Scott Adams does a great job with Dilbert and he presents a simple, sound financial strategy in Dilbert and the Way of the Weasel, page 172, Everything you need to know about financial planning:

- Make a will.

- Pay off your credit cards.

- Get term life insurance if you have a family to support.

- Fund your 401(k) to the maximum.

- Fund your IRA to the maximum.

- Buy a house if you want to live in a house and you can afford it.

- Put six months’ expenses in a money market fund. [this was wise, given the currently very low money market rates I would use "high yield" bank savings account now, FDIC insured - John]

- Take whatever money is left over and invest 70% in a stock index fund and 30% in a bond fund through any discount broker, and never touch it until retirement.

- If any of this confuses you or you have something special going on (retirement, college planning, tax issues) hire a fee-based financial planner, not one who charges a percentage of your portfolio.

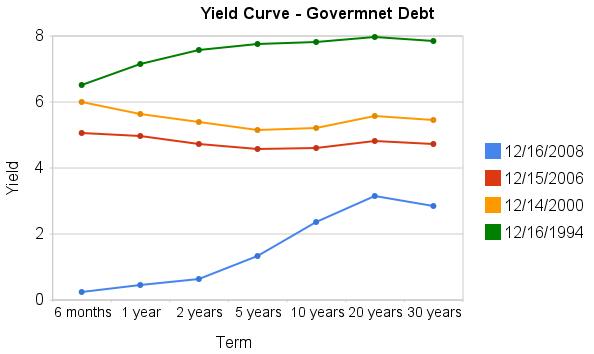

Treasury bills have been providing remarkably low yields recently. And the Fed today cut their target federal funds rate to 0-.25% (what is the fed funds rate?). With such low rates already in the market the impact of a lowered fed funds rate is really negligible. The importance is not in the rate but in the continuing message from the Fed that they will take extraordinary measures to soften the recession.

There are significant risks to this aggressive strategy (and there would be risks for acting cautiously too). But I cannot understand investing in the dollar under these conditions or in investing in long term bonds (though lower grade bonds might make some sense as a risky investment for a small portion of a portfolio as the prices have declined so much).

The current yields, truly are amazing as this graph shows. The chart shows the yield curve in Dec 2008, 2006, 2000 and 1994 based on data from the US Treasury

Related: Corporate and Government Bond Rates Graph – Discounted Corporate Bonds Failing to Find Buying Support – Municipal Bonds After Tax Return – Total Return

The Securities Investor Protection Corporation restores funds to investors with assets in the hands of bankrupt and otherwise financially troubled brokerage firms. The Securities Investor Protection Corporation was not chartered by Congress to combat fraud, but to return funds (with a $500,000 limit for securities and under that a $100,000 cap on cash) that you held in a covered account.

With the recent Madoff fraud case some may wonder about SIPC coverage. What SIPC would cover is cash fraudulently withdrawn from covered account (if I owned 100 shares of Google and they took my shares that is covered – as I understand it). What SIPC does not cover is investment losses. From my understanding Madoff funds suffered both these types of losses.

And I am not sure how the Ponzi scheme aspects would be seen. For example, I can’t imagine false claims from Mandoff about returns that never existed are covered. Therefore if you put in $100,000 10 years ago and were told it was now worth $400,000, I can’t image you would be covered for the $400,000 they told you it was worth – if that had just been a lie. And if your $100,000 from strictly a investing perspective (not counting money they fraudulently took to pay off other investors) was only worth $50,000 (it had actually lost value) then I think that would be the limit of your coverage. So if they had paid your $50,000 to someone else fraudulently you would be owed that. Figuring out what is covered seems like it could be very messy.

Read more

Fed Could Remake Credit Card Regulations

…

The proposal would also dictate how credit card companies should apply customers’ payments that exceed the minimum required each month. When different annual percentage rates apply to different balances on the same card, banks would be prohibited from applying the entire amount to the balance with the lowest rate. Many card issuers do that so that debts with the highest interest rates linger the longest, thereby costing the consumer more.

Industry officials have lobbied against the provisions, particularly the one restricting their ability to raise interest rates. They have warned that the changes would force them to withhold credit or raise interest rates because they won’t be able to manage their risk.

“If the industry cannot change the pricing for people whose credit deteriorates then they have to treat most credit-worthy customers the same as someone whose credit has deteriorated,” Yingling said. “What that means for most people is they’ll pay a higher interest rate.”

The government has been far to slow in prohibiting the abusive practices of credit card companies.

Related: How to Use Your Credit Card Responsibly – Avoid Getting Squeezed by Credit Card Companies - Legislation to Address the Worst Credit Card Fee Abuse – Maybe (Dec 2007) – Sneaky Credit Card Fees – Poor Customer Service: Discover Card

I don’t actually agree with the contention in this post, but the post is worth reading. I will admit I am more certain of I like the prospect of investing in certain stocks (Google, Toyota, Danaher, Petro China, Templeton Dragon Fund, Amazon [I don't think Amazon looks as cheap as the others, so their is a bit more risk I think but I still like it]) for the next 5 years than I am in the overall market. But I am also happy to buy into the S&P 500 now in my 401(k).

Stocks Still Overpriced even after $6 Trillion in Market Cap gone from the Index

…

Even if we assumed a healthy economy, the price is no bargain. Throw in the fact that we are in recession and you can understand why the S & P 500 is still overvalued. We haven’t even come close to the historical P/E of 15.79 which includes good times as well.

Just to be clear current PE ratios have nothing to do with next year. It would be accurate to say someone making the argument that the S&P 500 is cheap now because of the current PE ratio, is leaving out an important factor which is what will earning be like next year. It does seem likely earnings will fall. But I also am not very concerned about earning next year, but rather earning over the long term. I see no reason to be fearful the long term earning potential of say Google is harmed today.

Related: S&P 500 Dividend Yield Tops Bond Yield for the First Time Since 1958 – 10 Stocks for 10 Years – Starting Retirement Account Allocations for Someone Under 40 – Books on Investing

The percentage of loans in the foreclosure process at the end of the third quarter was 2.97 percent, an increase of 22 basis points from the second quarter of 2008 and 128 basis points from one year ago. The percentage of loans in the process of foreclosure set a new record this quarter, to 1.35 million.

Mortgages are counted as delinquent or in foreclosure (once they are in foreclosure they are not counted as delinquent). So the total percentage of mortgages not being paid by the homeowner is 2.97% (in foreclosure) + 6.99% (delinquent) = 9.96%. That is amazingly bad. In February of 2007 I wrote about this and the delinquency rate was 4.7% which sounded pretty bad to me. Amazingly 4.4% is a historic low for this figure. Can you believe 1/25 mortgages is delinquent and that is as good as we ever get? That is pretty shocking to me.

The seasonally adjusted total delinquency rate is now the highest recorded in the Mortgage Bankers Association survey. The seasonally adjusted delinquency rate increased 41 basis points to 4.34 percent for prime loans, increased 136 basis points to 20.03 percent for subprime loans, increased 29 basis points to 12.92 percent for FHA loans, and increased 46 basis points to 7.28 percent for VA loans.

The percent of loans in the foreclosure process increased 16 basis points to 1.58 percent for prime loans, and increased 74 basis points for subprime loans to 12.55 percent. FHA loans saw an eight basis point increase in the foreclosure inventory rate to 2.32 percent, while the foreclosure inventory rate for VA loans increased 13 basis points to 1.46 percent.

Since loans that would have gone into foreclosure in the past are being kept out of foreclosure due to some programs ( ) the rate or seriously delinquent is a useful measure of serious problems. Seriously delinquent mortgages are 90 days past due. The rate increased 52 basis points for prime loans to 2.87 percent, increased 171 basis points for subprime loans to 19.56 percent, increased 62 basis points for FHA loans to 6.05 percent, and increased 45 basis points for VA loans percent to 3.45 percent.

Compared to a year ago: the seriously delinquent rate was 156 basis points higher for prime loans and 818 basis points higher for subprime loans. The rate also increased 51 basis points for FHA loans and 89 basis points for VA loans.

Related: Homes Entering Foreclosure at Record (Sep 2007) – Foreclosure Filings Continue to Rise – How Much Worse Can the Mortgage Crisis Get? – How Not to Convert Equity

Recent market collapses have made it even more obvious how import proper retirement planning is. There are many aspects to this (this is a huge topic, see more posts on retirement planning). One good strategy is to put a portion of your portfolio in income producing stocks (there are all sorts of factors to consider when thinking about what percentage of your portfolio but 10-20% may be good once you are in retirement). They can provide income and can providing growing income over time (or the income may not grow over time – it depends on the companies success).

…

Strategy #3: Buy common stocks with solid dividends and a history of raising dividends for the long haul. That way you let time and compounding work for you. While you may be buying $1 per share in dividends today with stocks like these, you’re also buying, say, 8% annual increases in dividends. In 10 years, that turns a $1-a-share dividend into $2.16 a share in dividends.

3 of this picks are: Enbridge Energy Partners (EEP), dividend yield of 15.5%, dividend history; Energy Transfer Partners (ETP), 11.2%, dividend history; Rayonier (RYN), yielding 6.7%, dividend history.

Of course those dividends may not continue, these investments do have risk.

Related: S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 –

Discounted Corporate Bonds Failing to Find Buying Support – Allocations Make A Big Difference

All you need is a broadband internet connection and you can Kiss your phone bill good-bye:

…

Replacing your phone service is, of course, just the start for Ooma. In some ways, calling is the Trojan horse to get the box in your house and then figure out other services to sell, like enhanced network security or kid-safe Web surfing.

One Year Later: Ooma by Michael Arrington

I just ordered mine from Amazon for $203. I have been using Vonage for awhile and have been considering canceling it for awhile (and just using my cell phone) but I currently have a limited cell phone plan (because unlike so many people, I don’t feel a need to talk to someone every single minute of the day). I normally just use the cell phone if I am meeting someone or traveling. Otherwise, just leave a message, I don’t need to speak to you right now.

Related: Save Money on Printing – Frugality Plus – Save Money on Food

Why the Germans just hate to spend, spend, spend

…

US, French and British officials puzzle over Germany’s refusal to tackle the recession head-on. German leaders, meanwhile, cannot see why their taxpayers’ money should go into encouraging precisely the kind of behaviour – reckless lending, careless borrowing and overconsumption – that precipitated the financial crisis.

I am with the Germans on this one. The people that want to find some more credit cards to run up don’t understand the problem. Until they come up with strong policies that admit we have been living beyond our means for decades and have to pay for this at some point and fashion a policy based on that understanding we are in danger. Yes another credit card can allow you to continue to live beyond your means, but it also puts you into even worse financial shape than you have already gotten yourself into. It is not a solution, it is an emergency to deal with the complete failure of yourself previously and without a plan to change it is just setting yourself up for a worse situation soon.

Related: How to Use Your Credit Card Responsibly – Have you Saved Your Emergency Fund Yet? – Can I Afford That? – Too Much Stuff

Pension Funds Beg Congress to Suspend Billions in Contributions

Instead of money, they want legislation to suspend a federal law that would make them pump billions of dollars into retirement plans to offset stock-market losses as many struggle to find enough cash just to stay in business.

So lets see, you minimally fund the pension plan for your workers and make optimistic projections about investing returns. The market goes down, and you are now so far underfunding your pension that the law requires you to add funds to the pension. Your solution, go cry to the politicians. How sad. If Pfizer or IBM are having cash flow problems that is amazing. They really should be able to manage their cash better than that. Their most recent quarterly reports do not indicate cash flow problems. Yes I understand we have a credit crisis so if GM were having problems I wouldn’t be surprised (but you know what – they aren’t, in this area).

…

GM was notably absent from the five-page list of companies and organizations asking Congress for relief from the asset thresholds. GM said its pension plans had a $1.8 billion deficit as of Oct. 31, down from a $20 billion surplus 10 months earlier. At that level, GM’s plans would top the pension law’s 2008 asset threshold.

I think companies need to meet their obligations. If they choose to minimally fund their pensions without understanding that financial market are volatile, then they will have to pay up as required by law. When times are good you see all these CEOs taking advantage of pension fund “excesses” to reward themselves. They need to learn that you don’t raid your pension funds (either by taking cash out or not funding current investments – because you claim the assets are already sufficient). Pension funds are long term investments and you cannot manage as though the target value is the minimum amount allowed by law (unless you are willing to pay up cash every time your investments don’t meet your predicted returns). This is very simple stuff.