Position of the USA is Likely to Decline – Manufacturing Data, Accuracy Questions – Top 12 Manufacturing Countries in 2007 – Manufacturing Employment Data: 1979 to 2007 – USA Manufacturing Output Continues to Increase (over the long term)

* I made edits to the 1980 Brazil manufacturing data and 1980, 1985 and 2008 China manufacturing data because the UN data only showed manufacturing data combined with mining and utility data. And I am using older UN data that had manufacturing separated from mining and utility figures for China in the other years.